| Industrial Strength will be going on a temporary hiatus beginning in August while I'm on maternity leave. There may be a few special editions here and there, and you can follow me on Twitter (@blsuth), but for the most part I expect to be busy learning to be a mom. Thanks as always for reading. Try not to have too much fun without me, but I'm sure there will be plenty to talk about once I'm back. Have thoughts or feedback? Anything I missed this week? Email me at bsutherland7@bloomberg.net

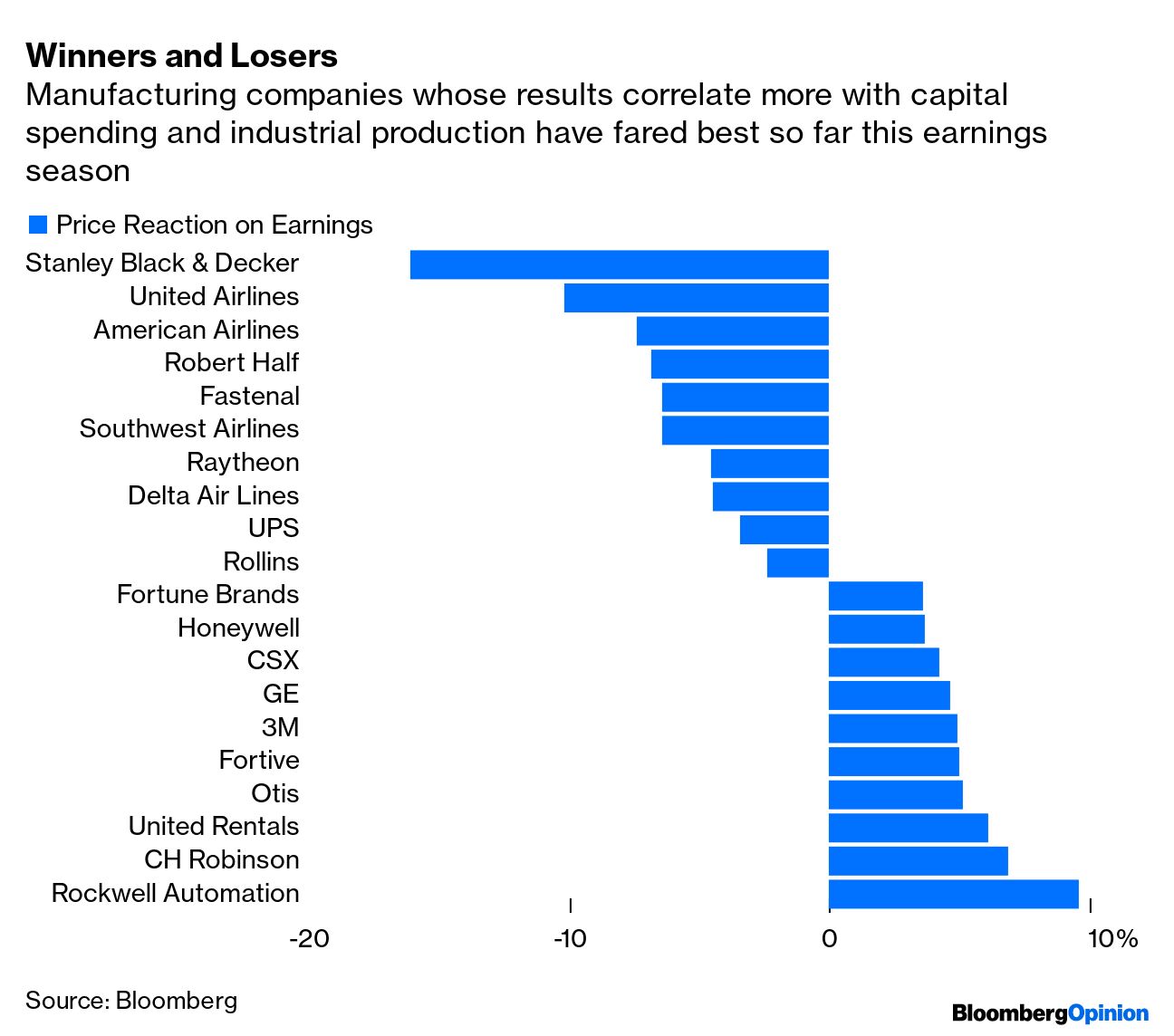

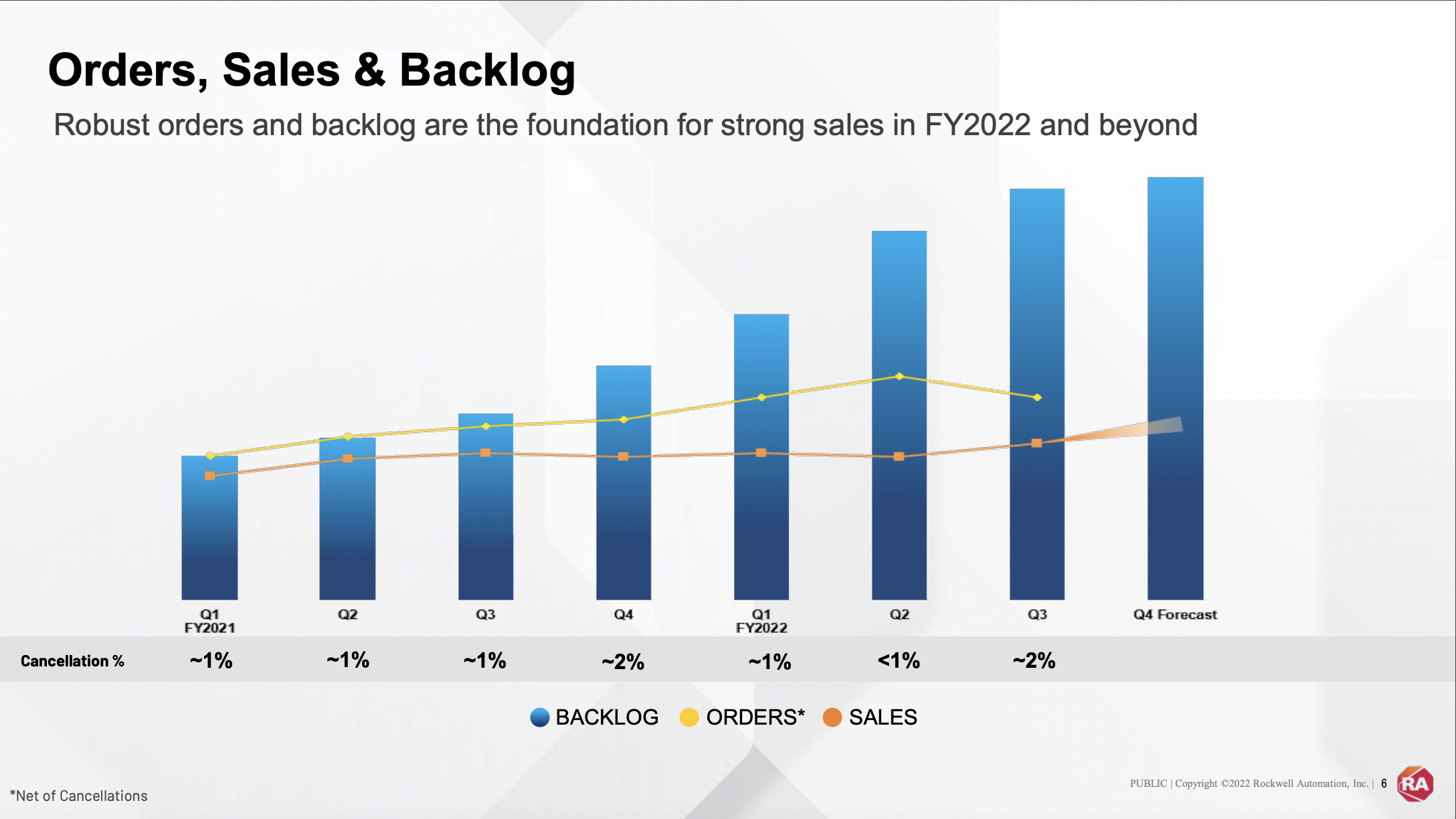

It was a good quarter to be an industrial company that no longer sells to consumers. Over the past decade, several manufacturers have divested businesses that make products for everyday shoppers, and they now sell primarily to other industrial companies. General Electric Co., for example, no longer makes appliances or residential lightbulbs. Raytheon Technologies Corp. used to sell Kidde smoke alarms and residential air conditioners, but that business was spun off as Carrier Global Corp. Honeywell International Inc. spun off its Resideo Technologies Inc. home thermostat, security systems and humidifiers business in 2018 and sold its lifestyle footwear unit last year. "We don't have a lot of consumer exposure," Honeywell Chief Executive Officer Darius Adamczyk said on a call this week to discuss the company's second-quarter results. "If you go back to 2020, right after the pandemic hit us, we probably had one of the most unfavorable pandemic portfolios you could have out there. I mean, our two biggest businesses were aerospace and energy and, frankly, other than maybe hospitality those got hit about as hard as anything else. Well, I think we're kind of entering a little bit of a different cycle." As a busy week of industrial earnings draws to a close, those who have struggled the most are the companies that have maintained a link to the consumer or housing markets. By far the biggest loser this quarter has been Stanley Black & Decker Inc., whose shares fell 16% after the company chopped its 2022 earnings guidance nearly in half, the second big cut so far this year. Whereas other diversified manufacturers have become more industrial, Stanley has moved in the opposite direction, reaching deals for its electronic doors, security and oil and gas assets in recent months to go almost all in on power tools and outdoor equipment such as lawn mowers. Those items were hot sellers during the pandemic as Covid lockdowns inspired a wave of home improvement projects and a rediscovery of the backyard, but with food and energy inflation starting to bite and a wider range of activities opening up, consumers are less willing to pay up for more discretionary items.  Pool-equipment retailers are cutting back on orders from Hayward Holdings Inc. as they work through existing industry. Demand has also moderated for paint purchases at Sherwin-Williams Co. by the do-it-yourself shopper in North America. 