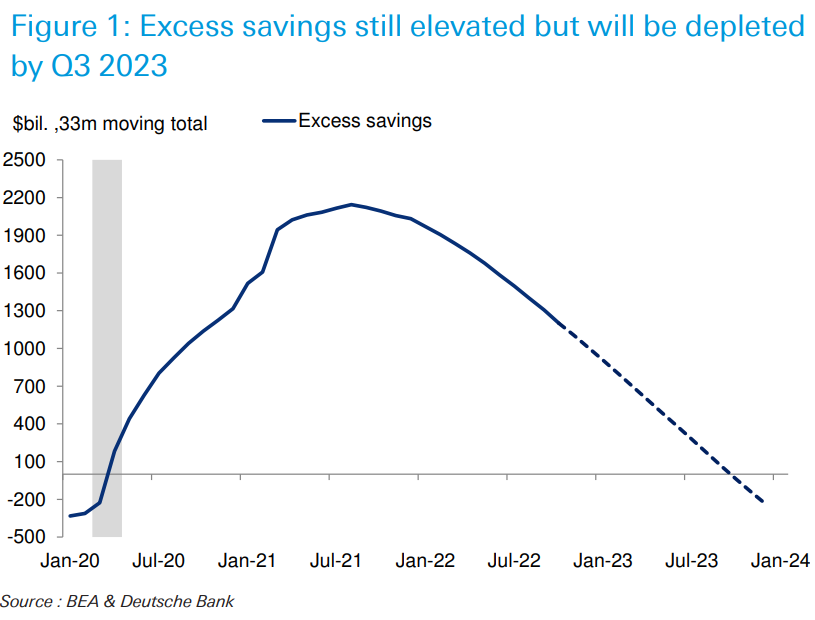

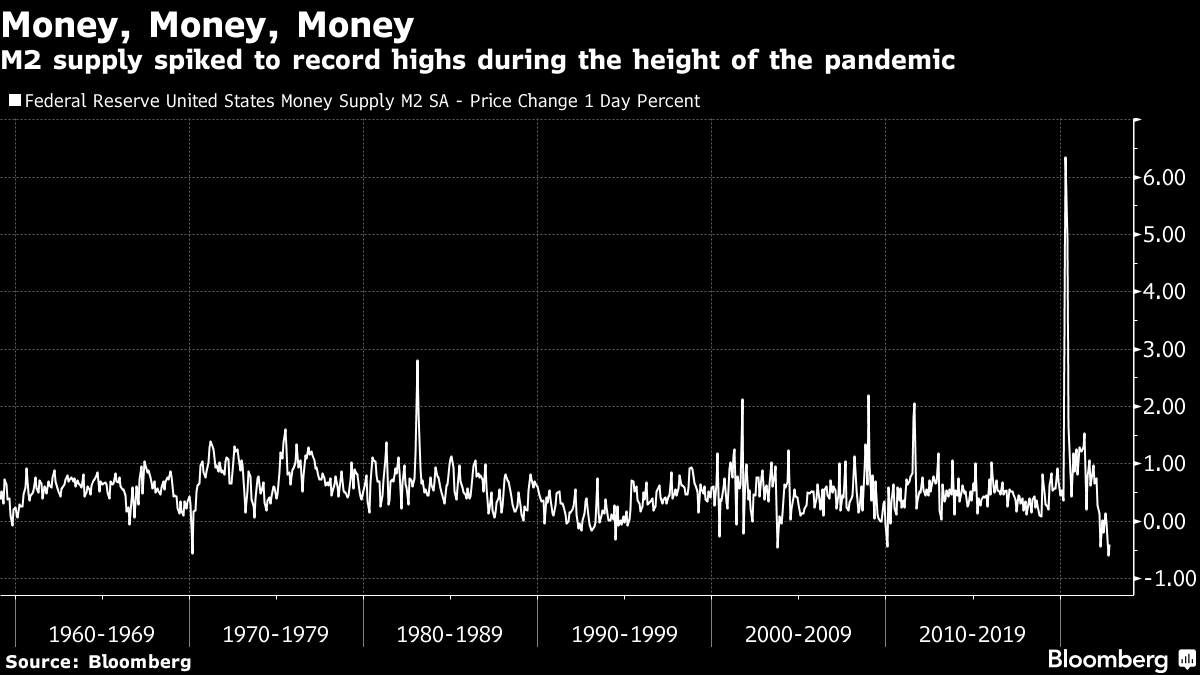

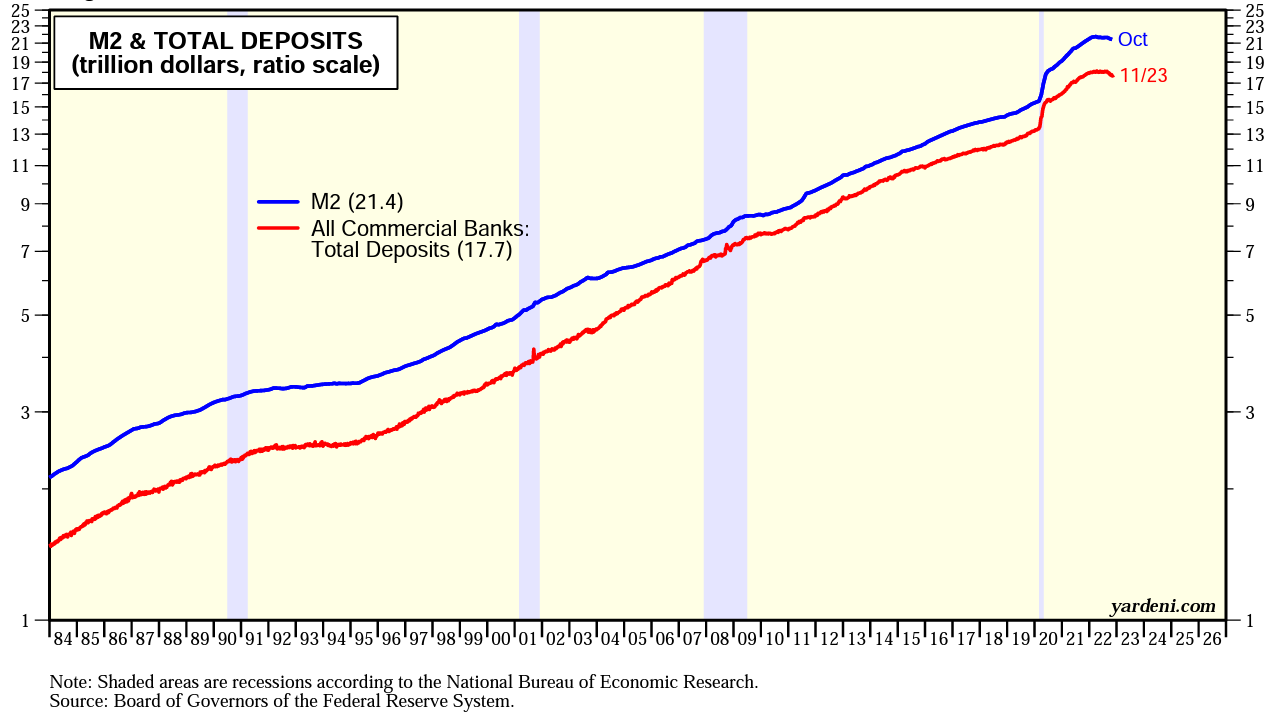

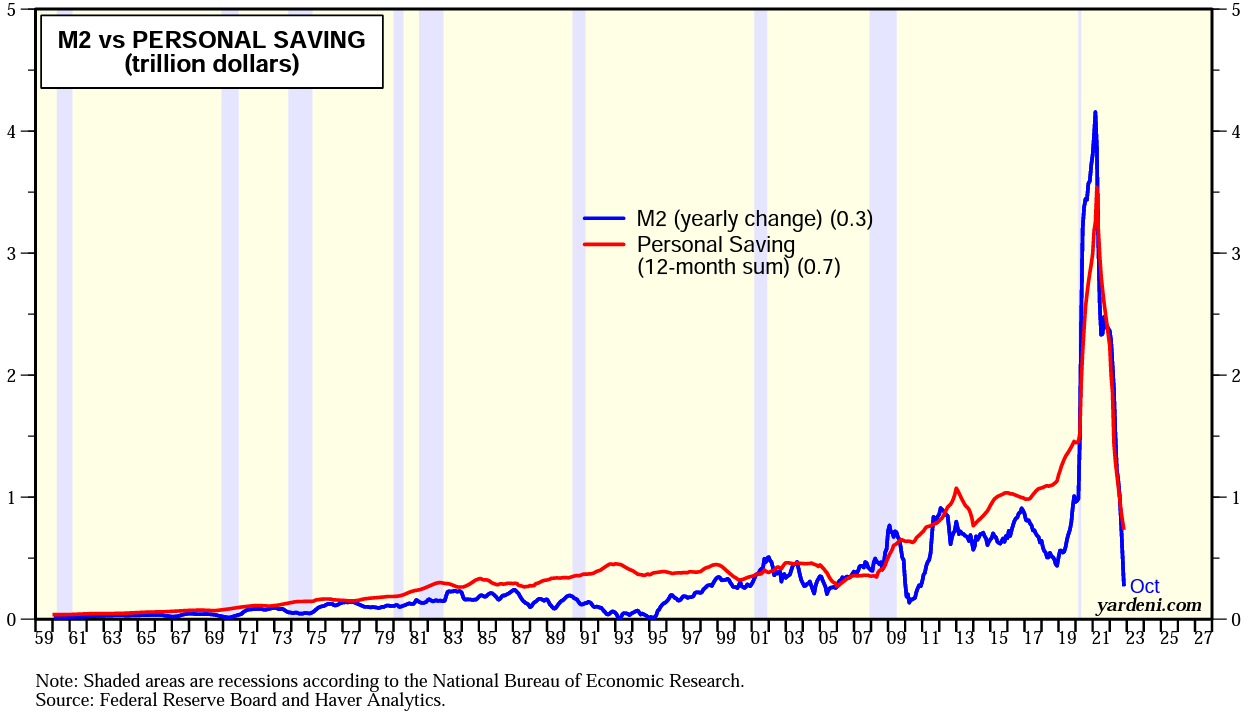

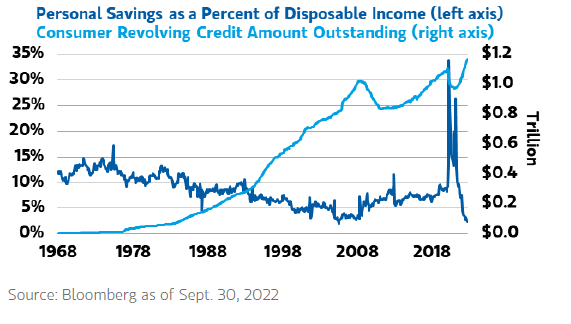

| It must be one of the most widely used phrases of the second half of this year. Federal Reserve Chair Jerome Powell himself regularly reminds us that monetary policy acts with "uncertain lags" and the full effects of the central bank's aggressive rate hikes have yet to be felt. If the Fed is going to force the US into a recession, in other words, that economic slowdown wouldn't be expected to start until next year. Also, widely forgotten, the same is also true of fiscal policy. After an historic $1.5 trillion injection directly into the pockets of Americans through the form of stimulus checks and unemployment benefits in 2020 and 2021, people are still flush with cash. Bloomberg Opinion's Justin Fox highlights that just before the pandemic, households held about $1 trillion in what was effectively cash, a figure that has ballooned to $4.7 trillion by the second quarter of this year. All that money might help explain why large swathes of the economy remain unbowed. On Monday, this was reinforced by a very positive ISM survey of growth for US service providers that unexpectedly accelerated in November as its measure of business activity jumped to 56.5, by the most since March 2021. Any reading above 50 signals growth rather than recession. The same survey also found that the prices that service businesses were paying were increasing, in a bad sign for inflation: For all the gloom and doom about an impending recession in 2023 (which still seems eminently reasonable), the US economy is not yet slowing as many would expect. Americans are still trudging along, and consumer