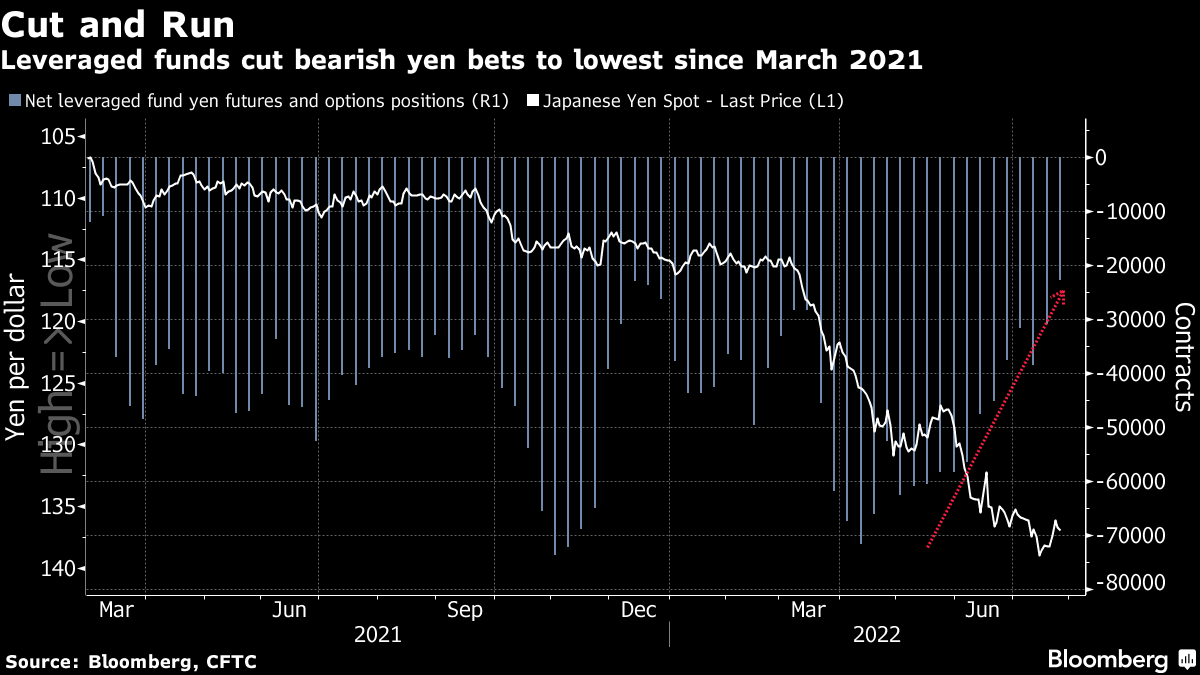

| Good morning. The euro's woes, Sunak promises a tax cut, JPMorgan's domination of the gold market and the fretting Federal Reserve. Here's what people are talking about. The euro, beaten down this year to the lowest in two decades, remains unloved and stuck under relentless pressure as its economy stumbles toward a recession. The currency — down some 10% against the dollar this year with analysts saying there's more to come — has become a lightning rod for mounting pessimism about the euro area. Much of the gloom is centered on the disruption of Russian energy supplies to Europe. But for some investors, the euro's travails are a boon: euro-funded carry trades are offering a refuge to emerging-market traders, yielding profits of as much as 29% this year depending on the choice of the higher-yielding currency, according to data compiled by Bloomberg. Rishi Sunak, trailing in the race to become the next UK prime minister, committed to reducing personal taxes by 20% within seven years in a move he described as the largest cut to income tax in three decades. Sunak said he would cut the basic rate from 20p in the pound to 16p — amounting to a 20% tax reduction and drawing accusations from Truss's camp of "flip flops and u-turns" on the issue. The announcement comes at a critical juncture in the race to succeed Boris Johnson. On Monday, the 175,000 Conservative grassroots members receive their postal ballots to elect Sunak or Liz Truss as the party's next leader and prime minister. They're both anxious to secure support before the summer vacation starts in earnest, with the winner announced Sept. 5.  | The trial of JPMorgan's former head of precious metals has offered unprecedented insights into the trading desk that dominates the global gold market. Michael Nowak, who ran precious metals trading at JPMorgan for over a decade, is being tried in Chicago along with colleagues Gregg Smith and Jeffrey Ruffo for conspiring to manipulate gold and silver markets. The business is a consistent moneymaker for JPMorgan, the biggest player among a small group of "bullion banks" that dominate the precious metals markets. Internal documents presented by prosecutors provided a glimpse of just how dominant a role the bank has played: 40% of all transactions in the gold market in 2010 were cleared by JPMorgan. Federal Reserve Bank of Minneapolis President Neel Kashkari said the central bank is committed to doing what's necessary to bring down demand in order to reach policy makers' 2% long-term inflation goal, a target that remains far off. Inflation that has continued to exceed the Fed's expectations is "very concerning," Kashkari said. Faster cost-of-living increases are becoming more broad-based and aren't limited to just a few categories, and that explains why the Fed is "acting with such urgency to get it under control and bring it back down," he said. European equity futures are lower along with US contracts, suggesting a recent rebound in global stocks could pause. Expected data include manufacturing PMIs from Sweden, Netherlands, Spain, Italy, France, Germany, Norway, Greece and the UK. On the earnings front, HSBC delivered better-than-estimated profits, vowing to restore paying quarterly dividends next year as it seeks to head off a call by its largest shareholder to split up. Heineken reported better-than-expected beer sales as higher prices did little to stop customers from drinking. This is what's caught our eye over the past 24 hours. Has one of the year's great global macro trades come to an end? The once-beleaguered yen is on a roll with both the Bank of Japan and Federal Reserve meetings out of the way and reduced expectations for US rate hikes causing hedge funds to cover bearish bets. Net-short leveraged fund futures and options positions on the Japanese currency have fallen to the lowest since March 2021, according to the latest data from the Commodity Futures Trading Commission. Dollar-yen has now dropped over 4% from a mid-July high and closed below its 50-day moving average Friday -- a key support level watched by traders. That paves the way for a decline to 130, putting calls that the pair was destined to hit 140 firmly in the rearview mirror. Expectations for a less aggressive Fed have led to a rally in Treasuries, narrowing the yield gap which had opened up between Japan and the US that helped push the yen to a 24-year low. That has weakened the argument behind sell-the-yen strategies and eased pressure on the BOJ, which reaffirmed its commitment to rock-bottom interest rates last week. Still, the yen is not out of the woods yet with some market participants saying it is too early to call an end to declines with the path for interest rates very much data-dependent.  Cormac Mullen is a Deputy Managing Editor in the Markets team for Bloomberg News in Tokyo. New from Bloomberg UK. Sign up here for The Readout with Allegra Stratton, your end-of-day guide to the stories that matter. |

No comments:

Post a Comment