What happened today in crypto markets – and why Was this newsletter forwarded to you? Sign up here. |

|

|

Good afternoon, and welcome to Market Wrap. I'm Glenn Williams Jr., crypto markets analyst with CoinDesk, here to take you through the day's crypto market highlights and news. Please feel free to reach out with any questions or comments at glenn.williams@coindesk.com or on Twitter @GWilliamsJr_CMT. In today's newsletter: Price Action: Bitcoin trades in a range around $20K Technical Take: Despite the lack of catalysts, institutions may be warming to bitcoin's valuation.

|

Would you like to receive a few of CoinDesk's other newsletters? Subscribe below! |

|

|

Bitcoin (BTC) and Ether (ETH) both declined on Thursday, settling into what seems likely to be a flat trading range for the foreseeable future. - Bitcoin (BTC) fell 1% on Thursday, temporarily falling below the psychologically important $20,000 level. The largest cryptocurrency by market cap has above and below $20K for the last six trading days.

- Ether (ETH), the second-largest cryptocurrency by market cap after bitcoin, rose 1.5% on the day. ETH has been essentially flat over the last three trading days, with above-average volume occurring only during Monday's decline. Since Monday's close, ETH's price has moved approximately 1%.

Global Macro: U.S. initial jobless claims of 232,000 in August were below consensus expectations of 248,000, and down from 237,000 in July. Continuing jobless claims for August were 1.44 million, matching the consensus, but also exceeding July's figure of 1.41 million. For digital assets, the better-than-expected jobs data is not likely to serve as a bullish catalyst. Given the Federal Open Market Committee's (FOMC) resolve to slow inflation, stronger employment data is likely to lead to increased consumer demand. The result of this increase (i.e., more dollars chasing a basket of goods) is likely to push prices higher. According to the CME FedWatch tool, the odds of a 75 basis point increase in the Fed funds rate during the FOMC's next meeting on Sept. 21 have increased to 72%, from 69% a day earlier. U.S. Equities: The Dow Jones Industrial Average (DJIA), tech-heavy Nasdaq composite and S&P 500 were mixed on Thursday. The Nasdaq fell .3%, while the DJIA and S&P 500 rose 0.46% and 0.30%, respectively. Commodities: Crude oil prices fell for the third consecutive day, declining 3.7% to $86 per barrel. Natural gas finished .61% higher, while the price of safe-haven asset gold as well as copper fell 1% and 3%, respectively.

Altcoins were mixed. Polygon (MATIC) rose 4.5% while Maker (MKR) and solana (SOL), decreased 2.8% and 2.7%, respectively.

|

●Bitcoin (BTC): $20,017 −0.9% ●Ether (ETH): $1,577 +0.4% ●S&P 500 daily close: 3,966.85 +0.3% ●Gold: $1,707 per troy ounce −0.4% ●Ten-year Treasury yield daily close: 3.26% +0.1 Bitcoin, ether and gold prices are taken at approximately 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information about CoinDesk Indices can be found at coindesk.com/indices. |

Absent Near-Term Catalysts, Institutions May See Current Valuations as Attractive |

