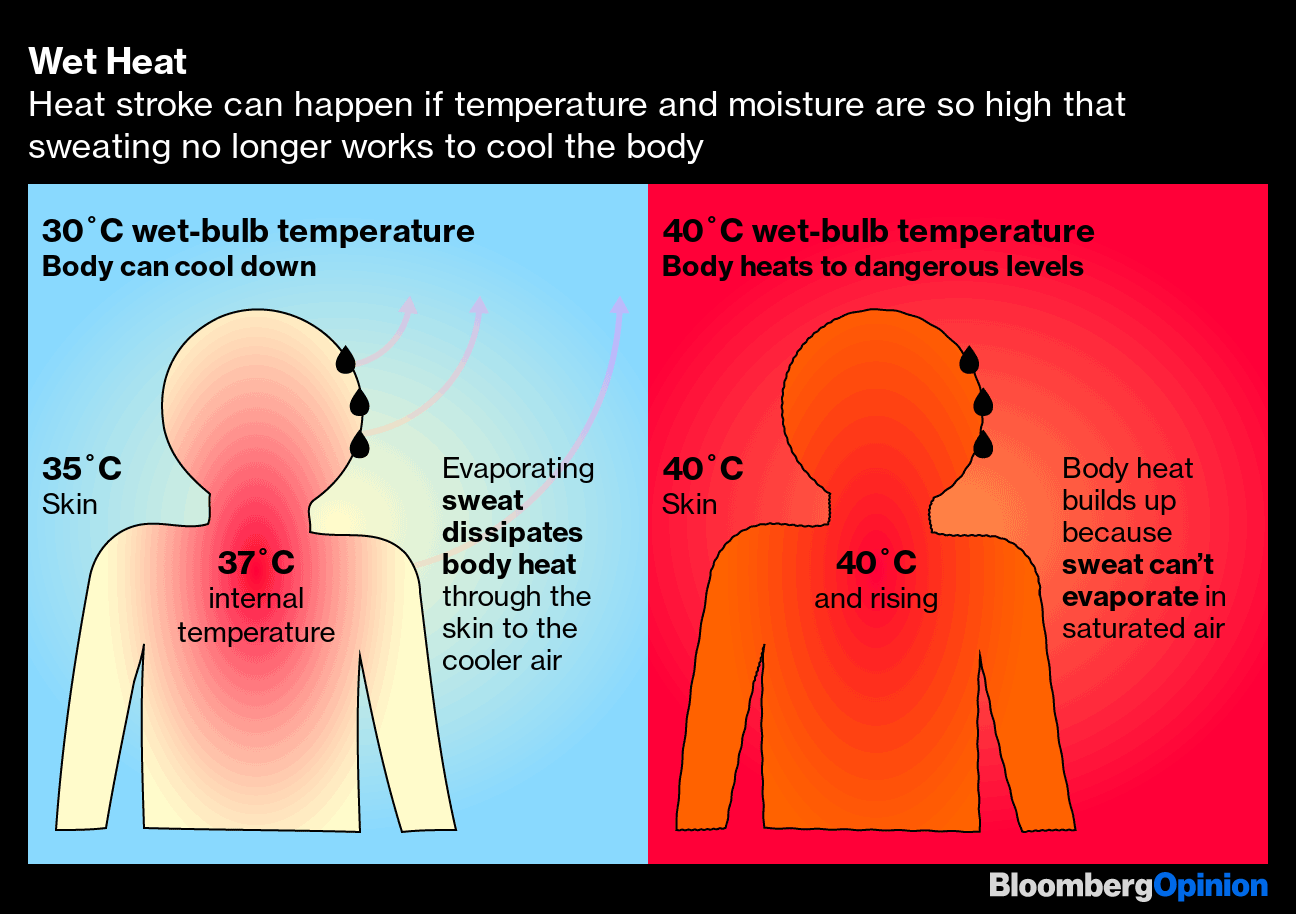

| This is Bloomberg Opinion Today, an assonant assemblage of Bloomberg Opinion's opinions. Sign up here. The death of former Japanese Prime Minister Shinzo Abe, assassinated at the age of 67 by a lone gunman at a campaign event on Friday, is all the more shocking because of the rarity of such violence in a country where firearms sales are strictly controlled. "This kind of attack on a national figure of his stature is utterly without precedent in the country's modern history," writes Gearoid Reidy. Unfortunately, the scarcity of these kinds of assaults means security at political rallies is often nonexistent. In a series of tweets, Nobel laureate economist Paul Krugman recalled meeting Abe in 2016, calling him "a complicated and interesting leader, not easy to characterize." Krugman found his militarism distasteful, but praised Abe's success in increasing the participation of women in the labor force, with Japan pulling far ahead of the US. Few politicians end up with an enduring branch of economic theory named for them, but "Abenomics" — a mix of ultra-loose central bank policy, increased spending by the government, and structural reform — came to define the monetary and fiscal response of authorities around the world to the global financial crisis. He was Japan's longest-serving premier, holding office from 2006 to 2007 and 2012 to 2020. "The assassination of Abe will have a resounding effect on the country," Gearoid writes. Further Listening: A Twitter Spaces discussion of Abe's legacy featuring Gearoid, Ruth Pollard, Yuko Takeo and Marcus Ashworth. The world is getting dangerously hot. When combined with moisture, high temperatures defeat the body's ability to cool down through sweating. After just a few hours with humid heat above 35 degrees Celsius (95 degrees Fahrenheit) — a measure known as the wet-bulb temperature — even healthy people with unlimited shade and water will die of heatstroke. "As the climate warms, conditions once experienced only in saunas and deep mineshafts are rapidly becoming the open-air reality for hundreds of millions of people, who have no escape to air conditioning or cooler climes," warn David Fickling and Ruth Pollard.  India is suffering from extreme heatwaves, and just suffered through the hottest March since the nation started keeping records more than a century ago. But it's not alone; temperatures in parts of Spain and France rose to 10 degrees Celsius above their seasonal averages earlier this summer, while almost a third of the US population was under a heat advisory by mid-June. Reality is forcing scientists to reevaluate their theories of how the atmosphere reacts to exceptional heat — and the prognosis is bleak. "As the climate warms, each year gets us closer to the tipping point where large swathes of the planet are exposed to dangerous humid-heat temperatures," David and Ruth write. "The trouble is, we have very little information about just