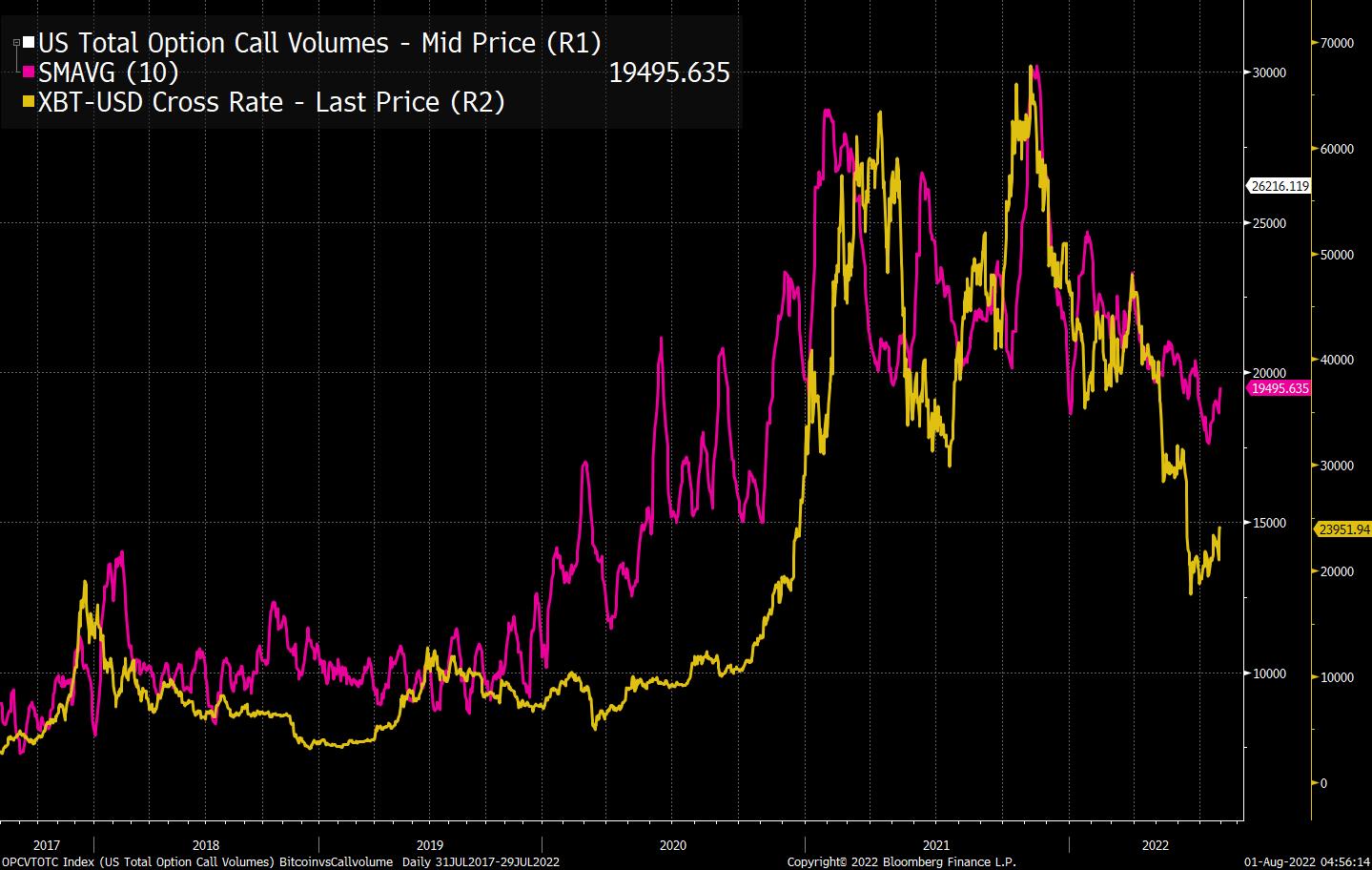

| Factory activity plunge, secrets of the biggest gold traders revealed, and there's speculation Musk might sell more Tesla shares European factory activity plunged and Asian manufacturing output continued to weaken in July amid lingering supply-chain complications and a slowing global economy. Purchasing managers' indexes for the euro area's four largest members all indicated contraction, with shrinking confirmed for the region as a whole after an initial estimate on July 22. The trial of JPMorgan Chase & Co.'s former head of precious metals has offered unprecedented insights into the trading desk that dominates the global gold market. Michael Nowak, who ran precious-metals trading at JPMorgan for more than a decade, is being tried in Chicago along with colleagues Gregg Smith and Jeffrey Ruffo for conspiring to manipulate gold and silver markets. Investors expect Elon Musk to sell more shares of his electric carmaker Tesla by the end of 2022, according to the latest MLIV Pulse survey. About 75% of 1,562 respondents, who include portfolio managers and retail traders, said Musk won't end up owning Twitter Inc. -- a deal that led him to offload about $8.5 billion of Tesla shares in April. The car company has signed new long-term agreements with two of its existing Chinese battery-materials suppliers. European stocks extended gains even as US equity futures slipped a tad at 5:34 a.m. New York time. Corporate earnings continued to deliver upside surprises while investors assessed remarks from central bankers that higher interest rates are needed to bring inflation under control. The dollar fell, while Treasury yields inched higher, but at about 2.67% the 10-year rate is well down from June's peak near 3.50%. The yen jumped for a fourth session versus the greenback. It's a very busy day on the earnings front, with reports from Activision Blizzard, ON Semiconductor, Pinterest, Global Payments, Williams Cos., Aflac, Devon Energy, Diamondback Energy, Arista Networks, Loews, CF Industries, Mosaic. Also due is the US July manufacturing PMI, and we'll get insight into the June construction-spending numbers. Here's what caught our eye over the weekend. Cryptocurrency prices have rebounded nicely over the last month, moving in line with the broader rally that we've seen in stocks. Here are three quick observations: 1) Since the bottom in mid-June, Bitcoin is up 31%. But Ethereum is up nearly 90%. You could argue that right now, the Ethereum narrative is MUCH stronger than the Bitcoin narrative. Bitcoin bulls had put all their eggs in the anti-inflation basket, that it was this super-hard form of money that would hold up during monetary mayhem. But the last year has really wrecked that narrative. Basically it's traded like a normal tech stock, and provided no extra boost in the face of rising consumer prices. Ethereum has also traded like a tech stock basically, but