| There are a few lines from a March investor presentation by Metropolitan Commercial Bank that — to put it mildly — make for cringeworthy reading now: "Voyager believes that crypto assets are the future of finance and investing. The Company is creating the broker that the crypto market deserves."

Now that Voyager has filed for bankruptcy, there surely are plenty of crypto haters who will happily agree that Voyager is indeed "the broker that the crypto market deserves." Of course, that sardonic interpretation was probably not intended in the presentation, which featured Voyager in a "client case study."

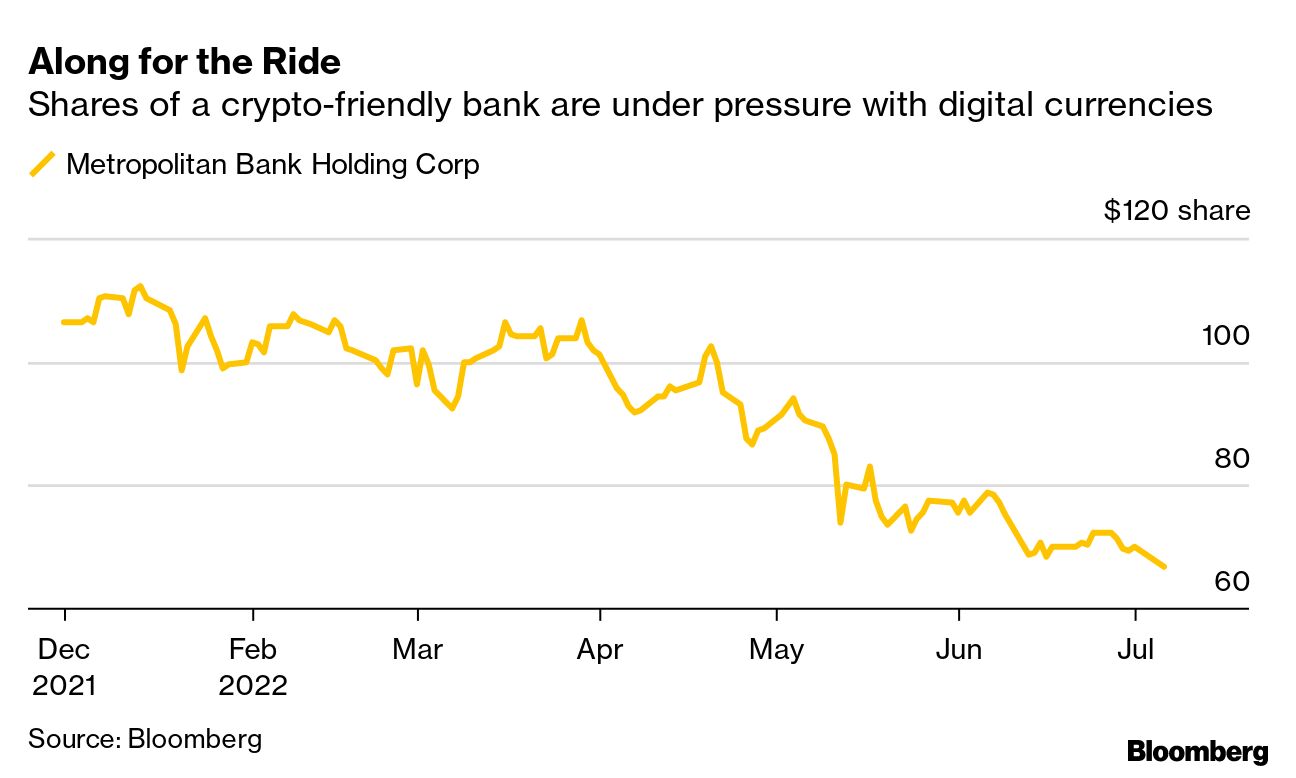

This client-bank relationship may turn out to be a much bigger industry "case study," or perhaps a stress test, than New York's tiny Metropolitan Commercial Bank had intended. The crypto bull market had caused many in the traditional financial industry to pivot quickly from full-on skepticism to full-on enthusiasm for the asset class. Now, with this year's plunge in prices rattling the industry and creating a pileup of casualties, we may see a change of heart.  The extent to which small, crypto-friendly banks like Metropolitan, Silvergate and a handful of others are able to successfully navigate the current turbulence will likely color how much skepticism returns to the banking industry if and when this crypto winter ever thaws out.

