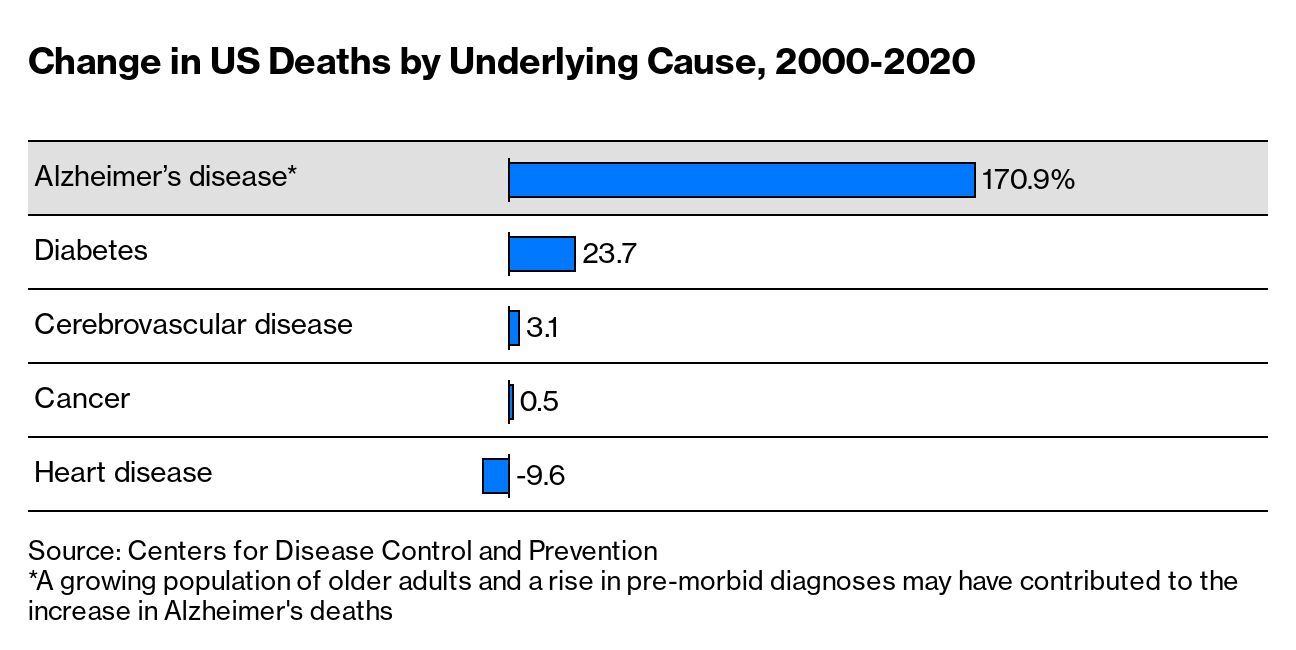

| In a year when soaring inflation and sinking growth rattled c-suites and trading floors alike, some corners of the stock market managed to provide shelter from hungry bears. What worked across most of 2022 was a bet that the dollar and Treasury yields would rise on the Federal Reserve's most aggressive policy tightening in four decades, while the biggest beneficiaries of a low-rate environment—tech companies—would fall. In some cases, the gains were a salve for years of meager returns, while in others the best hope was to simply lose less than the broader market. Here's where the markets did the best. —David E. Rovella Wall Street's favorite volatility gauge has acted so strangely in a brutal year for equities that a debate has emerged over its soundness. Options experts say there's nothing wrong with the gauge and the reason is the behavior of investors themselves. Technology stocks are headed for their worst December since the bursting of the dotcom bubble two decades ago. While the Fed has been fairly clear in its intent to continue raising rates at lower increments, investors had been hoping for more leeway. But strong job numbers this week have affirmed the central bank's course, in turn sending markets down. The economic figures "were hotter than the market was hoping for, so now we have to contend with the notion the Fed will stay aggressive," said Joe Gilbert, a portfolio manager for Integrity Asset Management. When someone develops high cholesterol, doctors don't wait until the patient's arteries are clogged to start treatment. They prescribe cholesterol-lowering drugs while the person is still healthy to prevent plaque buildup. Now some of the world's biggest drug companies are trying to do something similar for millions of aging baby boomers at risk of Alzheimer's disease. In massive final-stage trials underway at Eli Lilly and Eisai, researchers plan to test brain-plaque-removing drugs on thousands of healthy adults. The hope is to stave off cognitive decline before it begins, or at least delay it. Given the acceleration of Alzheimer's as an underlying cause of death, success could be nothing short of transformative.  China is likely experiencing 1 million Covid infections and 5,000 virus deaths every day as it grapples with what is expected to be the biggest outbreak the world has ever seen. The current wave may see the daily case rate rise to 3.7 million in January. The US said it was willing to assist with mRNA vaccines, which have been proven more effective than shots used in China, but hasn't heard back from Beijing. Chinese security personnel have been pushing journalists away from crematoriums as concern grows that authorities there are hiding the death toll, which outside parties have predict could claim a million lives or more in this wave alone. JPMorgan's losing bets on European bonds and credit-default swaps have sparked inquiries from aggrieved market players who are disgruntled by what they see as out-of-step prices and aggressive tactics. The losses came as one of the market's biggest banks looked to seize on what has been a turbulent year for European high-yield debt. Nigeria's currency is on track for its longest losing streak since 2020. Management of the nation's foreign exchange policy has come under scrutiny as Africa's largest economy prepares to hold elections in February. All of the three leading candidates have promised to end the country's multiple exchange rate system. Scott Minerd, the Guggenheim Partners chief investment officer who was regarded as one of the kings of the bond market during its four-decade bull run, died Wednesday at his home in Rancho Santa Fe, California, after suffering a heart attack during his regular workout. He was 63.  Scott Minerd Photographer: Brinson+Banks for Bloomberg Businessweek Bloomberg continues to track the global coronavirus pandemic. Click here for daily updates. - Five charts that capture the state of global energy.

- Pakistan cut by S&P as fiscal and economic outlook deteriorates.

- Extreme cold grips US as climate change buckles the jet stream.

- Crushed by mortgage rates, US home sales nosedived 35% in November.

- FTX's SBF finally shows up in US court, is freed on $250 million bail.

- Key witness says lawyer tried to hide Trump's Jan. 6 SUV outburst.

- Die Hard's "Nakatomi Plaza" has bigger problems than Hans Gruber.

| So you wanted to buy a Tesla, but then Elon Musk bought Twitter, flamed his trolls, flirted with QAnon and started banning journalists. You're not alone: Many people who once admired Musk for his green bluster now detest him as a robber baron who blithely fires thousands. The billionaire's behavior has made some people publicly declare they will never buy one of his electric vehicles. But they no longer have to. As Tesla begins to waver under the weight of his high jinks, there are a growing number of EVs out there that have nothing to do with Musk.  A substitute for the entry-level Tesla Model 3 is the Polestar 2, right. Source: Tesla, Polestar 2 On Dec. 21, the Evening Briefing incorrectly referred to the prosecution stemming from the 2016 Bitfinex hack. The defendants were charged with conspiracy to commit money laundering. Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive it in your mailbox daily along with our Weekend Reading edition on Saturdays. New for subscribers: Free article gifting. Bloomberg.com subscribers can now gift up to five free articles a month to anyone you want. Just look for the "Gift this article" button on stories. (Not a subscriber? Unlock limited access and sign up here.) |

No comments:

Post a Comment