| Have thoughts or feedback? Anything I missed this week? Email me at bsutherland7@bloomberg.net. Also a programming note: There will be no Industrial Strength next week because of the holiday. Look for the next one on April 14.

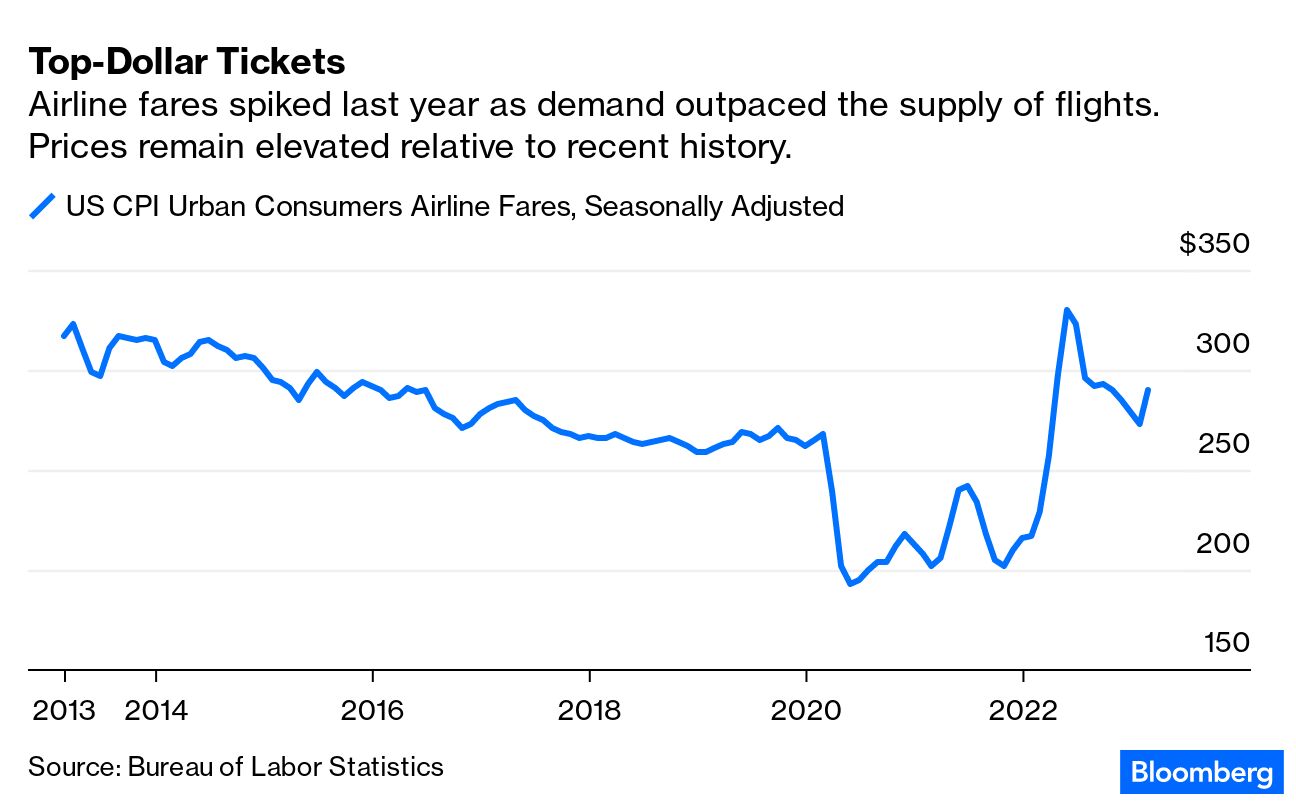

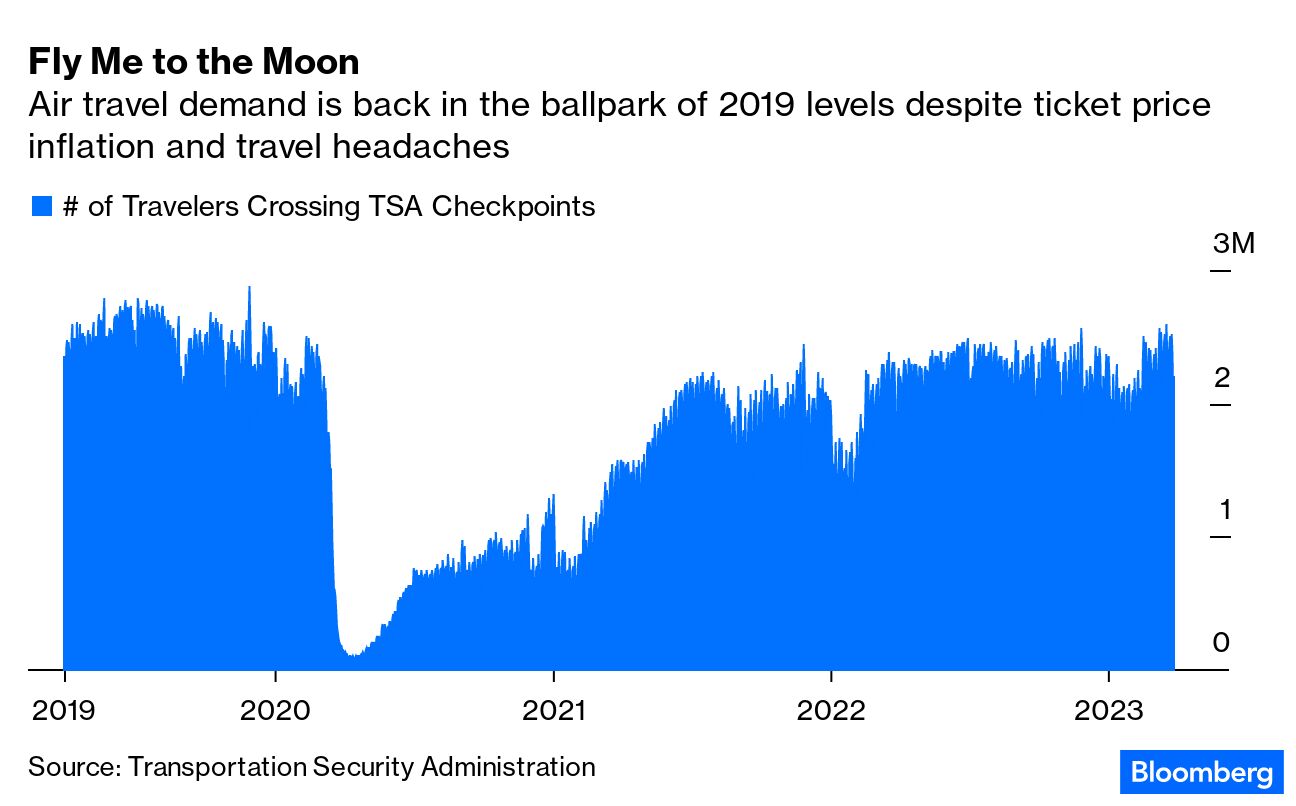

Air travel during the summer of 2022 was hellish. Get ready for the sequel. Delays, cancellations, long lines, lost baggage and other headaches were rampant last year as the entire aerospace ecosystem — planemakers, airlines, baggage handlers, in-flight caterers and air-traffic controllers — struggled to accommodate a sharp snapback in demand after the pandemic. US carriers delayed more than a fifth of flights between the beginning of May and the end of September last year, up from about 17% during the same period in 2019, according to data from FlightAware. Complaints filed with the Transportation Department over air travel surged. In some businesses, when service quality declines, so do prices. But a shortage of planes and pilots meant consumers eager for a respite from the home-bound days of Covid were competing for fewer seats, forcing them to pay up for tickets that may or may not actually get them to their intended destinations. Read more: US Airline Passengers Need a Bill of Rights Heading into the summer of 2023, not much has changed. Somewhat miraculously, inflation and the difficult experience of the past year haven't yet turned people off en masse from air travel, and demand remains robust. Amsterdam is getting so much tourism it's now trying to tell young British men and eventually other "nuisance visitors" to stay away. Whether this momentum shifts under the specter of a potential recession remains to be determined. The airlines have been hiring aggressively and have vowed to prioritize operational reliability after a series of high-profile blowups, but the reality is that the aerospace industry writ large has made little headway in addressing the structural drivers of the supply-demand imbalance that was at the root of 2022's travel misery.  The aerospace manufacturing supply chain remains crippled by labor shortages and production challenges, pushing out wait times for new planes and repair work on older ones. American Airlines Group Inc. said this week that it would temporarily suspend service from Philadelphia to Madrid for a few weeks in May and June because of continued delays in deliveries of Boeing Co.'s 787 Dreamliner jets. Southwest Airlines Co. rejiggered its 2023 guidance earlier this month, in part because the carrier now expects Boeing to deliver only 90 of the 100 planes it had previously planned to receive this year. Airlines still don't have enough pilots. United Airlines Holdings Inc. Chief Executive Officer Scott Kirby has said the hiring needs of the four biggest carriers alone this year will outpace