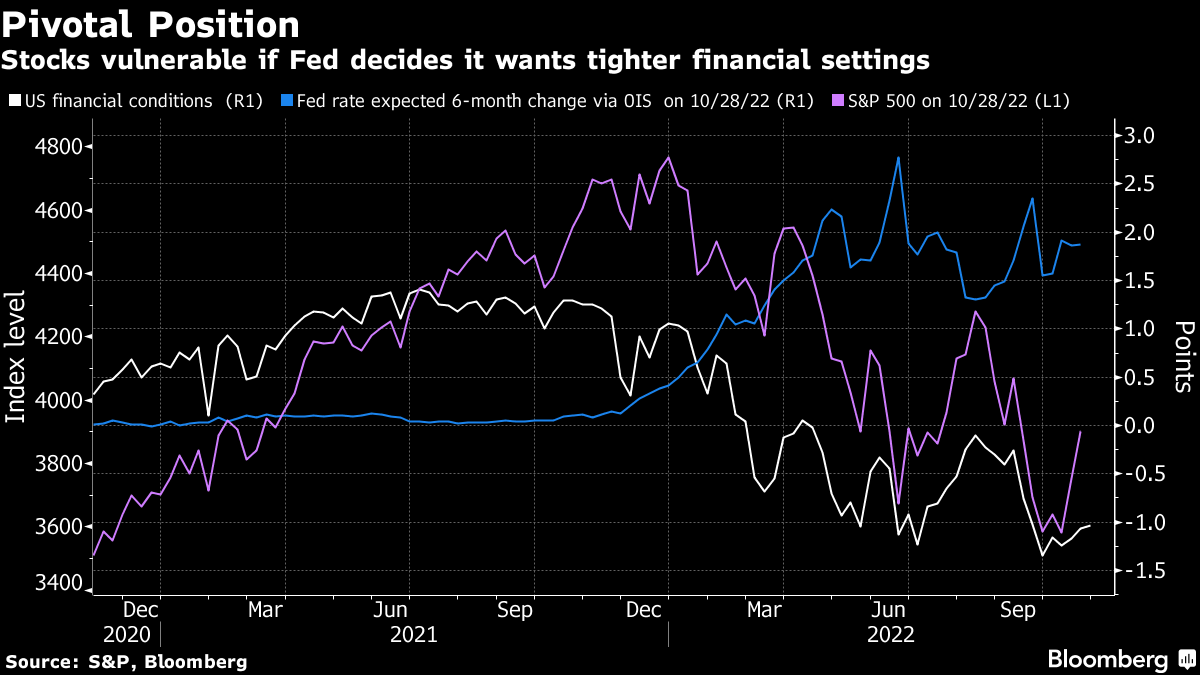

| Good morning. Efforts to salvage the grain deal, challenges for the UK's PM and Credit Suisse needs more money. Here's what people are talking about. Investors just got over a hectic week, contending with a blitz of earnings from some of America's biggest companies as well as a pile of uncertain economic and geopolitical news, but what's coming may be even worse. In the span of just seven trading sessions, there will be four major events that could shape the market's outlook for the rest of the year. On Nov. 2, the Federal Reserve will announce its latest interest-rate decision and give hints about its path forward. Two days later, the October jobs report will provide an important look at how much hiring is slowing. On Nov. 8, the mid-term elections may usher in a change in which party controls Congress. And finally, on Nov. 10 there's the consumer price index, a report that's played a key role in shaping expectations for the Fed's path. Rishi Sunak won an endorsement from financial markets in his first days as prime minister. His first full week in power may be more challenging. The new premier's economic policy is set to face scrutiny as the Bank of England delivers what could be its biggest interest-rate hike in more than 30 years and the government looks to fill the multi-billion hole in the nation's finances before a fiscal statement next month. Questions also continue to swirl over security breaches by his Home Secretary Suella Braverman, calling into doubt Sunak's political judgment in reappointing her to the position. At the same time, UK business confidence dropped to its lowest since March 2021, underscoring the turmoil in the economy.  | Turkey, the United Nations and others looked for ways to salvage the Ukrainian grain export initiative after Moscow said it would pull out indefinitely following an attack on its Black Sea naval fleet. Wheat in Chicago jumped as much as 7.7% to $8.9325 a bushel at the open on Monday before paring gains to 5.9% by 10:06 a.m. in Singapore. Russia said Saturday it was suspending the agreement after its ships off Sevastopol in annexed Crimea were hit by aerial and underwater drones it blamed on Ukraine. Turkey and the UN, which toiled together for months to broker the safe-transit deal for grain shipments from three Ukrainian ports, went back to work on Sunday. Credit Suisse has invited at least 20 banks to join the syndicate for a 4 billion francs ($4 billion) rights issue that should help the lender finance another multi-year restructuring program, according to people familiar with the plan. The Swiss bank's new Chief Financial Officer Dixit Joshi held a due diligence call for the capital increase -- dubbed as project Ghana -- with a group of FIG and ECM bankers on Friday evening after Credit Suisse's announcement of a new turnaround plan the day before. On top of the lead banks -- Morgan Stanley, Royal Bank of Canada, Deutsche Bank and Societe Generale -- Credit Suisse invited another long list of lenders to help with the underwriting of newly issued shares. The Saudi National Bank has already committed to roughly a third of the offer, becoming a big shareholder in the bank. European stocks are set to rise, in step with gains in Asia and the US amid optimism over company results. OPEC unveils its 2022 World Oil Outlook. Nordic prime ministers meet in Helsinki for a Nordic Council meeting. Bank of Italy Governor Ignazio Visco and Italian Finance Minister Giancarlo Giorgetti speak. The World Strategic Forum 2022 begins in Miami. Expected data include Eurozone CPI and GDP. Earnings season continues with NXP Semiconductors, Stryker and Aflac on deck. This is what's caught our eye over the past 24 hours. NEW | Like this newsletter? Sign up for John Stepek's Money Distilled newsletter for the biggest developments in the world of markets and economics, and what it all means for your money. Equities roared higher to close out last week, but that makes them look vulnerable with the Fed and the Bank of England each expected to deliver 75 basis-point hikes. There's some potential Friday's US surge owed much to the proximity to the end of the month, so a bit of an unwind could hit as soon as Tuesday, but we're also gearing up for another round of pivot peril. You should know the drill by now -- as the Fed jacks up rates at an accelerated pace, investors start anticipating that this massive interest-rate hike will be the last before policymakers ease back on their aggression. The question is whether the Fed wants to allow such a narrative to bloom and the inevitable loosening in financial conditions it would bring. Right now things are pretty tight, but the danger for equity investors is that Chairman Jerome Powell and his colleagues decide to underscore a hawkish outlook in order to keep it that way.  Garfield Reynolds is Chief Rates Correspondent for Bloomberg News in Asia, based in Sydney. |

No comments:

Post a Comment