| 2022 is almost over, and so it is time once again to pay our annual visit to the offices of Hindsight Capital LLC. For the uninitiated, you won't be able to look up Hindsight Capital on the Bloomberg terminal because it doesn't exist. That's a pity, because its managers are imbued with the ability to execute the one strategy guaranteed to beat all others, year after year: hindsight. At the outset of each January, they can foresee the future. Obviously, the potential gains for someone with this ability would be infinite, so I've subjected Hindsight's team to some tight conditions. No investing in individual stocks or highly illiquid frontier market indexes is allowed; no trading is permitted during the year; and they may not use leverage. The fund can, however, sell short by borrowing a security and selling it, thus profiting from any subsequent fall in its price. That proved vital in 2022. Also, being a particularly prestigious client, the fund is able to operate without incurring trading costs, and without having to pay interest on its short positions. Finally, and crucially, Hindsight Capital's managers must be able to demonstrate that there was a rationale for taking a position on Jan. 1. None of these trades rely on acts of God that nobody could have predicted; they all need to be rooted in what was known 12 months ago. At first glance, this was a difficult year for such a fund to excel, because more or less everything went down in a way not seen in decades. Place a short on the major equity and bond indexes, and you could go to the Bahamas for the year and still make returns well above 20%. But Hindsight Capital found ways to do better than that. It was armed with perhaps four key insights, none of which were consensus as the year started, but all of which were perfectly conceivable. These were: - Vladimir Putin really would invade Ukraine;

- China's economy would take a hit from the omicron variant;

- Inflation would prove intractable (aided in part by the first two factors); and

- Low rates had left many securities around the world wildly overpriced.