the historical annual supply. Meanwhile, the air-traffic control facility responsible for the New York area's three main airports is operating with only 54% of the staff it needs, the Federal Aviation Administration said in a memo last week. That's little improved from last year, when worker shortages contributed to 41,498 delays out of John F. Kennedy, LaGuardia and Newark airports between May and September. That worked out to almost 350 delays a day by JetBlue Airways Corp. CEO Robin Hayes's math. If airlines pushed ahead with plans to boost flights out of the region this summer, the FAA's modeling indicates delays would spike 45%. Such an increase on top of an already outsize rate of delays is "just not feasible," Hayes said Wednesday at an event hosted by the Economic Club of New York. The FAA encouraged airlines serving the region to dial back schedules by as much as 10% to ease the pressure, and Delta Air Lines Inc., JetBlue and United have indicated they'll make adjustments, including flying larger planes and using slots at Reagan National Airport in Washington to help maintain connectivity to non-New York destinations. Operating fewer flights will mitigate the congestion, but it's unhelpful to the economy and people who are traveling, Hayes said. The cuts will essentially wipe out the year-over-year capacity growth that was meant to ease last year's supply crunch, he said. This won't just affect New York; a large number of aircraft have to cross the region's airspace to get to other destinations, and the area serves as a key connecting point for a number of routes. Given the air-traffic control snarls, "a good outcome is this summer feels like last summer," Hayes said.  The FAA paused air-traffic controller hiring and training during the pandemic, exacerbating a long-standing shortage. While its efforts to refill the backlog have helped elsewhere — nationwide, air-traffic control staffing is at 81% of targeted levels — the FAA hasn't been able to make much of a dent in the New York region's shortfall. That's partly because the job of an air-traffic controller in the New York area is much more complicated than elsewhere in the country and requires more training. A plan to shift responsibility for certain Newark airspace to a Philadelphia facility should help, but that process isn't slated to begin until September and will take time to carry out. As of March 21, available capacity at US airlines during the third quarter is on track to be 7% higher than in the same period in 2019, according to an analysis from TD Cowen analyst Helane Becker. That would still result in a supply crunch because the economy has grown at a substantially higher rate in the intervening years, lifting demand for air travel. But the air-traffic staffing issue is the latest indication that even that target may fall out of reach as supply constraints force