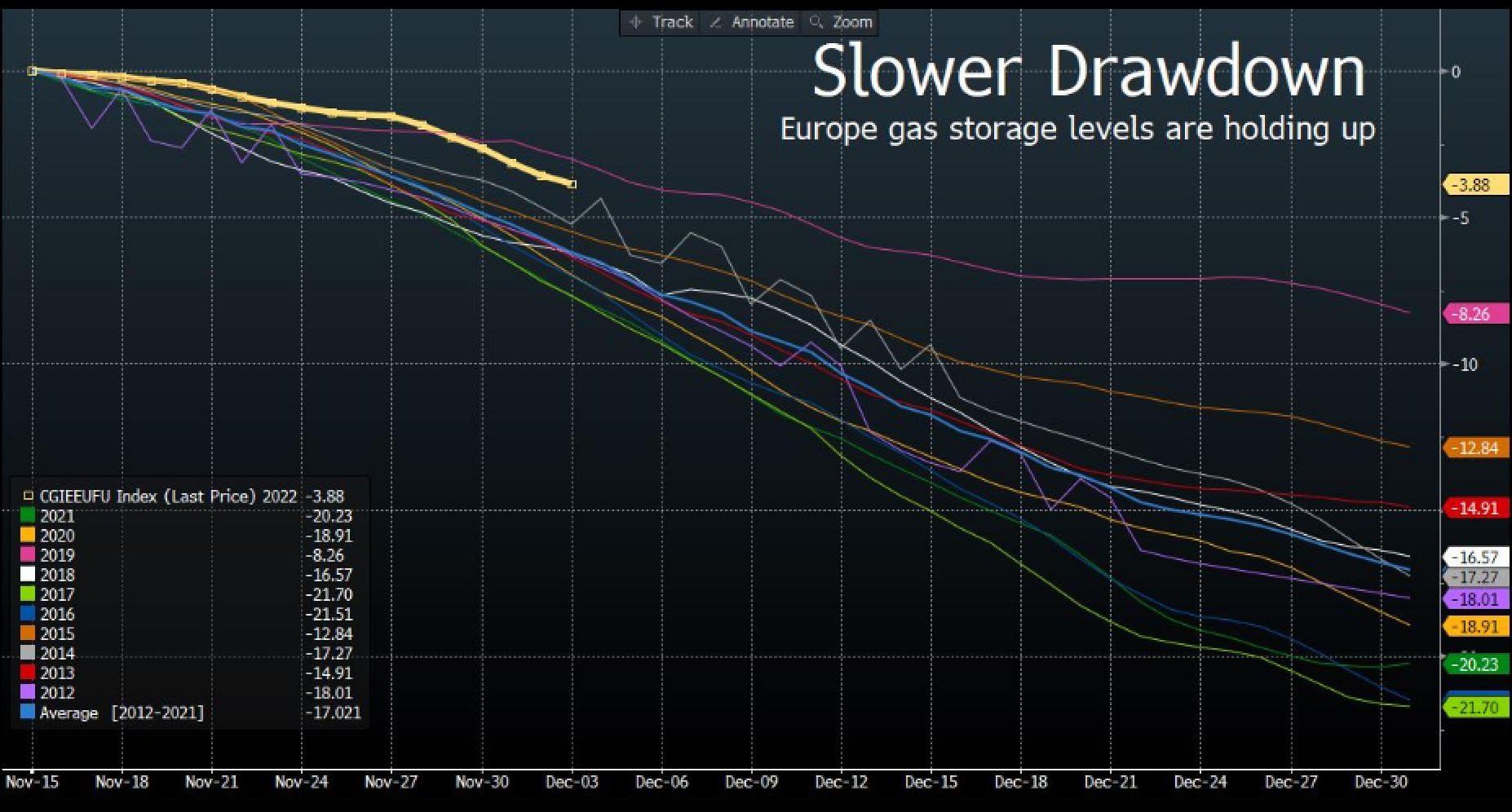

| Good morning. Metals tariffs to help fight carbon emissions, Covid cases falling in China, Deutsche Bank mulls jumping back into residential mortgage-backed securities and coming to grips with debt among European landlords. Here's what people are talking about. The European Union and the US are considering using new tariffs on Chinese steel and aluminum as part of a bid to fight carbon emissions and global overcapacity, according to people familiar with the matter. The idea, generated within President Joe Biden's administration, is still in an initial phase and hasn't been formally proposed, according to the people. US aluminum and steel producers climbed in extended trading, while in Hong Kong, Aluminum Corp. of China and China Hongqiao Group Ltd. slipped. China is reporting fewer Covid-19 cases as a wave that started to accelerate last month appears to be tailing off amid a pullback in the sweeping testing regime that saw a negative result needed to even enter a public park. Beijing no longer requires negative tests from people wanting enter a range of public venues, following cities from financial center Shanghai to tech hub Shenzhen in dialing back testing requirements.  | Deutsche Bank is considering a return to trading residential mortgage-based securities as part of a strategy to expand the markets business that has driven much of its recent growth. Trading head Ram Nayak has floated the idea internally as another potential step in his plan to build out the fixed income and currencies unit without the need for many additional resources, people familiar with the matter said. Chief Executive Officer Christian Sewing is looking for ways to keep the momentum at the fixed-income unit as the favorable market conditions of the past years are expected to normalize. The sudden end to the cheap money era is drawing fresh scrutiny to how European landlords account for their debt loads. At issue is more than $21 billion of hybrid bonds that are treated as equity, not debt, under international accounting rules. The debate around those securities intensified last week after one of Europe's largest landlords, Aroundtown SA, declined an early redemption option on one of its hybrids and said it will review whether to defer coupon payments. European stocks are tipped to follow global shares lower after surprisingly strong US services data supported bets for a higher Fed terminal rate. The first ever EU-Western Balkans summit takes place in Tirana, Albania. ECB Vice President Luis de Guindos speaks. Commodities giant Glencore hosts an investor day. Expected data include German factory orders for October. Ashtead, Ferguson and AutoZone report earnings. This is what's caught our eye over the past 24 hours. With winter now truly making itself felt in Europe, and temperatures dropping below early-December averages in parts of the region, storage levels in natural gas reservoirs remain a key issue. We already looked at inventories rising above seasonal averages in this column last week. What's impressive, though is how well they're holding up, falling only 3.9 percentage points since mid-November as seen in the chart, the second-slowest pace in the last decade (bar 2019). High gas prices, with the benchmark first-January TTF contract trading 850% above where it was two years ago, providing a possible explanation. Gas demand has fallen on a weather-adjusted basis as consumers wrap up in snug blankets rather than turn up the heating, and companies opt for alternative energy sources. All of which suggests the worst case will be averted. It's worth bearing in mind, though, that gas prices probably won't come back down to their pre-Ukraine-invasion averages. If that were to happen, the price incentive attracting additional flows to Europe via LNG terminals would be erased, and consumers would turn on the heating again. So while the outlook is good, we might as well accept the new normal of higher energy prices for the foreseeable future.  Eddie van der Walt is Deputy Managing Editor of Markets Live in London. @EdVanDerWalt Who is right about the outlook for the US economy, JPMorgan, Morgan Stanley or Dr. Doom? And which investor has the best tweets? Let us know, fill out our latest MLIV Pulse survey. |

No comments:

Post a Comment