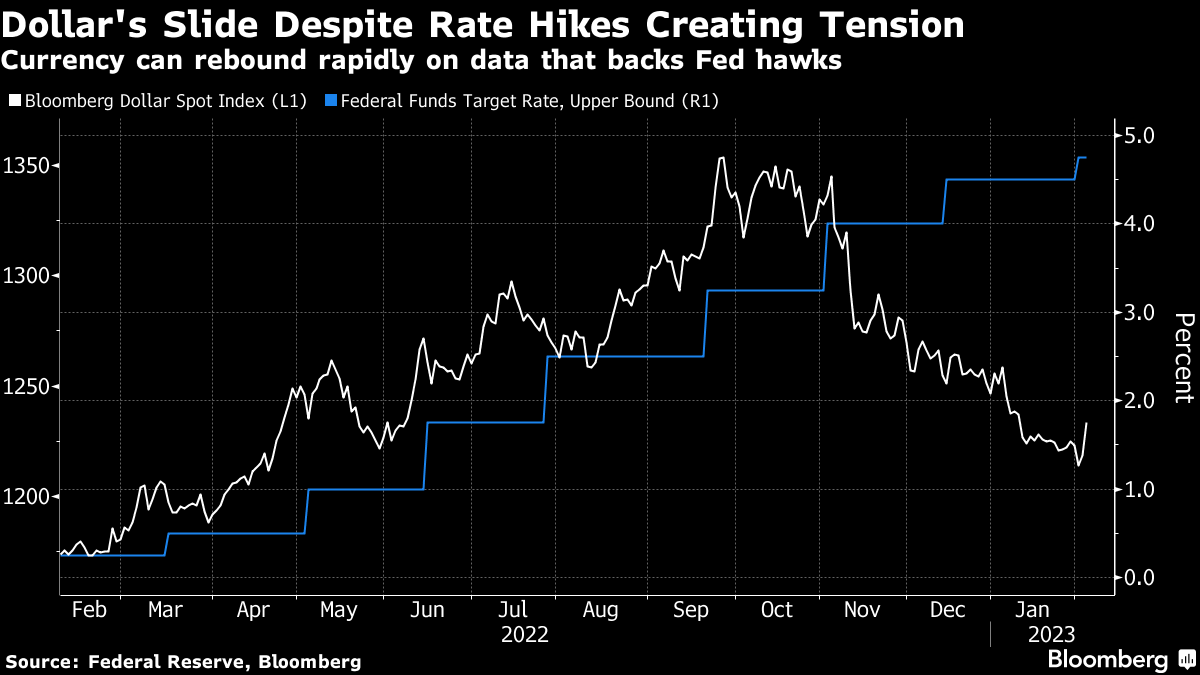

| US and China at loggerheads over balloon shooting. Mass trial of pro-democracy activists to start in Hong Kong. India tries to calm nerves over Adani meltdown. Here's what you need to know today. This weekend was supposed to be a step forward in ties between the US and China, with Secretary of State Antony Blinken arriving in Beijing for the first such visit in more than four years. But after an F-22 Raptor blasted an alleged Chinese spy balloon out of the sky off the coast of South Carolina — you can watch that here — it was spent instead trading barbs. Beijing's abrupt shift from expressing regret about the balloon's flight to threatening retaliation over US action highlights the need for Xi to show he's standing up for China against external pressure. Here's everything we know about the spy-balloon saga right now. Indian policy makers and regulators stepped in over the weekend to calm frayed nerves over concerns the turmoil surrounding billionaire Gautam Adani's conglomerate would affect global investor sentiment toward the country. Government ministers stressed that regulators would deal with the fallout, while the Securities and Exchange Board of India said it was committed to ensure market integrity. The market value of Adani's companies has slumped by almost half since the release of a scathing report by US-based short-seller Hindenburg Research accusing it of stock manipulation and accounting fraud. Here we take an inside look at the 19-hour meltdown that junked Adani's share sale.  | Australia's central bank is all but certain to increase interest rates at its first meeting of the year, with some observers pointing to the risk of a resumption of outsized moves to counter a surprising surge in inflation. Most economists and traders see the Reserve Bank lifting its cash rate by a quarter-point on Tuesday to 3.35%, the highest level since September 2012. The RBA's rate hikes have driven a downturn in the housing market that's beginning to weigh on broader activity. Retail sales fell far more than expected in December as cost of living pressures weighed on households. The mass trial of prominent pro-democracy figures in Hong Kong gets underway Monday in the city's largest national security case to date. The 47 defendants include legal scholar Benny Tai, former lawmaker Leung "Long Hair" Kwok-hung and former student leader Joshua Wong. Some face a maximum of life imprisonment on conviction. The prosecution of so many key opposition figures at once will draw focus on the controversial security law and the city's future as an international hub at a time when the government is seeking to promote Hong Kong globally after years of Covid isolation battered its reputation. The trading week opens in Asia with mixed messages from equity futures, along with headwinds from an unexpectedly strong US jobs report and the downing of the Chinese balloon that's aggravated geopolitical tensions. Contracts for Japanese and Australian equities suggested potential for small gains while those for Hong Kong were lower. US-listed Chinese stocks slipped Friday. In early currency trading, the yen slumped versus the dollar after the Nikkei reported that the government had approached Bank of Japan Deputy Governor Masayoshi Amamiya about succeeding Haruhiko Kuroda as head of the BOJ. Rumors of King dollar's demise may have been a touch exaggerated. That was the message rammed home for currency and bond traders with Friday's sizzling hot payroll numbers. Equities recovered some of their initial tumble as investors digested the data and decided that at least some of the apparent strength in the jobs market was driven by seasonal factors.  However, the dollar in particular kept on climbing as the tension created by the divergence between policy and currency pricing played out. The US currency has been sliding since early November, when the last of the Federal Reserve's three-quarter point hikes was deemed to signal that peak tightening was imminent. Rates traders have been piling into bets the central bank will stop sooner than its own forecasts and start cutting. Further data surprises could get markets listening to the Fed again and drive the greenback substantially higher, especially with the potential that the new Bank of Japan head will be dovish set to drive further dollar strength as the week opens. Garfield Reynolds is Chief Rates Correspondent for Bloomberg News in Asia, based in Sydney. |

No comments:

Post a Comment