| Hello. Today we look at how many are already upset that life feels recessionary even without economies contracting, the prospect of UK tax cuts and how wages are starting to push up inflation. Set aside the debate over when the next recession hits, and how long it may last. For many, it already feels like a recession right now. The reason? Prices are soaring worldwide, particularly for essential foods and fuels, eroding the spending power of families, Philip Aldrick, Enda Curran and Michael Sasso report here. Workers are complaining their wages aren't keeping up with the cost of living, a frustration that's already led to strikes in some countries. And small-business owners worry passing along too much of the jump will drive them to bankruptcy.  - Abbie Marshall, the landlady of The Buck Inn in northern England, has changed the prices on her menu four times since she took the pub over last year. "The cost of goods is moving so quickly, I have to pass that on," she says. "But at what point does my pricing become prohibitive?

- Gina Palmer, who runs She Salon on Atlanta's busy Northside Drive west of downtown, is seeing the impact on her customers of the surging cost of staples including gasoline. "I've seen my clients go from having weekly appointments to bi-weekly, and my bi-weekly clients are now coming in every six weeks."

- In Beijing, 31-year-old Tian Lijun began the year shutting the two florists she ran, and has since taken to selling flowers at stalls in community compounds. She's stopped shopping for anything beyond necessities. "There's no way to make money nowadays. I can only manage to repay my loans, pay the rent and feed myself," she says.