spending is proving largely resilient. This shouldn't be surprising. View the economy in terms of large sums of money, and the following chart from Deutsche Bank AG shows that Americans took on a huge load of excess savings during the pandemic and the stimulus payments that followed. Those savings are now being paid down. But at current rates, Americans will still have at least some excess savings until the second half of next year:  How exactly is the economy going to process a massive amount of money like this? To give an idea of the size of the pig that the python is currently trying to swallow, the graph below is the Federal Reserve's M2 money supply index, which covers notes and coins in circulation, checking accounts, and savings accounts and money market funds. Growth spiked at the height of the pandemic in a way never seen before (not even during the desperate money printing during the Global Financial Crisis that largely went into repairing balance sheets that had taken terrible losses). It has now registered several months of declines as the central bank tries to tighten money again. Like the boom that preceded it, that decline is without precedent. But even if we have confirmation that the total money supply is being reined in month by month, the question remains: How much money is still sitting ready to spend in consumers' bank accounts?  As Yardeni Research points out, some economists are worried about M2's decline. It has fallen 1.5% since peaking at a record high of $21.7 trillion in March. Although that followed a record peak, such a drop is unprecedented. Still, the firm's founder, Ed Yardeni, thinks that supply remains at least $2 trillion above its pre-pandemic trendline.  