| This is absurd. It really isn't fair. The week was halfway over and relatively uneventful. Then all hell broke loose. The fact that everyone knew a lot of data was coming didn't make life any easier. As I write, the market has had to absorb decisions from three major central banks, and results from a range of companies including four of the world's biggest, all in a span of 26 hours. Non-farm payrolls await before Wall Street opens on Friday. I don't have the energy to try to summarize the prospects for the employment report. It might be a damp squib, or it might shake things up as much as the news stories that have already hit us since Wednesday lunchtime. Here is an attempt to guide through the points of return and no-return of a hectic day of trading. The European Central Bank has taken on the image of the "last hawk standing," talking unabashedly about the need to keep tightening. True to form, the ECB announced that it was hiking its target rate by 50 basis points, and promised to hike by the same amount next month. The result of all these moves that should have made bonds thoroughly unattractive: one of the biggest surges into European bonds in years. German bund yields dropped by more than 20 basis points, and in the process the differential between US and German bond yields, which tightened significantly last month, snapped back to almost exactly its level of the turn of the year: The fate of Christine Lagarde was very similar to that of Jerome Powell about 18 hours earlier. She made a number of hawkish declarations, but markets espied a lack of commitment, and took that as an opportunity to bet that the hiking cycle was almost over. What went wrong? Davide Oneglia of TS Lombard suggests that it can ultimately be blamed on communication blunders: A few remarks in the policy statement such as that in March the ECB will "evaluate the subsequent path of monetary policy" and that "risks to the inflation outlook have become more balanced, especially in the near term" were prone to be interpreted in a dovish light by investors. Crucially, however, if the Governing Council's intention was to at least maintain the current hawkish communication stance (as we suspect, in line with ECB "sources"), Christine Lagarde's confusing answers in the Q&A about the ECB's reaction function and direction of policy beyond March proved a failure.

It's still hard to cast any of this as a justification for a massive repricing of the bond market. Jean Ergas, economist at Tigress Financial Partners, suggests the problem was more that investors were behaving like poker players: I listened to Lagarde this morning and she's more determined than ever. I think the ECB is going to go beyond 4%. But the market is trying to play poker. They think she's bluffing. They forget that in this context the house is the central bank, and the house always wins.