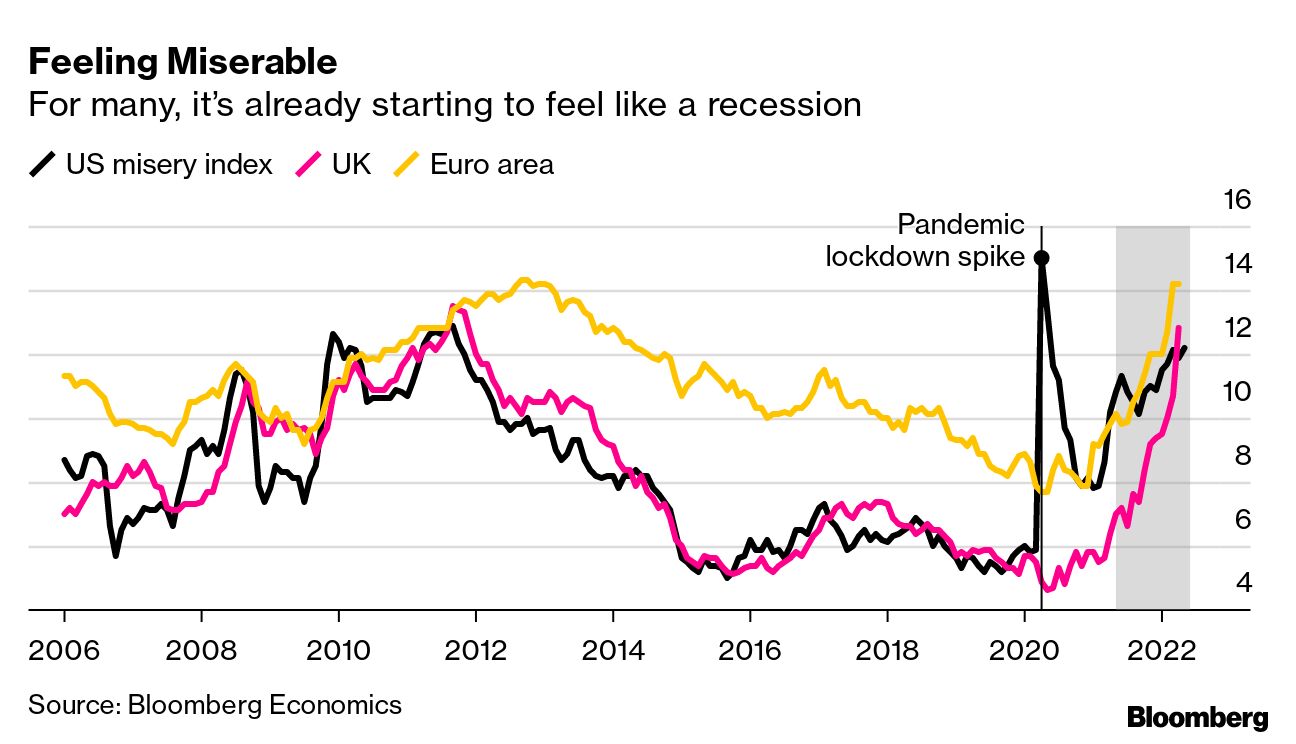

Sentiment across OECD member countries has fallen for 11 straight months and hasn't been this low since 2009. More than one-third of Americans believe their economy is now in a recession, according to a poll last month by CivicScience. The worries among small business owners, consumers and others are illustrated by so-called Misery Indexes, which blend unemployment and inflation rates. The gauge for the US is already 12.2%, similar to levels witnessed at the start of the pandemic and in the wake of the 2008 financial crisis, according to Bloomberg Economics. "People are getting poorer," says Ludovic Subran, chief economist at Allianz SE. "So this is not a recession, but it really feels and tastes like a recession."

What makes the downbeat sentiment particularly alarming is that it raises the odds of a self-fulfilling slump. Declines in US consumer expectations of 10 points or more are predictors of recessions going back to the 1980s, one 2021 study found. The Conference Board's measure of that is down almost 30 points this year. "Even though household and business balance sheets are strong, worries about the future could cause consumers to pull back, which in turn would lead businesses to hire and invest less," says Anna Wong, chief US economist at Bloomberg.

—Chris Anstey The UK government seems set to embrace tax cuts. That's one takeaway from another 24 hours of turmoil for Prime Minister Boris Johnson. Out as chancellor of the exchequer is Rishi Sunak, who had resisted the premier's preference for splashing the cash before resigning on Tuesday in frustration with Johnson's leadership.  Nadhim Zahawi Photographer: Chris J. Ratcliffe/Bloomberg In comes Nadhim Zahawi as finance minister with an early message that he's "determined to do more" on reducing taxes as the UK faces the biggest burden since the 1940s. Zahawi, a self-made millionaire who co-founded the polling firm YouGov, takes the reins of an increasingly fragile economy, with the OECD already predicting growth will stagnate next year and lag behind every member of the Group of 20 aside from Russia. On Wednesday, Zahawi told the BBC that 2023 will be "really hard" for the UK and that his focus is to rebuild and return to growth. Meanwhile, two Bank of England officials signaled they're prepared to hike interest rates even faster.  | - Coming up | The Federal Reserve will unveil details of what policy makers debated last month that may shed light on how they view the near-term path for rates.

- New supply stress | With the second half of 2022 just under way, there may yet be another culprit for strained supply chains — labor unrest.

- Russia outlook rallies | Russia appears on track for a much shallower recession than many forecasters initially expected this year, boosted by rising oil production. At the same time, more than 20,000 Russian tech workers have joined the exodus to Georgia.

- Slow recovery | China's real estate slump is probably past its worst — but the market remains a long way from a full recovery.

- Trade war | A move by President Joe Biden to remove tariffs on Chinese consumer goods will do little to dent inflation, economists say, and risks further hamstringing Democratic candidates in political battlegrounds.

The debate over the cause of inflation, especially in the US, continues, but is missing that there's a change in the dynamics underlying price gains, according to Dario Perkins, an economist at TS Lombard. While early on in the pandemic, corporate margins were the main source of price increases — an understandable by-product of a jump in demand meeting an impaired supply chain, Perkins says — that's changed to wage gains being the main concern. While the 1970s wage-price spirals — where higher employment cost spurred companies to raise prices then prompting workers to demand yet more in compensation — are a scary prospect for central bankers, the world has changed since then, Perkins argues in a note this week. "Companies were able to expand their margins during the pandemic, but it is a stretch to believe this is indicative of a "new pricing culture," he writes. "On the basis of what has happened over the past 20 years, stronger wage growth is more likely to be accompanied by a squeeze on margins than continued rapid price hikes."

Perkins says, rather than try to crush wage increases through a recession, policy makers ought to "let the dynamic play out," with the likelihood that the recent large increases in labor compensation proves a one-off. Read more reactions on Twitter and our story here |

No comments:

Post a Comment