Source: Yardeni Research The year-over-year change in M2, in fact, has been moving in near lockstep with the 12-month sum of the personal saving rate; money supply has stopped rising as Americans have stopped accumulating new savings. Thus, for Yardeni, the recent weakness reflects the excess liquidity accumulated by US consumers since the start of the pandemic:  Source: Yardeni Research To be sure, not everyone interprets the data the same way. For Gene Goldman, chief investment officer at Cetera Investment Management, the fact that savings rates are hovering at 2.7%, close to 17-year lows, means people aren't saving as much money. And since Americans are buying more food and basic commodities instead of goods or services, which in a way influences businesses to reduce prices to deal with their inventory glut, margins will be more compressed. The latest muted Black Friday reflected just as much. "All this together, we think, is going to create a recession in 2023. It will be the most anticipated recession we've ever had," Goldman said. For Lisa Shalett of Morgan Stanley Wealth Management, unless the labor market remains strong, "belt tightening might lead to further economic slowing." She also points out, rather alarmingly, that Americans are starting to borrow in a serious way once more, and doing so at the excruciating interest rates charged for credit card debt.  Source: Morgan Stanley Wealth Management Here's more: The spending spree that has kept real spending growing at close to a 7% annualized rate, based on November data, increasingly seems to be coming at the expense of savings and credit card balances. Revolving credit card balances now exceed the pre-pandemic peak, and the savings rate has plummeted to 2.7% ... suggesting that unless the labor market remains very strong in 2023, belt tightening might lead to further economic slowing.

