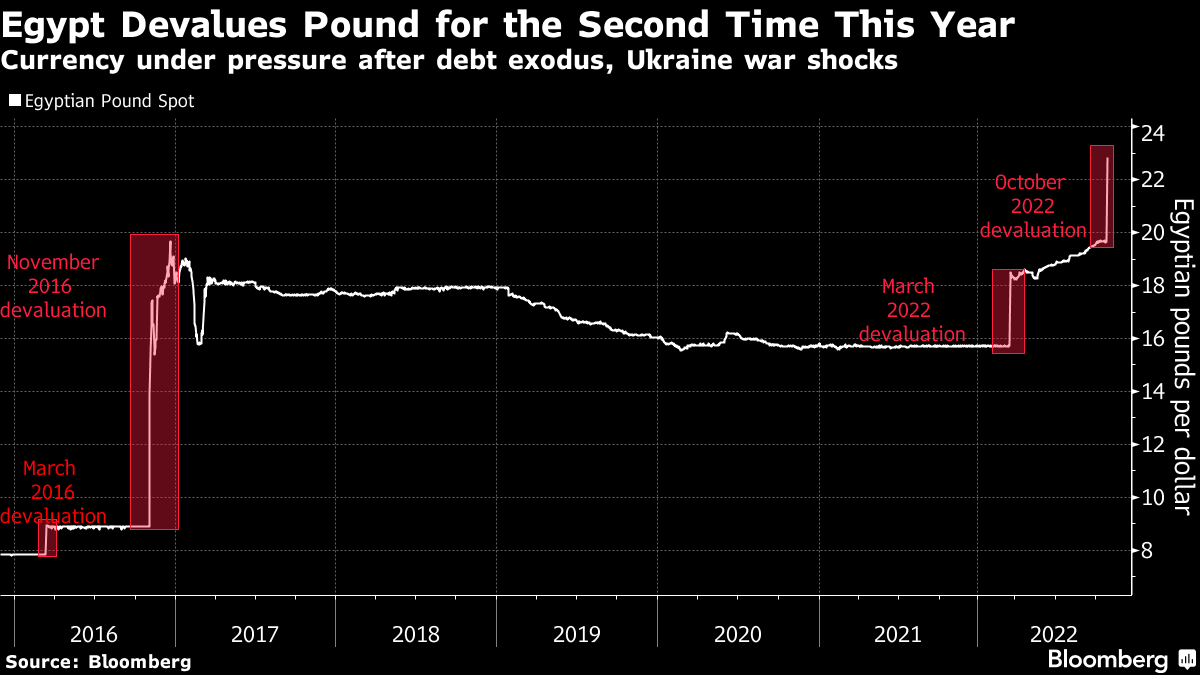

| Egypt's currency is under pressure after the country declared a landmark shift to a flexible exchange rate, a key condition for a deal with the International Monetary Fund.

The North African nation agreed on a $3 billion loan with the IMF to shore up an economy battered by the fallout from Russia's invasion of Ukraine. Egypt, which has faced soaring import bills and an exodus of foreign money due in part to the conflict, will also receive $5 billion from unidentified international partners to help finance the country's external funding gap. A further $1 billion from a newly created sustainability fund is also on the table, according to the IMF.

Egypt's pound extended its losses to depreciate as far as 24 to the US dollar for the first time. The drop followed Thursday's devaluation that saw the pound plunge more than 15%, after the central bank's move to let supply and demand decide its value, shifting from a practice of keeping the currency stable by using foreign reserves.

Policy makers also raised official borrowing costs by 200 basis points at an unscheduled meeting last week.  With Egyptians bracing for the fallout on inflation that's already running near a four-year high, the question is how far the pound will drop. Deutsche Bank analysts including Samira Kalla predicted it may end the year closer to 25 per dollar, before support from Egypt's Gulf allies, foreign inflows and more supportive current-account dynamics bring stability.

