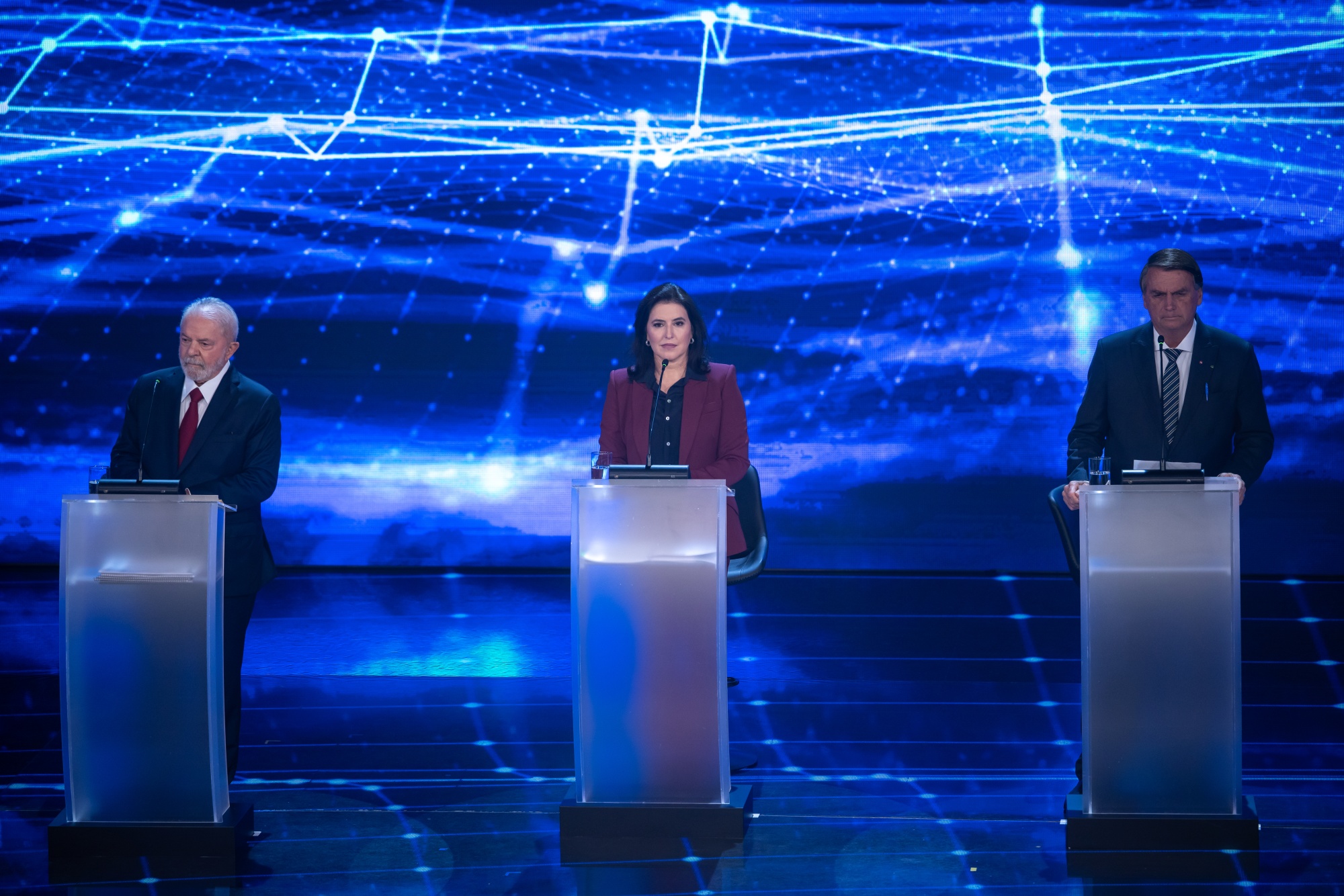

| Hello. Today we look at the huge economic stakes in Brazil's election this weekend, the threat automation poses to white-collar workers, and the gains Vietnam has made as a rising exporter to the US. When Brazilians cast their ballots in Sunday's presidential election, they will be thinking mostly about their $1.8 trillion economy. Polls show that's their top worry, spanning issues including rising poverty, inflation and social inequality. They have good reasons for concern. While Brazil's outlook just now may be the best in years, the recent record of Latin America's largest economy is a great disappointment: On average, it grew a meager 0.36% per year in the decade through 2021. The past decade saw three years where GDP shrank by more than 3% — and that's not just because of the pandemic. Income per person, measured in US dollars, is now almost 40% lower than in 2013, helping explain the bad mood among Brazilians after another economic lost decade. Whoever wins — the options are effectively between incumbent Jair Bolsonaro and former president Luiz Inacio Lula da Silva — will find jump-starting growth as the most immediate challenge. Big Take: World Fears for Fate of the Amazon as Brazilians Vote As a massive commodities producer, Brazil's fortunes can rise and fall on price cycles. Under Lula's two terms between 2003 and 2010, a surge in the price of grains, metals and oil put Brazil closer to fulfill its long-standing aspiration of being "the country of the future." Those were the years of BRICS euphoria, a concept that collapsed early in the last decade amid fiscal mismanagement and political instability.  Presidential candidates Luiz Inacio Lula da Silva, left, Simone Tebet, center, and Jair Bolsonaro. Photographer: Jonne Roriz/Bloomberg Lula — who polls show has a shot of winning an outright majority on Sunday, avoiding any need for an Oct. 30 runoff between the top two vote-getters — is running on nostalgia for the golden days. Bringing them back will be challenging, given prospects for a deteriorating fiscal picture and retreat in commodity prices. And Adriana Dupita at Bloomberg Economics points out here that neither Lula nor