How, then, to account for the resurgent animal spirits recently, which have seen the S&P rally from peak to trough by 17.4% in six weeks? Shalett's theory is that people are forgetting the lag of monetary policy (as well as the lagged effect of fiscal stimulus). Even if the Fed does start to ease as early as next summer, that easing won't have much of an economic effect until well into 2024. As she puts it: At the core, what troubles us is that by focusing only on the speed of travel of Fed policy, investors are not discounting the implications of that policy, which operates on a lag of six to 12 months. In discounting falling long-term real rates, investors are not only already pricing actual policy rate cuts that may not occur for many months but are essentially ignoring the implications of the inverted yield curve, which, at -77 basis points, as measured by the two-year/10-year differential, is its most negative since 1981.

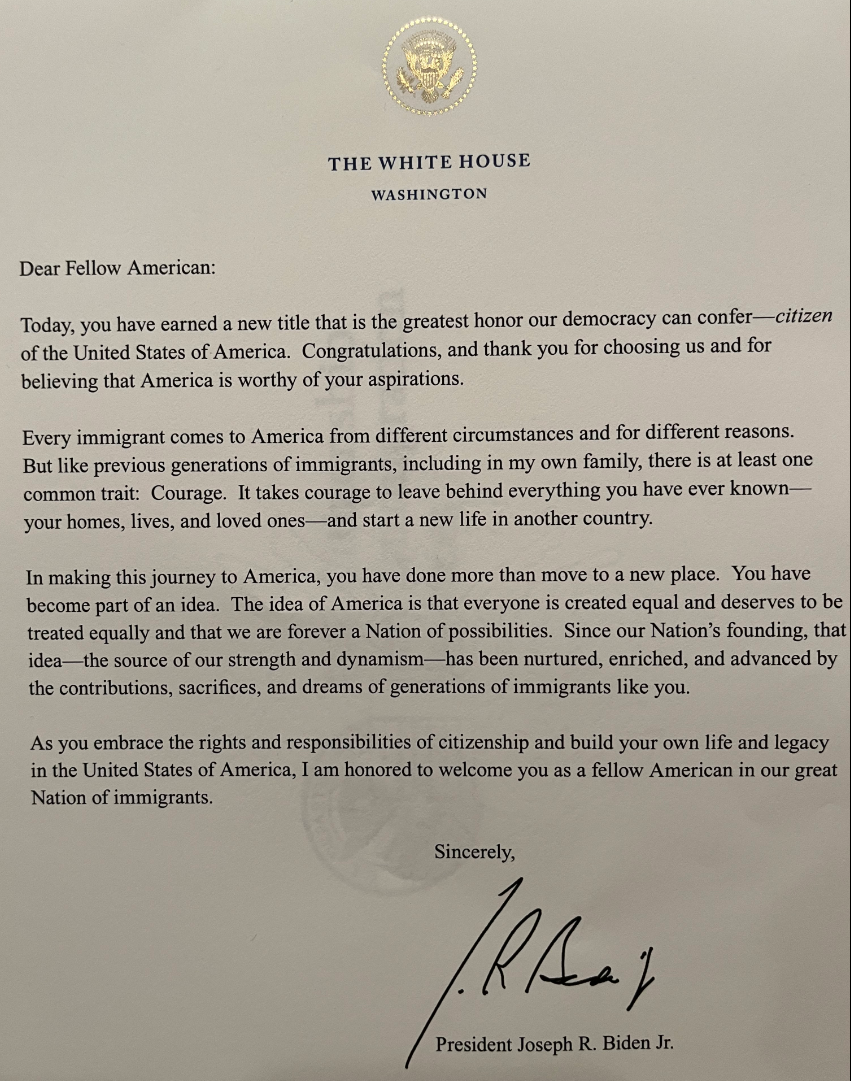

The yield curve, as covered yesterday, is an emphatic signal of an approaching recession. Early easing would do nothing to change that implicit prediction. It's fair to suggest that the stock market wobble of the last few days has been driven by just such thoughts occurring to investors. They may have overdone the beneficial effect of any Fed pivot toward cheaper money. Looking at the internals of the market, consumer discretionary stocks have slumped 32% year-to-date in the US, far worse than the S&P 500 as a whole, making clear that equity investors are also bracing for worse times ahead. As strategists publish their predictions for the US economy next year, it's clear that recession-positioning is regarded as more of a when than an if. Perhaps consumers should take their cues from Wall Street and gear up for one as well. —Reporting by Isabelle Lee OK, here's a universally applicable tip. Courtesy and humility toward newcomers is easy to do, and goes a long way. For reference, I'd like to share the letter I was given today by President Joseph Biden. Almost 38 years after I first came to the US as an exchange student, I have at last reached citizenship. And despite everything, the Customs and Immigration Service, not normally known for friendliness and courtesy, finds a way to make new citizens feel