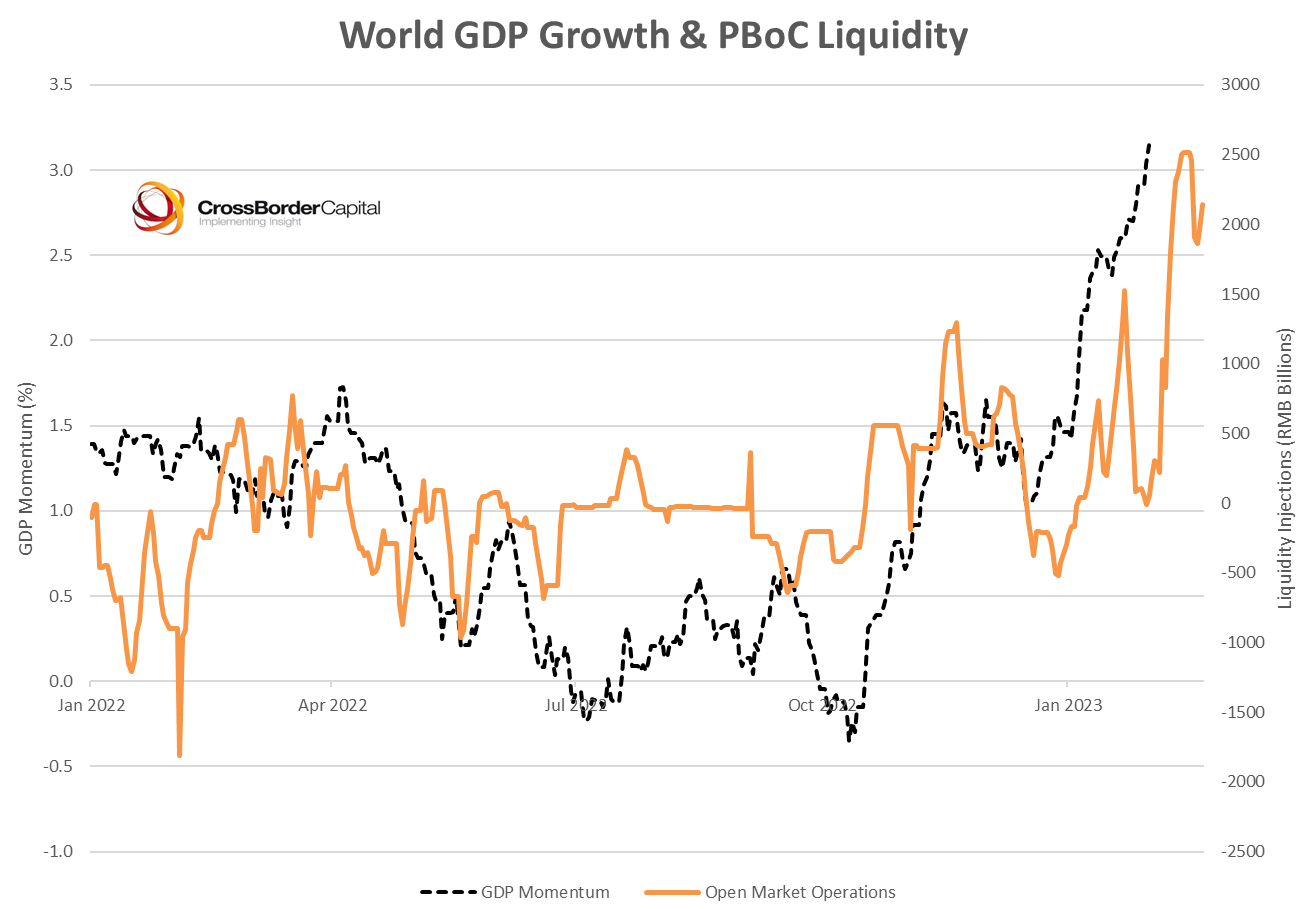

Much remains to be seen, of course, but as Lagarde was both more hawkish than the Fed in the present, and more hawkish in terms of what she was prepared to commit to in the near future, it's a very strange reaction for the market to bring European bond yields down far more than it has Treasury yields.  | The Bank of England was also part of the pattern. It announced a 50 basis-point hike, as most had expected, but with two dissenters calling to leave rates unchanged. The difficulties for the UK's economy were unmistakable. Thus, very perversely, a big rate hike was the cue for the bond market to push yields down, and in the process eradicate the last of the steep fall in gilt prices (and rise in their yields) that came during the disastrous brief premiership of Liz Truss. Both the overnight index swaps market's estimate of where the Bank of England's target rate will be this summer and the 10-year gilt yield itself are now back below their levels when Truss took over in the first week of September: The British economy still appears to be in an intractable mess, but the BOE said that the outlook has improved (perhaps at least in part because the bond market has calmed down surprisingly fast after the Truss meltdown). The trio of big central bank announcements gave way to a stock market rally for the ages. It looks a lot like the beginning of a new bull market. For the first time in a year, the Nasdaq-100 is comfortably ahead of its 20-day moving average. For a real sign that the bulls are back, Cathie Wood of Ark Management even told Bloomberg's Carol Massar in an interview that Ark was "the new Nasdaq." That might sound like hubris to you; I couldn't possibly comment. It's not just the US. Germany's DAX index has regained all its losses for the last 12 months (which, let it be remembered, included the Russian invasion of Ukraine): Adding to the fun, bonds have also been delivering capital gains for a change. That means the classic balanced portfolio, of 60% stocks and 40% bonds, has started to perform again after a historically miserable year in 2022. This is how Bloomberg's 60:40 benchmark has performed — note, yet again, that it appears to have broken decisively above the 200-day moving average: All these technical landmarks do matter. Many are now comfortably proclaiming that a new bull market is under way. And they are doing so within hours of rate rises by three of the world's most important central banks. If risk assets have enjoyed a historic rally, it remains difficult to see exactly why. Even if traders are right to call central bankers' bluff and bet that target rates will soon come down, after all, that still implies a slowdown in the economy — which would be bad for risk assets. If the economy isn't grinding toward a halt noticeably, why would the central bankers cut rates? As ever, positioning plainly has much to answer for. Across markets, this looks like a classic "short squeeze" as the stocks that had taken the biggest hit have seen the biggest rebound. For one nice illustration, this chart shows the performance of S&P 500 members for the year so far, on the vertical axis, and from August's brief high to 2022's year-end on the horizontal axis. The biggest fallers in the last downdraft of 2022 are the biggest gainers in this rally, with Tesla Inc. in the vanguard: The short squeeze is particularly effective because there's an abundance of liquidity to finance it. Arguably, this is the critical factor that had not been expected even a month ago, and that has turned market dynamics on their head. Some of the reasons for the turn in liquidity are counterintuitive, and include: - China, where a U-turn on public health and Covid has been followed through with a U-turn on liquidity. The sums involved are vast — in December and January, the People's Bank of China released 3 trillion yuan (about $425 billion) through open market operations, a sum 3.5 times greater than its total injections for the previous two years.

