| Hello. Today we look at what the layoffs in the technology industry mean for the broader US labor market, a fight involving Brazil's central bank, and the rise of side hustles. Big US technology companies are almost by definition cutting-edge — but are their recent layoffs the leading edge of a turn in the job market? It's obvious broader US labor conditions are still red-hot, as shown by the surge in payrolls recorded in January and the lowest unemployment rate since 1969. Yet at the same time, there's been a steady drumbeat of gloomy announcements from corporate giants. Across the tech industry, some 67,000 jobs have been eliminated since the start of the year, according to data compiled by Bloomberg. Among them: - Dell Technologies

- Google parent company Alphabet

- Microsoft

- Amazon.com

- International Business Machines

Economists at Goldman Sachs — which unveiled its own big round of layoffs last month — are cautioning not to read too much into these headlines. Besides being concentrated in tech, there's two other common denominators in the cuts, they wrote in a note to clients Monday: - Many of the companies took on a lot of new staff during the pandemic. Goldman estimates they had an average headcount surge of 41%. By contrast, total payrolls are only up 2% from pre-Covid levels. Firms often "over-extrapolated pandemic-related trends," such as increased time spent online, they wrote.

- They've also seen a bigger selloff in their share prices — down 43% on average from their peak levels. Consequently, some "appear to be responding to investor demand to cut costs," Goldman says.

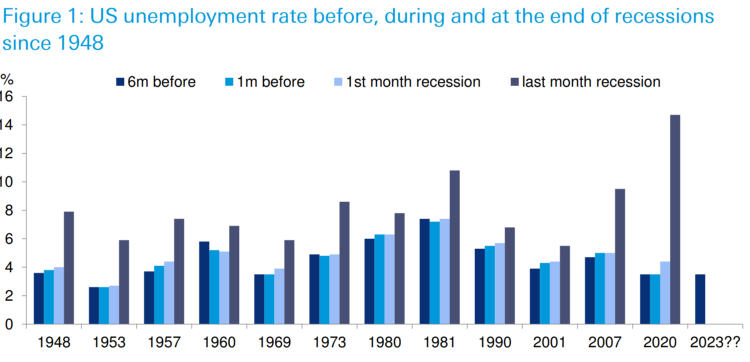

The new report chimes with a story Bloomberg wrote last November, which cited the ADP Research Institute as estimating tech companies represent about 2% of all employment. That compares with 11% in the leisure and hospitality sector. There could, of course, be more layoffs to come among companies sharing these attributes that haven't yet made announcements, wrote the Goldman economists, including Ronnie Walker. But at the end of the day, they are "not representative of the broader economy," the note concludes. "Many of the recent layoff announcements do not necessarily signal a weaker demand picture that might have wider implications." It's also worth noting that evidence suggests that people getting laid off are finding new jobs at an historically high rate, Goldman says. After all, job openings remain plentiful, with the number of available positions climbing to a five-month high of just over 11 million in December. The dynamic of companies wanting to hold onto workers they fought so hard to hire during the labor shortages experienced during the pandemic could also keep the broader job market healthy. That's not to say there's reason to rest easy. History shows that, when the overall job market does turn, it does so very quickly. The weakening tends to occur once the recession hits, not in the run-up, Deutsche Bank's Jim Reid wrote Monday. "The test will come if and when the recession comes and earnings fall. Then we'll see if this time is different for the labor market."

Source: Bureau of Labor Statistics, Deutsche Bank —Chris Anstey The central bankers of Brazil and Russia are coming under pressure from their political masters. Brazil's President Luiz Inacio Lula da Silva on Monday stepped up his criticism of current monetary policy, calling it an "embarrassment." He argues that prices have been surging because of supply-chain issues, which the central bank cannot address with higher interest rates. "There is no justification" for the 13.75% benchmark, he said. Leading economists are cautioning that noise around the autonomy of Brazil's central bank could spell trouble for Latin America's largest nation. "We could end up in a very dangerous environment if the inflation target actually changes, where inflation will stagnate above 6.5% and not even the central bank's interest-rate hike will bring it down," said Solange Srour, chief economist at Credit Suisse in Brazil.

