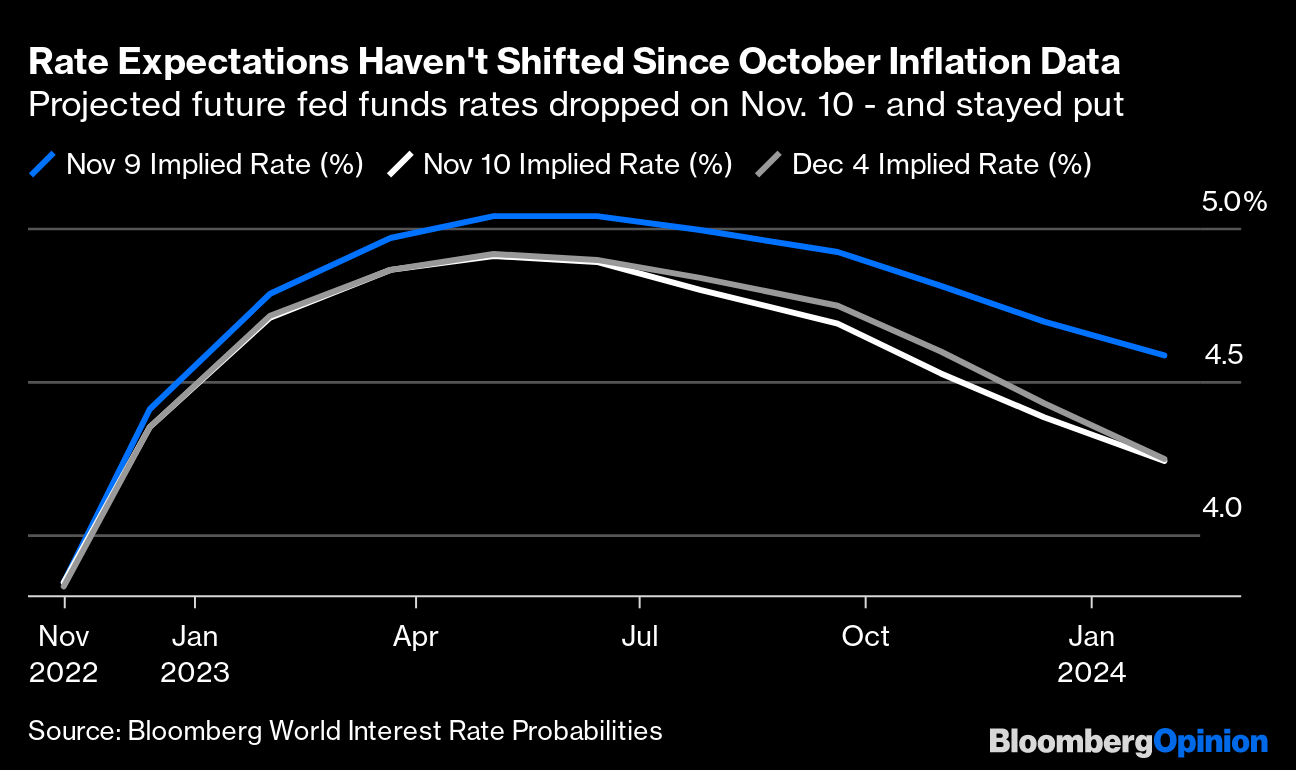

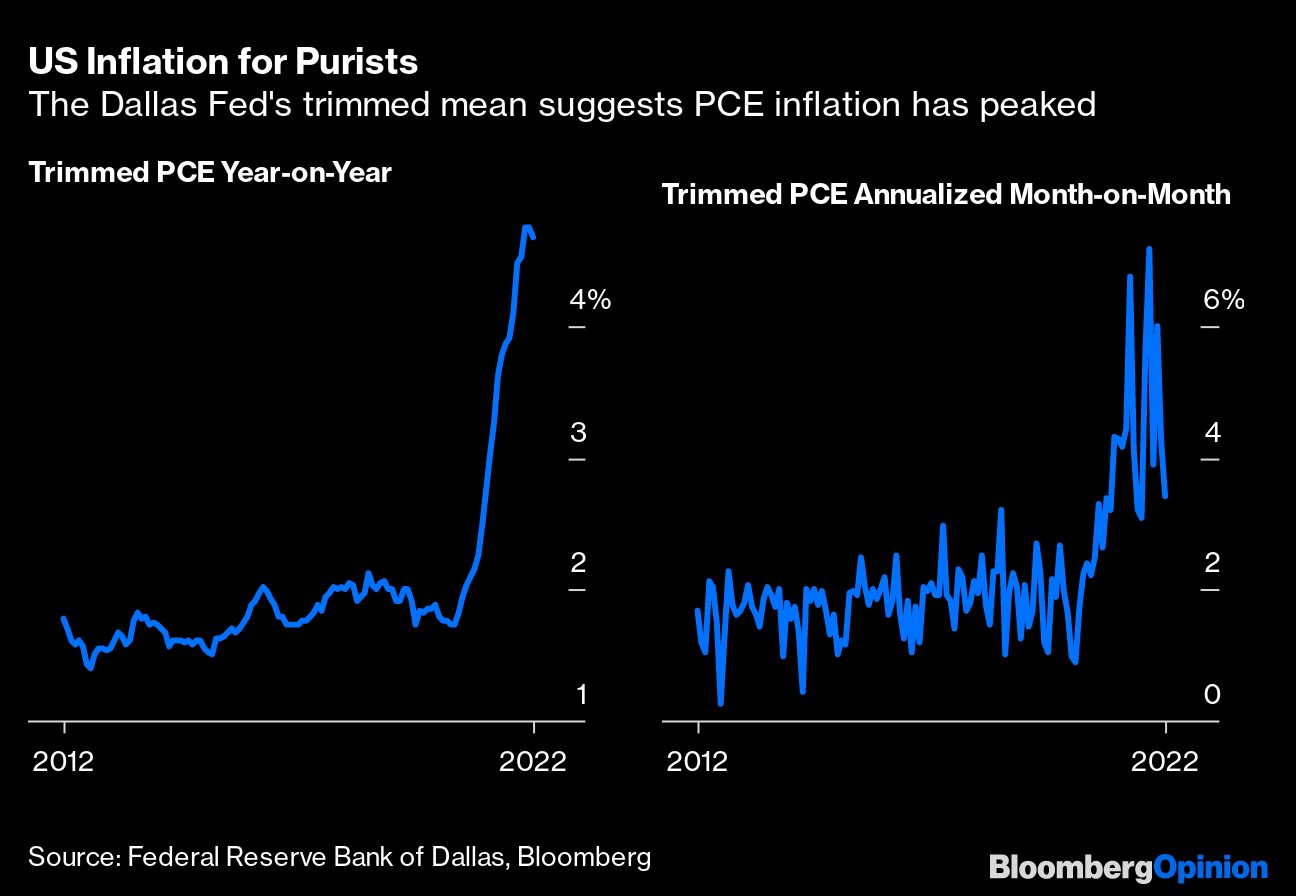

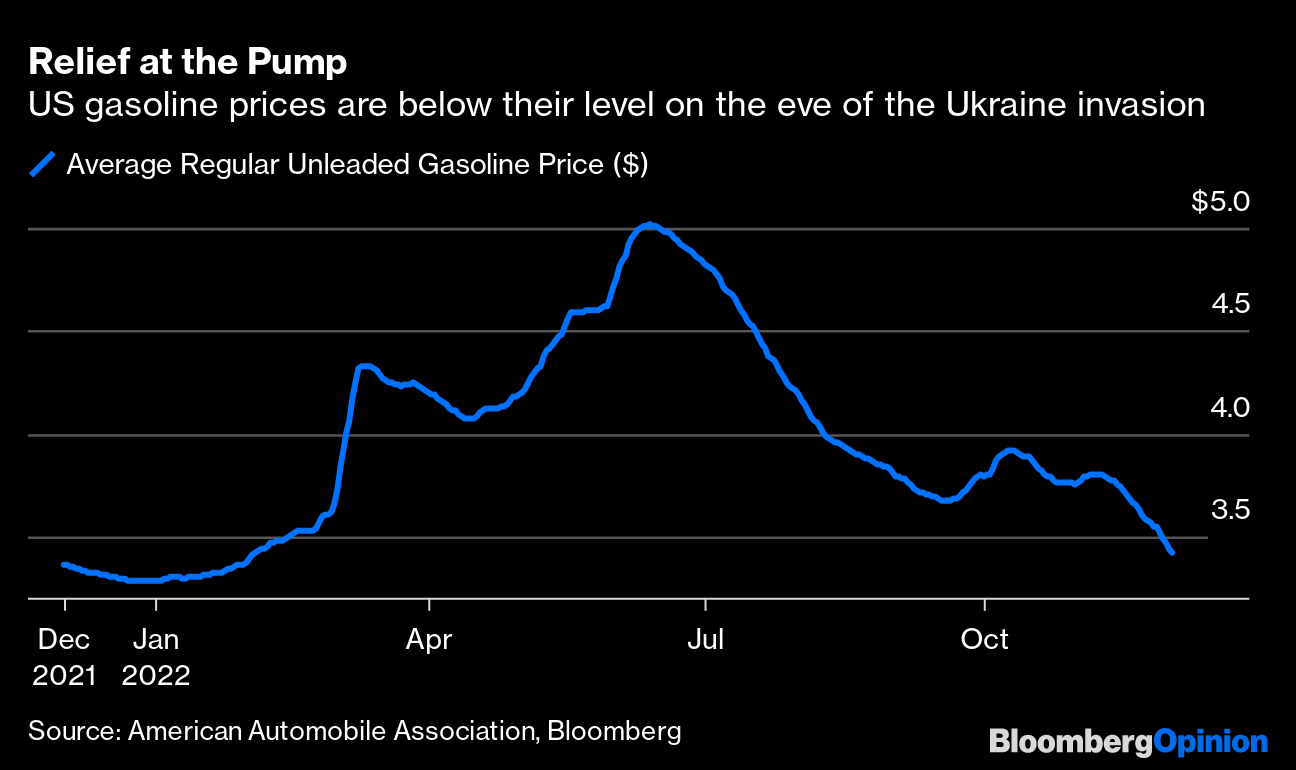

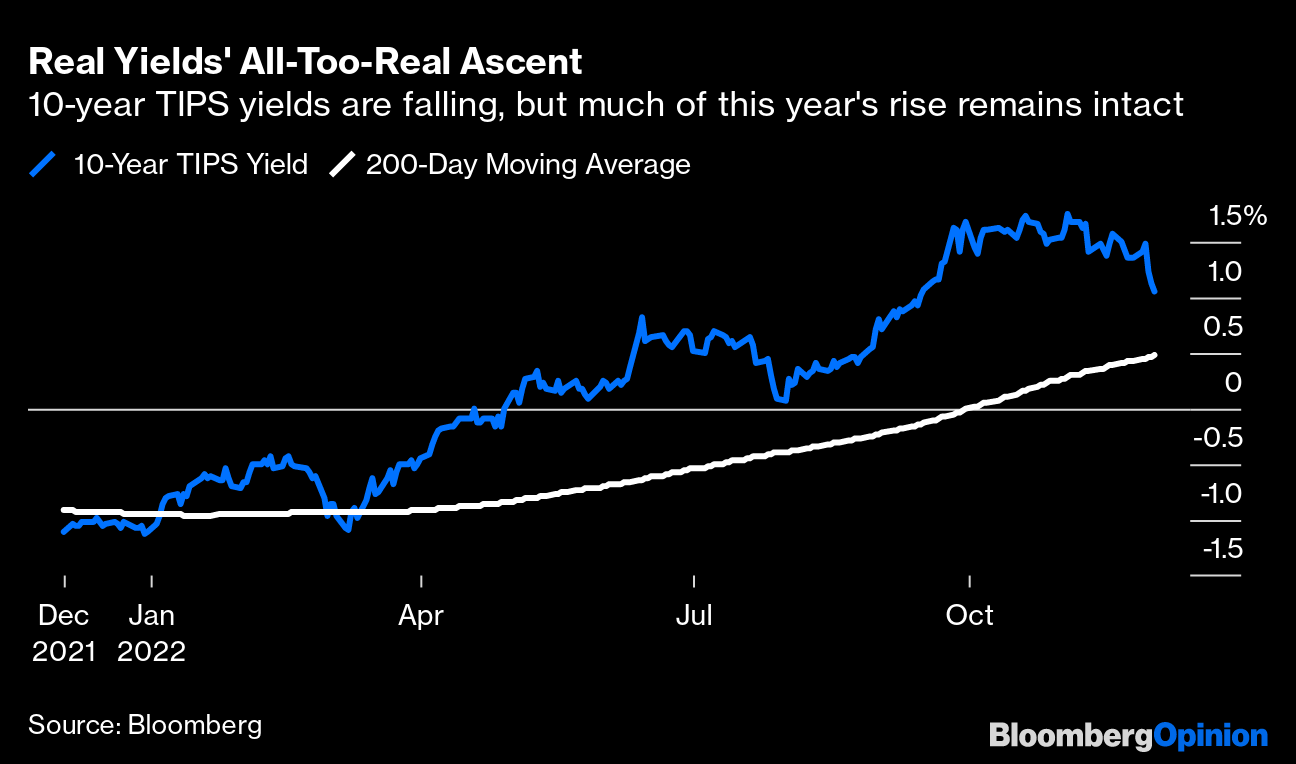

| For the last three weeks I've had my feet up (literally, of which more below), and watched lots of football on television. The last Points of Return covered inflation data for October, which gave some good reason to believe that the peak for price rises was finally in. What have I missed since then? The following is a brief tour as I reacquaint myself with the Bloomberg terminal. On the greatest subject of the day, the issue of how the Federal Reserve will run its monetary policy, the big shift happened on my last day in the office, in response to the inflation data on Nov. 10. There has been plenty of economic data since then, including surprisingly strong jobs numbers last Friday, and a lot of interventions by Fed governors. But if we look at the fed funds futures market, they haven't changed much. Since the October consumer price index, the implicit peak has been written down a little, and the speed of next year's easing has been increased; all of that happened in one day, and nothing much has moved the dial since then:  US inflation will as ever dominate conversation for the next few days, but without much new to discuss. With Fed governors now keeping their mouths shut as their final meeting of the year approaches, and the