- Japan, where the Bank of Japan's shift in its yield curve control target in December prompted many traders to bet that the bank would be forced to allow yields to rise still further. That prompted the BOJ to buy even more Japanese Government Bonds.

- The US, where the impending debt ceiling showdown has forced the Treasury into accounting maneuvers to delay the day of reckoning. These mostly have the effect of counteracting the Fed's attempt to tighten its balance sheet, and releasing more liquidity.

On top of this, the fall in yields creates its own momentum, making money cheaper and enabling more speculative activity. The liquidity effect in China has been most dramatic, as illustrated here by Mike Howell of CrossBorder Capital. The orange line shows the rolling three-month total of liquidity injections by the PBOC via open market operations, while the dotted black line is a NowCast of moves in global GDP:  Liquidity on this scale can keep markets moving for a long time. Howell tends to think this is the beginning of a new liquidity cycle, which could mean a long strong run for risk assets. Others expect it to be shorter-lived. Harry Colvin of Longview Economics said: "What we've seen for the last few weeks has been a short-covering rally, and then in the last few days an aggressive short squeeze." With the economic data still pointing to an imminent recession, he suggests the short squeeze can't last much longer, and that buying bonds is going to make far more sense than equities for the rest of the year. And indeed, if this isn't a short squeeze it looks an awful lot like one. John Roque of 22V Research points to a series of startling successes during this rally, which have all the hallmarks of an indiscriminate liquidity-driven rally. Non-profitable tech stocks are up 17% in the last five days, he says, and 27.5% in 2023. Meanwhile, high beta momentum is also up 17% for the week, and 28% for the year to date, while the most heavily shorted stocks have done better still, up 15% in five days and 29% for the year. It's dangerous, as ever, to try to get in the way of a wall of liquidity. But unless that liquidity succeeds in keeping the economy afloat, the risk is that asset prices will sink. Creative destruction is an idea with a long pedigree. It's supposed to be what makes capitalism superior. In order for the best to survive and flourish, the worst need to be destroyed. Rather than suck up more capital like so many zombies, they can die a quiet death, and new entrepreneurs can come along to try to do a better job. That is the notion put forward by the Harvard economist Joseph Schumpeter. And it appears that credit investors have lost all enthusiasm for it. The latest credit outlook by the rating agency Standard & Poor's includes this stunning chart of corporate default rates in the US over time: Generally, and as would be expected, default rates peak on a cyclical basis, during and immediately after recessions. The peak default rate in 2020 after the brief Covid shock was barely over half of those seen at the worst of the previous three recessions. Now, defaults are back about low as they ever go, at roughly their level on the eve of the credit crisis in 2007. This is not a great parallel. Depending on your outlook, and psychology, the continuing lack of defaults, or of widening credit spreads, could be taken as evidence that the world is in a genuinely good place or that the money injected into the system in 2020 and 2021 is still distorting outcomes and leading to malinvestment. Once trading had closed for the day, it seemed the euphoria that had steadily built up on the back of optimism about lower rates might suddenly have met its match — in a bulldozer called Big Tech. Three heavyweights — Apple Inc., Amazon.com Inc. and Google parent Alphabet Inc. — all reported earnings after hours Thursday that spelled a darkening horizon ahead. Each tumbled at one point by more than 5%, rallied somewhat while their executives were addressing earnings calls — and then subsided again: Clearly, Wall Street did not like what it saw. And it all made quite a contrast to the rally that had been driven by Meta Platforms Inc., which saw its biggest surge since 2013, gaining more than 22%, on the back of its own earnings report Wednesday. Treasuries pared earlier gains, with the 10-year yield around 3.40%. But three is more powerful than one one. Markets were evidently upset — and here, we break it down. Apple The company reported a steeper sales