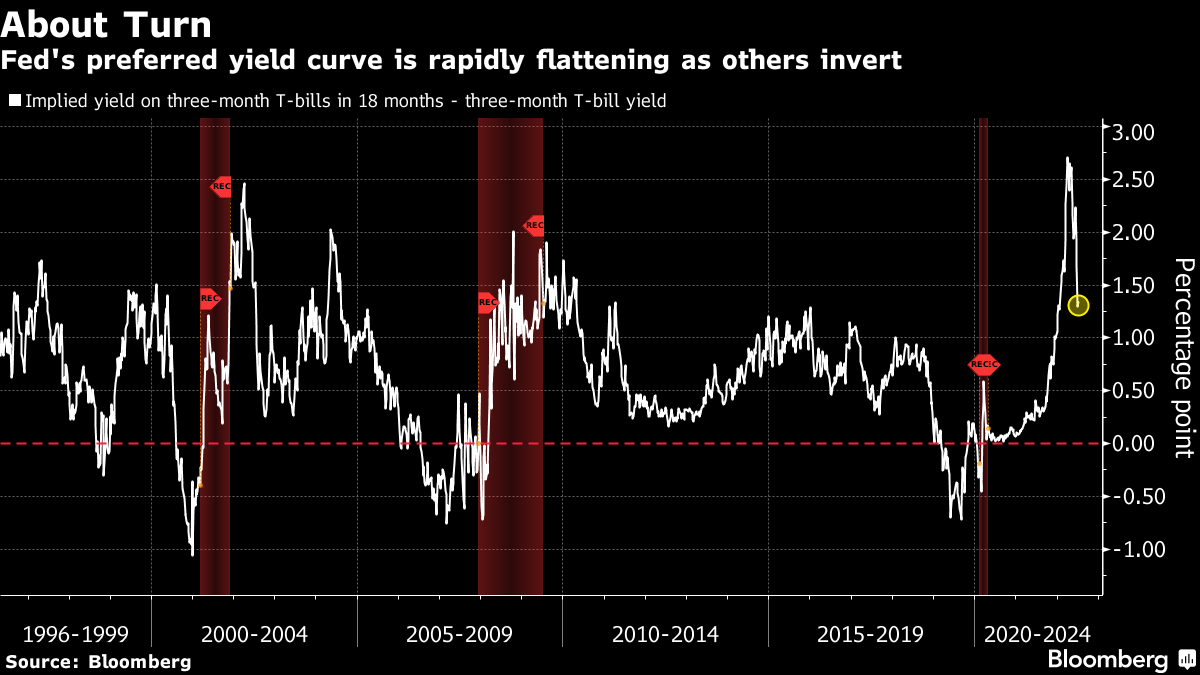

| Good morning. Japan stunned by Abe shooting, Boris Johnson is being rushed to the exit, soft landing hopes for the US economy and Europe's deepening travel chaos. Here's what people are talking about. Former Japanese Prime Minister Shinzo Abe was unresponsive after being shot during a political event on Friday, shocking a nation where gun violence is rare. Abe, 67, was shot twice from behind about three meters (10 feet) away while campaigning for Sunday's upper house election in the western city of Nara, broadcaster NTV said, citing an official in his ruling Liberal Democratic Party. Police arrested a local man in his 40s, Kyodo News reported. Two videos broadcast by NHK showed what appeared to be gun smoke coming from behind Abe as he spoke and a man being tackled by security personnel on the street soon afterward. Abe was rushed to a hospital immediately and may have gone into cardiac arrest, Kyodo News said, citing local firefighters. Boris Johnson's plans for an orderly retreat are under threat. The ruling Conservative Party is urgently drawing up plans for an accelerated contest to choose his successor by the end of the summer, rather than allowing the extended three-month swan song officials at No. 10 had floated earlier. The Tories are planning to whittle down candidates to a final two by July 21 and have the new leader decided by September. Meanwhile, the defeated UK prime minister told his senior ministers that any "major fiscal decisions" should be left to his successor.  | Two of the Federal Reserve's most hawkish policy makers backed raising interest rates another 75 basis points this month to curb inflation, while still seeing a good chance the US economy will have a soft landing. Governor Christopher Waller and James Bullard, president of the St. Louis Fed, both voting members of the Federal Open Market Committee this year, stressed the need to get policy into restrictive territory to confront the hottest price pressures in 40 years. Concern that the Fed could go too far and tip the economy into recession has convulsed financial markets, but Waller called those fears overblown. Travel chaos is spreading even wider in Europe, with Deutsche Lufthansa preparing another wave of flight cancellations due to staff shortages as the crucial summer vacation season kicks off. Europe's biggest airline, which already canceled a total of 3,100 flights last month, is preparing to eliminate about one fifth of departures from its Frankfurt and Munich hubs on select days next week. The European aviation industry has suffered unprecedented bottlenecks and long check-in lines at airports from Heathrow to Brussels to Dusseldorf. British Airways earlier ditched thousands of flights amid a staffing crunch. European equity futures are steady, while Asian stocks pared gains amid the reports that former Japanese Prime Minster Shinzo Abe had been shot. The news brought a somber tone to the trading session, which had earlier been lifted by easing recession fears. Expected data include Italy industrial production and Norway's trade balance. All eyes later Friday will be on the US jobs report for clues about the Fed's policy path. This is what's caught our eye over the past 24 hours. An about turn in the Fed's preferred yield curve measure means traders should take the latest 2-year/10-year inversion much more seriously than earlier this year. The last time sections of the US yield curve inverted in March, Fed Chair Jerome Powell downplayed the significance arguing that traders were looking at the wrong metric. He stressed the case for his preferred curve — where three-month rates are now versus where they are expected to be in 18 months' time — which at the time was still steepening. A Fed research paper in 2018 highlighted that this shorter-term curve adjusts for complicating factors like the so-called term premium, and thus gives a cleaner read on market expectations for future monetary policy. To quote Powell himself: "If it's inverted, that means the Fed's going to cut, which means the economy is weak." This time round, the Powell measure is flattening rapidly. While the spread is still well in positive territory, the closer it gets to zero, the more seriously the central bank will have to take signals from other parts of the yield curve.  Cormac Mullen is a Deputy Managing Editor in the Markets team for Bloomberg News in Tokyo. New from Bloomberg UK. Sign up here for The Readout with Allegra Stratton, your end-of-day guide to the stories that matter. |

No comments:

Post a Comment