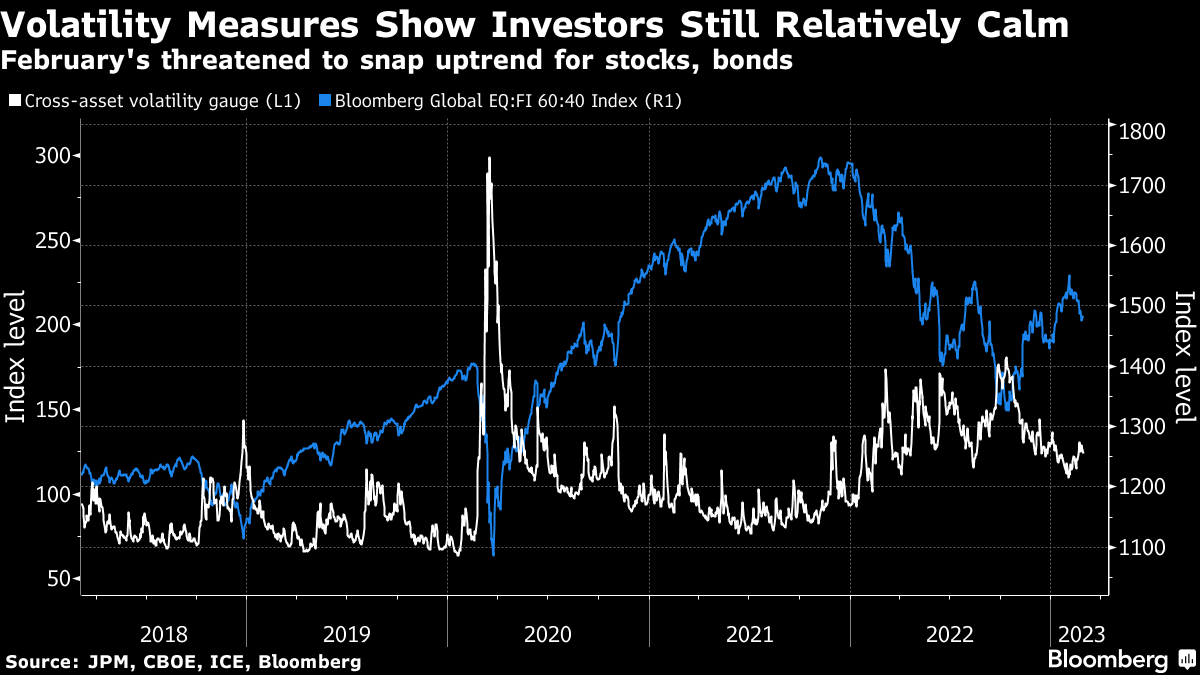

| China cracks down on "hedonistic" bankers. Citigroup to cut hundreds of jobs. US wants to take down Fugees rapper for 1MDB role. Here's what you need to know today. Citigroup is cutting hundreds of jobs across the company, with the Wall Street giant's investment banking division among those affected. The cuts amount to less than 1% of Citigroup's 240,000-person workforce, sources say. Staffers across the firm's operations and technology organization and US mortgage-underwriting arm are also among those affected. The move comes just weeks after rival JPMorgan cut hundreds of mortgage employees. This week it also axed 20 investment banking jobs in Asia. Goldman Sachs, for its part, embarked on one of its biggest ever rounds of job cuts in January. Bankers in China are being told to rectify their mindsets, clean up their "hedonistic" lifestyles and stop copying Western ways. The directives, part of a 3,500-word commentary from the country's top anti-graft watchdog, are the latest sign that President Xi Jinping's campaign to tighten the Communist Party's grip on the financial system has a long way to go. The directive comes on the heels of the sudden disappearance of Bao Fan, one of China's top investment bankers, and follows the downfall of dozens of officials in a huge corruption crackdown on the financial sector. US-based boutique firm GQG Partners has invested 154.5 billion rupees ($1.87 billion) in Adani Group, which is trying to recover from a rout triggered by a short-seller report. GQG bought shares in four firms from an Adani family trust at discounts ranging from 4.2% to 12.2% of Thursday's closing price, according to exchange filings.. Meanwhile, India's top court has set up a panel to probe allegations against Adani Group, after short seller Hindenburg's bombshell report, and Singapore said it would keep a close eye on short sellers and company responses. Asia shares look poised to advance after dovish comments by a US policymaker led stocks there to snap two days of losses. Australia's main index climbed while futures for benchmarks in Japan and Hong Kong point to gains on Friday, after the S&P 500 jumped the most in more than two weeks. The US 30-year yield rose to the highest level since November, joining the rest of the Treasury market in offering investors a return of at least 4% after another batch of strong labor-market data. Singapore is increasing the threshold for global investors seeking permanent-resident status in an attempt to create more jobs and benefit locals due to an influx of wealth. Applicants will need at least S$10 million ($7.4 million) in a business or S$25 million in an approved fund, the Singapore Economic Development Board said. For those establishing family offices, at least S$50 million must be deployed. That compares with a previous requirement of a S$2.5 million investment in a business entity, fund or Singapore-based single family office. Inflation readings keep coming in hot, and so do those for most labor markets. Don't let US equities hockey-stick close overnight fool you, the headwinds for assets from central bank hawkishness are blowing considerably harder by the day. The euro area's core CPI reading jumped to a record — exceeding economists' consensus, though it's hard to call such an event a surprise any more. Then we got readings highlighting the strength of the US jobs market, fewer jobless claims and higher wage costs.  The European Central Bank and the Federal Reserve have each made it crystal clear they will keep tightening until the data picture is very different from the current one. That's going to make it tough for risk assets around the globe, partly because of the direct impact of the two economies that between them account for about 40% of the world's GDP. But also because central bankers around the globe will look at sticky inflation elsewhere and fret that they need to be extra vigilant because of the risk that they will also experience it. The resilience being shown by the US and European economies is going to make it tough for policymakers to ease off even in places where the local data pulse is softening. Garfield Reynolds is Chief Rates Correspondent for Bloomberg News in Asia, based in Sydney. |

No comments:

Post a Comment