| Hello. Today we look at Europe's inflation woes, Russia's massive labor shortages amid aggressive military recruitment, and how pay-transparency rules can be most effective. For a glimpse of just how perplexing Europe's monetary policy picture is right now, watch the data coming out over the coming 24 hours. Inflation releases from Germany, France and then the euro zone as a whole may all paint a contradictory picture that only serves to fuel the interest-rate debate at the European Central Bank. According to the median forecast, economists reckon the euro-area headline number on Friday will plummet by 1.4 percentage point — the biggest drop in the history of the single currency — to 7.1%. A hopeful signal of lessening price pressures, you might think. But then core inflation, the underlying measure that strips out volatile items such as energy and food, is seen accelerating to a new record of 5.7%. That's the gauge most ECB officials are watching closely right now, as subsiding global banking turmoil refocuses them on the tightening task at hand. Last week, President Christine Lagarde noted a lack of "clear evidence" that underlying price growth is slowing, with domestic pressures posing a threat. But the dramatic drop in headline inflation, driven by far lower energy prices than a year ago, is emboldening dovish officials. That's the measure the ECB actually targets, they insist. Moreover, they point to tightened financial conditions after the recent market turbulence as a reason for caution on hiking rates. Spanish numbers released today underscored just how powerful the opposing consumer-price forces are. The headline inflation rate fell by almost half, to 3.1% — no longer very far from the 2% level targeted by the ECB. But core price growth slowed only a touch, to 7.5%. Next up later today will be Germany, Europe's biggest economy. After France tomorrow comes the euro-zone number, one of two such inflation reports informing ECB officials before their next decision on May 4. Chief Economist Philip Lane, normally one of the more dovish policymakers, hinted yesterday that the bias is already shifting toward another increase in borrowing costs. "If the financial stress we see is non-zero, but turns out to be still fairly limited, interest rates will still need to go up," he told German weekly newspaper Zeit. "However, if the financial stress we talked about becomes stronger, then we'll have to see what's appropriate."

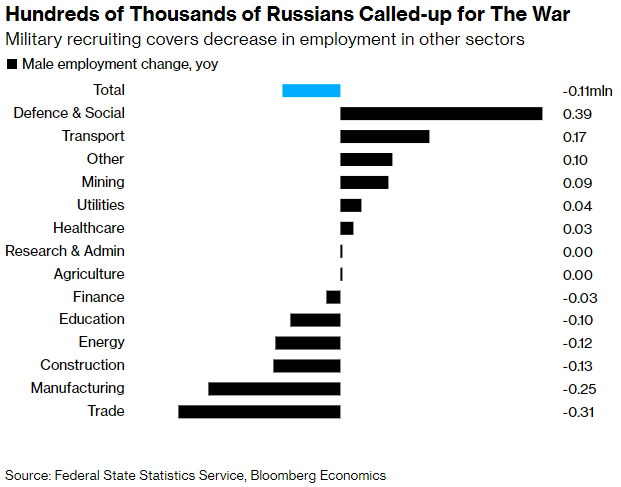

—Craig Stirling Among the hardships wrought by Vladimir Putin's war in Ukraine is a further strain on Russia's big labor-market shortages as hundreds of thousands of workers are recruited for military roles at the expense of other key sectors. Putin's orders last year for 300,000 reservists to be called up — Russia's first such mobilization since World War II — contributed to a net military increase of about 400,000 amid already record-low unemployment, according to Bloomberg Economics estimates using Federal Statistics Service data in a story published Thursday. The massive shift in workers' roles has seen clear losing sectors: Trade has shed some 310,000 workers, with manufacturing seeing net flight of about 250,000, according to the data.  Bloomberg Adding to the job-market woes and demographic decline: Hundreds of thousands of draft-age Russians fled the country the mobilization announcement in September. The working-age population could shrink by 6.5% over the next decade. The trends could well get worse this year, with the Kremlin seeking 400,000 more contract recruits to fight in Ukraine as Putin digs in for a long fight, according to people familiar with the plan. The Russian president has approved a goal to boost the size of Russia's military to 1.5 million from 1.15 million, which may take until 2026 to achieve. - Soft power | Chinese Premier Li Qiang said China is an "anchor for world peace" while the world's No. 2 economy sees a buoyant growth recovery.

- US entrepreneurs | In early fallout from banking turmoil, American small businesses face a tougher time accessing capital. Separately, women created about half of new US businesses for the third year in a row.

