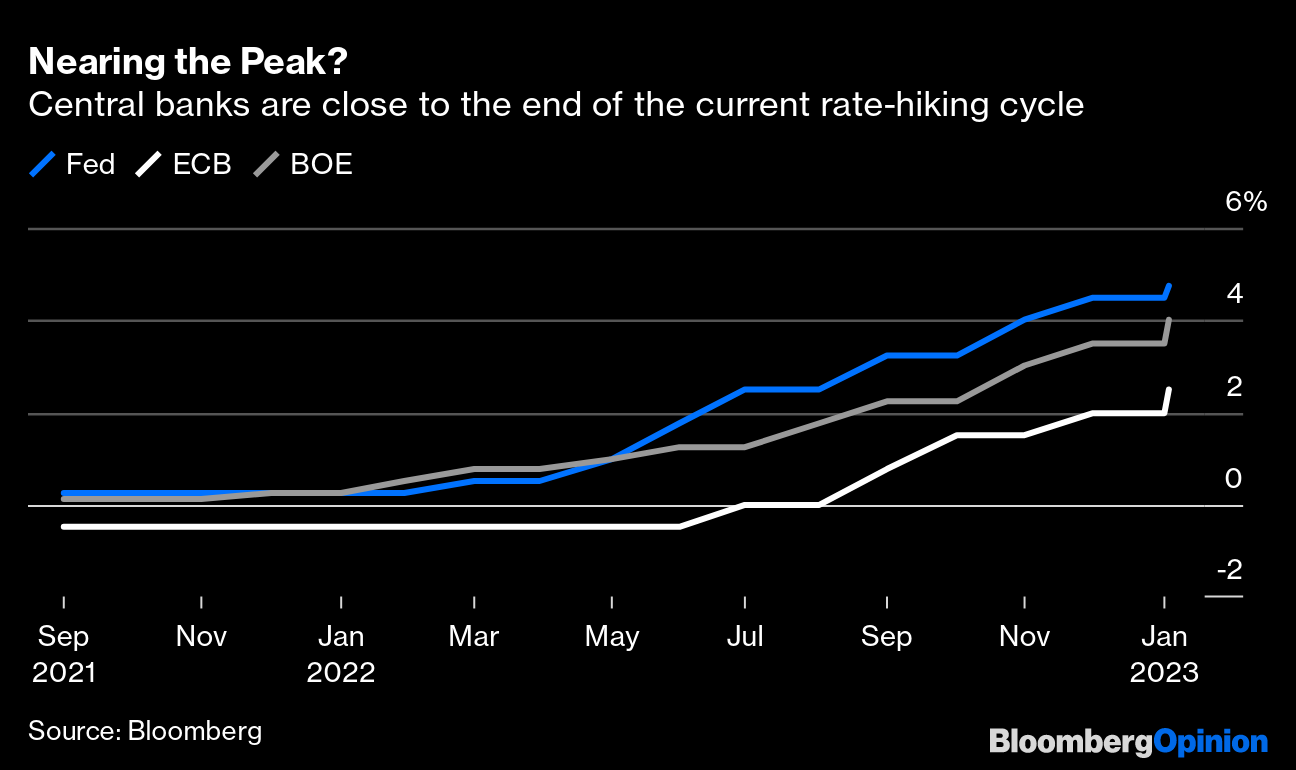

| This is Bloomberg Opinion Today, a fashionable fandango through Bloomberg Opinion's opinions. Sign up here. Friday's jobs report was "an absolute blowout upside surprise for a labor market that has been dogged by headline-grabbing tech layoffs," according to Prestige Economics President Jason Schenker. The US economy added 517,000 jobs last month, far exceeding the 188,000 gain anticipated by economists, while the unemployment rate dropped to a 53-year low of 3.4%. "It's as difficult an economy to read as I can remember," former Treasury Secretary Larry Summers told Bloomberg Television. Asked at Wednesday's press conference whether he was worried about the decline in bond yields creating easier financial conditions that could hamper efforts to curb inflation, Fed Chair Jay Powell chose not to push back hard. "Our focus is not on short-term moves, but on sustained changes" to financial conditions, he said. The bond market interpreted that as a license to continue rallying in the expectation that the US central bank is almost done raising interest rates. But after Friday's data, traders are starting to have second thoughts. The 10-year Treasury yield ended last week at 3.5%; it dipped as low as 3.33% Thursday, but looks set to end the week little changed. Clive Crook sees a disturbing possibility. "Not only do the Fed and the markets disagree about the economic forecast, but the markets suspect that the Fed is using interest-rate guidance dishonestly," he writes. "Many analysts are assuming exactly this — that the Fed isn't just mistaken, it's bluffing." That could be a dangerous game. By talking tough, policymakers may be hoping that the market will do its work for them by tightening financial conditions, is the argument. "The problem isn't just that interest-rate guidance isn't working. It's that the Fed's credibility is being called into question," Clive says. "If it can be deliberately misleading about its interest-rate intentions, where else might it shade the truth?" Thursday saw half-point increases in official interest rates from both the European Central Bank and the Bank of England. Echoing the market reaction to the Fed earlier in the week, "euro and sterling money markets have chosen to look straight through the hawkish rhetoric of their respective domestic central banks in anticipating an early end to the current hiking cycle," notes Marcus Ashworth. ECB President Christine Lagarde said in the post-decision press conference that a further 50 basis-point hike in rates would be delivered at next month's meeting — only to contradict that guidance by stressing that "intend" is not an "absolute, irrevocable commitment" to act. "She made a number of hawkish declarations, but markets espied a lack of commitment, and took that as an opportunity to bet that the hiking cycle was almost over," writes John Authers.  