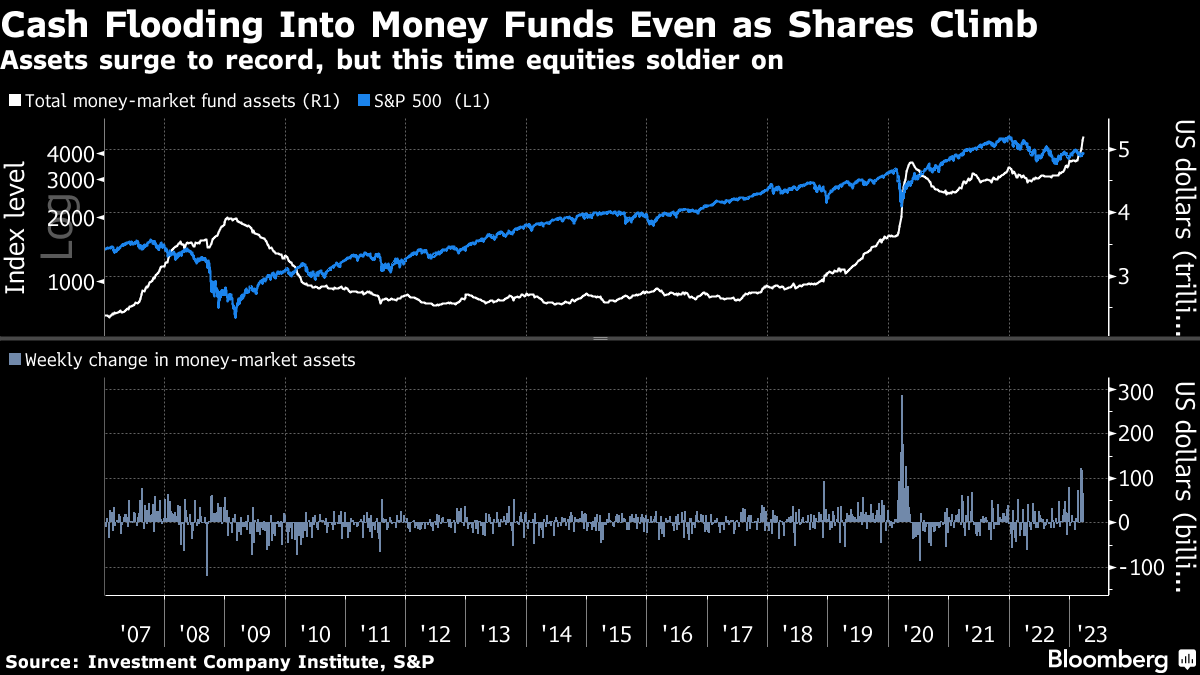

| Trump indicted over Stormy Daniels payment. Alibaba arm prepares for IPO. Stocks on track for second quarterly gain. Here's what you need to know today. Donald Trump has become the first former US president to be indicted, for directing hush money payments to porn star Stormy Daniels during his 2016 campaign. He's also being investigated for trying to overturn a 2020 state election loss and for his handling of government documents — all as he makes a third bid for the White House. Yet neither criminal charges nor a conviction disqualifies him from running or even serving as president. Get the full story here. Not familiar with US law? Here's all you need to know about an indictment — and what comes next. Alibaba's logistics arm, Cainiao, has started preparations with banks for its Hong Kong IPO, paving the way to be the first of the tech giant's six business units to go public. The firm is targeting a listing as soon as the end of this year, sources say. Cainiao is currently valued at more than $20 billion, the sources said. Alibaba this week unveiled plans to split its $250 billion business into six main units encompassing e-commerce, media and the cloud. Each business will explore fundraising or IPO at an appropriate time. Meanwhile, JD.com shares soared in the US after two of its subsidiaries filed for Hong Kong IPOs. Stocks in Asia were set to rise after US technology shares drove gains on Wall Street, despite pressure on financials after Federal Reserve officials reiterated their resolve to lower inflation. Equity futures for benchmarks in Japan and Hong Kong advanced, setting them on a course to notch second consecutive quarterly gains. The S&P 500 climbed 0.6% Thursday while the tech-heavy Nasdaq 100 rose 0.9%, pushing further into a bull market. Treasuries were little changed, the dollar was weaker against major peers and oil rose to a two-week high. Tesla is looking to build a battery plant in the US, in what would likely be a controversial arrangement with China's dominant electric-vehicle battery manufacturer. The EV maker discussed plans involving CATL with the White House in recent days, sources said. Tesla wants to pursue a deal similar to one that Ford announced with CATL last month in Michigan, which provoked ire from some lawmakers. The Chinese company makes lithium iron phosphate batteries — a chemistry that is cheaper than the nickel-based batteries used elsewhere. Nestle, the world's biggest food group, is among final bidders competing to acquire India's Capital Foods, as it seeks to boost its presence in the fast-growing economy. The Swiss company has been discussing terms of a potential deal for the Mumbai-based company, sources said, which would likely value the Indian firm at more than $1 billion. Capital Foods makes the Ching's Secret brand of spicy noodles and chutneys infused with so-called "desi Chinese" flavors. It also sells Smith & Jones cooking pastes and masala mixes. On the surface of it, the banking crisis looks to be fading rapidly enough that it will soon disappear from the rear-view mirror. Global and US equities are heading for decent March gains — a stunning achievement given they faced the Scylla of hawkish central bankers and the Charybdis of the banking crisis. Even Michael Burry — a self-described Cassandra to extend the Greek mythology theme — just congratulated dip buyers.  All the same, there are plenty of investors hunkering down against the potential for further turmoil. The surge in funds parked at US money-market funds continues apace, with the amount stashed there hitting a record $5.2 trillion. Inflows exceed the pace seen in the lead-up to the 2008 crash, indeed only the pandemic spurred a stronger flight to the funds. Unless the dash into cash eases, the omens aren't great for equities, given those antecedents, and they also underscore concerns about further banking turmoil. Or perhaps such flows will also help restrain yields to fuel further tech-stock gains. Garfield Reynolds is Chief Rates Correspondent for Bloomberg News in Asia, based in Sydney. |

No comments:

Post a Comment