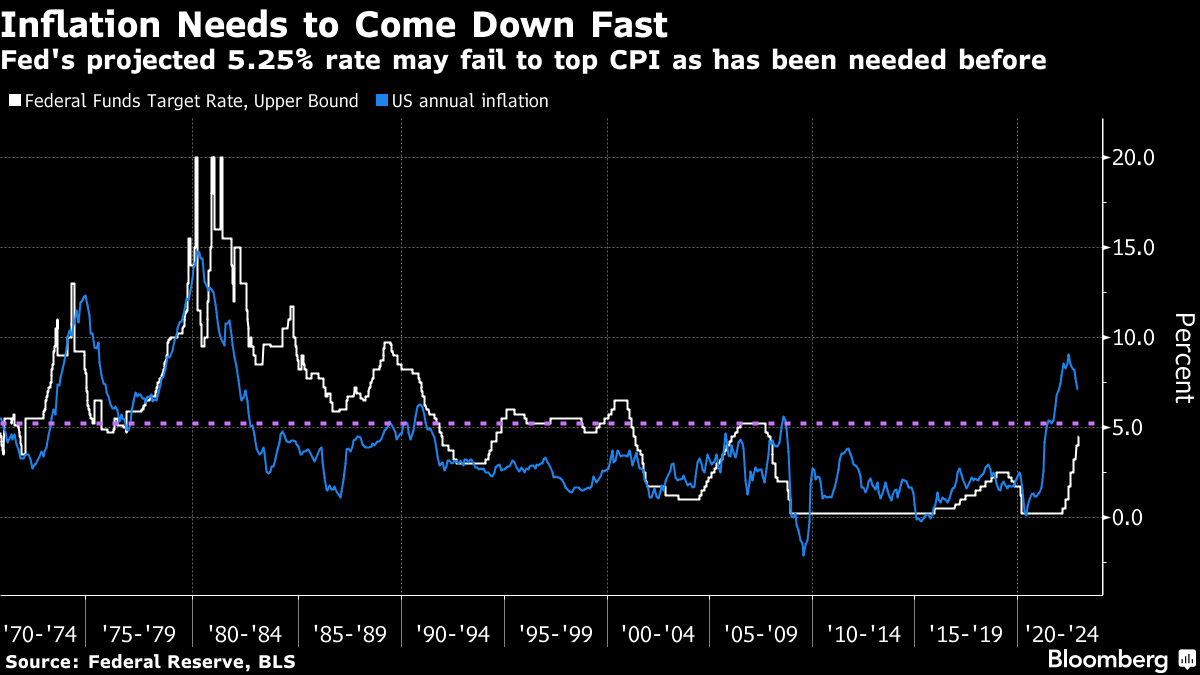

| China is scrapping its eight-day inbound quarantine on Jan. 8. Tesla posts its longest streak of losses in four years. Tech stocks dragged US index down. Here's what you need to know today. China will no longer subject inbound travelers to quarantine from Jan. 8, putting it on track to emerge from three years of self-imposed global isolation. The country will also start issuing new passports and Hong Kong travel permits to mainland residents. Concern that China's decision to relax its pandemic restrictions would spur inflation caused global bonds to fall in thin post-holiday trading. Meanwhile, the country's citizens have mixed emotions about Covid Zero coming to a sudden end, with some expressing relief and others worrying about the spread of infections. Tesla Inc.'s tailspin accelerated Tuesday, with shares in their longest losing streak since 2018, after a report of a plan to temporarily halt production at its Shanghai factory. The electric-vehicle maker's stock has dropped 69% this year on Musk's Twitter takeover and related distractions, investor jitters about growth and worries that high inflation and rising interest rates will dampen consumers' enthusiasm for EVs. Tesla's problems weighed on technology stocks, and led losses on the Nasdaq 100 index. Tesla wasn't the only headache for US equity markets. The S&P 500 Index began its final week of trading in 2022 by dropping 0.4%. Its most important stock, Apple Inc., closed at its lowest level since June 2021 on concerns over iPhone supplies in the key holiday period. Asia's indexes were also poised to start the day in the red. FTX founder Sam Bankman-Fried said he and former executive Gary Wang borrowed more than $546 million from Alameda Research to buy a nearly 8% stake in Robinhood Markets Inc, according to court papers. US federal prosecutors said that they were investigating an alleged cybercrime that drained more than $370 million out of FTX just hours after the company filed for bankruptcy. And US Securities and Exchange Commission Chair Gary Gensler signaled the agency will step up its crackdown against cryptocurrency firms shirking its rules. Dangerously cold temperatures settled over a wide swath of North America as a massive winter storm upended holiday travel and left millions without power. Southwest Airlines Co. canceled almost two-thirds of its flights Tuesday as a massive winter storm that most major rivals were able to recover from caused major disruptions for the company. The country's largest power grid operator, PJM Interconnection, underestimated its peak demand forecast on Friday by the equivalent of enough power to typically supply 9 million households in a region that stretches from Chicago to Washington. A brutal year for assets is drawing to a close amid at least some speculation that 2023 will offer brighter times for bonds and equities. With inflation already cooling down in the US and a number of other major economies, investors are hoping next year will see central bankers slow interest-rate hikes and then stop them all together. There are also strong bets that the Federal Reserve will actually be cutting borrowing costs within a year, in order to engineer a soft landing.  The problem with that outlook is its assumption that the Fed can soon halt hikes, and that requires a very rapid slowdown in inflation. The Fed has usually ended up hiking rates above inflation in previous tightening cycles, so that means annual CPI growth likely has to tumble at least 2 percentage points from its latest 7.1% reading to meet policymakers' projections for peak borrowing costs. Inflation has dropped that far in the past five months from its peak in June, so it's possible we could see that sort of slide. Garfield Reynolds is Chief Rates Correspondent for Bloomberg News in Asia, based in Sydney. |

No comments:

Post a Comment