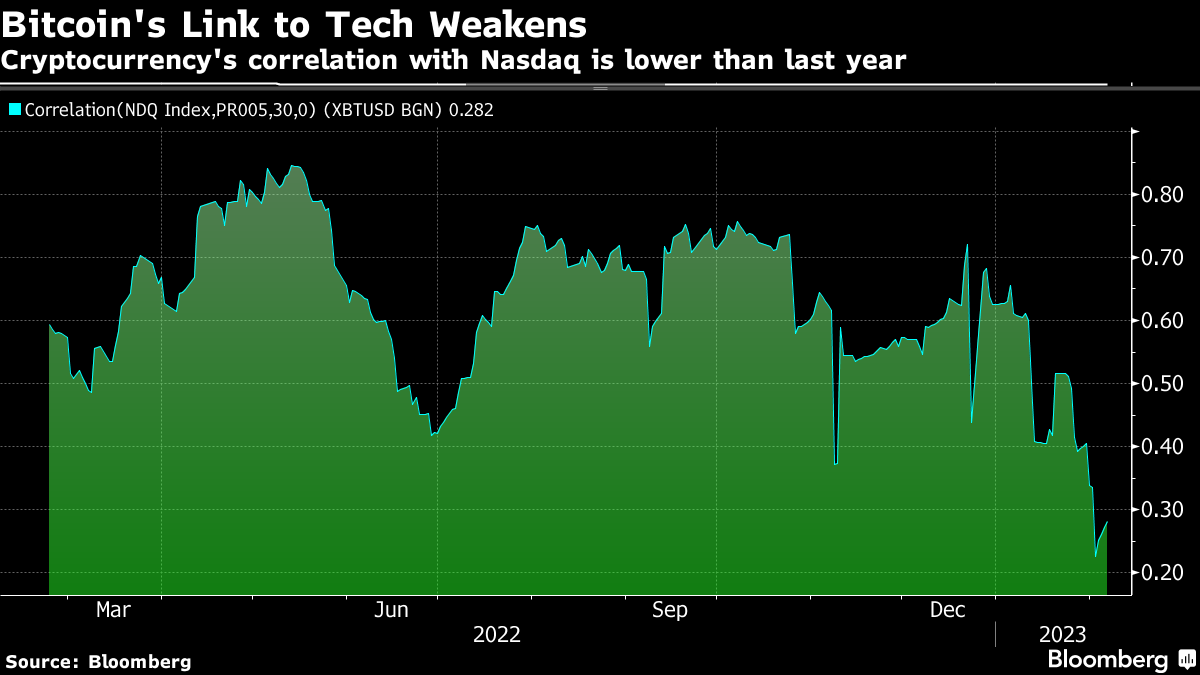

| Good morning. Recovery begins after devastating earthquakes, a Fed official warns of higher rates and Credit Suisse delays bonus talks for some of its bankers. This is what people are talking. Rescue teams from overseas began arriving in Turkey on Tuesday after a pair of powerful earthquakes a day earlier killed at least 4,000 people in the country and neighboring Syria, leaving millions to suffer without power or heat throughout a snowy night. As dawn neared, people in both countries were set to spend a second day searching through the ruins of thousands of buildings left damaged or demolished by a magnitude 7.7 quake that hit near the Turkish city of Gaziantep on Monday morning. Another temblor measured at 7.6 struck nearby just nine hours later, according to Turkey's disaster response management agency, known as AFAD. Federal Reserve Bank of Atlanta President Raphael Bostic said January's strong jobs report raises the possibility that the central bank will need to increase interest rates to a higher peak than policymakers had previously expected. If a stronger-than-expected economy persists, "It'll probably mean we have to do a little more work," Bostic told Bloomberg News in a phone interview on Monday. Investors will be keenly awaiting comments from Fed Chair Jerome Powell, who is set to speak with David Rubenstein at 12.40pm Washington time today.  | Credit Suisse is delaying a much-anticipated compensation day for some of its bankers, further straining its relationship with employees as it restructures its Wall Street operations, according to people familiar with the matter. The bankers — mainly at managing director or director level — were notified on Monday that meetings set for Tuesday Feb. 7 have been canceled, pushing back conversations on bonuses, said the people, who requested anonymity discussing confidential information. The discussions may be rescheduled in the coming weeks, the people said. The bonuses are typically paid at the end of the month. UK Prime Minister Rishi Sunak plans to carry out a mini reshuffle of his cabinet as soon as Tuesday in an effort to re-set his premiership after a rocky first 100 days in office, according to people familiar with the discussions. Sunak will appoint a new Conservative Party chair, after he sacked Nadhim Zahawi over a tax scandal more than a week ago, as part of a wider overhaul, officials told Cabinet ministers Monday. Officials have also held talks with ministers in recent days about splitting up the Department for Business, Energy and Industrial Strategy, according to a person familiar. European stocks are poised to eke out an advance as traders await commentary from Fed Chair Jerome Powell. ECB Executive Board member Isabel Schnabel participates in webinar, while BOE's Huw Pill and David Ramsden address an event. UK Chancellor Jeremy Hunt takes questions in the House of Commons. Expected data include France trade balance and German industrial production. It's a massive day for earnings, with BNP Paribas, BP, Carlsberg, Nokian Renkaat and Securitas among companies reporting. This is what's caught our eye over the past 24 hours Bitcoin's correlation with tech stocks is a bit like that magic mirror Harry Potter™ encountered in the Philosopher's Stone, in that people see in it exactly what they want to see. When it's low, fans say it proves the diversification benefits of crypto, and detractors say it shows the asset class is unpredictable. When it's high, fans say it's proof that the asset class is growing up, and detractors say it shows Bitcoin is a liquidity play.  Right now, it's much weaker than it was for much of last year, and what that tells me is that the asset class is starting to trade on something that resembles its own fundamentals. Don't forget, this is an asset class that can make its own weather like no other. Born from the ashes of 2008, it certainly had the tailwinds of loose monetary policy at its back for most of its existence. But when supply halvings occur, regardless of monetary conditions, they can drive mania-like excitement and parabolic rallies. And we may just be gearing up for the next cycle. This commentary first ran on Markets Live on the Bloomberg Terminal, where Eddie van der Walt is Deputy Managing Editor based in London. Follow him on Twitter at @EdVanDerWalt Are you more bullish on residential market in Singapore, Dubai or New York? If you could work from anywhere in the world, where would you move? In our latest MLIV Pulse survey, we also ask about the outlook for US housing prices as Americans head into the peak of the real estate selling season. Share your views here. |

No comments:

Post a Comment