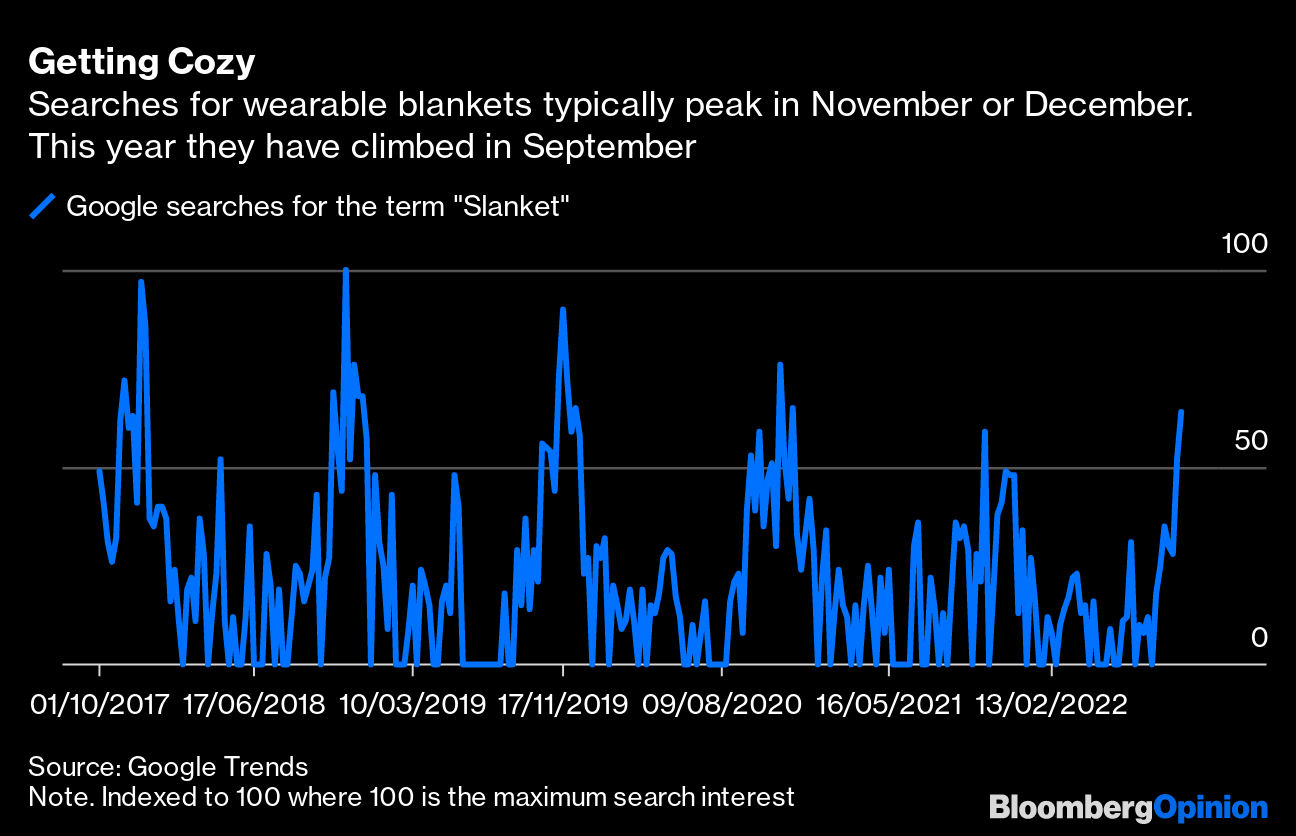

| This is Bloomberg Opinion Today, a dumpster dive into Bloomberg Opinion's opinions. Sign up here. It's been a turbulent time for UK financial markets. A week ago, the government revealed a tax-cutting bonanza, delivering a fiscal splurge that's diametrically opposed to the Bank of England's efforts to tighten the monetary spigots to curb inflation. Since then, the pound has round-tripped from $1.10 to a record low of $103.5 and back again — leaving it about a fifth weaker against the greenback this year. The yield on the 30-year UK government gilt soared by more than a percentage point, driving it above 5% — until the central bank announced unlimited intervention "to restore orderly market conditions" as pension funds who've been dabbling in derivatives to boost returns faced ruinous margin calls on suddenly underwater positions.  Domestic repercussions of the economic debacle that is Trussonomics include the growing risk that the City of London gets displaced by Paris as home to Europe's biggest equity market, a 70% surge in the average monthly cost of a mortgage, and public hot tubs closing and swimming pools getting colder as British leisure companies brace for rampant energy costs this winter. Britons are even stocking up on dressing gowns, snuggly tops and cozy onesies to keep warm, says Andrea Felsted.  But it's the international shockwaves that are most concerning. Richard Cookson points out that the BOE-inspired rebound in the price of the long-dated gilt still leaves pension funds nursing huge losses; and without central bank purchases around the world, bond yields everywhere would be much higher and debt prices much lower. "Recent turmoil in the UK draws attention to the fragility of markets for government debt around the world when they are not, one way or another, being manipulated by governments and central banks," he writes.  Allison Schrager argues that what happened in the UK this week should be a warning to other jurisdictions about the dangers of ultra-low yields and unknown unknowns. "Some economists are arguing that such a thing can't happen in the US because rates won't rise as fast or as much as they did in the UK since America is the world's reserve currency," she writes. "Perhaps, but this experience shows why piling on risk and illiquid assets leaves you vulnerable, and very low interest rates for a very long time creates risks many regulators and pension fund managers never anticipated." Bonus British Aftershocks Reading: Sterling's slump makes the FTSE 100 one big dumpster dive — Chris Hughes Bonus British Budget Thoughts: There's a stealth tax increase buried in Kwasi Kwarteng's proposals. — Stuart Trow Amazon.com Inc.'s Ring has been a roaring success for the company, dominating the blossoming market for video doorbells and selling for about $105 a unit. This week, it launched Ring Nation, a daily 20-minute television show featuring videos captured on smartphones and Ring cameras. The jovial full-color clips — kids excited at a new puppy, a