| In the final months of 2022, Warner Bros. Discovery asked its senior executives to be extra mindful of spending. Chief Executive Officer David Zaslav and his Chief Financial Officer Gunnar Wiedenfels have been slashing and burning ever since Discovery merged with Warner Media, but this latest edict was inspired less by debt than by flagging advertising sales. WBD's suite TV networks isn't delivering as much revenue as Zaslav expected, and the company will need to cut costs, find more sources of revenue or do a bit of both, according to people familiar with the matter. The chief financial officer of just about every media company is having some version of this conversation right now – and they are likely to feel the pressure for at least the first six months of 2023. For all the concern about the streaming business model, the biggest challenge for media companies right now has nothing to do with subscriber growth, churn, or the next big hit. Just as in politics, it's the economy, stupid. The prospect of a recession looms over everything in media, including labor negotiations, succession planning and creative decisions. It's not yet clear if the current challenges pervade the entire economy or are specific to a few sectors. Employment is still strong, as are wages. But macroeconomic pessimism has already damaged the media industry. Fear of a recession has suppressed advertising sales, which account for most of the revenue at Google, Facebook, Snap, Twitter and TikTok -- and a substantial portion of sales at most entertainment companies. To make matters worse, a confluence of factors having little to do with the media business – including a war in Ukraine, inflation, changes in interest rates and the pandemic – compounded this slowdown in growth. The stock prices at most major media companies slumped at least 35% last year — and in some cases more than 60%. This isn't because they all turned into bad businesses overnight. There is a strong argument to be made that we are still digesting the economic impact of the pandemic. Investors and advertisers had been exuberant, perhaps too exuberant in some cases. Media companies posted record growth in 2021, buoyed by the reopening of society. That meant the numbers in 2022 suffered by comparison. I am not an economist so I will defer to the experts on what happens with the macroeconomy. But it does feel as though some of this pain is transitory and we will emerge from 2023 with a clearer sense of which media companies will, in the words of Zaslav, make it to the other side of the river. A lot of these companies are going to be just fine. People are still buying clothes from Amazon, searching for restaurants on Google and streaming video using Netflix and YouTube. Disney and Universal theme parks were packed and Live Nation reported a record year for concerts. Advertising sales growth, averaged out over the past three years, has been steady and consistent, according to GroupM. Netflix and Disney will generate billions of dollars from advertising on their streaming services over the next few years. But some media businesses face real problems, especially those that still make the bulk of their profits from linear TV networks. AMC Networks, Paramount Global, Warner Bros. Discovery and Walt Disney Co. must counter an acceleration in cord-cutting and the continued erosion of linear TV advertising. We've been watching the slow demise of the linear TV business for almost a decade, and there will come a breaking point at which companies will need to sell or shut down longstanding cable networks. This will lead to further consolidation, mimicking music's contraction to three major record label groups. Here are a few things you can expect from this year in media: The walled gardens are coming down. Media companies have historically made money by selling TV shows and movies several times. They put them on TV, then they sell DVDs and license them into syndication. Streaming compressed these markets, and caused many companies to give up on this idea. Disney vowed to only produce movies and TV shows for its own streaming services and reclaimed titles it had licensed to others. Netflix and HBO didn't license out their shows in the first place. But that's about to change. Warner Bros. Discovery is already starting to license more of its library, and has discussed licensing old HBO shows (like True Blood) to third parties. Disney is likely to follow suit with titles from the Fox library that can live on Hulu and elsewhere at the same time. Even Amazon may license titles from the MGM library. Netflix and Apple will be the two outliers — for now. Is anyone going to cancel HBO Max because they can also watch The Vampire Diaries on Peacock? Bundle now, bundle forever. The genius of the cable bundle was that it made customers pay for networks they didn't want in order to access networks they did care about. (Same deal with CDs.) People wouldn't cancel cable because it was the only way they could get everything they wanted. The ultimate streaming bundle would combine Netflix, the Disney services and Max (nee HBO Max). Netflix and Disney aren't ready to do that, but they will find more ways to package their services inside phone plans, Amazon storefronts and pay-TV packages. With so many streaming services competing for our time, these companies need to find new ways to keep you from canceling. The obvious answer is that you make it harder to cancel. Hollywood will accept Saudi Arabia's money. What do you do when you want to limit costs? You find someone else to pay. Saudi Arabia is very eager to put money into entertainment and it feels like a foregone conclusion that a movie studio or major producer will take Saudi money. Cristiano Ronaldo just signed up to play for a Saudi soccer team. Let's not pretend Hollywood movie studios are going to pick morality over profit. Exclusive podcast deals are going away. Spotify spent more than $1 billion buying and licensing the rights to top podcasts over the last four years. Many of these shows, including Call Her Daddy and The Joe Rogan Experience are exclusive to the platform. But many of Spotify's earliest deals are expiring without a renewal. It's a case of conscious uncoupling. All of the biggest buyers in podcasting are getting more conservative in their deal-making due to the macroeconomic climate. Spotify, Amazon and SiriusXM aren't going to buy at the same rate they were when the economy was strong and their podcast businesses were nascent. The talent suffered serious declines in audience (though not to their bank account). Most podcasts would now rather distribute their shows on every platform. A few quick hits - The NBA will create a third package of games on top of its deals with Disney and Turner Sports.

