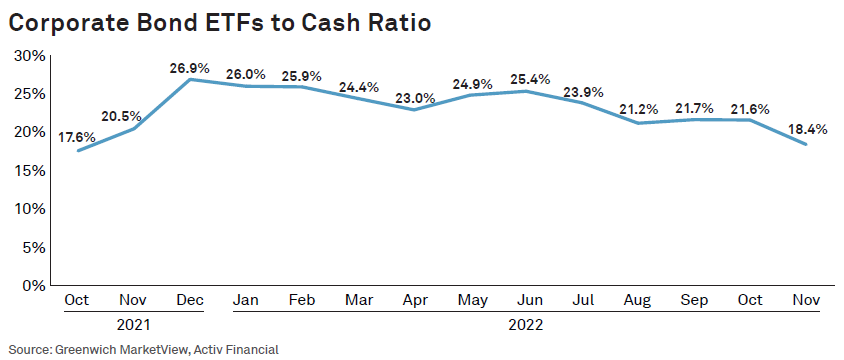

| Welcome to The Weekly Fix, the newsletter of choice for wealthy retail investors. I'm cross-asset reporter Katie Greifeld. After the Federal Reserve, the European Central Bank and the Bank of England down-shifted in unison last week, this was supposed to be a relatively quiet stretch on the macro front. The Bank of Japan made sure that didn't happen. Policymakers sent shock waves through global markets with an announcement that Japanese government bond yields will now be allowed to rise to around 0.5%, double the previous limit of 0.25%. That move wasn't on anyone's bingo card: all 47 economists surveyed by Bloomberg ahead of the decision had expected the bank to keep its yield-curve control policy unchanged. While the BOJ maintained that the move was designed to enhance the sustainability of its monetary easing, naturally, the speculation rippling through markets is that lifting the cap is an early step on the road to an eventual departure from a decade of extraordinary stimulus policy. "Whatever the BOJ calls this, it is a step toward an exit," said Masamichi Adachi, chief Japan economist at UBS Securities and a former BOJ official. "This opens a door for a possible rate hike in 2023 under a new governorship." Obviously, the ramifications of a BOJ hike would be huge. Symbolically, it would make the official end of easy money. The BOJ is the last remaining Group-of-10 central bank with interest rates below zero, which currently stand at -0.1%. That compares to the 2.6% average policy rate among G-10 banks. A BOJ exit from negative rates and the idea that there's more to come would also upend the investing playbooks built upon Japan's ultra-easy monetary stance. The yen surged as much as 4.8% against the dollar in the wake of the BOJ's decision — the largest move this millennium. Some investors are betting the yen could surge another 10% from here, with the likes of Societe Generale SA, Schroders Plc, PineBridge Investments and Fidelity International — the list goes — making bullish noises about the yen. That could have profound implications for so-called carry trades, in which investors borrow in cheaper currencies to finance purchases of higher-yielding peers. With Japan's still-negative rates, the yen is one of the most popular funding currencies. That role may be questioned from here. "If this week's move is the first step towards tightening (which we think it is), this will likely usher in a new period of a strong yen," Brown Brothers Harriman strategists wrote in a report Wednesday. "As a result, the yen may no longer be the currency of choice for the carry trade." The BOJ's surprise also reverberated in global bond markets, sparking a quick 10 basis point climb in 10-year Treasury yields in New York trading on Tuesday. Investors pulled roughly $1.2 billion from the $28 billion iShares 20+ Year Treasury Bond ETF (ticker TLT) in the aftermath of the decision, the fund's largest one-day outflow since January. The logic there is simple: higher yields at home could mean less investment from Japanese bond buyers. While they've been selling Treasuries as of late, Japanese investors are the biggest foreign holders of US government bonds. "The concern is that as FX hedges roll off, Japanese holders will be selling dollar bonds," said Peter Tchir, head of macro strategy at Academy Securities. "I'm not overly concerned, but at these yields, it's definitely an excuse to sell or take some profits." While Japanese investors stepping back from the Treasury market may be a long-term headwind to worry about, looking into 2023, it feels like everyone is bullish on bonds. The call is two-fold: a 2023 recession is the consensus call on Wall Street, and yields are approaching 4% on many Treasury tenors and 5% on blue-chip corporate debt. While an economic downturn would spell trouble in equities, with many warning that next year's earnings estimates are still too lofty, bonds would likely benefit. "If you don't think you're headed for that worst-case economic scenario, you don't want to be in equities just because we think the earnings numbers will be disappointing," Nuveen chief investment strategist Brian Nick said in a Bloomberg Television interview. "But being in credit, if you think default risk is pretty low and you're getting — depending on the credit rating — 5% to 9% if you're looking at high-yield, those are places where we think investors are going to be able to make money." To be sure, stocks and bonds alike have suffered an abysmal year. But fortunes are expected to diverge next year. This year's fixed-income selloff has dramatically cut duration risk — a measure of sensitivity to interest-rate changes — while elevated yields mean clipping coupons is an attractive proposition. But for equities, more pain is seen in the offing as earnings reports begin to roll in next year. In addition, higher yields mean equities have been steadily losing their edge to bonds all year. The so-called Fed model — which plots the S&P 500's earnings yield against that of 10-year Treasuries — shows that the benchmark's advantage over bonds is around the slimmest levels in a decade. "We don't believe we're getting paid for being in the stock market going into the next quarter," Amy Kong, chief investment officer at Barret Asset Management, said in a Bloomberg Television interview. "Any excess cash, we have been focusing more and more in the bond markets, where yields are starting to look more attractive." Trading of credit ETFs slumped to the lowest level in more than a year last month, as wealthy retail investors turned to the cash market to chase the highest yields in years. Volume in credit ETFs came " back down to earth" in the fourth quarter, according to a Coalition Greenwich report. Notional volume in corporate bond ETFs accounted for roughly 18% of total trading activity in November, the slowest month relative to the cash market since October 2021 and down from a 2022 peak of 26%, the data show. That pickup in cash bond trading was partly driven by wealthy retail investors, who are more likely to trade individual bonds than their less-affluent counterparts. The advantage of holding a bond to maturity means investors are able to capture the coupon along with the principal payment, according to Coalition Greenwich's Kevin McPartland. Credit ETFs in contrast don't mature and their valuations can swing day-to-day on rate moves.  Credit ETFs trading volume came back to earth in the fourth quarter, Coalition Greenwich says. Bloomberg "There is certainly a correlation here to the record trading volumes in the cash market, driven in part by retail investors," McPartland, head of market-structure research at Coalition Greenwich, wrote in a report. "Unlike holding individual bonds to maturity, credit ETFs still carry some interest-rate risk given the uncertain future actions of the Fed." That parallels neatly with electronic platform Tradeweb's annual client letter from earlier this month, in which chief executive officer Lee Olesky and president Billy Hult detailed the rise of retail fixed-income in a market you might expect: municipal bonds. "Through the summer of 2022, financial advisors accessing Tradeweb's municipal bond platform on behalf of their retail clients were buying up munis at a rate of roughly 4-to-1 versus institutional investors, illustrating just how significant the trend toward retail fixed income has become across the broader municipal bond market," Olesky and Hult wrote. SBF's $250 Million Bail Is One of the Largest in US History. It Doesn't Mean He Has That Much Guggenheim's Minerd Was a Wall Street Outsider Who Made It His Home Bitcoin's Biggest Trade Goes From Hero Creator to Widow Maker |

No comments:

Post a Comment