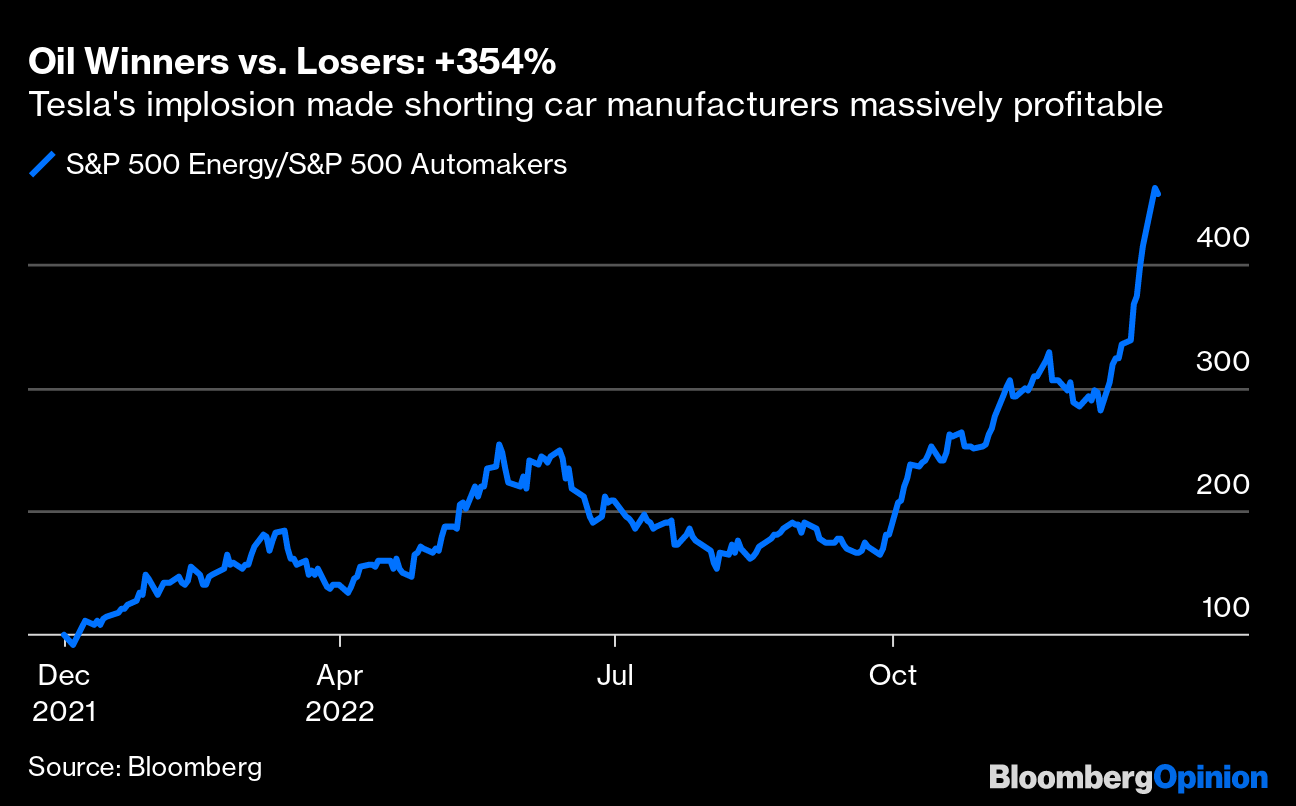

Anybody who grasped these things and bet confidently on the back of them would have enjoyed a fabulous 2022. In all the graphics below, numbers are obtained from the terminal and are up to date at the point of publication; all charts are rebased to show the growth of the trade, starting at 100 at the beginning of the year. This is how Hindsight Capital LLC did it: The War Trade: Long US Defense Contractors/Short Ukrainian stocks Putin wasn't massing a huge army at the Ukrainian border for fun, and his rhetoric, and actions, over the preceding decade made clear that he deeply resented the nation's independence. The tanks would obviously roll in, and while western troops were never going to respond, it was a given that plenty of western armaments would find their way to Ukraine's defense. Naturally, the destruction that goes with an invasion would lay waste to Ukrainian stocks. The S&P 500 Aerospace & Defense sub-index gained 14%; the MSCI Ukraine index lost 64.6%. Put them together, and the trade made 224%. The Oil Trade (Camouflaging the Anti-Musk Trade): Long S&P 500 Energy/Short S&P 500 Automakers A huge spike in the oil price was a natural consequence of the Russian invasion and the sanctions and embargos that followed, so buying the energy sector (up 57.3% for the year) was a no-brainer. Shorting automakers, whose products become that much less appealing when the fuel to run them becomes more expensive, is a natural complement to this. But this trade in fact takes advantage of the absurd overvaluation of Tesla at the beginning of the year. A year ago, Tesla accounted for 84% of the index, and it still accounts for 77%. On Jan. 1, it traded at 88 times expected earnings, and that has now dropped to 22. Over that period, the same figure for Ford (which continues to make and sell far more cars than Tesla) dropped from eight to six times expected earnings. So shorting the automakers index (down 65%) was a perfect way to profit from the 68% fall in the value of Tesla shares. Put the trades together, and Hindsight made 354%.  The All-Strongmen-Are-Not-Equal Trade: Long Borsa Istanbul 100/Short Russia RTSI Index By the end of last year, the market was fed up with the antics of Recep Tayyip Erdogan, the autocratic president of Turkey. His increasingly idiosyncratic meddling in monetary policy seemed to be taking the country to disaster. In 2022, however, attention shifted elsewhere and the situation stabilized somewhat. This created a massive opportunity in the stock market: The Borsa Istanbul's prospective price/earnings multiple halved in 2021, which created a tradable bottom. Dec Mullarkey of SLC Management in Wellesley, Massachusetts, opined as follows: Who would have thought Turkish equities would be a world-beater with rampant inflation the catalyst. While Turkey's unorthodox monetary policy has spooked foreign capital, local investors have concluded that equities are the most reliable inflation hedge and have piled in and stayed committed. While it's been a bizarrely technically driven market, there are decent fundamentals underscoring it. Some of the companies in the index are large exporters whose costs are in Lira but bill in Dollars, creating a bonanza for profits.

