| Good morning. A new episode of FTX probe, Biden said he would talk with Putin and a key meeting that will set the course for China reopening. Here's what people are talking about. US authorities are asking crypto investors and trading firms that worked closely with FTX to hand over information on the company and its key figures, including founder Sam Bankman-Fried and the former head of his Alameda Research investment arm, Caroline Ellison. Recipients of requests sent by the US Attorney's Office for the Southern District of New York include firms that frequently traded on FTX and may have had conversations with platform executives or hold other information that might help the criminal investigation. The moves show authorities are casting a wide net as they embark on their investigations into FTX's collapse. President Joe Biden said he would talk with Russian President Vladimir Putin about the war in Ukraine if the Russian leader is serious about ending his invasion, after previously saying only Ukraine's leaders can decide when to hold peace talks. The Russians have so far shown no indications they are going to stop or slow military operations, which US officials believe will continue through the winter months. Meanwhile, shipping costs for Russian crude are skyrocketing as more tanker owners shun the trade days before stricter European Union sanctions take effect.  | China's top leaders will likely signal a more pragmatic approach toward Covid controls at a key upcoming meeting while putting more focus on boosting economic growth, economists say. The 24-member Politburo, the Communist Party's top decision-making body, usually convenes in early December every year to set broad guidelines for economic policy for the coming year. Top of mind for investors is how officials will balance the Covid Zero strategy against the need for economic growth. With Beijing now signaling a decisive shift away from its zero-tolerance approach to combating Covid infections, economists say China desperately needs more monetary and fiscal stimulus to support the recovery into next year. The UK opposition Labour party held a key parliamentary seat in a special election, a boost for leader Keir Starmer in his first electoral test against new Conservative Prime Minister Rishi Sunak. Labour's Samantha Dixon defeated Tory candidate Liz Wardlaw in the northwest England city of Chester, winning 61% of the vote. The election was triggered by the resignation of Chris Matheson, who had represented the seat for Labour since 2015, following allegations of sexual misconduct. Chester is a swing seat that's changed hands between Labour and the Tories since the 1990s, and the scale of the win will be analyzed by opposition strategists as they look ahead to the next general election. European shares are on track to edge lower ahead of a US jobs report that may shed light on the Fed's path forward. Other expected data include Germany trade balance, France industrial production and Ireland GDP. ECB's Joachim Nagel speaks. Cracker Barrel and Canadian Western Bank are among companies set to report earnings. This is what's caught our eye over the past 24 hours. - Blackstone's $69 billion real estate fund hits redemption limit.

- Here are the VIP guests invited to Biden's dinner for Macron.

- Kim Kardashian's investment firm hires Brisske from Permira.

- World Cup stocks rise in Tokyo as Japan upsets Spain to advance.

- Vulnerable Britons unable to afford energy may unplug from grid.

- Credit Suisse is cutting a third of debt sales positions.

- OPEC slashes oil output by most since 2020 to fulfill new pact.

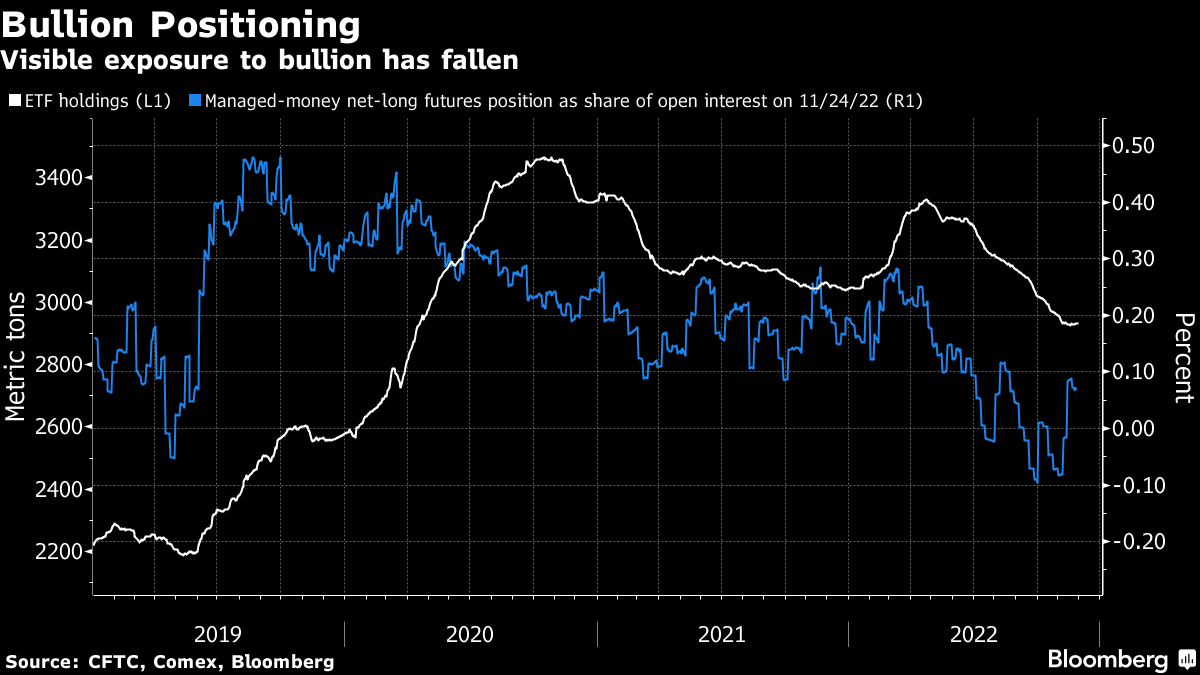

NEW | Like this newsletter? Sign up for John Stepek's Money Distilled newsletter for the biggest developments in the world of markets and economics, and what it all means for your money. The biggest drivers of the gold market, in terms of determining fundamentals, are US dollar and real rates. The mechanism through which those fundamentals are reflected in prices consists of positioning in ETFs and futures markets. With Fed Chairman Jerome Powell and other central bankers starting to sound a little cautious about the wisdom of tightening into weakening growth, real rates (as reflected in inflation-adjusted Treasury yields) are starting to drift lower. At the same time, there's a pretty solid case that the US dollar has put in a medium-term peak. Both of those things augur for higher gold prices, and indeed, spot metal soared 10% since Nov. 3. What's really interesting, though, is that positioning remains relatively subdued. Neither hot money in futures markets (admittedly recorded with a lag) nor exchange-traded funds have bought into the rally in size yet. That suggests that the advance has momentum into year end.  Eddie van der Walt is Deputy Managing Editor of Markets Live in London. @EdVanDerWalt |

No comments:

Post a Comment