Marcus argues that the BOE "is at a similar crossroads" with regards to monetary policy. While Governor Andrew Bailey stressed that inflation risks are "skewed significantly to the upside," it finessed its message by saying there will have to be evidence of price pressures not abating for it to take further action. "Moreover, it dropped the word 'forceful' — code for half-point moves — from its description of how policy is likely to have to react," he notes. "The Fed is leading the way toward a pause; the ECB and the BOE won't be too far behind." Bonus Market (Ir)rational Exuberance Reading: When markets are this hot, should you jump in? — Mohamed El-Erian It's three years since Britain formally left the European Union. On Thursday, the BOE delivered one of the most dismal economic forecasts it has ever produced, saying the economy is already in recession and will struggle to recover even once the downturn is over; Friday, Chief Economist Huw Pill said the nation had yet to see any benefits from the exit, only negatives. "While London rues Brexit, Paris says 'merci,'" argues Lionel Laurent. The City is leaking more jobs; 2021 data from the European Banking Authority shows a jump in the number of top-paid finance pros in the EU. It's not just in banking that London is losing out — Millennium Management and Citadel LP are among hedge funds expanding in Paris. Lionel dubs recent developments as signaling a shift "from Singapore-on-Thames to City-on-The-Seine." It's not all good news for the EU, though. The bloc remains fragmented, with 27 competing markets and regulators rather than a single financial pool, while both Europe and the UK have lost market share of capital-markets activity relative to the US and Asia. "The continent is living up to what resembles bear-like behavior — long stretches of hibernation interspersed with crisis management," Lionel argues. "With social unrest brewing and protectionism on the rise, the danger is that Brexit's legacy becomes the 'lose-lose' the EU's negotiator Michel Barnier expected it to be." After being devastated during the pandemic, gyms have bounced back strongly. "Although soaring costs and a slide into recession now pose a threat, there are grounds for optimism," argues Andrea Felsted. "Fitness clubs may feel less of a burn from this contraction — if it comes — than previous downturns." Google will join the AI internet search wars, pitting LaMDA against ChatGPT. — Parmy Olson Amazon's dreaded "Day Two" is too close for comfort. — Leticia Miranda Detente still makes the most sense for the US and China. — Bloomberg's editorial board Move over, Tesla. Old auto is also locking in lithium supplies. — Elements by Liam Denning Joe Biden's policy successes were made possible by Barack Obama. — David A. Hopkins Deglobalization is the new globalization. — Tyler Cowen Adani's $108 billion crisis is shaking investors' faith in India's stock market. Cyber attack sends the world of derivatives trading back to the 1980s. A Hong Kong luxury apartment in the upscale Mount Nicholson development sold at a $17 million loss. Cathie Wood takes a victory lap, calling her ARKK fund "the new Nasdaq." Ford plans to return to Formula 1 auto racing after a decade-long absence. Ugg boots are back in fashion. Allegedly. Britain's ugliest dog, Peggy the Pugese, wins a makeover. (h/t Andrea Felsted)  Peggy, pre-makeover Peggy, post-makeover A wave of sushi terrorism is gripping Japan's restaurants. (h/t Elaine He) A 30-year-old Portuguese canine has been named the world's oldest ever dog by Guinness World Records. Notes: Please send sushi — unadulterated, please — and complaints to Mark Gilbert at magilbert@bloomberg.net. Sign up here and follow us on Instagram, TikTok, Twitter and Facebook. |

No comments:

Post a Comment