November data not due until the eve of next week's meeting of the Federal Open Market Committee, there will be room for maximum speculation. The latest hard data on inflation, the Personal Consumption Expenditure deflator for October, did confirm the message that inflation does look as though it may well have peaked. Using the Fed's favored measure of the "trimmed mean," which excludes the greatest outliers and takes the average of the rest, inflation did indeed tick down slightly last month, on both a year-on-year and month-on-month basis. There's still a long way to go, but it's important that this stripped-down measure of inflation beloved by purists is no longer accelerating:  Meanwhile, on the single most important outlier, gasoline, there is good news. Prices at the pump, as measured by the American Automobile Association, are now below their level on the eve of Russia's invasion of Ukraine. This reduces headline inflation, but also possibly increases pressure on other prices by releasing money from household budgets to be spent on something else. But the critical point is that one of the biggest one-time upward pressures on inflation is in abeyance for now:  I don't think any of this proves that inflation will come down swiftly and allow the Fed to start easing in short order, but it does suggest that the economy is slowly turning in the direction that anti-inflationistas want. This doesn't seem to have affected the market's implicit judgment that a recession is coming soon. Two of the best mainstream market indicators of economic bearishness are the bond yield curve (if shorter-term yields are higher than longer-term ones, that implies a belief that the economy is due a fall) and the ratio between consumer discretionary and consumer staples stocks (when discretionary stocks underperform, it implies that bad times are coming). On these simple measures, a recession looks ever more likely, and nothing much has changed in the last three weeks: On the critical issues of the day, then, it looks like I missed nothing. Now, for what does seem to be shifting. First of all, there is a continuing retreat from the sharply higher yields that have been seen this year. That's clearest if we look at the real yields, on 10-year Treasury Inflation-Protected Securities (TIPS). As the chart shows, real yields have shifted down very significantly in the last few weeks. They still have a long way to go as they remain far above their 200-day moving average, a widely followed measure of the long-term trend. But the fact that real yields managed to fall sharply at the end of last week, despite employment data that was better than expected and should therefore lead to higher yields in future, does show strong momentum behind the notion that rates have risen too much:  It's in the currency market that the sharpest shift can be seen. King Dollar is in ill health. If we look at the popular dollar index, we find that after an extraordinary rally it is now below its 200-day moving average. Differentials in bond yields between the US and other major economies have not moved enough to explain the decline, just as they didn't explain the ascent: This selloff looks overdone and has little obvious trigger, but then much the same was true of the rally that preceded it. It's primarily driven, it would appear, by an attempt to get out of positions betting on the dollar. Plenty of people who had decided to shelter in the dollar in the years after the pandemic are deciding that now is a good time to exit (and plenty of them will be realizing good profits). That puts pressure on exporters to do something about their own buildup of dollars. This comment from Marc Chandler of Bannockburn Global Forex explains the issues: The momentum indicators continue to show the dollar is oversold. Yet, at the same time, the structural long dollar positions built for the better part of the past two years are unwinding. For example, Japanese insurers and pensions appear to be boosting hedge ratios. Dollar-functional exporters who had been allowing the USD balance to grow are being forced to act. The magnitude of the greenback's decline here in Q4 is breathtaking. Of the G10 currencies, only the Canadian dollar has not risen by at least 5%.

