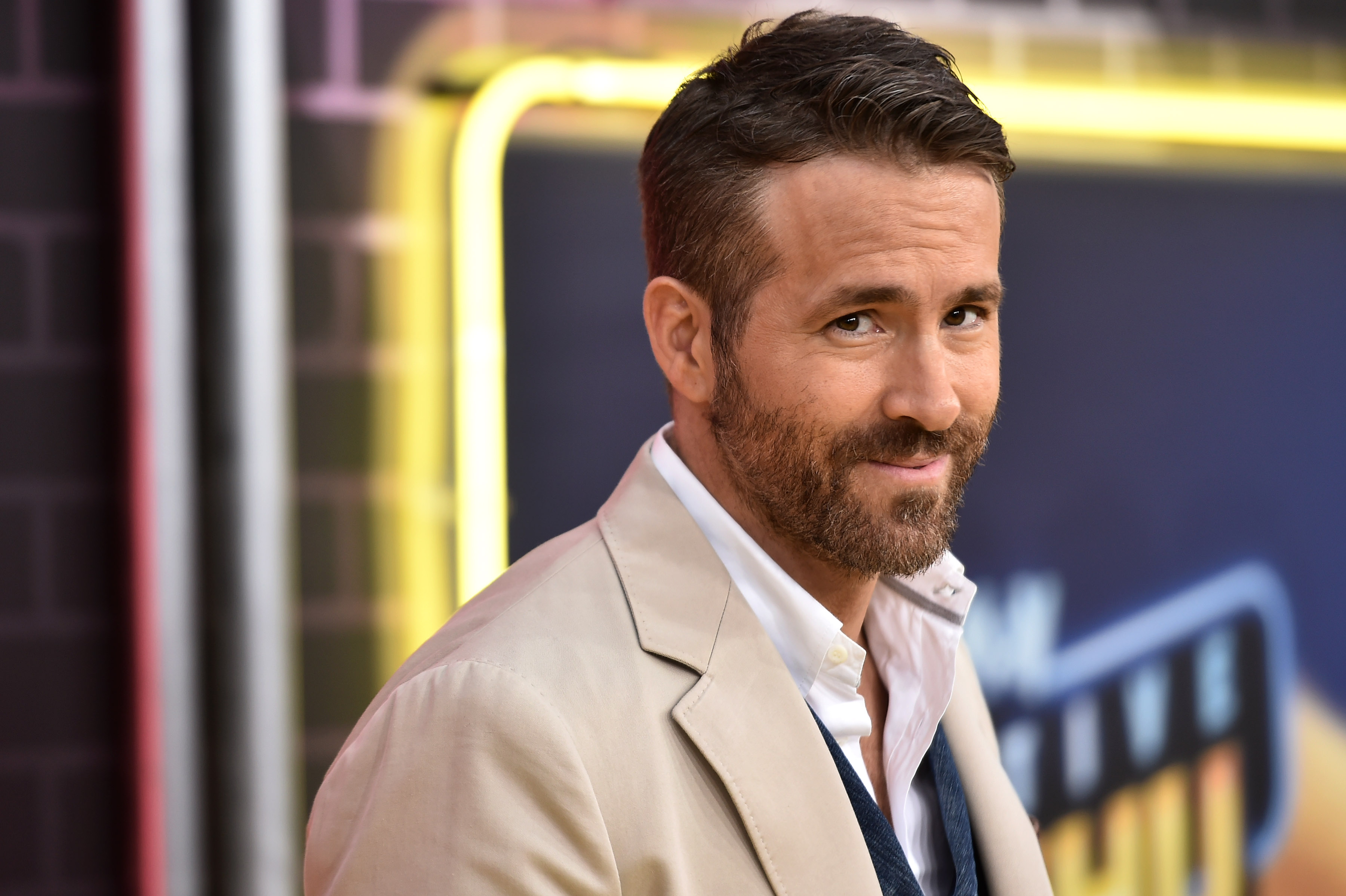

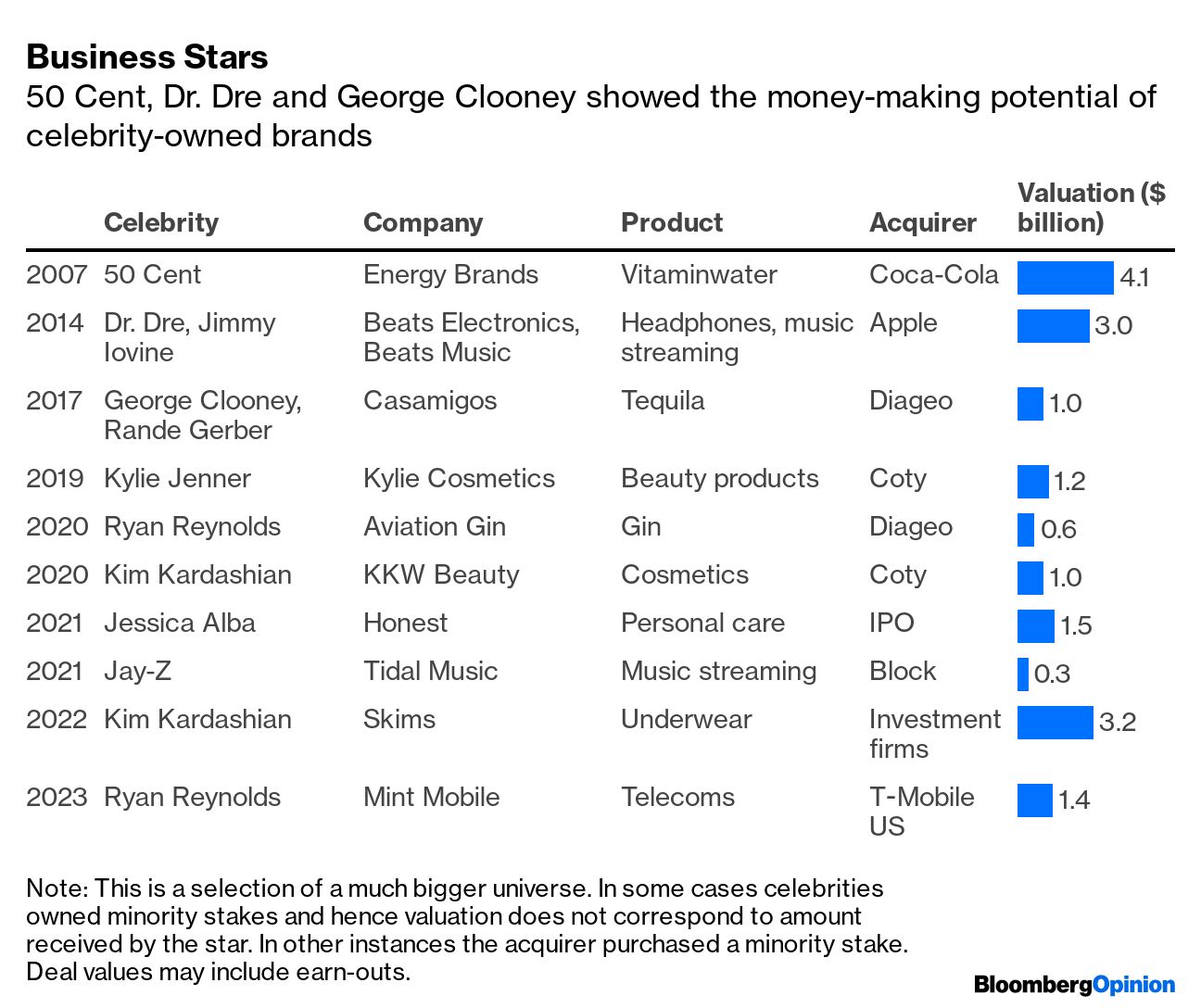

| This is Bloomberg Opinion Today, an abundance of Bloomberg Opinion's opinions. Sign up here. As an American millennial named Jessica, I am accustomed to being surrounded by other women named Jessica. For my entire life, I have been unable to escape a classroom, dinner party or grocery store without encountering another Jessica that was born vaguely between the eighties and nineties. There are too many Jessicas! It is unnatural, the abundance of Jessicas in this country: The tale of Too Many Jessicas is all too familiar to patrons of Signature Bank, who, upon hearing that Signature Bank of New York was going down, had a full-on panic attack. "There are four Signature Banks in the US, and customers weren't immediately sure which one was in trouble," Marc Rubinstein writes, noting depositors from Arkansas to Ohio were seconds away from needing a defibrillator. This kind of snafu hits close to home. There are too many banks! It is unnatural, the abundance of banks in this country. To illustrate the point even further, Marc has a factoid in his latest column that is absolutely BRUTAL: "Canada has fewer banks than the single state of North Dakota." Roasted on all sides! Canada doesn't want to look skimpy by being less banked than one of America's least-populated states. But also North Dakota wants to be known for buffalo, not banks. So how did we get too many banks? In the mid-1980s (peak Jessica, coincidentally) banks weren't allowed to do their business across state lines. So more and more popped up around the nation. It wasn't until 1994 that interstate banking restrictions were fully lifted. Since then, things have changed: The number of banks has shrunk, as has the number of Jessicas in the NICU. But there's still a long way to go: "Even after multiple mergers and acquisitions (and failures) there may still be too many banks in America. Consumers get lots of choice, but the competition such a fragmented system breeds can lead to instability," Marc writes. Too much competition can lead banks to take too many risks, a lesson SVB executives had to learn the hard way. The banking crisis of the past few weeks has raised the risk of a recession, which in turn is hurting the dollar, as Marcus Ashworth charts: This may seem like a bad thing. But if this whole