| Welcome to Next Africa, a weekly newsletter on where the continent stands now — and where it's headed. Many Nigerians are losing faith in the septuagenarian titans and established parties that have long dominated Nigeria's political scene. That's clear from an opinion poll commissioned by Bloomberg. Peter Obi, a 61-year-old representing a party with just one seat in the senate, is the preferred presidential choice for most respondents.  Obi's supporters during a rally on Sept. 24. Photographer: Kola Sulaimon/AFP/Getty Images The wealthy businessman and former state governor was selected by almost three quarters of those who've decided who they will vote for. Bola Tinubu of the ruling All Progressives Congress was chosen by 16% and Atiku Abubakar of the People's Democratic Party polled just 9%. Tinubu, 70, has been a force in Nigerian politics for over two decades, governing the economically powerful Lagos State for eight years. Abubakar, 75, is an ex-vice president who has failed in five tries to win the top post. The APC and PDP have been the governing parties in Africa's most-populous country since the 1999 restoration of democracy. Yet, they have little to show for it. Nigeria has more extremely poor people than any other nation, according to a United Nations measure, unemployment has surged and inflation is at a 17-year-high. The northern half of the country is beset by Islamist militant activity and banditry. Click here to read our interview with Obi. The survey, conducted by Premise Data Corp., has its limitations. The survey of 3,973 Nigerians from Sept. 5-20 was by smartphone, and less than half of Nigerians own those devices. The election is still five months away and the political machinery of the two dominant parties will now grind into action. So, Obi will have an uphill task to keep that lead. But what the results signal is a deep dissatisfaction with the status quo, among a population with an average age less than a third of those campaigning to be their leaders. — By Antony Sguazzin Click here for this week's most compelling political images, and here to sign up for the global politics newsletter, Balance of Power. IMF Talks | Ghana will start to engage with local and foreign investors to help fast-track negotiations with the International Monetary Fund for as much as $3 billion of support. The government of the West African nation wants "key aspects of that program to be reflected" in next year's budget, due to be presented in November, according to Finance Minister Ken Ofori-Atta. Bloomberg reported last week that Ghana was poised to start talks with domestic bondholders on the possible restructuring of local-currency debt, and that external liabilities may be included. Wrecking Ball | Power cuts of as many as eight hours a day in South Africa have closed factories and businesses and darkened streets and homes. While they aren't the first, the outages since the end of June amidst the Southern Hemisphere winter have been the worst. For the past 14 years, Eskom has struggled to meet demand for electricity, damaging the economy. Now, fixing the broken state utility and its rickety power system is proving a crucial test for the ruling African National Congress party ahead of elections in 2024.  A shop at night in an informal settlement in Hout Bay, near Cape Town, on Aug. 3. Photographer: Dwayne Senior/Bloomberg Oil Risks | Residents in 14 villages in the Democratic Republic of Congo visited by Greenpeace weren't aware of the government's plans to open up a vast swath of the nation's tropical forest for oil and gas drilling. Some of the 30 planned exploration blocks announced in July overlap with protected areas and the world's biggest tropical peatlands, which store carbon equivalent to three years of global greenhouse-gas emissions. The villagers are among more than a million people in the exploration areas who may be affected, according to the activist group. New Team | Kenyan President William Ruto nominated former central bank Governor Njuguna Ndung'u to lead the Treasury as he prepares to tackle the East African nation's burgeoning debt and surging cost of living. A sweeping overhaul of the executive sees only one of his predecessor Uhuru Kenyatta's ministers retained. Ndung'u is a key architect of Ruto's so-called bottom-up economic model, a pro-poor program that seeks to channel state resources to industries that can create the most jobs, such as farming. Retail Retreat | Two decades ago, Shoprite unveiled an ambitious plan to expand beyond its home base in South Africa, entering more than a dozen countries north of the border and becoming the continent's biggest grocer. Today, it has largely retreated back to South Africa and a few nearby places after shutting its operations in eight markets. In September, it said it had wrapped up in Madagascar and Uganda, and last year it left Nigeria and Kenya. Other South African retailers have also seen cash shortages and import restrictions hobble their pan-African operations.  A Shoprite store in Malawi. Photographer: Amos Gumulira/Getty Images Big Find | TotalEnergies's oil discovery off Namibia could be a "giant," boosting hopes that the country is home to a prolific new hydrocarbon basin. The optimism around the find in the southwest African country's waters is based on the results from a single well, the company's Chief Executive Officer Patrick Pouyanne told investors in New York this week. The French major announced an initial discovery in Namibia in February, weeks after Shell also drilled a successful offshore well there. Cllck here to read our guide for Zambian Finance Minister Situmbeko Musokotwane's budget speech due Friday afternoon in Lusaka. Data Watch - Nigeria hiked it's benchmark interest rate to a record high and signaled more increases may be coming if efforts to rein in inflation fail. It raised the rate by 150 basis points to 15.5%. Mauritius's central bank lifted its rate for a third meeting, to 3%, as it struggles to tackle rising prices.

- Kenya raised borrowing costs by the biggest margin in seven years to 8.25%. That's the second increase this year after unexpectedly leaving it unchanged in July.

- Angola bucked the global trend, cutting its key rate for the first time in three years.

- Zimbabwe's inflation slowed for the first time since January. It's still at 280%, though, prompting the central bank to maintain the highest benchmark interest rate in the world at 200%. Inflation in Cape Verde slowed to 8.6%, the first drop in price growth since December 2020.

- Zambia's economy expanded 3.5% in the second quarter, Botswana's grew by 5.6%, while the Namibian economy expanded by 5.6% from a year earlier. Senegal's gross domestic product increased 1.6% from the previous quarter.