Meanwhile, Bloomberg reports today that President Vladimir Putin's government is pressuring the Bank of Russia to be more upbeat about the outlook for the economy and signal it's ready to loosen monetary policy as his invasion of Ukraine heads for its second year. - Higher peak | Atlanta Federal Reserve President Raphael Bostic told Bloomberg that January's strong jobs report raises the possibility that rates may need peak higher than policymakers previously expected.

- Hawkish hike | Australia's central bank raised rates by a quarter-percentage point and reiterated its resolve to cool the hottest inflation in three decades, sending its currency and bond yields higher.

- Housing warning | Danny Blanchflower, a former Bank of England policy maker, said "collapsing" house prices will push the UK central bank into a rapid pivot toward rate cuts. Separately, the BOE is seeking more women in management roles to diversify its leadership.

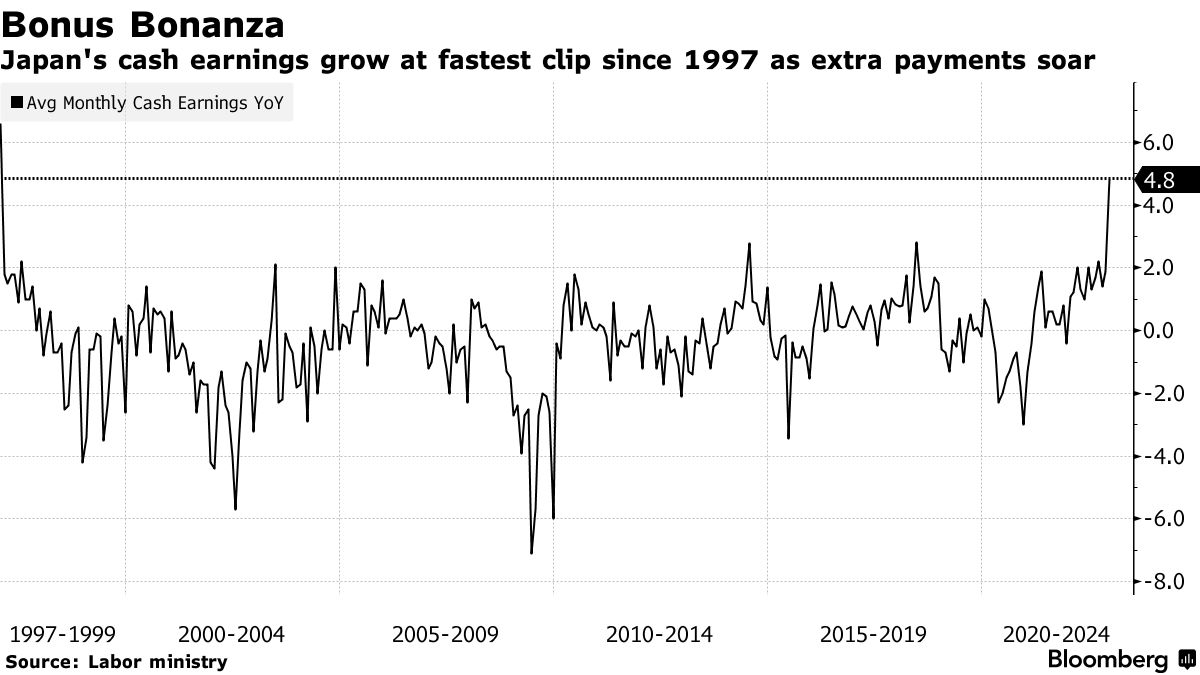

- Wages jump | Japanese workers' nominal wages in December rose at the fastest pace since 1997, fueling speculation the central bank will consider shifting policy after Governor Haruhiko Kuroda steps down in April.

- Britcoin | The Bank of England and the UK Treasury stepped up work on creating a digital currency to sit alongside physical banknotes and sought to allay concerns that the work could threaten the stability of banks.

- China rates | The calculus behind the People's Bank of China's pledge to use monetary policy to bolster the economy has been altered by the faster-than-expected recovery after the scrapping of Covid restrictions.

Side hustles are twice as prevalent as government data suggests, indicating that more Americans need to work multiple jobs to make ends meet amid historically high inflation.

Nearly 10% of workers reported having a main job plus at least one other side gig, according to the latest work-from-home survey conducted by economists including Stanford University's Nicholas Bloom.

By contrast, the January employment report showed 8 million, or about 5% of US workers had multiple jobs, according to the Labor Department. Read more here. Read more reactions on Twitter here. |

No comments:

Post a Comment