Jessica-bank exercise teaches you one thing, it's that there can be too much of a good thing, the good thing in this case being the dollar. Marcus argues the shrinking dollar actually helps "correct a serious imbalance" in the global currency market. If only my mother got that message all those years ago when she named me. Pop quiz! Who is attractive, kind, funny and astronomically wealthy?? Hahaha not me, silly. It's RYAN REYNOLDS. Duh! Look at this guy:  Photographer: Steven Ferdman/Getty Images North America Chris Bryant pays homage to the actor's genius ability to market himself and his side hustles, culminating in his recent sale of Mint Mobile to T-Mobile, pocketing him a casual $1.35 billion. And Reynolds is not alone in his success: Kylie Jenner, 50 Cent and many other Hollywood stars have skipped Shark Tank and gone straight into the upper echelons of entrepreneurship, thanks to their business savvy. Who needs an acting job when you can spin together a (delicious) tequila company with your pal that will soon be valued around 12 figures? Hi George Clooney, I'm looking at you:  The prospect of wealth is enticing for many actors and actresses, but it doesn't always work out as as planned — as evidenced by the vast selection of discounted celebrity perfumes and colognes that line the sad shelves of TJ Maxx. Consumers can smell inauthentic endorsements from a mile away. Unless a product truly sings, they're not buying it. Because of this, "billion-dollar exits like those achieved by Reynolds, George Clooney and Dr. Dre, remain outliers," Chris writes. Read the whole thing. Last week on Capitol Hill, TikTok did a poor job of convincing US lawmakers it can be trusted. Many states have already pursued restrictions of the app, and a nationwide ban could be around the corner. Tim Culpan writes the company's best shot at staying on American soil will involve groveling with regulators and a right-leaning Supreme Court. Bribery and crime are seeping into every corner of South Africa's economy, Richard Cookson writes. From ongoing blackouts to a flailing currency, Cyril Ramaphosa's rule has been a far cry from the anti-corruption regime markets were promised in 2018. Bolivia is home to the world's largest lithium reserves — a resource the government bets will deliver a much-needed economic boost. But Bolivians would be wise to think twice before