Meanwhile, also in the foreign exchange world, the pound has stabilized under Rishi Sunak's premiership after briefly hitting an all-time low against the dollar during the crisis over his predecessor Liz Truss's attempt to spur growth with unfunded tax cuts. When the run on sterling was at its worst, plenty of people denied that Truss and her policies had anything to do with it. The circumstantial evidence, with the pound now recovering despite a rather wobbly debut by Sunak, is that her government did hurt the pound, a lot: That's my tour of markets. Now for the real world, where by far the most important event of the last few weeks appears to be the rolling opposition to lockdowns and even the Communist Party itself in China. The upshot for now appears to be that "Covid Zero" — a policy of zero tolerance for Covid-19 that entails aggressive lockdowns and has hampered the economy — is now being withdrawn in a big way. Chinese markets are steadily positioning for economic revival. The wet blanket in me feels the need to point out that the impact of big street mobilizations is very hard to judge in real time. The 1989 Tiananmen Square protests appeared to be winning concessions at one point, before the tanks rolled in; the 2011 Arab Spring revolts generally failed to work out as many hoped at the time, and so on. The key variables ahead of us concern politics, public health and the economy. On politics, if China's leadership really is conceding a victory of sorts to protesters so soon after Xi Jinping had secured a third term as president, that implies a sudden weakening, and with it the possibility of greater instability. In the short term, that wouldn't be great. The precedent of 1989 and a welter of evidence from the last few years suggest that Xi would not cede power easily, and that a tighter clampdown would be in prospect. That would make it all the harder to sustain normal economic relations with China. Or, alternatively, by backing off now before protests escalate, he's defusing things quickly enough and actually making the regime stronger with the use of some political judgment. The point is that very different outcomes remain quite possible. On public health, the question is more complicated. Most other countries moved on from extreme lockdown policies more than a year ago, and so Covid Zero does seem excessive. However, as China doesn't have a good record on vaccination, and while lockdowns have kept the population from developing any useful form of "herd immunity," the risk is that a sudden move away from Covid Zero could lead to a sharp rise in mortality. Exhibit A for this concern is Taiwan, which lifted its own version of zero tolerance earlier this year. The result was a spike in deaths that earlier controls had postponed but not prevented: On the economy, relaxing Covid Zero should stoke Chinese demand, which is a consummation devoutly to be wished by the rest of the world. It would also put extra upward pressure on inflation. And removing Covid policy as an excuse for poor performance should also tell us something about the true underlying strength of China's economy. It does look as though significant change is afoot in China, and markets are so far reacting positively. Certainly, plenty of positive scenarios look more plausible than they did a few weeks ago — but it's worth maintaining caution. Looking back to the joy with which many of us greeted the scenes of massive peaceful demonstrations in Tiananmen Square 33 years ago, I'd caution that we don't yet know how this story ends.

—Reporting by Isabelle Lee My thanks to the many who asked after my health during my absence. It's nice to know that people missed this newsletter when it was gone. I had a total knee replacement (early arthritis isn't fun and I don't recommend it), so I've spent much of the last three weeks with my feet up. I'm hoping to return to something close to normal service, but I'm warned that I'm probably not going to be able to work at full pelt for another month or so, so please have some patience. For one recommendation, I've been enjoying the World Cup while I've been away — one big advantage of the disastrous decision to award the tournament to a small desert country with no tradition of football excellence is that it all started just as I'd had surgery, and not in summer when it should have. I'll be sharing more about the World Cup, but for now I'd like to recommend the brilliant podcast "After The Whistle," hosted by Rebecca Lowe, the British-born sports journalist who fronts NBC's coverage of English football in the US, and Brendan Hunt, the American comic actor best known for his role of Coach Beard in Ted Lasso. They make a funny and intelligent pairing, and they attract guests not only from the Lasso cast, but even Steve Kerr, the coach of the Golden State Warriors basketball team. It's fun and you can find it here. Have a good week everyone, and I hope to be in your inbox most days. More From Bloomberg Opinion: Want more Bloomberg Opinion? OPIN <GO>. |

No comments:

Post a Comment