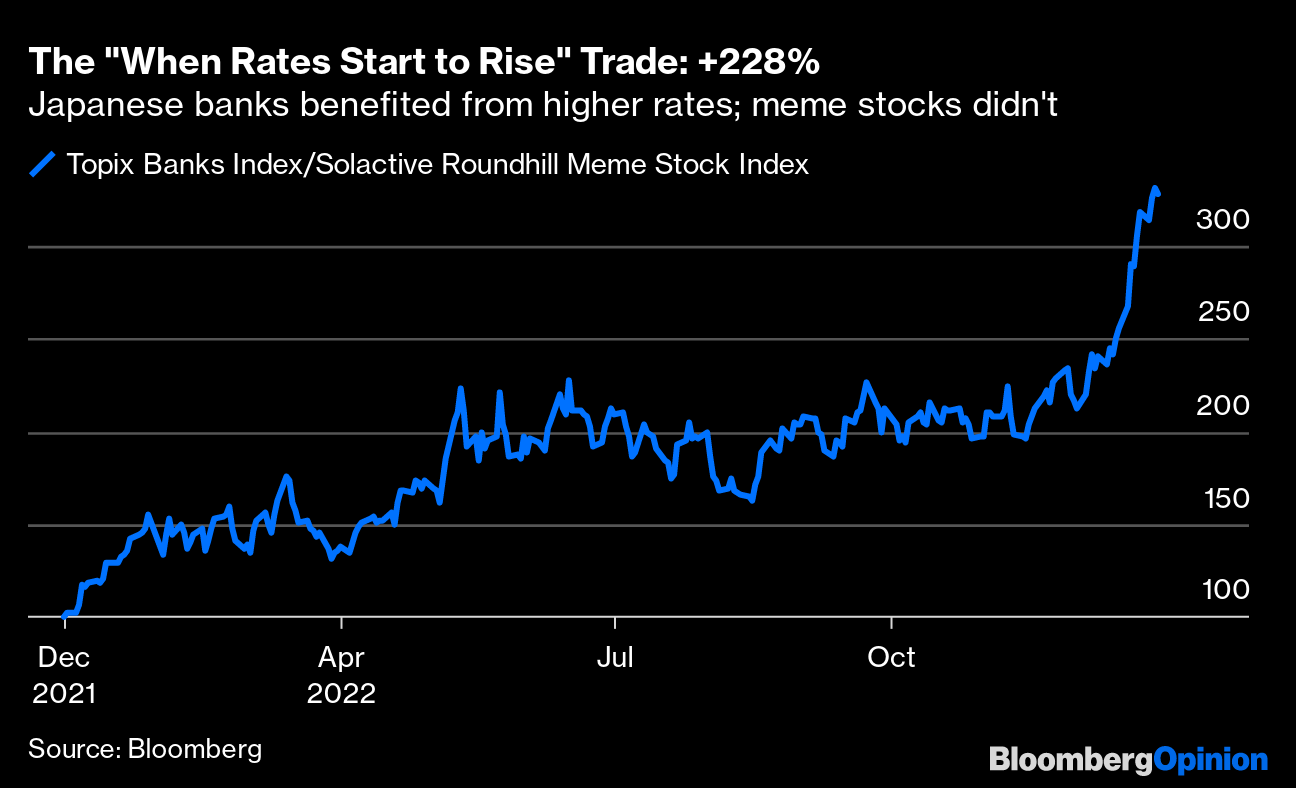

As foreign exchange reserves are dwindling and inflation is running at 80%, it's hard to see this ending well, but for the time being Erdogan is living to tell the tale. Meanwhile, Hindsight Capital had Putin's measure. He was obviously determined to invade, but it was also obvious that this would prove to be a terrible mistake. The impact on the Russian economy, combined with the abrupt curtailing of demand from international investors, was predictable. The Borsa Istanbul gained 187% in lira (and 103% in dollars), while the Russian RTSI fell 41% in dollars. Put them together, and the profit was 234%. The Fossil-Fuel-Revival Trade: Long S&P Integrated Oil & Gas/Short ISE Global Wind Energy This one was simple. A spike in oil would be helpful for oil companies, while the urgency of the situation ensured that alternative energy would have to take second place to carbon-emitting energy that could be mustered quickly. Hence, shorting the ISE Global Wind Energy index (down 15%), and putting the proceeds in the S&P 500 Integrated Oil & Gas sector (up 68.5%) yielded a profit of 101%. The Bet-Against-Duration Trade: Long Bloomberg China Aggregate/Short Austrian Century Bond Grasp that interest rates were rising, and it was natural to bet against bonds with the highest duration — in other words, those whose price is most sensitive to changes in interest rates. Austria's famous century bond, in which investors must still wait more than 90 years for the return of their principal, is the poster-child for duration. It had a terrible 2022, while Chinese bonds actually gained slightly for the year, according to Bloomberg's indexes. As Hindsight Capital accurately foresaw, a weak economy would leave the People's Bank of China unable to ease monetary policy, at a point when its bonds (unlike those in neighboring, long-deflation-stricken Japan) actually paid a positive yield. So, putting together the Austrian government bond due to mature in September 2117 (which lost 54% for the year), and coupling it with a long position in the Bloomberg China Aggregate index, which made a stolid 3.58%, returned a profit of 118% for the year.  Bet on Rising Rates: Long Topix Banks Index/Short Solactive Roundhill Meme Stock Index When rates go up, trades that have been unwittingly inflated by cheap rates tend to go down, a lot. The 2021 craze of the "meme stock," in which investors looked for cheap (but not necessarily undervalued) stocks with heavy short interest and made coordinated purchases to squeeze the short sellers, had by the end of that year led