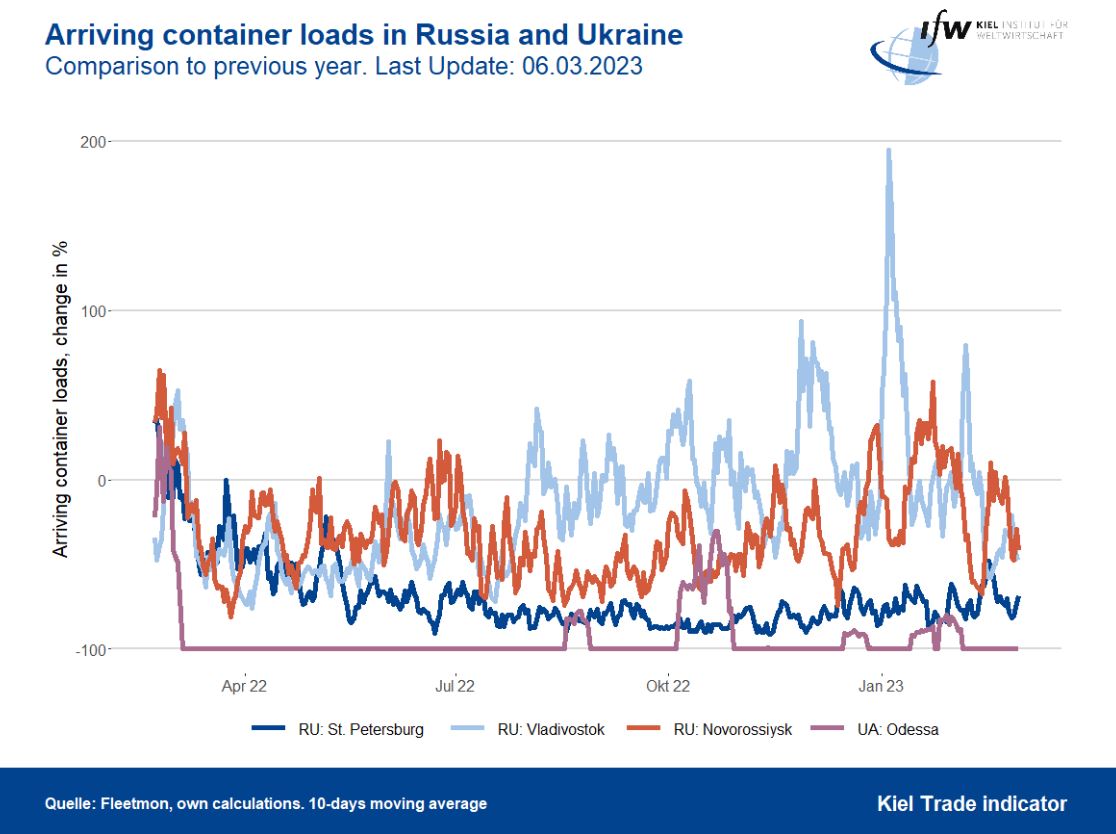

| Russia's ambassador to the World Trade Organization is accusing Europe, the US and others of "blatantly" disregarding international trade rules. During a WTO general council meeting in Geneva this week, Dmitry Lyakishev bemoaned the coalition's "illegal and unjustified" restrictions on Russia, according to a copy of his speech obtained by Bloomberg. Lyakishev added that the crackdown has caused "enormous and irreparable damage to the global economy by provoking and aggravating global economic, energy and food crises." In response, countries like the US and Ukraine countered that Russia's invasion was the primary reason for the turmoil in global markets — something they said could be resolved immediately if Moscow halted its hostilities. Russia's complaints come a year after a group of the world's largest economies — including the US, the European Union, the UK and Japan — revoked Russia's fundamental WTO rights. Read More: EU Hits Russia With More Sanctions One Year After Invasion The countries cited Russia's invasion of Ukraine as justification for their decision to stop treating Russia as a most-favored-nation under WTO rules. While Moscow no longer publishes detailed trade data, it's fair to say the restrictions have had a significant negative impact on Russia's economic trajectory. In 2022, Russia's gross domestic product contracted by somewhere between 2.2% and 3.9% and may keep shrinking this year, according to data compiled by the European Council of the European Union.  Source: Kiel Trade Indicator Many of Russia's banks and companies remain cut off from major international financial systems and some trade relationships, and there's evidence that the trade restrictions on key technologies have weakened Russia's ability to innovate in the future. But that hasn't stopped Russia from getting key materials, and as the Ukraine war enters its second year, the US and EU are now planning to tighten the sanctions screws. Information collected by the Geneva-based Trade Data Monitor indicates that some sanctioned goods — particularly advanced semiconductors — are being diverted to Russia through third countries, many of which abruptly changed their trading habits following the February 2022 invasion. In some cases, the exports to Russia of technologies that could be used for military purposes in Ukraine have gone from effectively zero to millions of dollars. Read More: How Russia Avoids Sanctions to Buy Key Chips for Its War Kazakhstan provides a key example. Last year, the Central Asian nation exported $3.7 million worth of advanced semiconductors to Russia, up from a mere $12,000 worth the year before the war started. The Russian economy is also staying connected to global goods trading system through companies like FESCO, the nation's largest private transportation and logistics company. Late last year, FESCO said it expanded services between China and Russia by adding a deep-sea route, as well as a new intermodal service connecting China, South Korea and Japan. Its transportation group posted a 38% increase in sea trade through Far East ports in 2022 compared with a year earlier. Additional Reading: —Bryce Baschuk in Geneva |

No comments:

Post a Comment