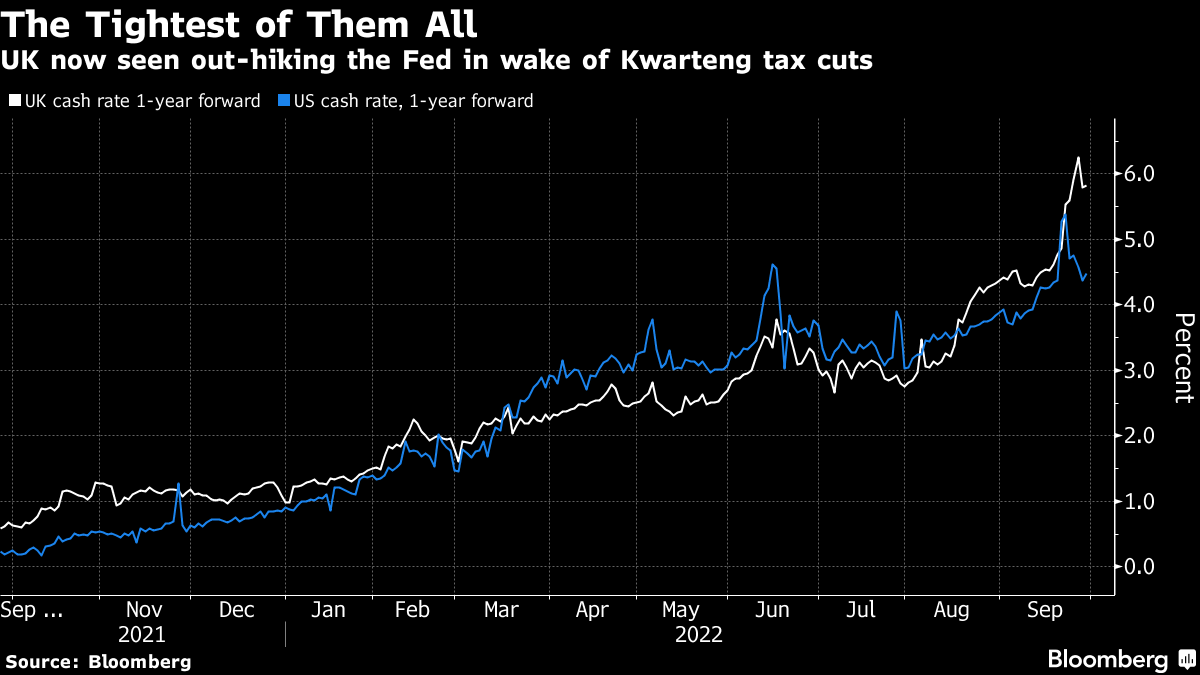

| Hurricane Ian hurtles towards South Carolina, Meta plans to reduce headcount and the pound rallies. Ian, now a hurricane again, is threatening to carve a new path of destruction through South Carolina on Friday when it roars ashore north of Charleston. Biden declared an emergency exists in South Carolina, authorizing the Federal Emergency Management Agency to provide equipment and resources to the state. Ports in Florida that are still shut will reopen by Saturday, and the state is trucking in food, water, ice, blankets, tarp and pet supplies to help people devastated by the storm. Ian's aftermath is even harder to fix, with supply chains in tatters. Meta Platforms Chief Executive Officer Mark Zuckerberg outlined sweeping plans to reorganize teams and reduce headcount for the first time ever. Zuckerberg said the Facebook parent will freeze hiring and restructure some teams to trim expenses and realign priorities. Separately, Apple shares dropped 4.9% Thursday after a rare analyst downgrade exacerbated another wave of selling pressure that wiped out hundreds of billions of dollars in market value from the largest US technology stocks. The pound held gains on Friday after a three-day advance, as traders speculated the UK government will be forced to backtrack from fiscal policies that pummelled the currency to a record low. Prime Minister Liz Truss is set to hold emergency talks with the head of the nation's fiscal watchdog on Friday. While the Bank of England's emergency action has restored a semblance of order to the UK's financial markets, the next pain threshold may not be too far away for both the pound and gilts. US equity futures gained following another bruising session on Wall Street that took the S&P 500 to the lowest in almost two years. S&P 500 contracts rose 0.6% as of 5:40 a.m. New York time. European shares also gained, paring the longest run of quarterly losses since 2009. Government debt markets rallied while the dollar weakened. A big dose of US data include consumer income and PCE deflator at 8:30 a.m., followed by University of Michigan consumer sentiment at 10 a.m. A busy week of Federal Reserve speakers concludes with Thomas Barkin, Lael Brainard and John Williams. Carnival reports earnings. Here's what caught our eye over the past 24 hours. The Fed was rudely shunted aside this week as the center of the bond market world, with the new UK government's unfunded tax cuts setting off perhaps the wildest action yet in what has already been a year that many investors might wish to forget. The British pound's Monday swan dive to a record low showed that traders were certain Chancellor Kwasi Kwarteng's mini-budget would be unsustainable. Rates traders were soon pricing for an emergency interest-rate hike from the Bank of England, and when there wasn't one that sent UK gilts crashing, which then took German bunds, US Treasuries and the rest of the global sovereign bond markets with them.  An eternity later (well a couple of days), and the BOE was forced to start buying billions of pounds of government debt to stop the bleeding — only a few days before it was planning to start selling off some of the last boatload it snapped up during the pandemic. It later said it would sell back the new ones as soon as it could. The central bank's hand was forced by the prospect that market losses meant pension funds were facing the sort of margin calls that could crash the whole UK financial market unless a halt was called. The purchases led to one very good day for global bonds and stocks, but much like Japan's recent intervention to prop up the yen, there were plenty of doubts about how sustainable such a course was. What there was very little doubt about was the way the "black swan" out of London had added to what were already epic losses for global bonds, with the first bear market in at least a generation extending deeply. The collapse in gilts in particular sparked cries that the bond vigilantes were back in business, as well as offering some harsh lessons for global markets, policy makers and politicians.

Follow Bloomberg's Garfield Reynolds on Twitter @GarfieldR1966 |

No comments:

Post a Comment