it's thesis hasn't quite been wrecked like Bitcoin's. Ethereum is a long way from being some world computer, or decentralized platform for finance and communications. I'd say the major Ethereum narrative is unproven, as opposed to disproven. The ETH/BTC ratio is nearly back to where it was this spring. Bitcoin desperately needs some new narrative that hasn't been undercut by the events of the last year. 2) Speaking of Bitcoin and inflation, a notion you see sometimes is an attempt to redefine inflation as something other than "prices going up". Instead people say that inflation should be defined as an expansion of the money supply (like growing M2 or M3 or something). If you go by this, they argue, Bitcoin has done well when the money supply has grown, and only started doing badly over the last year, with the start of monetary tightening. There's a bunch of problems with this line, though. The main one is that people who were sold Bitcoin as an inflation hedge almost certainly didn't have this alternative definition in mind. And for good reason! People don't need a hedge against some increase in a measure of monetary aggregates. What they need is a hedge against prices going up. People want a hedge against rising gasoline, food and rent. And when that happened, the value of their Bitcoin flopped. Even setting aside Bitcoin's performance, redefining inflation as an increase in the money supply is silly on its own face. We've had plenty of periods where monetary aggregates soared without an increase in consumer prices (most notably in the wake of the Great Financial Crisis). So yeah, this one is a non-starter. 3) So if inflation isn't a guide to Bitcoin's price, then what is? On the latest episode of the podcast, we spoke with Benn Eifert of QVR Advisors about the lessons of the last incredible two years in markets. And of course, we talked about how present speculative Robinhood buyers still are in the market, and all that stuff. Obviously many of the retail players have departed the scene, but also many are still around. Anyway, while we were chatting during the recording, talking about call option volume, and all that stuff, I came up with this chart. It shows Bitcoin (yellow) vs. the 10-day moving average of call option volume on US equities.  Total equity call option is a reasonable guide to retail speculative activity, and the two charts align pretty nicely. You can definitely see it with the two peaks in 2021. And in fact you can even see the link with the 2017 Bitcoin peak. Basically when people have an impulse to gamble in the stock market, that's also a bullish period for Bitcoin. And when people are losing interest in speculating, Bitcoin slides. Not perfect, of course, but a better guide than what inflation is doing, that's for sure. Anyway, check out our whole interview with Benn on Apple or Spotify. Follow Bloomberg's Joe Weisenthal on Twitter @TheStalwart |

No comments:

Post a Comment