crane chasing a boy across his front yard — contrast with the usual fare on TikTok, which specializes in fear-arousing monochrome footage of shadowy figures who are Up To No Good. And that's a problem, argues Parmy Olson. "Reframing surveillance as fun and quirky makes it more normal, which takes a sinister turn when that monitoring comes at the expense of people's privacy and civil liberties," Parmy writes. "Evidence that Ring cameras actually reduce neighborhood crime is flimsy. Its much bigger impact is on human sentiment. Owners feel a greater sense of security and control. Another outcome is this: Collectively, people come to accept that their behavior is being watched." George Orwell, she writes, wouldn't be a fan of the show. Economists surveyed by Bloomberg expect the US economy to slide into a recession in the next 12 months. But US companies started the year in a position of "extraordinary financial strength," argues Jonathan Levin. "High-yield default rates are still low for normal times, let alone recessions, and it could take several quarters for the defaults to start materializing in significant numbers." The surging dollar is causing real problems for economies outside of the US. But there's little prospect of a repeat of the Plaza Accord, the 1985 agreement whereby finance ministers and central bankers formed a pact to weaken the greenback. "The money and the will aren't there for currency markets this time," argues John Authers. Facebook's age of austerity couldn't have come at a worse time. — Parmy Olson The oil market has a big Russian sanctions problem. — Elements by Julian Lee Italy's Giorgia Meloni needs less rhetoric and more reform. — Bloomberg's editorial board India's internet bill is straight out of Beijing's playbook. — Andy Mukherjee Another absurd debt ceiling fight? Enough is enough. — Jonathan Bernstein This Republican 'commitment' is an exercise in redundancy. — David Hopkins For the first time in decades, cash is a legitimate investment asset class. Chinese automaking giant Geely has taken a 7.6% stake in British sportscar maker Aston Martin. The Egg King of Ukraine, Oleg Bakhmatyuk, is facing a $1 billion fraud case in the Cowboy State. Inflation reached double digits in the euro zone for the first time, piling pressure on the European Central Bank. A Himalaya Retourne Kelly 25 handbag made by Hermès fetched a Sotheby's auction record of €352,800 ($344,862) at an auction in Paris Thursday night, almost three times its pre-sale estimate, and it's not even vintage.  Source: Sothebys.com New coins featuring King Charles III will come into circulation in the UK by Christmas.  Photographer: Chris Ratcliffe/Bloomberg A breed of Scottish grouse is near to extinction after a cold, wet spring. Bruce Willis has sold the rights to a deepfake likeness so his twin can appear in future movies. Notes: Please send happy daydreams and feedback to Mark Gilbert at magilbert@bloomberg.net. Sign up here and follow us on Instagram, TikTok, Twitter and Facebook. |

No comments:

Post a Comment