buying into that narrative: "No country offers a starker warning about the perils of betting on raw materials to fund a path out of poverty," Eduardo Porter notes. Justin Fox interviewed Matthew Desmond, the Pulitzer Prize-winning sociologist whose new book, Poverty, by America argues policies designed to benefit affluent Americans have deprived the poor of opportunity. We asked Desmond for some recommended reading: - Clean Slate for Worker Power: "Union organizers and academics and folks from the corporate world hash out what a new job market would look like. Their ideas are really fresh and new and big."

- Race for Profit, by Keeanga-Yamahtta Taylor: "This book looks at exploitation in the housing market and how Black homeowners were enticed into really bad deals in the latter half of the 20th century. She has this idea called 'predatory inclusion,' which is very useful to work with and think through."

- The Road to Wigan Pier, by George Orwell: "An oldie but goodie. Orwell is someone I return to again and again, and I was struck by my last reading of Road how completely current it is for a lot of the debates we're having today."

The US is reinforcing the idea that China wants peace while the West wants war. — Bloomberg's editorial board A Swiss executive with experience restructuring a bad bank is exactly what UBS needs. — Paul J. Davies New York's Financial District has become an oasis — but only for the Shiv Roys of the world. — Justin Fox A blanket guarantee on all bank deposits isn't the enemy some say it is. — Karl Smith Kevin McCarthy has no idea how to get out of a government default. — Jonathan Bernstein AI misinformation may spur a revival of news outlets that people can trust. — Leonid Bershidsky A bellwether for the British economy provides some uplifting news for shoppers. — Andrea Felsted Satellites are crowding the skies. Deadly superbugs are winning. Pope Francis has an infection. Chris Christie goes for Donald Trump's jugular. Cats and dogs can lower the risk of allergies. "AI whisperers" make a pretty penny. Zoom divorce is long-term. Pop-Tart sweaters are chic. Area goat and area dog are BFFs.  Source: Wake County Animal Services Notes: Please send Pop-Tarts and feedback to Jessica Karl at jkarl9@bloomberg.net. Sign up here and follow us on Instagram, TikTok, Twitter and Facebook. |

No comments:

Post a Comment