| This is Bloomberg Opinion Today, an inner monologue of Bloomberg Opinion's opinions. Sign up here. There are two types of people in this world: people who talk to themselves — in the shower, at the laundromat, as they're writing a newsletter — and people who don't. Elon Musk must be the first type, since he's already uploaded his brain to the cloud so that he can talk to a virtual version of himself. Here's how I imagine his inner monologue went before he unveiled his Top Secret Master Plan 3 at Tesla's Investor Day this afternoon: I couldn't sleep last night because I stayed up rewatching Step Brothers for the 420th time on the factory floor. My back hurts a little but seeing Will Ferrell on screen is worth the pain…. OK, have to check in with the Twitter devs — when I logged on this morning all I heard was *crickets* — it was so weird. Whatever. I can't be letting the haters derail my hype train at a time like this. My TESLA MASTER PLAN 3 is going to crush all expectations. Investor day is going to be better than witchcraft. The robotaxis, the solar panels, the dad jokes, the semi trucks, the based AI — these are the KEYS to sustaining our world. People are gonna be so over the moon … they'll be on Mars! And Mars just so happens to be the ~next destination~ for Tesla's Master Plan 4, which I've already developed because you always need a backup … and a backup to the backup, which is Tesla Master Plan 5 … OK, getting called up on stage! Where's my flamethrower??

