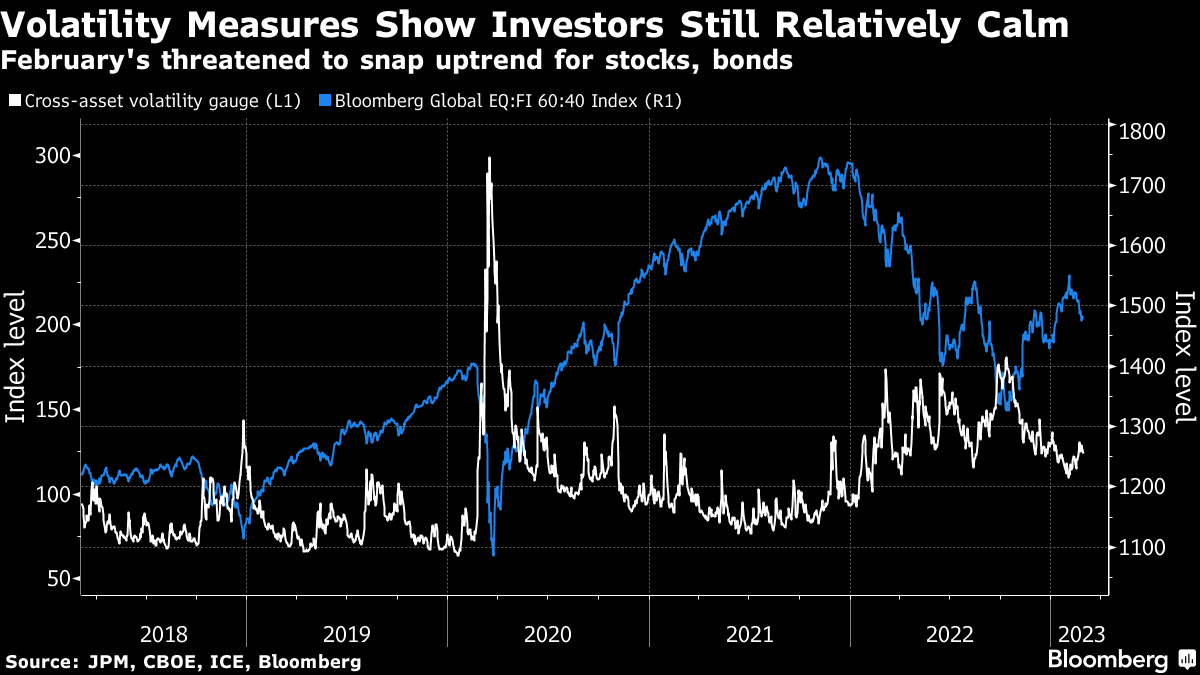

| Elon Musk unveils his Tesla master plan. Bridgewater reveals a new strategy — and job cuts. TikTok imposes time limits for teens. Here's what you need to know today. Elon Musk said the next phase of Tesla's growth will be built around a global sustainable energy future that can serve a larger world population and be achieved without great economic sacrifice. Outlining his third "Master Plan" for the company during an investor day presentation, he described a vision for a global switch to electric vehicles, driven by $10 trillion in spending to develop sustainable energy worldwide. Check out our blog of the the entire Tesla event here, to see what else Musk and his staff revealed. Bridgewater Associates, the world's largest hedge fund, is adopting an ambitious strategy to boost returns, increase profitability and develop new sources of revenue, in the biggest shakeup in four decades. The moves mark the end of the Ray Dalio era and will be spearheaded by CEO Nir Bar Dea. Bridgewater is capping the size of its flagship funds, plowing money and talent into artificial intelligence and machine learning, expanding in Asia and in equities and doubling down on sustainability. Over the next two weeks about 100 jobs will be cut, out of a total 1,300-strong workforce.  | Federal Reserve officials said interest rates will need to increase further and stay elevated into next year to curb US inflation that's showing few signs of abating. Interest rates would need to rise to between 5% and 5.25% and then remain there "until well into 2024," Atlanta Fed President Raphael Bostic said. Financial-market bets for the peak rate have reached 5.5%. Bank of Minneapolis President Neel Kashkari said he was "open-minded" on whether the next hike would be 25 or 50 basis points. One problem confounding the Fed right now is: Why is wage growth slowing if the jobs market is so tight? Asian stocks are poised to fall as investors position for a higher peak in interest rates. The likely weakness in Asia comes after the S&P 500 closed near the lowest in six weeks and Treasury yields climbed, with the 10-year rate piercing the closely watched 4% level. Asian investors continue to closely watch developments in China amid signs the economy is recovering strongly after exiting Covid-zero, and as top officials prepare for the National People's Congress. TikTok will automatically impose a 60-minute time limit for users under age 18, in an attempt to mitigate the app's addictive nature and address concerns about its impact on teens. The approach will require younger users to enter a password if they want to binge more than an hour of videos at one time, the company said. Parents can monitor the amount of time teens spend on the app and see the number of times it was opened. The 60-minute limit will be the default for users under 18, though it can be removed. Meanwhile, legislation authorizing President Joe Biden to ban TikTok took another key step Wednesday. Investors remain under pressure as policymakers around the globe maintain and even bolster their hawkish stances. Still, there's an argument to be made that so far markets are bending, rather than breaking. China's robust data releases from Wednesday will help that trend, but so will the relatively calm demeanor maintained by so-called fear gauges.  An index that blends the implied volatility for US equities, Treasuries and for global currencies has climbed this year, but it is still substantially shy of the levels reached during 2022's routs. There's also been a lack of the sort of sudden spikes unleashed last year. Drilling down shows that expected stock fluctuations are little changed in 2023, while currency volatility has declined. The bond market then remains the key source of angst, and even there the increase hasn't taken it out of recent ranges into white-knuckle territory. With even those hawkish policymakers mostly signaling they are close to the peak in their hiking cycles, investors may continue to surprise with their resilience. Garfield Reynolds is Chief Rates Correspondent for Bloomberg News in Asia, based in Sydney |

No comments:

Post a Comment