Bolsonaro has a track record of budget discipline. That's worth keeping in mind given how Britain's collapsing currency and bond market are showcasing how powerfully investors can react to new fiscal programs that appear poorly thought out. One more risk is the possibility that the election result ends up being contested. By contrast, a clear mandate for the next president may open the way for Brasilia to tackle the pressing long-term challenges that voters dearly want to see addressed. —Juan Pablo Spinetto Automation was long thought to be a threat mainly to manual-labor jobs. But evidence is emerging that robots are making inroads into white-collar work as well, Alexandre Tanzi and Reade Pickert report here. Data is hard to come by. But on earnings calls this summer, executives at all kinds of firms — including Goldman Sachs Group Inc. and clothing retailer Abercrombie & Fitch Co. — were touting their investments in AI and other kinds of automation. The latest wave of automation is building on advances in artificial intelligence and machine-learning that allow computers to perform tasks like speech recognition, and make some of the decisions that used to be done by employees. With wages rising fast, workers in short supply and near-record job vacancies, US businesses are racing to automate as much as they can. There are likely to be "many winners and many losers," according to MIT economist David Autor, a leading scholar in the field. "Computerization increases the productivity of highly educated workers by displacing the tasks of the middle-skill workers who in many cases previously provided these information-gathering, organizational, and calculation tasks," Autor wrote in a recent paper.

| - Austerity drive | UK Prime Minister Liz Truss is under pressure to cut spending on the same scale as George Osborne's infamous austerity drive of 2010 in order to stabilize public finances and win back the confidence of investors. She meets the budget watchdog today.

- Slower growth | China's factory activity continued to struggle in September, while services slowed, as the country's economic recovery was challenged by lockdowns in major cities and an ongoing property market downturn.