- YouTube will figure out how to pay creators for short-form video before TikTok, but no creators will leave TikTok.

- Taylor Swift won't set the record for the biggest tour in world history — but only because she won't play enough dates.

- Spotify will raise prices in the US.

The movie business will grow, but it won't get back to pre-pandemic levels. Hollywood will release more movies next year, which will solve one of the theater industry's two big problems. But sales will still be down as a lot of people choose to watch movies (or play video games) at home. — Lucas Shaw When Avatar: The Way of Water posted a softer opening than most experts predicted, alarms bells started going off in certain corners of Hollywood. But, as happens with seemingly every James Cameron movie, the audience kept coming. The film is grossing more than $50 million a day around the world and posted higher grosses most of the days this past week than in its first full week. (More people were off work.) It's still premature to say the movie can hit $2 billion at the box office, but it's definitely going to eclipse $1.5 billion and $1.8 billion seems reasonable as well. The performance is good enough that Disney has to feel pretty good about the next movie. A few more things to know about its success: - It's making about 70% of its money outside the US.

- It's the biggest Hollywood movie of the year in China, where it has grossed $153 million.

- It has now made enough to be profitable, per Brent Lang at Variety.

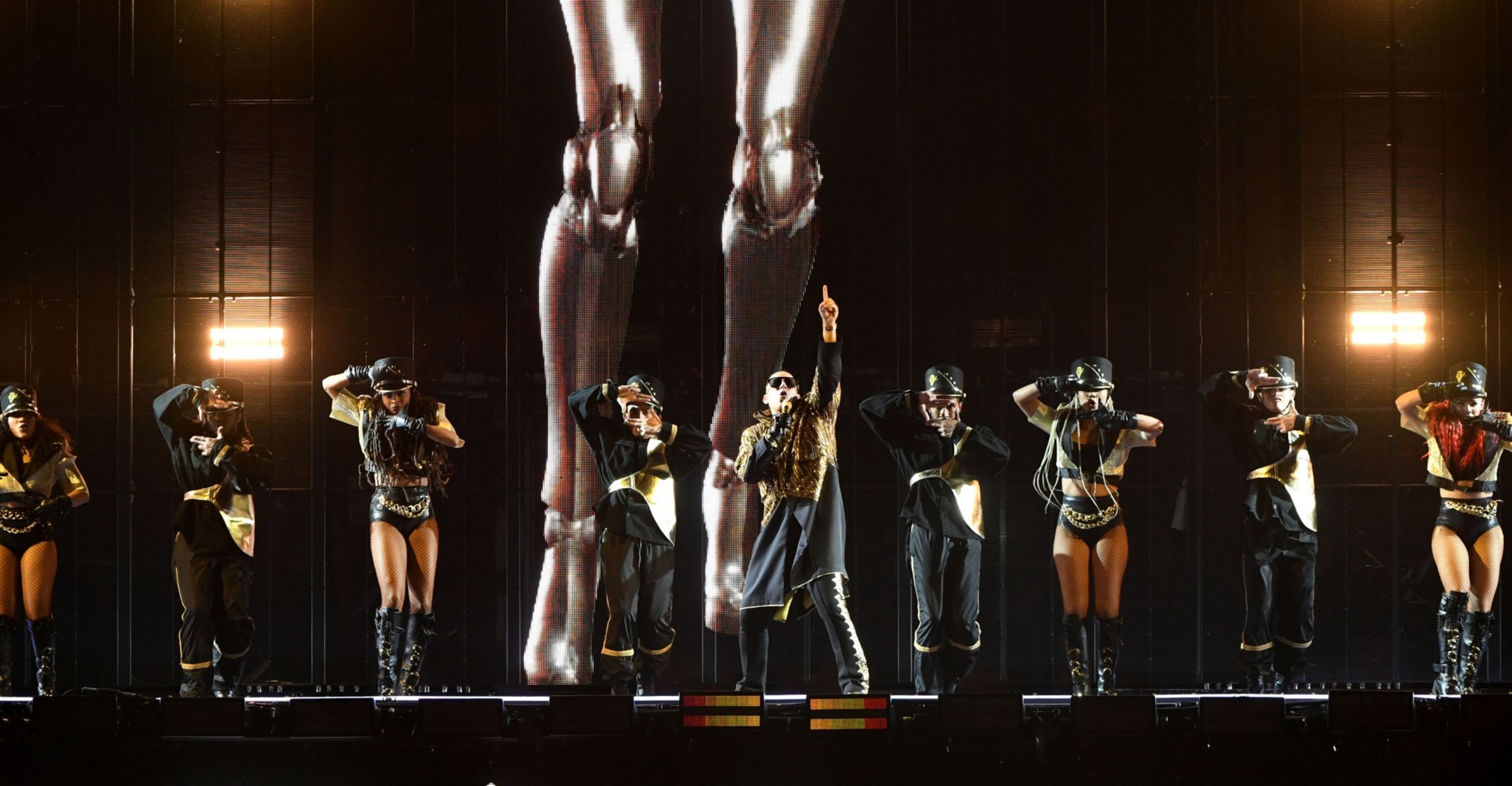

