| In the season for predictions, let's start with some good news. Confidence among UK firms rose at the fastest rate in 20 months, according to a new report, with businesses expecting a better festive period than last year and more optimism about the economy. The findings from Lloyds Bank stand in stark contrast to other industry surveys and official statistics in the UK. But there is some echo to the sentiment globally, with dealmakers predicting more mergers and capital market activity as companies get used to operating in a world of rising interest rates and inflation. Sectors like energy and technology, facing different kinds of pains, could also see more consolidation as smaller companies go under. The same could be said of property firms — sample today's warning from economists that UK house prices may tumble as much as 10% next year. In other news, UK population growth is already slowing down, with data out today showing that the nation of 67 million has been getting older over the past decade. And French lender Lyonnaise de Banque has become the first to lose its post-Brexit permit to operate in the country after failing to apply for a permanent authorization in time. In the absence of festive news — and with another dose of gloom to close out this year, some European-inspired philosophy from my colleague Andreas Kluth may be in order: "Here's the advice I'll try to follow, and not just during the upcoming holidays. First, ignore silly 'happiness indices' and other claptrap. Second, strange as it sounds, don't feel bad if you're not happy. Third, remember that, like Aeneas, you have more important things to do in this world, so stay focused on those. And fourth, keep watching your own mind, lest it gallop off too wildly in the wrong directions."

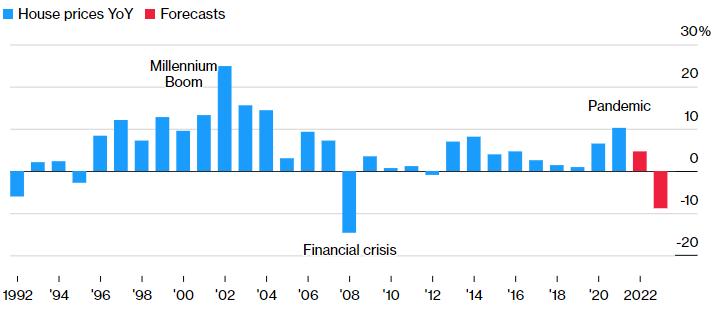

The Readout is taking a Christmas and New Year break. We'll be back on Jan. 3.  Source: Nationwide, Bloomberg EconomicsNote: Calculations based on 4Q averages Soaring interest rates and a deepening recession could weigh down a market that thrived through the pandemic, according to economists and property market forecasters. Falling house prices and higher borrowing costs will drain more money from household balance sheets, making many homeowners feel poorer and perhaps more cautious about spending. |

No comments:

Post a Comment