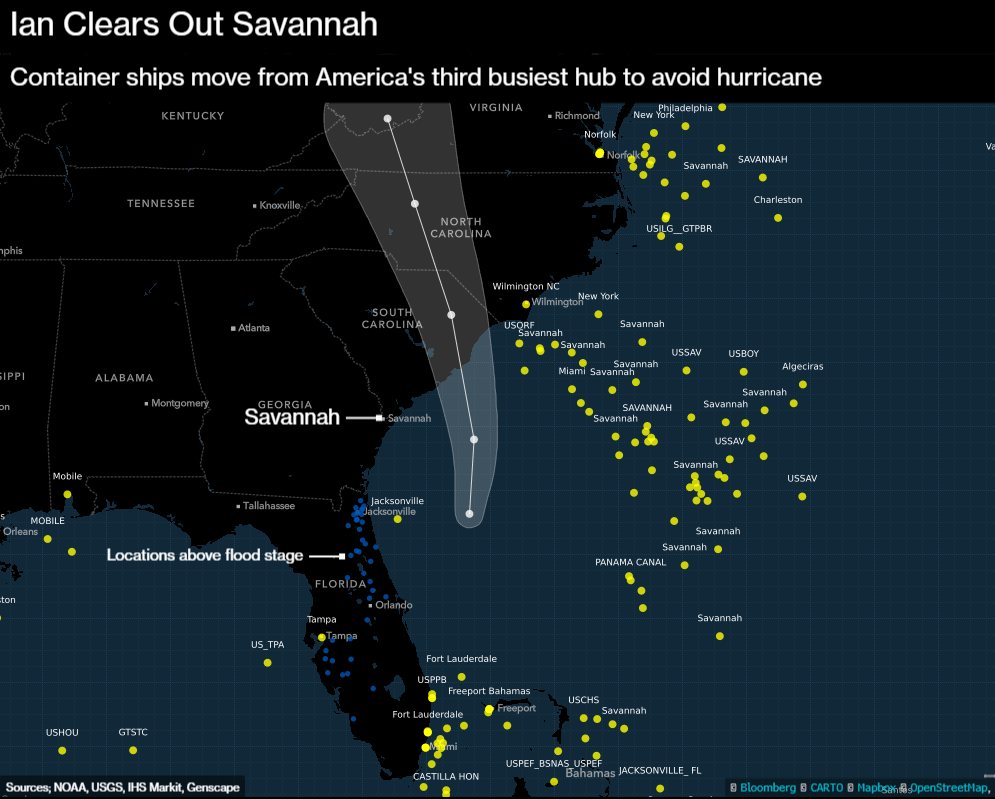

- Hurricane fallout | Major ports and rail facilities across the US Southeast have halted operations as one of the strongest hurricanes to ever hit the country heads north, causing disruptions along the way and resulting in another blow for already-strained supply chains.

- Apple woes | American firms that have had no shortage of reasons to damp ties with China in recent years — tariffs, Covid-Zero, Taiwan, and "friend-shoring" among them — are finding breaking up is hard to do.

- Help on the way | Japanese Prime Minister Fumio Kishida on Friday ordered up a fresh economic stimulus package by the end of October to help mitigate the impact of inflation and to boost growth.

- Inflation watch | The euro zone's economic crisis intensified with the first ever reading of double-digit inflation, piling pressure on the European Central Bank to keep raising interest rates aggressively.

- Revealing salaries | California this week became the latest state to join a growing nationwide salary-transparency movement.

Beyond the near-term headwinds for its domestic economy as well as potential global recession, Vietnam looks poised to keep gaining in its share of US imports. Southeast Asia has been a key benefactor from any shifts in low-level production out of China amid stresses between the world's two largest economies. The region now makes up 10% of total US imports, compared to about 7% in 2018, Sian Fenner of Oxford Economics notes in a report this week. Most of that boost has been from Vietnam, which has soared to a 3.9% share. There's healthy skepticism that Vietnam will ever come anywhere close to being the "world's factory" as China has been, especially with a ways to go on infrastructure and local training, and because a lot of the US-China trade war gains are owed to tariff-dodging re-routing of cheap goods. At the same time, the Southeast Asian nation does have some critical factors working in its favor — among them, a robust slate of trade agreements and investor enthusiasm. "In Vietnam's case, some of this growth in trade share may reflect some routing of products from China to Vietnam for minor adjustments to avoid higher US duties, but it also reflects an increase in export capacity following a decade of strong FDI inflows into manufacturing," Fenner wrote.

Car trouble... Read more reactions on Twitter - Click here for more economic stories

- Tune into the Stephanomics podcast

- Subscribe here for our daily Supply Lines newsletter

- Follow us @economics

- Coming Up: The fifth annual Bloomberg New Economy Forum will be held in Singapore Nov. 14-17, convening public and private sector leaders with ambitious ideas, ample capital and the courage to act on the pressing issues facing the global economy. Learn more and get exclusive alerts to watch the livestream.

|

No comments:

Post a Comment