The year of Latin Music  JC Olivera/Getty Images I write a lot about Bad Bunny — and with good reason. The Puerto Rican trap star had the biggest tour of 2022 and was the year's most popular streaming act. But the depth of talent coming out of Latin America right now is outrageous. To wit: Bad Bunny was one of three Latin musicians to rank among last year's 25 biggest tours. During the first half of the year, Latin music accounted for more than 6% of all consumption in the US, according to Luminate, a jump of 34% from just two years ago. Latin acts accounted for 22 of the 200 biggest tours in the world last year. They also claimed eight of the top 25 spots in Bloomberg's latest Pop Star Power Rankings.

Women direct less than 6% of top moviesThat stat reflects the 100 highest-grossing movies from the last 16 years, according to the University of Southern California's Annenberg Institute. What studios employ the smallest number of female directors and directors of color? Disney and Paramount (unless you count STX). Lionsgate and Universal have employed the most. The year aheadThere are no deals to speak of right now, unless we're talking about resolutions. So, I turn it over to you. What are your predictions and what should we write about in 2023? The best things I watched, read and listened to during the last two weeks: Sarah Polley's film Women Talking, Natsuo Kirino's novel Out, Rob Harvilla's podcast about '90s music, an audiobook of Hua Hsu's memoir Stay True, the Coach Carter soundtrack and the World Cup final. If you want to reach out with tips (or criticisms), please message me here. If you don't yet sign up for this newsletter, you should do so here. |

No comments:

Post a Comment