airlines to dial back their growth plans. As of last April, the US airlines were aiming to offer slightly more seats in the third quarter of 2022 than they did in the same period in 2019, according to a report at the time from Becker. They ended up flying only about 93% of their pre-pandemic capacity. "We believe the industry capacity aspirations for 2023 and beyond are simply unachievable," Kirby of United said on the company's January earnings call. Fewer flights on the schedule mean no relief for consumers on high fares. That's good news for airlines' profit margins and free cash flow. But it's not a great setup for anyone hoping to take a trip this summer. "Historically, we've seen times when lending standards have gotten very tight, hurdle rates on projects have gotten really high and office towers get canceled on a moment's notice. On these mega-projects, though, we just haven't seen in our careers fiscal stimulus to this degree flowing through construction activity. We haven't seen this impetus on semiconductor production … or the transition to electric vehicles." — Ferguson Plc CEO Kevin Murphy Murphy made the comments in an interview this week. Ferguson, a $27 billion company, distributes heating, ventilation, plumbing and other industrial supplies. Do-it-yourself home-improvement spending has dropped significantly as consumers devote a greater portion of their budgets to travel and experiences, and demand for residential construction has also slowed amid pressures in the housing market. But the professional repair, maintenance and remodeling side of the residential market is holding up well, thanks to continued strength in employment and interest-rate pressure that makes it more economical to upgrade existing homes than move to new ones, Murphy said. That's a more important business for Ferguson. A little less than half of the company's revenue also comes from nonresidential markets, including industrial construction, infrastructure and commercial projects such as shopping centers and offices. Murphy says he's "a touch cautious" about the sustainability of run-of-the-mill commercial real-estate spending, which historically tracks trends in residential construction, but he's not concerned about the mega-projects, which are being driven by national strategic priorities rather than macroeconomics.  There have been more than $380 billion of mega-projects — defined as an investment greater than $1 billion — announced cumulatively since the start of 2021, according to an analysis by Melius Research's Scott Davis. Nearly 60% of those have already broken ground, Davis said in a video report this week. "Whether it's semiconductors or battery facilities or electric vehicle facilities, there's just a real sense of urgency out there that I believe we've never seen in the past, at least not in our time period," Davis said. "That's a very bullish