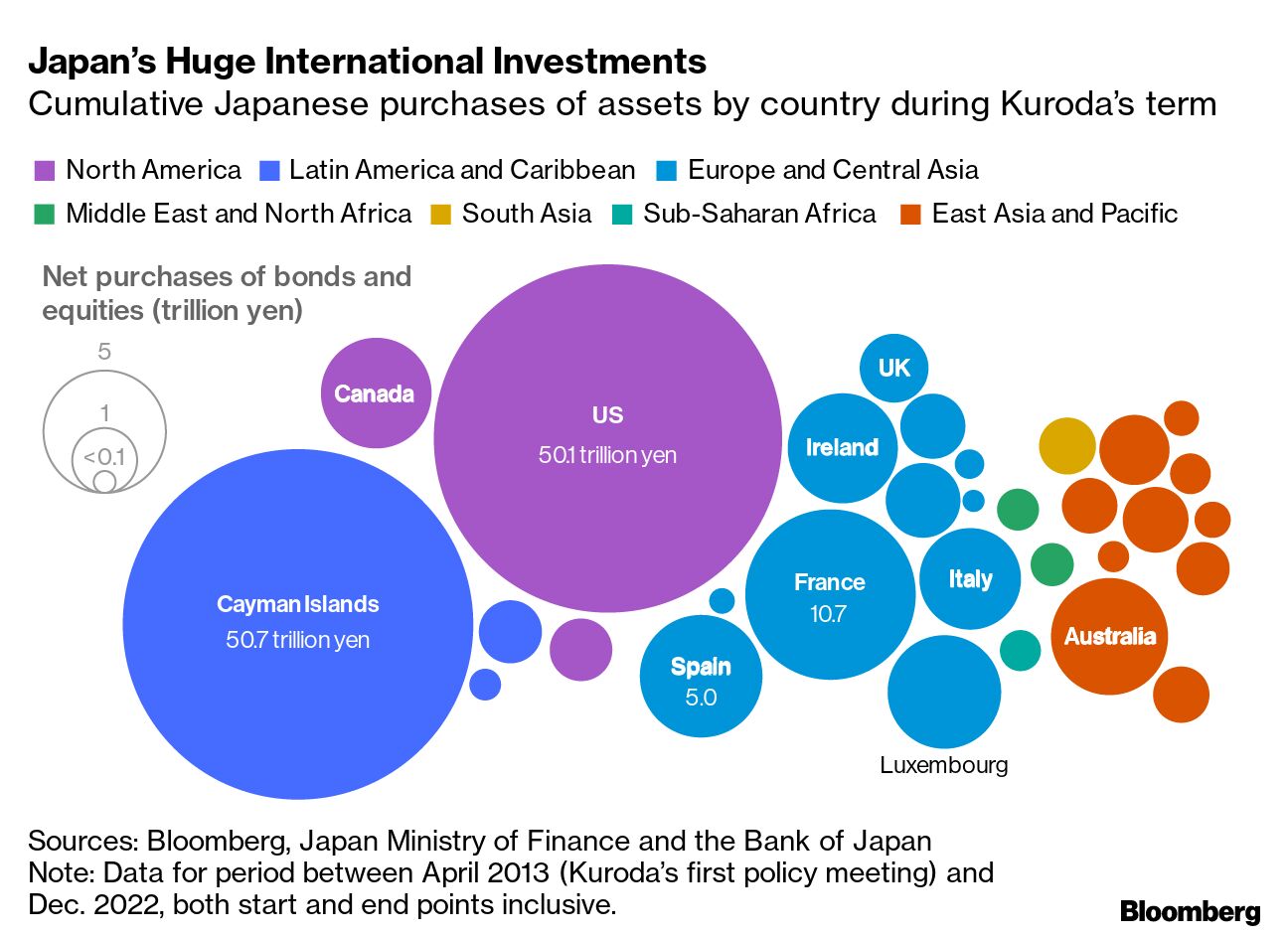

- Japanese shift | The Bank of Japan changed the course of markets with a $3.4 trillion firehose of Japanese cash. Reversing that flow risks sending shockwaves through the global economy.

- Paying up | The US deposit-insurance overseer may hit up big banks to help pay for rescuing depositors during recent bank collapses.

- Big jobs | The US pick for World Bank chief, Ajay Banga, looks to be the only candidate. And as Switzerland's banking crisis subsides, its central bank will soon need a successor to a key player behind the scenes.

- K-Chips Act | South Korea's lawmakers are set to approve a bill Thursday to boost the country's powerhouse semiconductor industry by giving firms tax breaks to spur investments.

Pay transparency has spread fast in recent years, such that the vast majority of new jobs listed in California and New York these days now include salary information. But new research shows that exactly what type of transparency is provided can make a big difference on the effects it has. Horizontal transparency, where co-workers know each others' pay, turns out to be "counterproductive," spurring employers to bargain harder and ultimately drive down average wages, according to Zoe Cullen at Harvard Business School, writing in a National Bureau of Economic Research working paper. By comparison, "vertical pay transparency policies reveal to workers pay

differences across different levels of seniority," she writes. "Empirical evidence suggests these policies can lead to more accurate and more optimistic beliefs about earnings potential, increasing employee motivation and productivity." Bloomberg New Economy Gateway Europe will be held in Ireland, April 19-20. Join us as leaders gather to discuss solutions to the most pressing challenges facing the European economy. Request an invitation. Read more reactions on Twitter |

No comments:

Post a Comment