Separately, the United Nations' International Fund for Agricultural Development and partner organizations will provide $2 billion in finance to boost food security in Egypt as part of the country's drive to increase investment in food, water and energy. Saudi Arabia's net foreign assets rose to 1.69 trillion riyals ($448.8 billion) in September, the most in nearly two years, as high crude prices boosted the coffers of the world's largest oil exporter. Opinion polls before Israel's general election put the coalition led by former Prime Minister Benjamin Netanyahu ahead of the one led by caretaker Prime Minister Yair Lapid, but neither will muster the 61 seats required in the 120-seat Knesset to form a government. Both men will pin their hopes, in the first instance, on voters of Palestinian descent; and in the second, on the political parties that represent them, Bobby Ghosh writes.  | Not enough: US companies' investment in new energy supply is "just not enough," Amos Hochstein, President Joe Biden's special envoy for energy, said on the first day of the Adipec oil and gas conference in Abu Dhabi. He spoke after Claudio Descalzi, chief executive officer of Eni SpA, warned that Europe will have to rely on the US to make up for a loss of oil supplies from Russia next year.

Gas-rich waters: Lebanon and Israel have signed a US-brokered deal that ended a dispute over gas-rich waters in the Mediterranean and paving the way for the development of energy resources. Meanwhile, Qatar is in talks with TotalEnergies and Eni for a 30% stake in an exploration block in waters off Lebanon, QatarEnergy CEO Saad Al Kaabi said.

Enough, for now: Credit Suisse's Saudi backer is bullish on its investment in the struggling Swiss lender, but ruled out pumping more money into the bank for now. Saudi National Bank, the kingdom's largest lender, is set to become one of the Swiss bank's biggest shareholders with a 9.9% stake.

Simmering spat: Saudi Arabia's energy minister defended OPEC+'s contentious decision to cut oil production, while criticizing major importers for trying to tame prices by selling down their inventories. The US is seeking to recalibrate its relationship with Saudi Arabia in a way that "better reflects our own interests," Secretary of State Antony Blinken said.

Abdulaziz bin Salman, Saudi Arabia's energy minister, speaks during a panel session at the Future Investment Initiative conference in Riyadh. Photographer: Tasneem Alsultan/Bloomberg Top LNG trader: Qatar plans to use its massive liquefied natural gas expansion to transform the nation into the world's top trader of the super-chilled fuel. European proposals to set limits on the price paid for natural gas are "hypocritical," Energy Minister Saad Al Kaabi told Bloomberg TV.

Saudi stocks rush: Saudi Arabia's sovereign wealth fund is pushing ahead with plans to reduce its stakes in some of the kingdom's biggest companies and raise billions of dollars for new investments, with plans to pour $24 billion into Middle Eastern and North African countries.

Meantime, the CEO of the country's main stock exchange said the slew of initial public offerings that's made Saudi Arabia one of the hottest listings markets this year is unlikely to slow down.

UAE's busy too: Private school operator Taaleem is set for a rare private sector listing in the UAE, while a consortium of Abu Dhabi state-backed entities is weighing an offer for a stake in GEMS Education. Dubai is set for its fourth privatization of the year with the IPO of Emirates Central Cooling Systems, while shares in Bayanat AI more than tripled in their Abu Dhabi trading debut.

Trillion-dollar windfall: The IMF expects energy exporters in the Middle East and Central Asia to earn a cumulative windfall of about $1 trillion over 2022-2026, a bonanza that will go a longer way for Gulf Arab economies because they'll save a lot more of their oil revenues. Saudi Arabia's economy grew an estimated 8.6% in the third quarter compared to the same period a year earlier. - Saudi Aramco 3Q results: Nov. 1

- Israel elections: Nov. 1

- Abu Dhabi International Petroleum Exhibition and Conference: Oct. 31-Nov. 3

Pessimism about the state of the world has been front and center as leaders of global finance gathered in Saudi Arabia last week, but with the host nation a striking exception to the general gloom.  Saudi Crown Prince Mohammed bin Salman Photographer: BERTRAND GUAY/AFP The kingdom is enjoying its moment, with oil money gushing in to drive the fastest growth rate in the Group of 20 major economies, and a sense -– tangible in the hallways of the Ritz-Carlton Hotel in Riyadh, where the Future Investment Initiative conference wrapped up on Thursday -- that Saudi Arabia is in the ascendant. The three-day event was meant to showcase an economic transformation in the kingdom, and Crown Prince Mohammed Bin Salman now has more cash than ever to make that happen. It's a stark turnaround for the 37-year-old heir to the throne, who has re-emerged from relative isolation following the murder of Saudi critic and columnist Jamal Khashoggi in 2018. |

No comments:

Post a Comment