sign overall." Applying the decline in office space and other commercial real estate spending from the financial crisis to today's market implies about $100 billion of lost value, Melius analyst Rob Wertheimer added. Should a recession occur, few are projecting the downturn would be of the same magnitude as 2008, but even that kind of hole could be filled by the mega-project spending, which would be spread out over several years given the scale and complexity of the investments, he said. Of course, this assumes that the financing and timelines for all of this planned government and corporate spending won't waver in an economic downturn. It's a popular opinion to say that these projects are recession-proof, but that idea is relatively untested. On this front, it's not encouraging that permitting issues, labor shortages and political strings risk complicating the construction of new semiconductor manufacturing capacity with Chips Act funds — as documented in this must-read Bloomberg Opinion editorial. Norfolk Southern Corp. was sued by the Department of Justice on behalf of the Environmental Protection Agency over the Feb. 3 derailment of one of its trains in East Palestine, Ohio, and the associated release and spillage of toxic chemicals. The suit seeks to hold Norfolk Southern accountable for "unlawfully polluting the nation's waterways and to ensure it pays the full cost of the environmental cleanup." Interestingly, the suit calls out a drop in operating costs at Norfolk Southern that the Justice Department says included reductions in spending on car repair and maintenance, train inspections and crew compensation. The EPA has already invoked its authority under federal Superfund law to order Norfolk Southern to conduct clean-up and monitoring operations, pay for them and share information about the process both online and at public meetings. The company says it's doing those things. More than 9.5 million gallons of impacted water and more than 13,000 tons of soil have been recovered and will be disposed of, and the company is using the website nsmakingitright.com to detail its cleanup efforts and financial support for the local community. Government officials have said tests show the air and water are safe, although many residents understandably remain concerned about the potential impact on their health and the environment. Why is consumer confidence so high?

A top Mexico bank is expanding to capitalize on the nearshoring boom

EV price wars may ultimately lead to a healthier market

Reducing aerosol emissions is a good idea but may warm the planet

Biden wasted an opportunity to refill the Strategic Petroleum Reserve

A group of college students wants to put a robot on the moon

Walmart struggles to get more employees to bike to work

Ammunition maker worries its growth plans will get foiled by cat videos |

No comments:

Post a Comment