| Hello. Today we look at the ongoing battle between markets and the Federal Reserve, what central banks in Europe will do today in the wake of the US monetary decision yesterday, and how Fed rate hikes are making its operating losses worse. "We're just going to have to see." That's Federal Reserve Chair Jerome Powell's bottom line with regard to the disagreement between markets and the Fed on the monetary policy outlook. It was enough to stoke another rally, Jonnelle Marte reports here. As outlined in this newsletter before Wednesday's Fed meeting — where, as expected, policymakers raised interest rates by 25 basis points — markets see the Fed easing policy later this year. But Powell and his colleagues are determined, as they showed again yesterday, to boost rates further and hold them there "for some time." Powell did follow through on expectations he'd emphasize the Fed's job isn't done — highlighting that a number of key price categories have yet to show a reversal. But he also refrained from pushing back against recent exuberance in markets. In some ways he even fed that exuberance: - He declared: "We can now say I think for the first time that the disinflationary process has started"

- While repeating that it's not their base case, Powell did acknowledge that if inflation comes down much more quickly than expected, that would "play into" the policy setting

- And he specifically mentioned that rates are now in positive territory after accounting for inflation, with those real rates "positive across the yield curve"

Meantime, he specified that policymakers currently anticipate "a couple of more rate hikes" to complete their expected tightening cycle. Powell "goofed" with that revelation, or so says Kathy Bostjancic, chief economist at Nationwide. That helped stoke the gains posted Wednesday afternoon in stocks and bonds, she said. And while policymakers in December had worried over an "unwarranted easing" in financial conditions, Powell passed up on the opportunity of delivering any warning on that score. Asked about that December language, he responded that conditions hadn't really changed much since the Dec. 13-14 meeting. True. But the narrative since New Year's has been about a rapidly improving outlook. The Nasdaq Composite index has soared 13%, with both government and corporate bonds also rallying. "It's important markets do reflect the tightening that we're putting in place," Powell said, observing that financial conditions had still tightened considerably over a one-year timeframe. The Fed chief said, at the end of the day, there's just a "difference in perspective" about how fast inflation will come down. If inflation really did come down much faster, that would be "incorporated into our thinking about policy," he said — effectively not ruling out the chance of a rate cut. "I'm not going to try to persuade people to have a different forecast," Powell said. The Fed chief's calm demeanor on the battle with the markets belies an age-old central banker attitude not to "take on the market," former Atlanta Fed chief Dennis Lockhart told Bloomberg Radio. Powell was "very aloof" and "very measured" on that particular point, Lockhart said. Some are betting that by playing it cool, Powell actually erred in not taking the bait and scolding the markets. "He was dismissing the thing the market was most concerned about: that they would react to the easing of financial conditions," said Jeffrey Rosenberg, a senior portfolio manager at BlackRock. Fed officials "may look back on that and need to walk that back."

