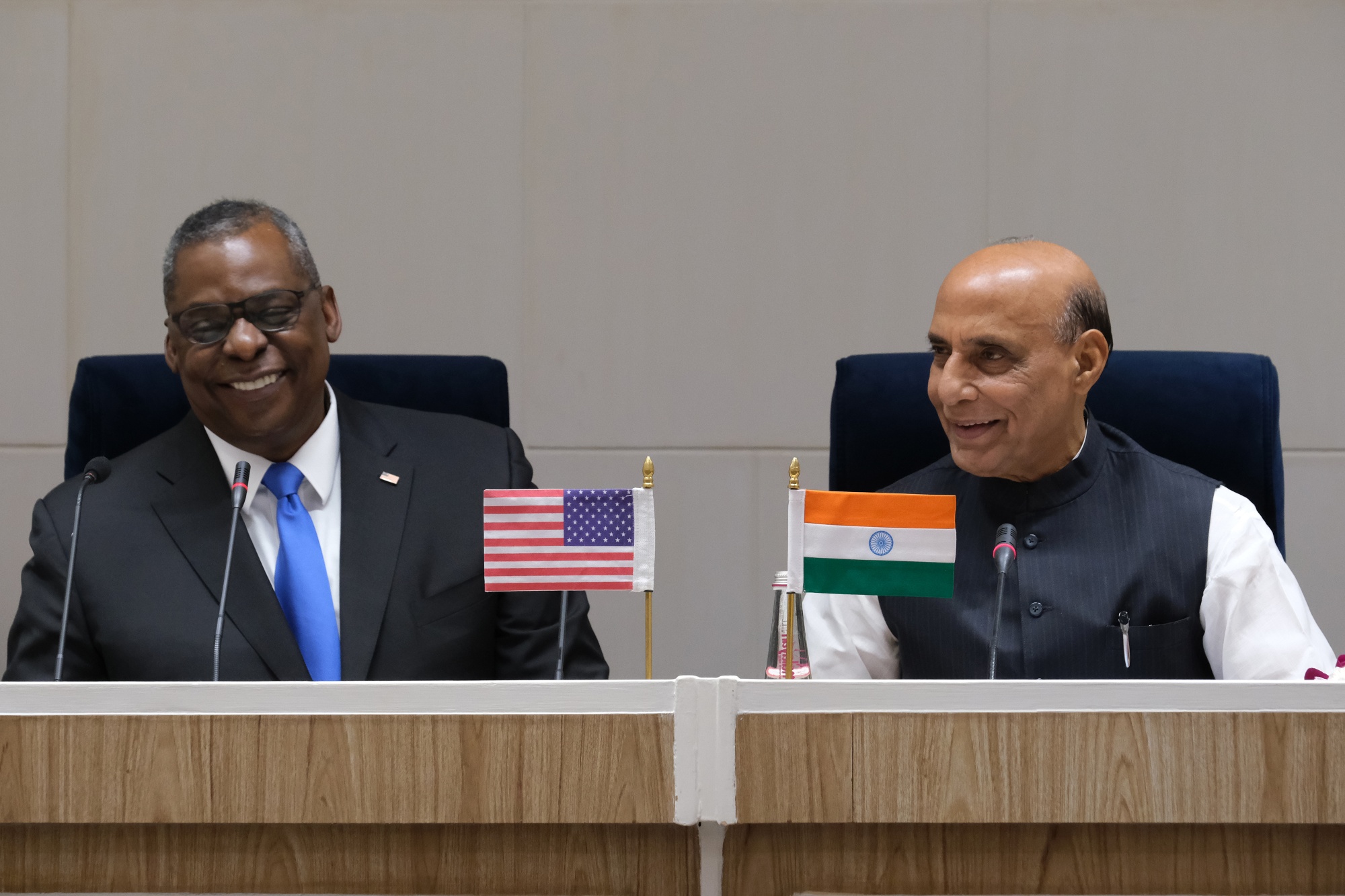

| In the board game Axis and Allies, a contest set during the height of World War II, one way of bolstering strategic military advantage is setting up industrial complexes closer to theaters of operation. A similar strategy is underway now—in the real world. US allies and partners in the Indo-Pacific region are becoming defense-production nodes for American strategic interest in the region, part of an increasingly global US-China geo-strategic standoff. Debate among Republicans in the US House of Representatives is turning toward budget cutting, so even if defense spending is somewhat shielded, for the Pentagon it helps that partners are stepping up. From Japan to Australia to India, military budgets are being expanded, helping to strengthen capacity to respond to a China that's steadily pushing its scope of military operations. With the US and India this week agreeing to share advanced defense technology and to look at potential joint production, it's becoming clear that Washington has moved beyond the era of simply looking to sell American gear abroad. For some economies, defense is becoming a key sector propelling job growth, in a shift that will also encourage the development of political lobbies entrenching higher public spending.  US Secretary of Defense Lloyd Austin, left. and India Defense Minister Rajnath Singh Photographer: T. Narayan/Bloomberg The US–India Initiative on Critical and Emerging Technologies, a deal released Tuesday, bolstered Washington's broader agenda of strengthening military, technology and supply-chain links with partner countries in the region. Linked to the accord, US officials are evaluating a proposal from General Electric Co. to approve joint production of jet engines for Indian warplanes. That would be a step toward lessening India's historic reliance on Russia for military hardware. Meantime, US ally South Korea is seeing a boom in its defense sector. Exports for 2022 totaled about $17 billion through November, surging from $7.25 billion a year before. Washington appears to have given Seoul the green light to sell to Poland and other east European nations, while US defense contractors focus on weapons for the likes of Ukraine and Taiwan. In August, Poland signed a $5.8 billion contract with South Korea for the supply of tanks and artillery. That was months after Australia, which with the US is part of the strategic "Quad" dialogue along with Japan and India, bolstered ties between its defense industry and South Korea's in late 2021, including a deal worth A$1 billion ($695 million) to buy K9 Thunder artillery.  