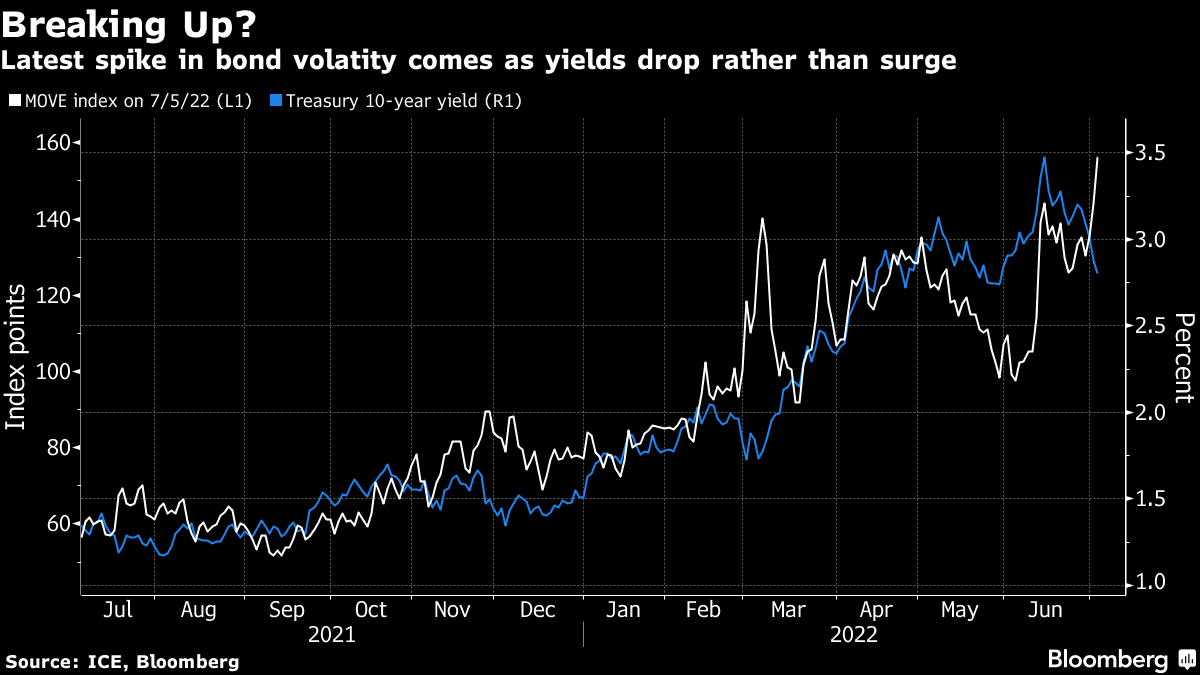

| Oil sinks as recession fears churn through markets. Removing some China tariffs may fail to help the US temper inflation. The UK's Boris Johnson is clinging to power. Here's what you need to know today. Oil prices have plummeted, bonds are rallying and the dollar is the strongest in more than two years — all signs of the recession fears gripping markets. Stocks in Asia set to come under some pressure on Wednesday too. Week after week of on-the-fly calculations about the intensity of inflation and the likelihood of a recession are preventing markets from finding an equilibrium. The churn is spurring increasingly worse forecasts for when and where the volatility will cease. The pessimists have history on their side. Strategas Securities compared market and economic indicators now versus past bear cycles over nine decades and found virtually no reason to believe the rout in equities is over. A move by President Joe Biden to remove tariffs on Chinese consumer goods will do little to dent inflation, economists say. Barclays said any rollback of tariffs on Chinese goods would be "a drop in the bucket" for lowering the US inflation rate, which climbed an annual 8.6% in May. Meanwhile US-China ties look set to remain tetchy even if some levies are scrapped. American officials are lobbying the Netherlands to bar ASML from selling some of its older deep ultraviolet lithography, or DUV, systems to China, mainstream technology essential in making a large chunk of the world's chips. These machines are a generation behind cutting-edge but still the most common method in making certain less-advanced chips required by cars, phones, computers and even robots.  | Two of the most senior members of Boris Johnson's government quit in quick succession, putting the UK prime minister in grave political danger after months of scandals eroded his authority. Chancellor of the Exchequer Rishi Sunak said in his resignation letter that "we cannot continue like this," while Health Secretary Sajid Javid told Johnson he's lost confidence in him. Johnson intends to stay on. Adding more pressure on Johnson's position, the resignations came just as the Prime Minister was acknowledging in a televised address that he had made a "mistake" in promoting Chris Pincher who had resigned as a government whip following allegations he had groped two men. That was damaging to Johnson, who promoted Pincher to the role in a bid to bolster his own faltering support. It's deja vu in Shanghai. Officials launched mass testing for Covid in nine districts after detecting cases the past two days, fueling concerns that China's financial hub may once again find itself locked down in pursuit of Covid Zero. The city of 25 million people recently emerged from a brutal two-month lockdown that took an enormous toll on residents and the economy. The quick rebound in cases once curbs were eased shows the difficulties of fully stamping out more contagious virus variants, and explains why only China is still engaged in the effort of eliminating transmission. The Covid-Zero approach has left China isolated from the rest of the world and most economists predict the country will fail to meet its annual growth target for this year. Read more on why China is sticking with its strategy. The ECB's landmark test of banks' resilience to global warming was far softer than many lenders had expected. Even the toughest hypothetical scenarios in the climate stress test didn't result in losses that would make a meaningful dent in capital buffers. Banks participating in the exercise had to estimate how events such as floods would impact mortgage values, or how big a hit they faced if corporate clients defaulted after a spike in carbon prices. The test has been presented as a learning exercise for banks and regulators alike, but the industry is already using the results to lobby against efforts by some ECB officials keen for lenders to set aside more money to cover climate risks. Treasuries have had an extraordinary start to July, gyrating perhaps even more frenetically than they did last month. The MOVE index of implied bond volatility jumped to the highest since the pandemic panic of March 2020, so investors don't expect calm anytime soon. And why would they? Markets are starting to realize recession is necessary to ease inflation from 40-year highs, even if an economic contraction might prove insufficient to the task. Yields continue to tumble down from the 3.5% peak seen for 10-year notes in mid-June despite the potential that this week's payrolls data and next week's CPI could put fresh pressure on the Federal Reserve to stick with aggressive interest-rate hikes. With even crude joining the rout among commodities, every rate hike is going to be seen bringing the US central bank closer to a fresh round of cuts. It's possible yields are going to keep going down even as bond volatility remains high.  Garfield Reynolds is Chief Rates Correspondent for Bloomberg News in Asia, based in Sydney. |

No comments:

Post a Comment