how close we're getting, because of the poor quality and availability of data." This year's selloff in equities and bonds has diminished their role in the portfolios of pension and endowment funds, in turn increasing the percentage of assets allocated to private equity — potentially capping their scope to make additional investments in the asset class. Fortunately for PE funds, billionaires, family offices and other ultra-wealthy investors are still keen on putting more of their capital to work in private markets. "Wall Street banks have done their part, enthusiastically marketing PE funds to their private-wealth clients," explains Shuli Ren. A UBS AG survey of the 221 biggest family offices each managing an average of $1.2 billion of assets found 75% expect private equities to continue to outperform public markets — an investment strategy that's not available to retail investors. "So the rich will just get richer, while everyone else looking for the big score gets stuck chasing meme stocks and crypto tokens," Shuli laments. Additional Capital (Mis)Allocation Reading: Venture capital has a blind spot with electric-vehicle batteries. — Anjani Trivedi As roaring inflation leads to the end of negative rates and quantitative easing in the euro zone, the European Central Bank needs to come up with a credible mechanism to stop the yield spreads of the bloc's economically weaker members (i.e. Italy) from blowing out. But German intransigence risks sabotaging those efforts, writes Marcus Ashworth. Ukraine shouldn't overplay its hand with its allies. — Pankaj Mishra Boris Johnson leaves a real legacy that his successor will have to contend with. — Martin Ivens From Putin to Erdogan and Orban: how to be a modern autocrat. — Clara Ferreira Marques Messy politics won't keep Goldman Sachs out of Texas. — Paul J. Davies We should all be grateful that crypto's meltdown has come when it has. — Bloomberg's editorial board A quarter of a trillion dollars of emerging-market debt threatens to cascade into default. Low water levels on the Rhine River are threatening to exacerbate Europe's energy crunch. Former soccer chiefs Sepp Blatter and Michel Platini acquitted of fraud over $2.1 million payment. Hedge fund icon John Paulson hid billions in secret trusts, his wife Jenica claims in lawsuit. Leaked invoice shows Boris Johnson spent 200,000 pounds refurbishing his Downing Street apartment, including 2,260 pounds worth of "gold wallpaper" and a 500-pound table cloth. Gin prices poised to soar as war in Ukraine leads to grain shortages. At one point earlier today, 99% of the world's population was in sunlight. The French Riviera faces a weird summer as Russian oligarchs berth their superyachts in harbors where they're less likely to be seized in sanctions. Notes: Please send botanical beverages and complaints to Mark Gilbert at magilbert@bloomberg.net. Sign up here and follow us on Instagram, TikTok, Twitter and Facebook. |

No comments:

Post a Comment