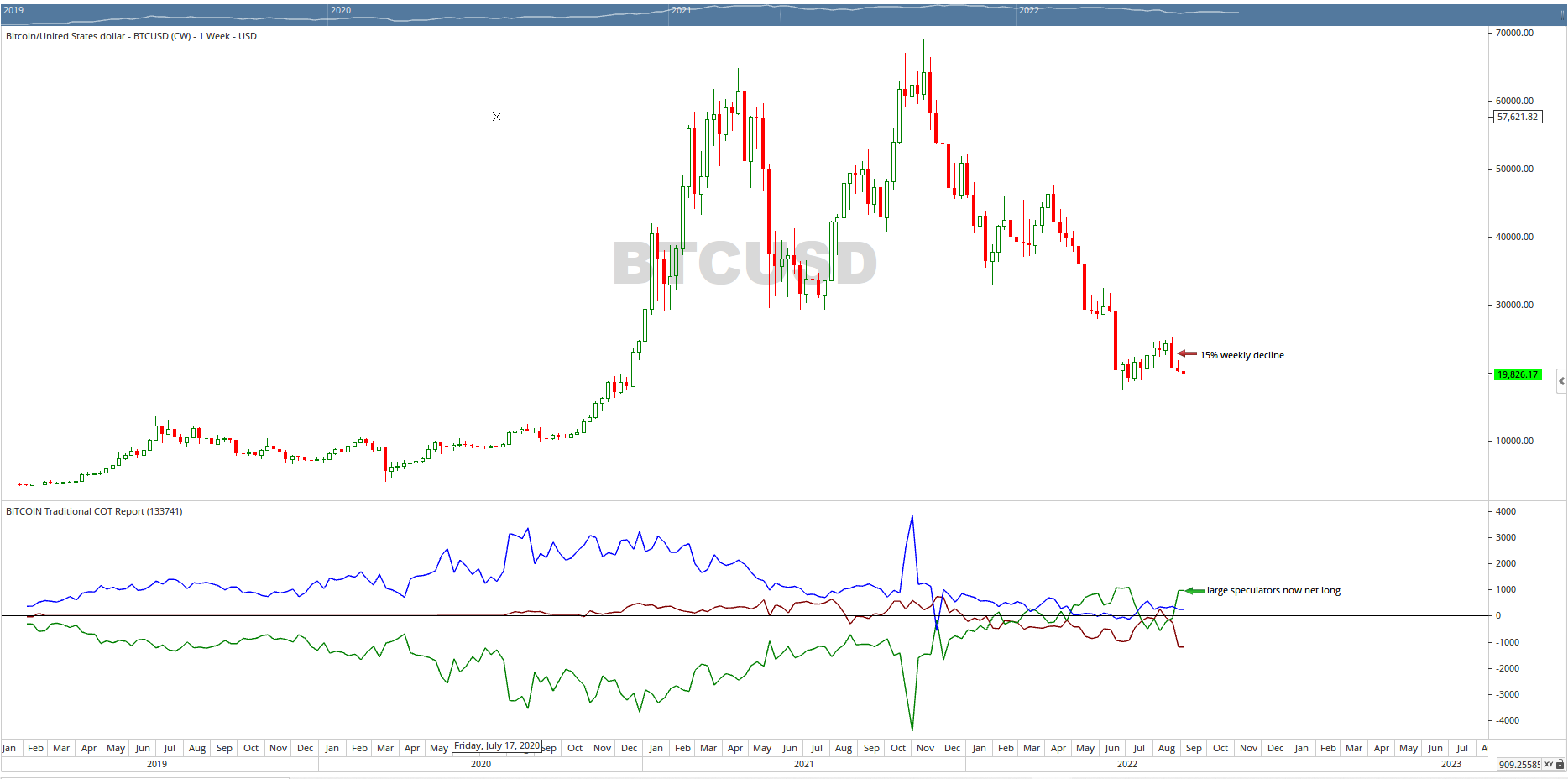

Bitcoin was recently trading below $20,000 on Thursday, continuing a flat trading range that began on Aug. 27. While the price of BTC has traded above and below $20,000 in each of the last six days, in the aggregate the price has moved just 2%. The average true range (ATR) for BTC has fallen from 2,065 in June, to a current level of 903. ATR is a technical indicator that measures the absolute value of price movement over a period of time. Increasing ATR levels signal increased volatility while a declining ATR (which we currently have) indicates the opposite. The compression in volatility for BTC, combined with moderate to below-average volume and proximity to its $21,000 point of control (discussed in Wednesday's Market Wrap), or price level with substantial activity, signals a continuation of sideways trading behavior in the near future. Given the oft-mentioned macroeconomic overhang, BTC doesn't seem to have a bullish catalyst at the moment. BTC's low valuation, however, may be enticing institutions to start buying, particularly as the crypto landscape continues to mature. Ben McMillan, chief investment officer of investment firm IDX, called the current crypto climate a potential buying opportunity: "With more visible development happening in the crypto ecosystem, many institutional investors are starting to view the current crypto 'winter' as similar to the period after the 'dot.com' bust which ultimately ended up being a generational buying opportunity for technology stocks," McMillan said. McMillan added that investors are seeing more interest in cryptos than other assets partly because of their longer-term prospects. "Investors are still certainly focused on the near-terms risks, but we're definitely seeing a greater appreciation for the growth potential going forward which definitely isn't shared with other asset classes," he said. A look at BTC's "Commitment of Traders" data shows that larger speculators (i.e., institutional money) are indeed beginning to enter into long positions. The report, published by the Commodity Futures Trading Commission (CFTC) each Tuesday provides a weekly snapshot of positions held by traders in futures markets. The positions of small speculators are denoted in blue, while positions of larger speculators (i.e., institutions) are denoted in green. A look at BTC's weekly chart shows large speculators moving into a net long position following the 15% decline during the week ended Aug. 19. |

BTC's weekly chart (Optuma) |

|

|

The following are the biggest movers in the CoinDesk 20 digital assets over the past 24 hours: |

|

|

Biggest Gainers Biggest Losers |

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive, and standardized classification system for digital assets. The CoinDesk 20 is a ranking of the largest digital assets by volume on trusted exchanges. |

|

|

- Potential Ethereum Hard Fork Token ETHPOW May Trade at 1.5% of Ether's Price, Futures Suggest: The proof-of-work (PoW) chain, representing a group of miners opposing the impending Ethereum's Merge and its switch to proof-of-stake (PoS), would have a new token called ETHPOW. Paradigm expects the token will open at $18 at minimum. Read more here.

- Helium Proposes Shifting its Entire Network to Solana Blockchain Months After $200M Raise: The developers propose shifting all Helium-based tokens, governance and economics around the network's native HNT, DC, IOT and MOBILE tokens from its own network to Solana. They cited faster transactions and "higher uptimes" among several reasons behind the proposed move. Read more here.

|

|

|

Which institutes are most impacting the blockchain world? Tell us your thoughts in a five-minute survey. We're welcoming responses until Sept. 7. Take the survey here. |

|

|

Disclaimer: The information presented in this message is intended as a news item that provides a brief summary of various events and developments that affect, or that might in the future affect, the value of one or more of the cryptocurrencies described above. The information contained in this message, and any information liked through the items contained herein, is not intended to provide sufficient information to form the basis for an investment decision. The information presented herein is accurate only as of its date, and it was not prepared by a research analyst or other investment professional. You should seek additional information regarding the merits and risks of investing in any cryptocurrency before deciding to purchase or sell any such instruments. |

|

|

|

No comments:

Post a Comment