Soldier from Japan's Ground Self-Defense Force 1st Airborne Brigade take part in a joint military drill with the US, Britain and Australia in Funabashi, Japan, on Jan. 8 Photographer: Yuichi Yamazaki/AFP And a number of US contractors are now looking to set up manufacturing inside Australia, including Lockheed Martin Corp. and L3Harris Technologies Inc. A decade ago, Australian industry was on the ropes (as manifested by the demise of the iconic Falcon sedan made famous by the Mad Max films). But now, defense is becoming significant enough to the economy that the Australian Bureau of Statistics recently kicked off a new data series measuring the sector. The segment employed 61,600 people in 2022, up 10% from the previous year, and contributed A$10.6 billion to the Australian economy. Missile output is a notable focus for multiple US allies—especially those within reach of China's formidable and growing arsenal. But it's a two-way street. "Quite frankly we need more missiles in Australia, both as a stock and also the ability to maintain, repair and upgrade those missiles," Labor Party lawmaker Pat Conroy said in October, according to local media. His government has embarked on setting up sovereign missile production in Australia, backed by Lockheed and France's Thales SA. Japan is also planning to enlarge its arsenal of missiles, as part of a planned 43 trillion yen ($330 billion) boost to defense spending over the next five years. That will include domestic development and production. South Korean missile producer LIG Nex1 is among the companies that have seen their stock climb amid the expansion in defense budgets. Its shares have more than doubled the past two years. (It's also benefited from South Korea's new ambitions in space.) The expansion of defense industries among US allies and partners is surely a trend set for the long haul, especially given the increasingly aggressive nature of Washington's standoff with Beijing. In the Indo-Pacific at least, it seems that swords are winning out over ploughshares. —Chris Anstey Get Bloomberg's Evening Briefing: Sign up here to receive our flagship newsletter in your mailbox daily, along with our Weekend Reading edition on Saturdays. |

No comments:

Post a Comment