| Hello. Today we look at how the markets are making it increasingly difficult for central bankers to defeat inflation, what the Adani saga means for India's investment and growth prospects, and how Russia's current account has evolved during wartime. Three major central banks reported decisions this week, each acknowledging a slide in price growth while affirming that it's way to early to declare victory in their fights against inflation. Investors broadly chose to focus on only that first part. As we explain here, the selective hearing on the part of markets — celebrating citations of disinflation from the Federal Reserve, European Central Bank, and Bank of England and collectively plugging their ears about the tightening that those officials say remains — has exacerbated a game of chicken with policymakers. And it's starting to make their jobs that much more difficult, given the dovish bets are a form of financial easing that, ironically, could force even more aggressive action that runs against market expectations. After each of Jerome Powell, Christine Lagarde, and Andrew Bailey delivered their latest takes on the outlook, bond yields slid. Overnight-priced swaps contracts also tell the story, with traders of those securities seeing an overwhelming wave of rate cuts coming. "Central banks are talking tough — 'higher for longer, the job's not done' — but once economies start to collapse because of the speed and magnitude of their earlier tightening, the market will price recessionary policy paths regardless of the level of inflation," said Kellie Wood, a fixed-income money manager at Schroders Plc in Sydney. Minneapolis Fed chief Neel Kashkari, a former investment banker, said recently with confidence that investors will lose on bets that the Fed will give in on the inflation battle. Ray Dalio of Bridgewater Associates says it's "one of the easiest, safest bets" that the Fed won't give in. The latest turn, though, has some concerned that this has become much more than just a war of words. Three International Monetary Fund officials warned in a blog post this week that central banks needed to push back on markets and "remain resolute" without loosening prematurely — or risk a sharp resurgence in inflation as activity rebounds. And then, it's game over. — Michelle Jamrisko Just 10 days ago, Gautam Adani and his sprawling energy-to-ports empire looked invincible. Now, a damning short-seller attack has left the billionaire battling the worst crisis of his corporate life — and is raising bigger, darker questions about India's credibility as a global growth engine and a destination for international investors. The Adani Group has shed $108 billion in market value since Hindenburg Research accused it of stock manipulation and accounting fraud in a Jan. 24 report. But it was only when the tycoon scrapped a $2.4 billion share sale this week that the potential for lasting impact became clear. The fallout from its almost 100-page report threatens to undermine investor confidence in India more broadly, and in the nation's regulatory framework — whether its claims ultimately prove to be true or not. Read the full story in today's Bloomberg BigTake. - COMING UP: Today's payrolls report may show US hiring continued to moderate at the start of the year. But strong wage growth, unemployment near historical lows and high vacancies are also likely to feature.

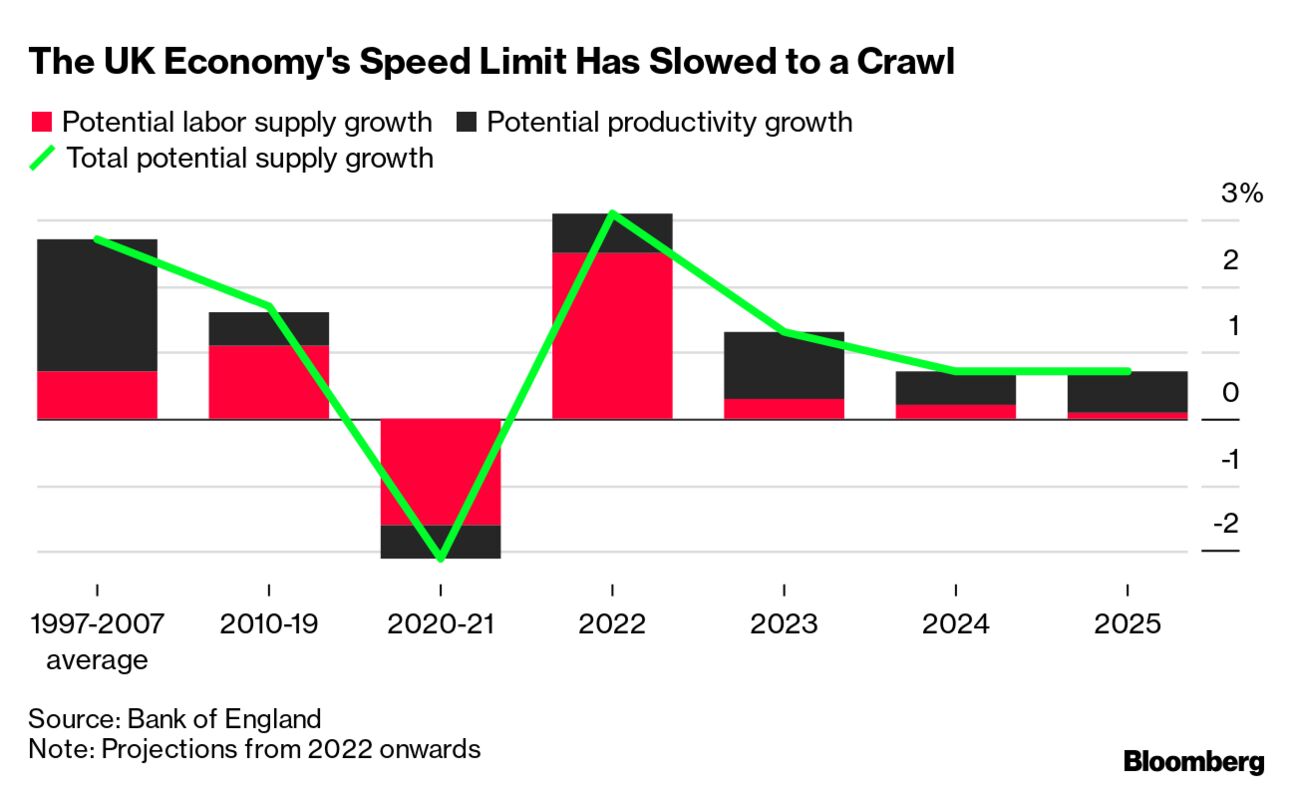

- Brexit blow | Economic damage from Brexit is happening sooner than feared, the Bank of England warned, adding that the UK now faces its bleakest outlook in generations as people give up on work.

- China lobby | Days after Japan and the Netherlands joined the US in agreeing to restrict some high-technology exports to China, Beijing has reached out to those American allies, encouraging them to protect existing supply-chain relationships.

- Paris club | The Paris Club of creditors formally supports debt restructuring for Sri Lanka, bolstering the bankrupt nation's efforts to unlock a $2.9 billion bailout from the International Monetary Fund.

- Traders guide | It's the final stretch in the race to replace Bank of Japan Governor Haruhiko Kuroda, a decision that could whipsaw markets from the yen to Treasuries. Here's our guide laying out what it all means.

Russia's current-account surplus last year more than doubled its previous record, hitting a new all-time high of $227 billion, according to estimates by the Institute of International Finance. China's trade with Russia expanded significantly, and the Eurasian neighbor "is now, by far, Russia's most significant trade partner," IIF economists including Elina Ribakova wrote in a note Wednesday. That's thanks mainly to higher Russian exports, but China is serving an important role for Moscow in imports, also. Despite export controls put in place by the US and its allies, Russia was able to increase its imports of semiconductors and electronic circuits, the IIF found. "China and Hong Kong have successfully replaced other countries as chip suppliers," and now provide about 40% of Russia's total chips, the IIF says. Read more reactions on Twitter |

No comments:

Post a Comment