wanted. As part of the welcome pack given to me and the 149 other new citizens who took the ceremony and said the oath of allegiance at the same time, I got this letter from the president:  I'm sure Biden didn't sign each copy individually, and I'd be pleasantly surprised if he even checked the final version of the text. But that doesn't matter. Getting US citizenship is a grueling and expensive process, even for a white British man like me, and much harder for many others. The courtesy of a note from the president when the big day comes does make a difference. After putting potential citizens through the grinder, the US is welcoming them, and its head of state is even going so far as to say that he is honored to do so. It's a beautiful gesture at a point when it means a lot. The kit also included a handy pocket-size copy of the Declaration of Independence and the Constitution, and a little Stars and Stripes. Meanwhile, we huddled masses in a faceless federal office in downtown Manhattan were treated with total courtesy. All the officials had a smile (not typical at USCIS occasions), and the staff went out of their way to help me as soon as they saw that I was walking with a cane. It's nice to get a letter from the president saying he's honored to welcome me, even if many thousands of others get the same one; and it does indeed feel like an honor to be a citizen of a "great Nation of immigrants." This is the way to welcome someone to your home. No music was played. Some possibilities that USCIS might consider in the future: America by Simon & Garfunkel, This Land Is Your Land by Woody Guthrie (covered here by Bruce Springsteen), Coming to America by Neil Diamond, For America by Red Box, The Big Country by Talking Heads, The Hands That Built America by U2, Leonard Bernstein's America from West Side Story, James Brown's Living in America, Dvorak's From the New World symphony (written amid the excitement of turn-of-the-century New York), or "The Campers at Kitty Hawk" from Michael Dellaira's "USA Stories" (in either a pandemic version or the original recording). Yes, it's pretty exciting to be part of a nation of immigrants that produced all that.

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: Want more Bloomberg Opinion? OPIN <GO>. |

No comments:

Post a Comment