decline in its holiday period than forecast, which Wall Street took as an ominous sign. The Cupertino, California-based technology giant was long one of the industry's most resilient companies. Among the disappointments were the iPhone and Mac. As many know, pandemic supply chain disruptions also caused quite the conundrum for Apple by making it harder to ship some versions of its iPhone. Chief Executive Officer Tim Cook cited a "challenging environment" in the statement but added that the firm remains "focused on the long term." Yet as Bloomberg News pointed out, it was a tough comparison year-over-year, especially since Apple launched a revamped MacBook Pro line in the previous holiday season. There is no updated laptop this time around. Continuing its practice since 2020, Apple didn't provide a revenue outlook for the second quarter, leaving many giving their best guess. The stock in extended trading dropped as much as 4% — but the skittishness of sentiment meant that at one point during the press conference it was able to erase all of its decline. That came as Cook was discussing artificial intelligence. Once he'd moved on from the hot topic of the moment, the shares fell again. Amazon That the brainchild of Jeff Bezos projected lackluster revenue in the current quarter was all investors could think about. Many were worried that Amazon's main e-commerce business has stalled on top of sales growth slowing in the cloud computing division. Never mind that the Seattle-based firm beat expectations for the holiday shopping season. Its online store revenue fell 2%, marking four out of five quarters of year-over-year declines. Amazon Web Services, which has long generated most of the company's profit, is also suffering as corporate customers reassess their technology spending. (Its rival Microsoft Corp. also reported disappointing results for its cloud unit last week.) "In the short term, we face an uncertain economy, but we remain quite optimistic about the long-term opportunities for Amazon," Chief Executive Officer Andy Jassy said Thursday in a statement. Shares fell 4% in extended trading. The stock lost half of its value in 2022 in what was the company's worst performance in more than a decade.  Ring-side seats to a beatdown. Photographer: Marlena Sloss/Bloomberg Alphabet The artist formerly known as Google posted lackluster results that only narrowly missed expectations, yet investors did not miss a chance to punish it. Shares fell more than 6% in extended trading. The tech giant signaled lower demand for its search advertising during a slowing economy. This was a big concern since Google's core advertising business is under threat on multiple fronts, including the US Department of Justice, which has called for a breakup of its search business, and hotter, newer competitors like Open AI Inc.'s ChatGPT. Google in fact last year declared a "code red" in response to the buzzy chatbot. Perhaps this is why Chief Executive Officer Sundar Pichai put artificial intelligence front-and-center in his discussion of results. "I'm excited by the AI-driven leaps we're about to unveil in Search and beyond," Pichai said in a statement. "We're on an important journey to re-engineer our cost structure in a durable way and to build financially sustainable, vibrant, growing businesses across Alphabet." The summary It's a lot to digest, but taken together the three tech behemoths didn't exactly paint a rosy picture. As elaborated in Points of Return yesterday, it remains a challenging year ahead. Interest rates are still high, recession risks are still there, consumer sentiment has shifted. And while investors remain eager for any excuse to buy, it looks as though they may already have used up all their best reasons to trust Big Tech. — Isabelle Lee Unless you have stamina, high emotional intelligence, and a decent supply of liquid money that you can afford to lose, you probably don't want to try trading the markets at present. If you'd like an aid to slowing down, maybe try listening to some trip-hop; for example Slow Down by Morcheeba, Sour Times by Portishead, or Teardrop by Massive Attack (or by Aurora). All are the rough musical equivalent of a warm bath. The same can be said of Miles Davis's Kind of Blue. And for something truly sublime, try this. Have a good weekend everyone. Only one more day to go.

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: Want more from Bloomberg Opinion? {OPIN <GO>}. Web readers click here. |

No comments:

Post a Comment