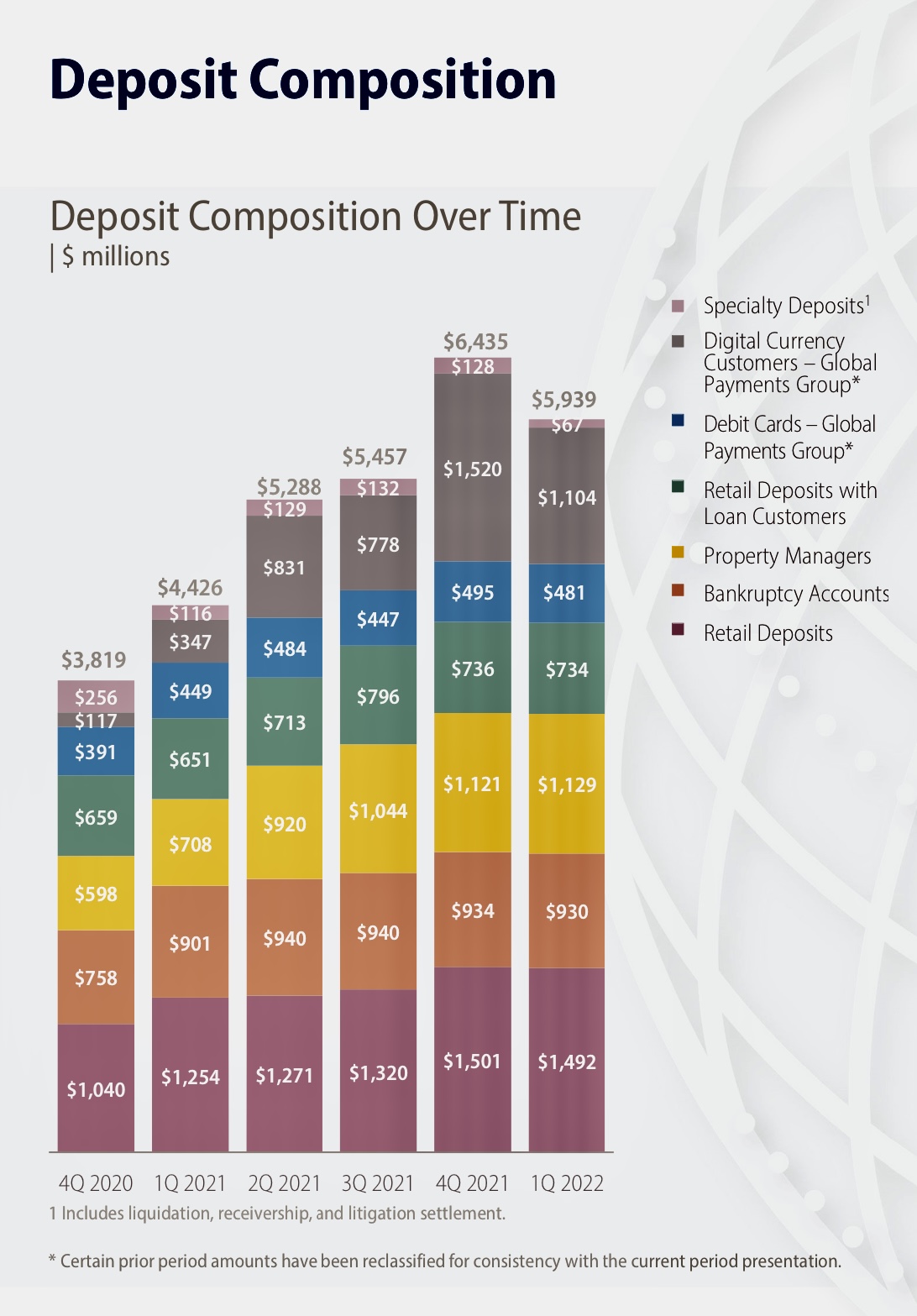

For all the crypto-world talk of subverting or reinventing the traditional financial system, Voyager shows that some crypto ventures can't quite quit the old-school banking system. Deposits from digital-currency customers like Voyager were the fastest-growing segment for Metropolitan in recent years, going from just $117 million in the fourth quarter of 2020 to $1.5 billion at the end of last year before plunging back to $1.1 billion in this year's first quarter. That was still about 19% of the bank's $5.9 billion in total deposits.  Voyager had $350 million deposited in the "For Benefit of Customers" account at Metropolitan. And while the fate of their crypto holdings is in doubt, Voyager customers with dollar deposits "will receive access to those funds after a reconciliation and fraud prevention process is completed with Metropolitan."

This is the type of hot-money headache that's likely to make less-adventurous bankers pivot back to full-on skepticism when it comes to doing business with the type of clients that "the crypto market deserves." |

No comments:

Post a Comment