3M Co. warned of the knock-on effects on its business from weaker consumer electronics sales and flagged a dropoff in spending on home-improvement products such as Command picture-hanging strips and Scotch painters tape. With stores reopening and discretionary spending dropping, daily package volumes fell more than expected in the second quarter at United Parcel Service Inc. The e-commerce downtrend also weighed on orders for warehouse equipment from Honeywell's Intelligrated unit and Rockwell Automation Inc. Outside of consumer-facing markets, however, "we're just not really seeing a defined trend" that would indicate a slowdown, Rockwell CEO Blake Moret said in an interview. The percentage of orders that were canceled by customers ticked up modestly in the fiscal quarter ended June 30, but only just: The cancellation rate was 2% compared with about 1% in the previous two periods. Overall, orders increased 17% in the quarter relative to a year earlier, and the majority of that reflected volume increases rather than price. Rockwell actually raised its 2022 orders outlook to more than $10 billion, up from a previous forecast for bookings "approaching" $10 billion. "Based on the conversations that I'm having with customers and my peers, they still want the material and they want it now," Moret said. "Inflation is very high. We don't discount that for a minute," he added. But things are "for sure going to look a little different, whatever happens. I'm not going to say industrial is impervious. That would not be prudent. What's different is the enormous backlog that we have to support."  Source: Rockwell Automation Source: Rockwell Automation Rockwell is sitting on a backlog worth more than $5 billion, compared with about $1 billion to $1.5 billion normally, he said. That's largely a reflection of its struggles to get the semiconductors needed to finish production and ship out equipment, but an important contrast to previous economic downturns. Theoretically, strong order backlogs offer a reservoir of demand that should help support growth for the foreseeable future — assuming cancellation rates remain low. That is a big "if" in times of economic distress; manufacturing companies have not been shy about yanking spending at the first sign of a slowdown. But Moret points out that unemployment rates have remained low and that companies continue to complain about difficulties finding workers. For many, the long-term solution is to invest in automation. That includes non-e-commerce warehouse customers that are continuing to invest in ways to reduce labor needs and improve efficiency, Moret said. The company is also seeing solid demand from food and beverage makers, with sales to those customers up mid-single digits in the most recent quarter. Even as big-box retailers such as Walmart Inc. warn of bloated inventories for discretionary items such as clothing and home goods, "people are still drinking soda pop," Moret said. This quarter is likely to revive the debate about whether the manufacturing sector might prove more resilient in the face of a consumer slowdown than precedent would indicate. The opposite has been true: the consumer largely powered along just fine during the 2015-2016 industrial recession that was sparked by the plunge in oil prices. To Moret's point, the consumer slump thus far has been far from uniform. The aerospace industry, for example, continues to experience more demand for travel than it can handle. "This general recession thing so far hasn't impacted our aviation industry. At some moment, maybe," Boeing Co. CEO Dave Calhoun said this week after reporting quarterly results. If you were looking for evidence of cracks in industrial demand this quarter, they were there, but you would have to be really looking for them to notice. To the extent there is a slowdown underway in the industrial sector, it's happening at a glacial pace. But the lessons of the remaining consumer-facing industrial companies are worth