| Thousands dead after earthquakes in Turkey. Recovery of downed Chinese balloon underway in US. Fed's Bostic sees interest rates pushed to a higher peak. Here's what you need to know today. The US has started to recover some parts from the Chinese balloon that an American F-22 fighter jet shot down off the coast of South Carolina. Experts say the balloon was about 200-feet tall and probably weighed thousands of pounds. US officials are still trying to figure out how much senior leaders in Beijing knew about the alleged spy mission, which China claimed was a meteorological balloon. The incident shines a spotlight on China's surveillance methods around the world. Beijing said a second balloon spotted over Latin America had been blown off course and was "for civilian purposes." Meanwhile, it emerged that three Chinese surveillance balloons flew over the US during Donald Trump's presidency.  Collapsed buildings in Hatay, Turkey. Photographer: Ercin Erturk/Anadolu Some of the most powerful Middle East earthquakes in decades killed thousands of people in Turkey and Syria, and left tens of thousands homeless as snowfall increased. A pre-dawn quake first hit the Turkish city of Gaziantep on Monday morning and a second struck nearby just nine hours later, toppling thousands of buildings in the country and neighboring Syria. President Recep Tayyip Erdogan said Turkey is facing "the strongest disaster in a century." See the devastating aftermath of the quakes in pictures, here.  | Federal Reserve Bank of Atlanta President Raphael Bostic said January's strong jobs report raises the possibility that the central bank will need to increase interest rates to a higher peak than policymakers had previously expected. Bostic reiterated that his base case remains for rates to reach 5.1% and stay there throughout 2024. But a higher peak could come through an additional quarter-point hike beyond the two currently envisioned, he said, while not ruling out a half-point increase. Goldman Sachs economists have slashed their estimate for the probability of a recession in the next 12 months. Billionaire Gautam Adani and his family have prepaid $1.11 billion worth of borrowings backed by shares as the conglomerate seeks to allay investor fears and stem a stock rout that's in its third week. Adani is seeking to restore confidence in his sprawling conglomerate's financial health after a scathing short seller attack in late-January wiped out $118 billion of the group's market value and forced the flagship to scrap a share sale. Meanwhile, a leading New York University finance professor known for his expertise on valuation said shares of Adani Group's flagship firm are still way too expensive. Asian equities look poised for a cautious open, after US stocks gave back some of this year's gains amid bets the Federal Reserve will keep a firm grip on monetary policy. Futures for Japan and Hong Kong were little changed after the S&P 500 and the tech-heavy Nasdaq 100 finished lower. US-listed Chinese companies fell, with the Nasdaq Golden Dragon Index dropping to the lowest in more than two weeks. Treasuries extended their selloff from Friday as traders ramped up bets on future tightening. - Are you more bullish on residential markets in Singapore, Dubai or New York? If you could work from anywhere in the world, where would you go? What will happen to US housing in 2023. Take our latest MLIV Pulse survey here.

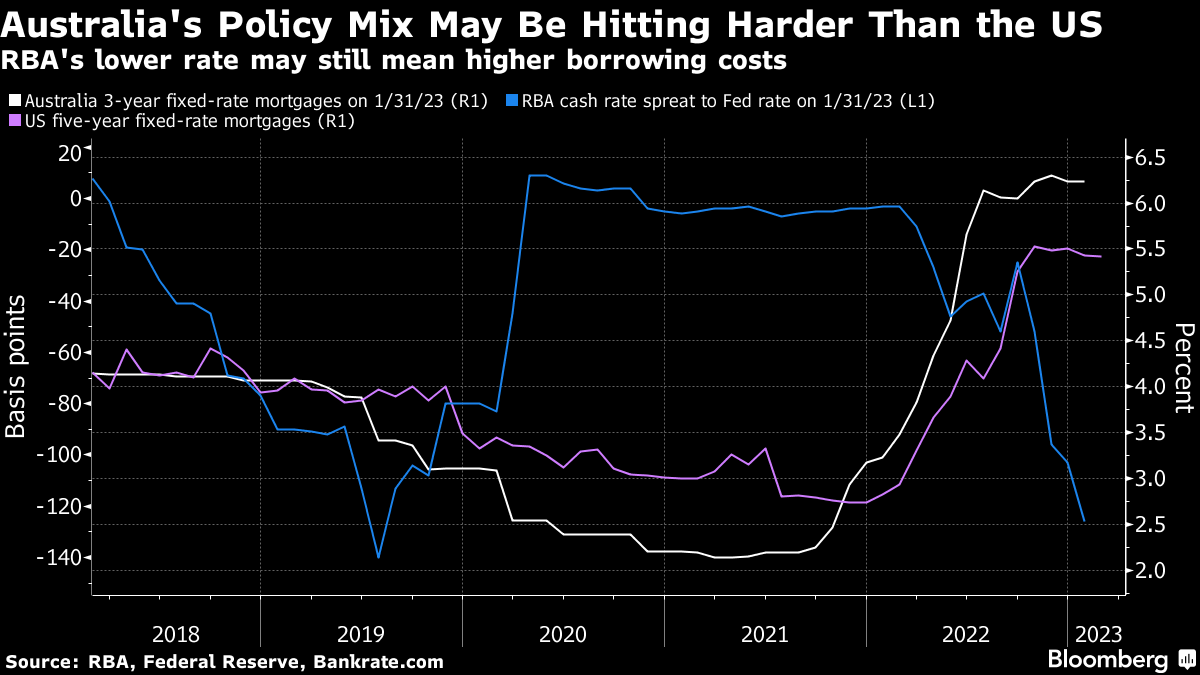

Australia's central bank is overwhelmingly expected to raise interest rates by a quarter point on Tuesday, so all eyes will be on the accompanying statement for clues as to how many more hikes are set to come. Investors may want to be wary about reading too much in to Governor Philip Lowe's comments as a guideline to where global peers are likely to go, especially if he comes across with a dovish bias.  While the Reserve Bank's slower and lower benchmark rates path has won it a reputation for a soft touch, that view glosses over the significant differences between Australia's property market and those of its peers. Even with the RBA's cash rate sitting 125 basis points below the Fed's, mortgage rates in Australia are a lot closer than to American ones. And most US home loans are fixed while Australian mortgages are overwhelmingly variable-rate offerings — so the hit from an increase in the central bank's target is that much stronger Down Under. If you look at the shortest US fixed rate and the shortest Australian one, as the two most readily comparable benchmarks, you can see the Australian one is substantially higher. Garfield Reynolds is Chief Rates Correspondent for Bloomberg News in Asia, based in Sydney. |

No comments:

Post a Comment