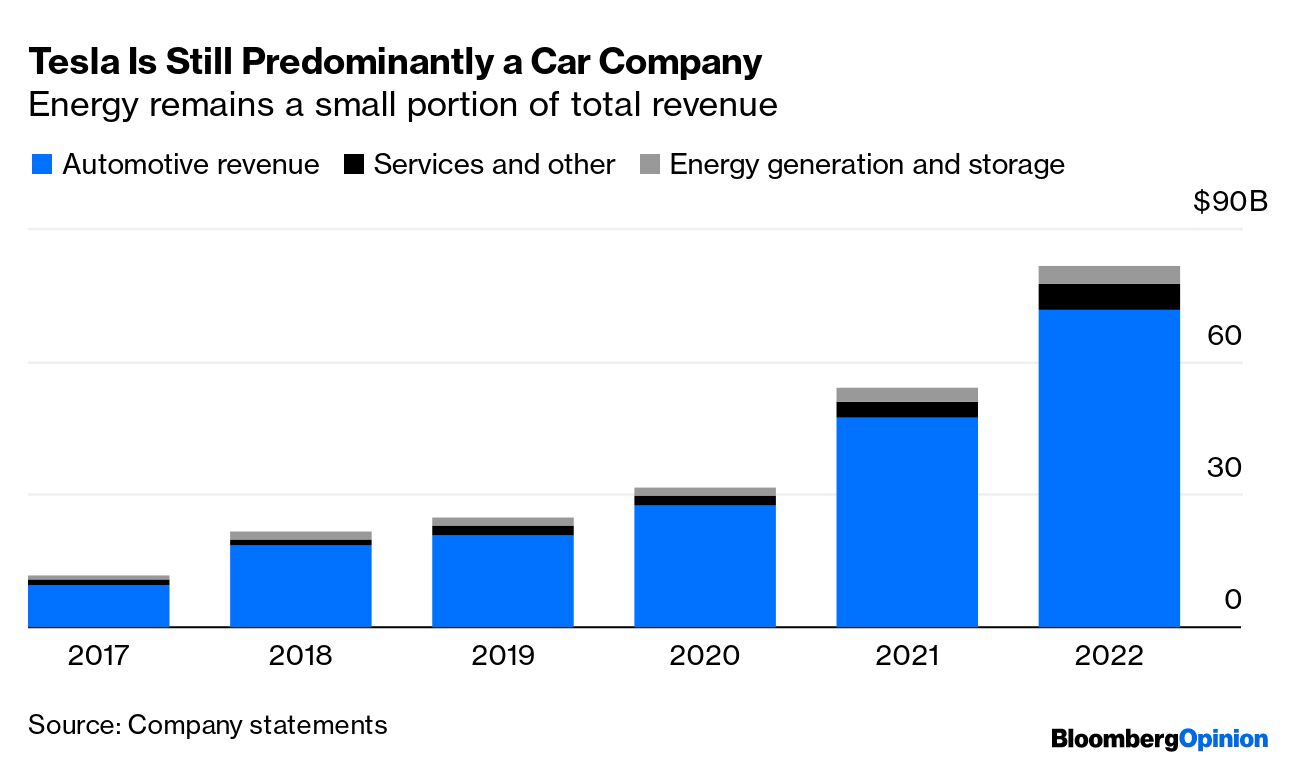

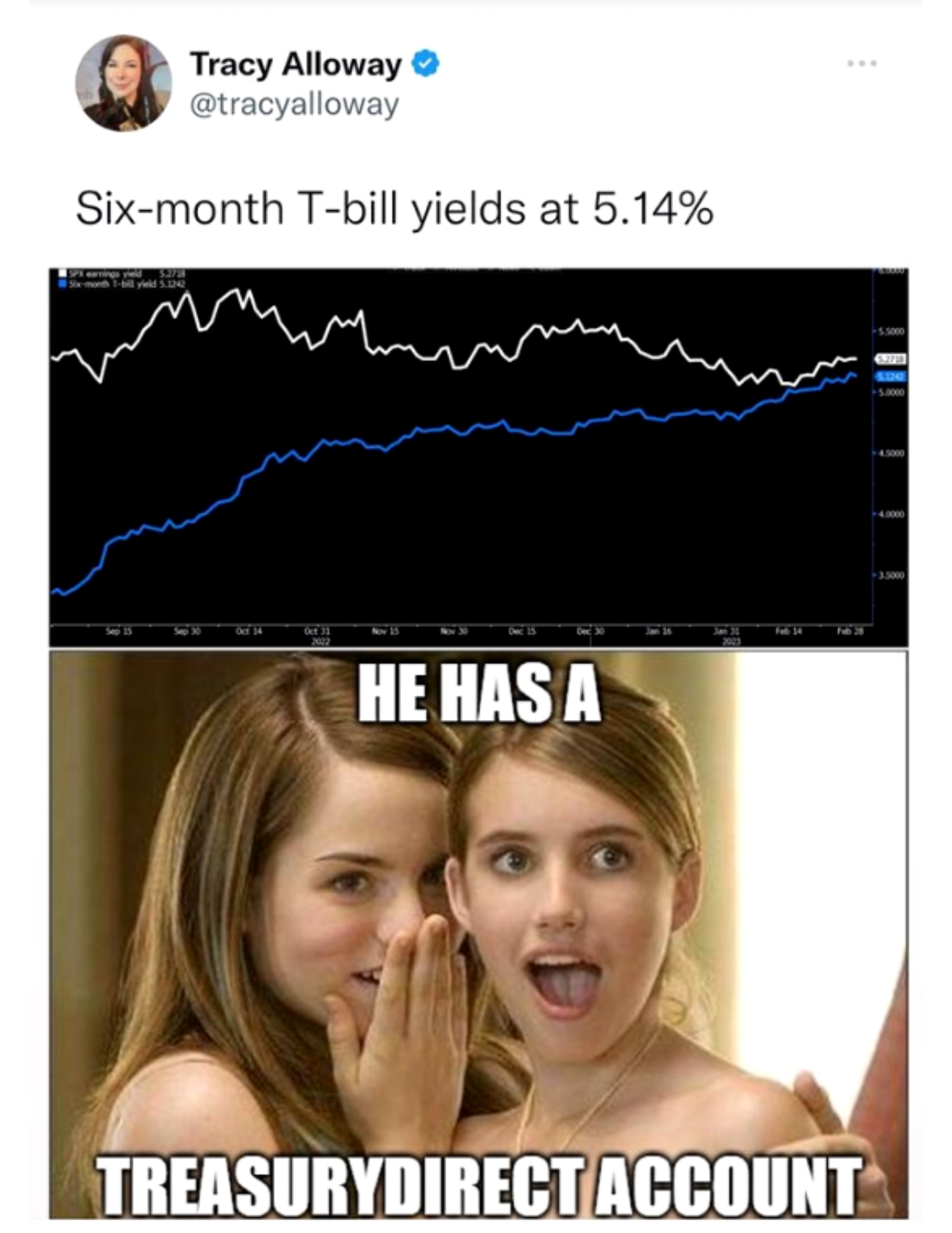

In 2019, Musk predicted that Tesla's energy business would match or exceed the size of its car business, but his solar-panel side hustle has remained on the sidelines. Some 88% of Tesla's revenue still comes from automotive operations — which makes sense! Tesla is a car company, after all. Liam Denning argues that the Tesla CEO need not have a grand plan to solve all the world's problems. He just needs to focus on the stuff he's actually good at executing — like making cars. In that light, announcing a next-generation, cheaper Tesla is a smart move.  Parmy Olson says Musk has spent the past year hopping from one distraction to the next, the most recent being his plan to create a non-woke chatbot to compete against OpenAI's "woke" ChatGPT. His $44 billion acquisition of Twitter is turning out to be a disaster. His personal fortune has been on a roller coaster. Amid it all, his core business — Tesla — is still towering above the competition, as Matt Winkler has noted. Rivian and Lucid's decision to create a copycat blueprint of Tesla is backfiring, Chris Bryant writes. Costs are ballooning for the EV rivals, and operating losses are in the billions: Nikola is even warning that it may run out of cash in the next 12 months. Musk was able to scale his business in a way that none of his competitors have been able to match. That's really all investors needed to know. China came out with some super duper strong economic numbers, with its manufacturing sector seeing the biggest gains since April 2012. Some of that strength is probably due to President Xi Jinping's abandonment of China's Covid Zero policy, so the jury's out on whether it's a temporary phenomenon. Still, the numbers are impressive enough to make people second-guess their grand plans to establish Vietnamese supply chains and save globalization:  Anjani Trivedi writes that "Vietnam's allure as version 2.0 of the world's factory floor has receded sharply." Industrial production is tanking. Wages are low. Inflation is sticky. The Southeast Asian nation's headaches may make the dreaded supply-chain crisis even worse — which is exactly the opposite of what global business bosses had in mind. And yet, as tensions rise between Washington and Beijing, China's place in the global assembly line is no sure thing. At the upcoming National People's Congress, Xi won't be able to rely on pie-in-the-sky promises. While business-friendly policies and lower barriers to entry are nice things to have, investors may have more concrete concerns. How about, say, finding some of those missing billionaires? Additionally, Minxin Pei argues that "a radical restructuring of inefficient state-owned enterprises (SOEs)" would be another way to attract long-term investment. "More decisive measures such as privatizing, breaking up or forcing failing SOEs into bankruptcy could help convince