bearing in mind. In April, Stanley and Hayward didn't think there was any reason to be overly concerned about demand for their products, either. In this period of inflation, I've often wondered whether the industrial sector's efforts to limit exposure to consumer markets might alter or even cloud companies' understanding of economic shifts. We're about to find out. 3M Co. separately announced this week plans to put its Aearo Technologies subsidiary into bankruptcy in an attempt to mitigate the impact of burgeoning potential liabilities tied to earplugs sold to the US military. A growing number of veterans have been winning lawsuits alleging that the company knowingly sold products that left them with hearing loss and tinnitus; the total awarded damages to successful plaintiffs so far is about $300 million. 3M has said the earplugs were safe and effective and had vowed to appeal the rulings it has lost, but the uncertainty has weighed heavily on its stock. With 115,000 filed claims and an additional 120,000 sitting on an administrative docket as of June 30, it's possible to come up with astronomical estimates of 3M's eventual liabilities that far exceed the company's current market value. The benefit of the bankruptcy ploy is that it stops the clock on litigation and forces settlement talks into the domain of bankruptcy court, where they will likely be sorted faster than they would if plaintiffs continued to pursue cases as part of a multidistrict litigation. It also theoretically limits the claims on the rest of 3M's assets. That is, of course, assuming the arrangement holds up to legal scrutiny. Both the federal judge overseeing the earplug lawsuits and a separate bankruptcy judge have already raised questions about elements the strategy. At a minimum, it seems unlikely that the $1 billion 3M is proposing to put into trust to help fund the resolution of legitimate claims will be sufficient. Analysts including Wolfe Research's Nigel Coe have estimated 3M could be on the hook for more like 10 times that amount. This is to say nothing about a separate, potentially massive liability related to 3M's legacy manufacturing of per- and polyfluoroalkyl substances (PFAS) that will continue to loom large over the company. So from a practical standpoint, the Aearo bankruptcy does little to ring-fence the earplug liability or dispel the legal headaches that have made the stock radioactive. But it does signal a more aggressive posturing from 3M, and that appears to be a welcome change for shareholders frustrated by the company's previous strategy of sitting on its hands as negative headlines pile up. It felt like almost an afterthought amid the Aearo news, but 3M also announced it would spin off its health-care unit, at long last joining the industrial breakup trend. The carveout may create value for shareholders by further ensuring this chunk of the company remains untainted by 3M's legal woes, but the health-care business was also supposed to be a growth engine. After running the numbers on the value of 3M's parts, few analysts see reason for the health-care spinoff to result in a materially higher valuation for the company. "The only thing that's going to solve labor availability — I hate to say this — is a slowdown in the economy. Because right now, there just simply aren't enough people in the workforce for all of our suppliers." — Raytheon Technologies Corp. CEO Greg Hayes Hayes made the comments on the company's earnings call this week as