| A possible rollback of US tariffs on Chinese goods. Bitcoin may be finding a bottom. Japan's energy issues. Here's what you need to know today. Joe Biden may announce a rollback of some US tariffs on Chinese consumer goods this week, along with a new probe into industrial subsidies that may lead to more duties in strategic areas like technology. Biden hasn't made a final decision and the timing may slip, people familiar said. A reduction would mark his first major policy step on trade ties between the world's two biggest economic powers. Hints of a shift have increased in recent weeks as inflation has accelerated, putting pressure on US officials to find ways to tamp down prices paid by consumers for everyday merchandise. Here's a lesson on what happens when inflation gets out of control.

Asian stocks look set for a steady start after risk currencies like the Aussie dollar rallied overnight as traders weigh up the possible easing of tariffs by the Biden administration. Such a step could help to lift some of the overarching gloom caused by slowing economic growth and persistently high inflation. In cryptocurrencies, Bitcoin may be finding a bottom to its bear market rout. Analysts at Glassnode track a number of gauges to make such a call — from instances when Bitcoin dips below a moving average to when it closes below the so-called balance price measure, which reflects a market price that matches the value paid for coins minus the value ultimately realized. What they're seeing now is that many of these measures are all flashing in similar fashion, which rarely happens.  | In Japan, things are looking more difficult for the Bank of Japan. The slump in the Japanese yen to around a 24-year-low, the war in Ukraine and a heatwave in Tokyo are pushing the world's third-biggest economy toward an energy crisis. Japan imports about 90% of its energy, mostly priced in dollars, and costs were already soaring from a jump in global oil, gas and coal prices, even before the yen fell. The price of Brent oil, a benchmark for global trade, has risen more than 40% in dollar terms this year, bolstered by Russia's invasion of Ukraine and a recovery in demand. But in yen terms, it's up almost 70%, heaping pressure on the Bank of Japan to adjust its policy stance and support the currency. Japan's inflation will be stronger and last longer than the BoJ expects, making an upward revision of its price outlook likely later this month, according to a former chief economist at the bank. We're entering the corporate belt tightening phase of the economic cycle.

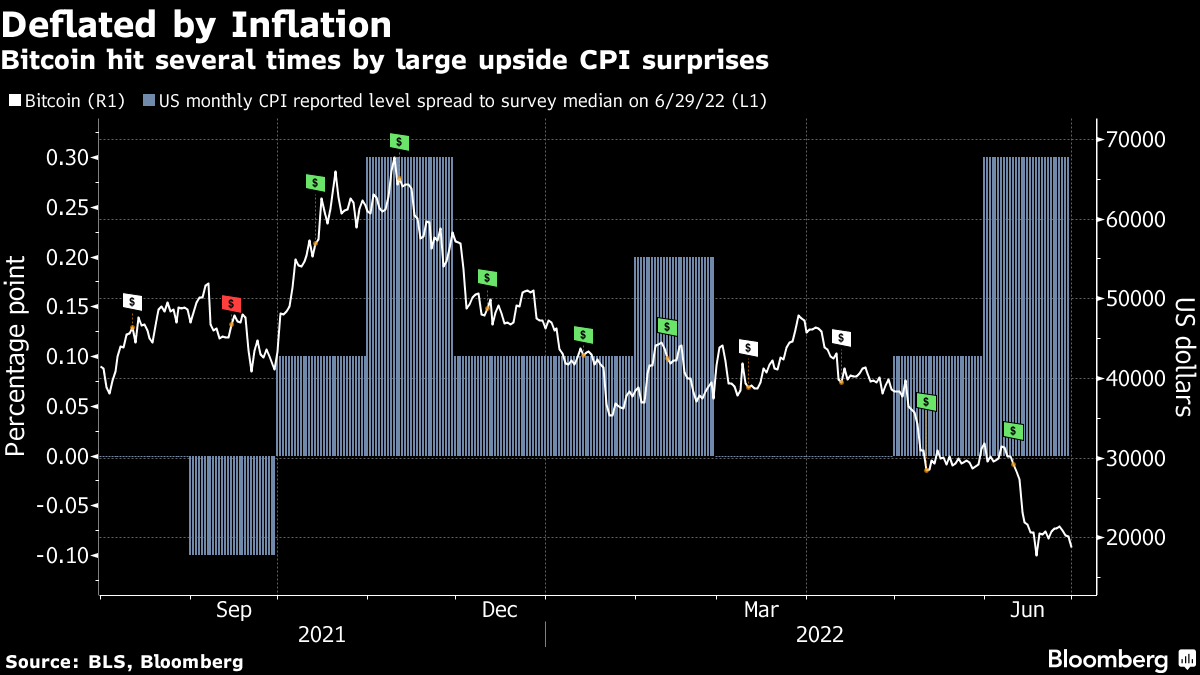

Credit Suisse Group is cutting more than two dozen front line roles at the investment bank in Asia as the Swiss lender grapples with losses and a weakening outlook for the global economy, people familiar with the matter said. The reductions in recent weeks fell across businesses including deal-making and trading, and are part of a global effort to reduce costs. More cuts may follow in the fourth quarter. The European Central Bank plans to rejig its corporate bond portfolio to favor issuers that pollute less, marking its most significant shift yet to weave environmental considerations into monetary policy. The ECB will reinvest its bond proceeds in a way that penalizes companies with a big carbon footprint, affecting some some 30 billion euros ($31.3 billion) worth of reinvestments each year, or around 10% of the ECB's corporate portfolio. It's the first foray by a central bank to penalize dirty corporate issuers. The move comes amid a growing sense of anxiety that time is running out to address the threat posed by global warming after the United Nations Intergovernmental Panel on Climate Change estimated that the planet might be on track to warm by more than 3°C — twice the limit set out in the Paris climate accord. Among the narratives that accompanied Bitcoin's serial spikes to eye-watering heights the past decade was the idea that it and other crypto currencies offered an excellent hedge against inflation. Digital gold gained some, shall we say, currency as a description for Bitcoin given the inbuilt limit on the number of the tokens that could be mined. As inflation burst higher last year, that theme initially played out just fine, but that changed in late 2021 as the Federal Reserve dropped "transitory" from the lexicon and moved toward hiking interest rates. Sure enough, Bitcoin has tumbled over the past few months in the wake of upside inflation surprises. The token has stabilized, more or less, near $20,0000 but there's a nervous edge to trading as stablecoins get fresh attention. Another hot inflation reading later this month would be likely to send Bitcoin down searching for another round number stopping point.  Garfield Reynolds is Chief Rates Correspondent for Bloomberg News in Asia, based in Sydney. |

No comments:

Post a Comment