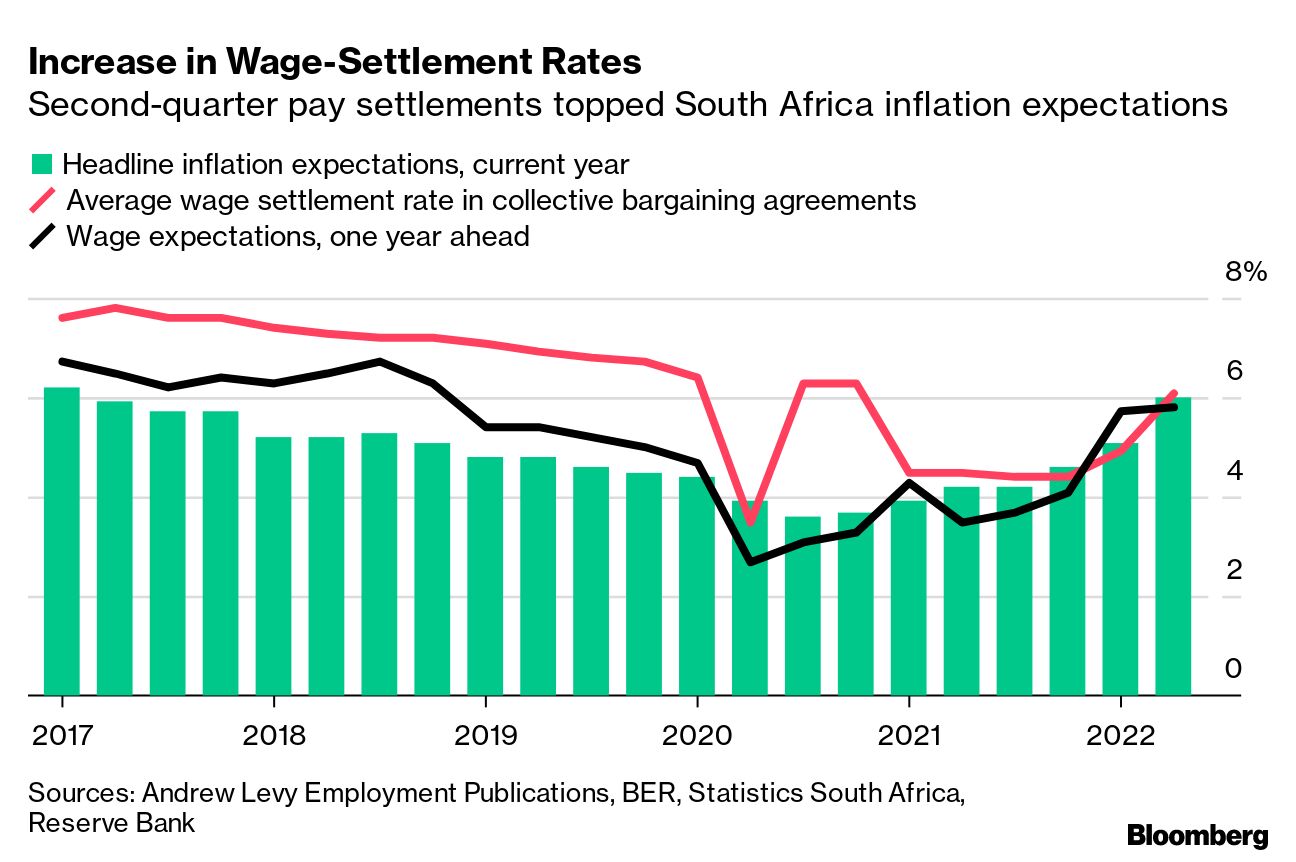

South Africa lost 1.6 million work days due to strike action in the first six months of the year, an increase of more than 30-fold from a year ago, according to central bank data. That's helping to drive up wage-increase settlements and expectations for future inflation. Coming up - Oct. 3 South African manufacturing PMI & new vehicle sales data for September, Angola reserves for September

- Oct. 4 Monthly PMI for Nigeria, South African central bank six-month monetary policy report

- Oct. 5 September PMI releases for Kenya, Uganda, Zambia and Ghana, South Africa whole-economy PMI

- Oct. 6 Uganda interest-rate decision, PMI for Mozambique

- Oct. 7 Ghana interest-rate decision, Tanzania inflation, Mauritius inflation and reserves for September, South Africa reserves, Lesotho election

| Toward the tail-end of Jose Eduardo dos Santos's almost four-decade rule of Angola, Porsches, BMWs and even the occasional Ferrari meandered through the streets of downtown Luanda past legions of beggars. Such public displays of affluence in one of the world's most unequal nations are now far less prevalent. President Joao Lourenco unleashed an anti-corruption drive in 2017 that targeted several members of his predecessor's inner circle, prompting many of the well-heeled to try hide their wealth or pretend they were never really that rich after all. The government says it has already opened more than 3,000 corruption, money-laundering and other commercial probes since Lourenco came to power, and more than $20 billion worth of illicitly acquired assets have been seized in Angola and abroad. Opposition parties, however, say he's using the anti-graft crusade as a smokescreen to distract from the country's economic woes and settle political scores.  Luxury motor yachts at their harbor moorings in Luanda in November 2013. Photographer: Simon Dawson Don't keep it to yourself. Colleagues and friends can sign up here. For even more: Subscribe to Bloomberg All Access for full global news coverage and two in-depth daily newsletters, The Bloomberg Open and The Bloomberg Close. How are we doing? We want to hear what you think about this newsletter. Let our editors know. |

No comments:

Post a Comment