Raytheon trimmed the 2022 sales outlook for its missiles and space divisions. Interestingly, those units appear to be having a more challenging time navigating labor and supply chain constraints than the company's commercial aerospace operations. You would think the opposite would be true: During the peak of the pandemic, Raytheon was targeting 19,000 job cuts (including contractors) across its Pratt & Whitney jet engine and Collins aerospace parts divisions as the slump in air travel demand left workers with little to do and pushed the company to rein in costs. The defense industry, by contrast, was fairly stable during Covid, thanks in part to government and end-equipment manufacturer efforts to speed payments throughout the supply chain. One explanation for the divergence now, according to Hayes, is a difference in how contracts are typically structured. Most aerospace suppliers (about 80%) are on long-term agreements, which typically give Raytheon priority in production processes and require companies to keep a certain amount of buffer stock available to meet its demand. Only about 10% of the suppliers for Raytheon's missile and space divisions are on similar agreements, which reflect rules around the government contracting process. "As we've received all these new awards, we've been going out and once the award is set, once the contract is signed, we're going out and we're putting suppliers on contract and we're seeing lead times double and sometimes triple," Hayes said. Typically, about 75% to 80% of the people who get laid off from the aerospace and defense industry during downturns come back when business revives, but only about a quarter are returning in this tight labor market, he said. In particular, there is a lot of competition for engineers with necessary security clearances, he said. Raytheon is far from the only defense contractor having these challenges: Northrop Grumman Corp., General Dynamics Corp. and Lockheed Martin Corp. also complained about hiring constraints.  | Spirit Airlines Inc. scrapped its deal with Frontier Group Holdings Inc. after failing to get enough shareholder support for the merger. Spirit had already rescheduled the vote on the transaction four times, but the standoff still went down to the wire, with the airline pausing the proceedings at midday on Wednesday to allow for a few more hours of negotiations. It was for naught. A "disappointed" Spirit was then "thrilled" to sign a deal the next day with JetBlue Airways Corp., according to company statements. The terms of the JetBlue tie-up are largely the same as a late June proposal that Spirit had rebuffed because of antitrust concerns — just as it had a series of earlier bids from the suitor. JetBlue is offering $33.50 a share to acquire Spirit, or about $7.6 billion, including the assumption of debt. JetBlue will prepay a $2.50 special dividend to Spirit shareholders and also agreed to a so-called ticking fee mechanism that could boost the overall merger consideration to $34.15 a share in a bid to help ease the sting of a regulatory review process that may stretch into 2024. JetBlue faces a tough battle to convince regulators that the deal won't harm competition amid widespread frustrations over flight delays and cancellations and an existing lawsuit over its marketing alliance with American Airlines Group Inc. But for Spirit shareholders, JetBlue's willingness to offer a significantly higher price than Frontier made the regulatory risk worth it.