skeptics that Xi's talk of reform is for real." Read the whole thing. If you know someone who's putting their extra cash into certificates of deposit, you miiiiight want to send them the link to Alexis Leondis's latest column. They'd be much better off buying Treasury bills outright, which now let people earn over 5% (!!!) on their money in a single year. We haven't seen a percentage that high seen since 2007 — the year that Crank That (Soulja Boy) was released. "Even money market funds, which are paying pretty generous yields, can't compete with most T-bills right now," Alexis writes. Who knew US Treasury bonds — normally a snoozefest — could be this hot:  Source: @tracyalloway Investors were pretty uninspired by Goldman Sachs's second-ever investor day, Paul J. Davies writes. Maybe that's because CEO David Solomon spent the entire time convincing everyone that Goldman is boring (Matt Levine's words, not mine). When Solomon took the reins in 2018, he went all-in on Goldman's consumer finance division — an effort that was a colossal fail, to put it nicely. Solomon claims Goldman is searching for "strategic alternatives" to spin off the unit, but it might be too little, too late. The bank has already poured billions into the CEO's pet project, and it'll be at least two more years before the bleeding stops. Paul calls it a "rare and significant strategic misstep" that is causing many to lose confidence in its ability to generate revenue. De-influencing is one of the most interesting economic forces of the year. Jerome Powell should take some notes. — Kyla Scanlon America's fentanyl crisis is mounting. Naloxone can save lives — if we let it. — Bloomberg's editorial board Sweden's cashless paradise has plenty of storm clouds brewing in the distance. — Lionel Laurent The death of socialite Abby Choi exposes the dark side of Hong Kong's housing policy. — Shuli Ren Culture wars provide little comfort to the 38 million Americans who are living in poverty. — Francis Wilkinson Economists are directly contradicting people's lived experiences. — Kathryn Edwards The Fed needs to abandon its 2% inflation ship. — Allison Schrager How did evangelical voters go from supporting Jimmy Carter to Donald Trump in a matter of decades? — Joshua Green Ukraine has legitimate reasons to stay far away from the negotiating table. — Leonid Bershidsky Greece's worst train crash in history. The nuclear fusion race pits lasers against magnets. Insulin prices are getting trimmed. Chicago's democratic divide. Jennifer Coolidge gets the last laugh. Wait, is King Charles evicting Harry and Meghan? Area man hasn't worn shoes in 20 years. Man lost at sea survives on ketchup. (h/t Mark Gilbert) The presidential mullet thread you never knew you needed. Notes: Please send ketchup and feedback to Jessica Karl at jkarl9@bloomberg.net. Sign up here and follow us on Instagram, TikTok, Twitter and Facebook. |

No comments:

Post a Comment