to the creation of a meme stock index. It arrived just in time to chart the deflation of the phenomenon. Over the course of 2022, the index dropped 64%. But what to pair it with? There are at least some companies that actually benefit from higher rates, and if their share price starts at a very depressed level, that allows for leveraged profits. There are few sectors on the planet more thoroughly out of favor than Japanese banks. But this year, the Tokyo Stock Exchange's Topix Banks index rose 35% in yen terms (and 15% in dollar terms). There was a big flurry of interest at the end of the year as the Bank of Japan surprised everyone by relaxing its yield curve control regime — which allowed long interest rates to rise a little and helped the profits of the country's banks. If this sounds like an outlandish trade, bear in mind that Hindsight had some margin of safety from valuation. Twelve months ago, the Topix banks index traded at only 39% of banks' balance sheet book value, implying almost total lack of confidence in their assets. That has now risen to 54%, which is still excruciatingly low, but created a big gain along the way. Meanwhile, the meme index's valuation has descended from five times book to only two times now, while its price/trailing earnings ratio is a spectacularly low 1.36 (not a misprint). Put the two trades together, and a long Japanese banks/short memes trade made 228%:  With hindsight, 2022's weirdness presented plenty of other opportunities to make money at the beginning of the year. We'll be back with the remainder of Hindsight Capital LLC's trades tomorrow, along with some thoughts on the whole exercise. (No, Hindsight Capital is not a fair benchmark for any sane individual, but it always shows the possibilities for those who have a clear view of the macro outlook and turn out to be right…) This is a suggestion inspired by the wonderful Desert Island Discs interview given by the show's former presenter Kirsty Young for its Christmas edition. Guests on the BBC's longest-running program are required to come up with the eight records that they would want to have with them if shipwrecked on a desert island. Young's taste is eclectic and includes Count Me Out by Kendrick Lamar (which features Helen Mirren in the video), but I was most taken by her single favorite record, which was Steven Isserlis's recording of Bach's Cello Suite No. 1. It's very, very good for the soul.

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: Want more Bloomberg Opinion? {OPIN <GO>}. Or you can subscribe to our daily newsletter. |

No comments:

Post a Comment