Honeywell International Inc. announced it was promoting Vimal Kapur, currently head of the performance materials and technologies unit, to be the company's president and chief operating officer effective immediately. The shake-up raised a few eyebrows because COO postings are typically a fast track to the CEO role. Honeywell CEO Darius Adamczyk was named COO in April 2016, just three months before the company announced he would succeed Dave Cote in the top post. Speaking on Honeywell's earnings call this week, Adamczyk, 56, said that he had no definitive plans to retire and that the reshuffling was more about freeing him up to devote more time to things like brand-building, customer outreach, business development and M&A. Honeywell's strong operational focus doesn't "happen by accident. It takes a lot of hard work and attention to detail and data and so on. And I kind of found myself maybe more in the middle of that than maybe I wanted to be. It's good and bad," Adamczyk said. M&A and business development are among areas "that I probably should be spending a little bit more time on." The comments are interesting against a backdrop of frequent speculation about how and when Honeywell might put its balance sheet to work on a significant transaction. Under Adamczyk, the company has stuck to smaller deals and often complained that high valuations were handicapping its ability to spend more aggressively.

Aspen Technology Inc. agreed to acquire Perth, Australia-based Micromine, which sells operational management technology to the mining industry, for A$900 million (about $623 million). Emerson Electric Co. merged its software business with Aspen Technology in a deal that was completed earlier this year and gave it a majority stake in the combined entity, with the idea being that a digital-focused standalone company would be in a better position to expand through M&A than an old-school industrial giant. This is the first takeover of scale attempted by Aspen under the new ownership structure. It's interesting that Aspen is paying cash for Micromine; the Emerson deal was modeled in part on Schneider Electric SE's combination of its digital assets with Aveva Group Plc and a key benefit of that tie-up for Schneider has been the ability to use the software company's higher-valued stock as currency in acquisitions. Manchin shock gives energy transition needed momentum

Commercial paper is back in favor as free money era ends

E-commerce slowdown hits the cardboard box market

VW CEO ouster revives concerns company is ungovernable

Caskets are a dying business

Blame mountains of Covid debt for airline chaos

How to avoid travel scammers

Governments should plan better for EV charging needs

Strikes spike among logistics workers

|

No comments:

Post a Comment