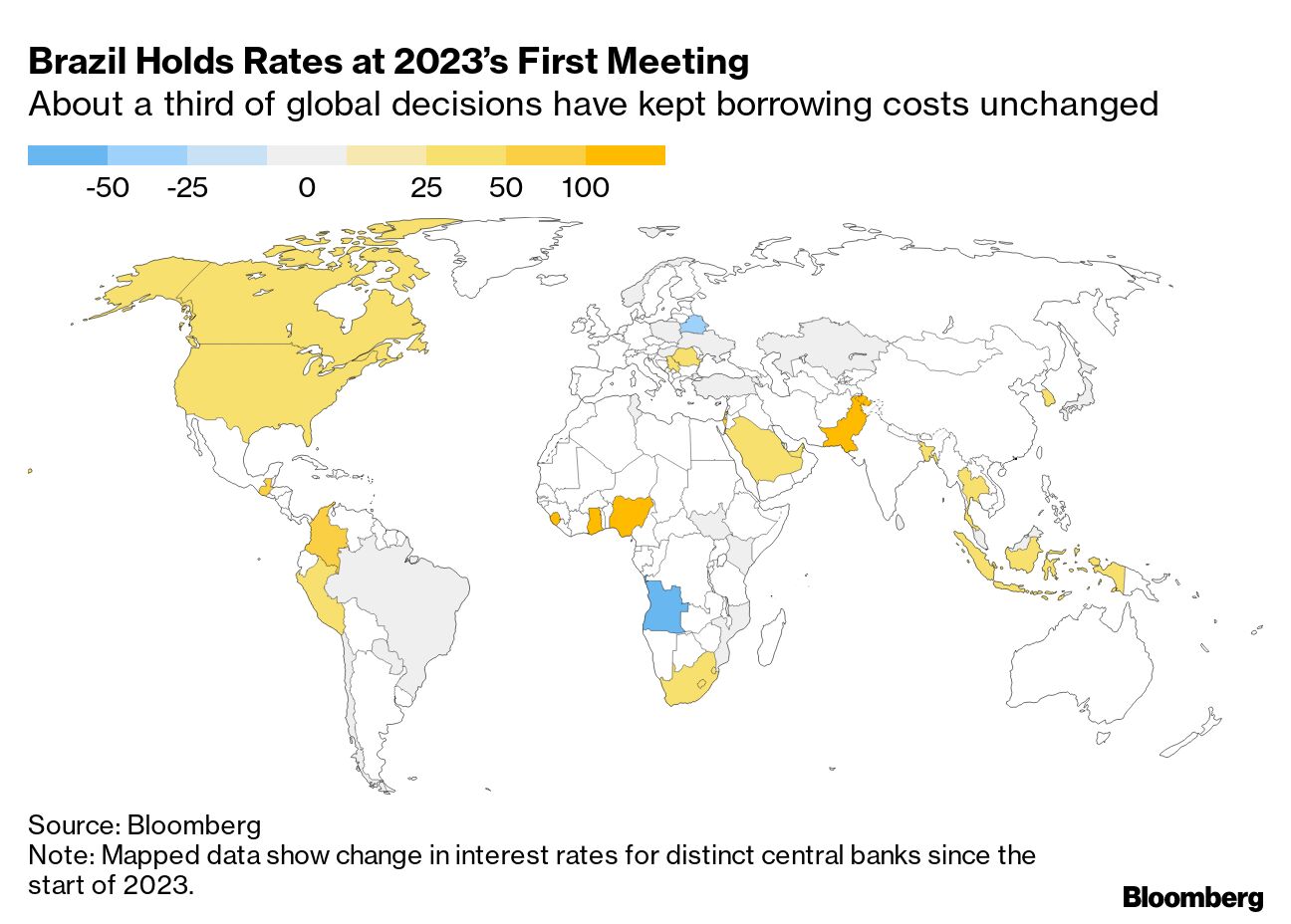

—Chris Anstey Just as with Powell, it's the hints from policymakers in Europe about what they'll do next that will focus investors today. A half-point rate hike by the Bank of England is the majority expectation of forecasters, and a move of the same size by the European Central Bank a short while later is all but certain. As we explain here, the UK decision will feature quarterly projections that may point to a shallower recession than predicted, and an assessment of the economy's supply potential that might point to greater inflation risks. In such a scenario, further aggression would be needed. The focus of ECB debate meanwhile is whether the March meeting should feature another half-point increase, or a smaller hike, as we report here. Both sides have a case to push: while headline inflation has slowed more than expected and bank lending is dropping off, the so-called core measure of underlying price pressures remains at a record high. Whatever happens to euro-zone rates today is likely to be echoed by a subsequent move, possibly within hours, by the Danish central bank, whose monetary regime is tied to the single currency. Other European countries are far more advanced in their tightening. That's certainly the case in the Czech Republic, which will probably keep its rate at 7% today, the highest since 1999. Here's our guide to that decision. - Rate bets | Brazil's central bank held the benchmark rate for a fourth straight meeting amid concerns about rising inflation expectations and government infighting. In South Korea, inflation quickening in January suggests potential further tightening even as the economy weakens.

- Adani saga | The Reserve Bank of India is asking lenders to Adani Group about more details of their exposure to the embattled corporate giant.

- Ripple effects | Emerging markets saw some side benefit to market excitement around the Fed's talk about progress on fighting inflation, with one measure of EM currencies soaring to the highest since April.

- Airfare giveaway | Hong Kong officials plan to distribute 500,000 plane tickets as part of a "Hello Hong Kong" tourism campaign.

- Swedish housing | Prices fell on a seasonally adjusted basis in January, stretching out a drop for the market that's in the spotlight for enduring some of the biggest declines globally.

- Rate pledge | Turkish President Recep Tayyip Erdogan pledged the nation will keep slashing rates to shore up the economy ahead of a crucial reelection bid this year.

- BOJ on wages | Bank of Japan Governor Haruhiko Kuroda has placed wage growth at the center of debate over whether potentially market-jolting policy change looms at the central bank after years of stimulus.

With Wednesday's rate increase, the Fed will be running deeper operating losses. That's because it's now paying more on the reserve balances that commercial banks park at the central bank. Those outlays are exceeding the interest accrued on its massive portfolio of bonds. While usually the Fed sees net earnings — which are passed along to the US Treasury — things flipped in September. "The absence of Fed profits being remitted to the Treasury represents a shortfall" that the government will need to make up with more debt sales or tax increases, Derek Tang, an economist at LH Meyer in Washington, wrote in a note this week. If the Fed hikes its benchmark rate to 5.1%, the "annualized loss could amount to $100 billion," Tang wrote. Still, the Fed "has stressed that the profit-loss position of the Fed is incidental to its monetary policy goals" and this wouldn't prompt the Fed to start easing sooner, he concluded. Read more reactions on Twitter |

No comments:

Post a Comment