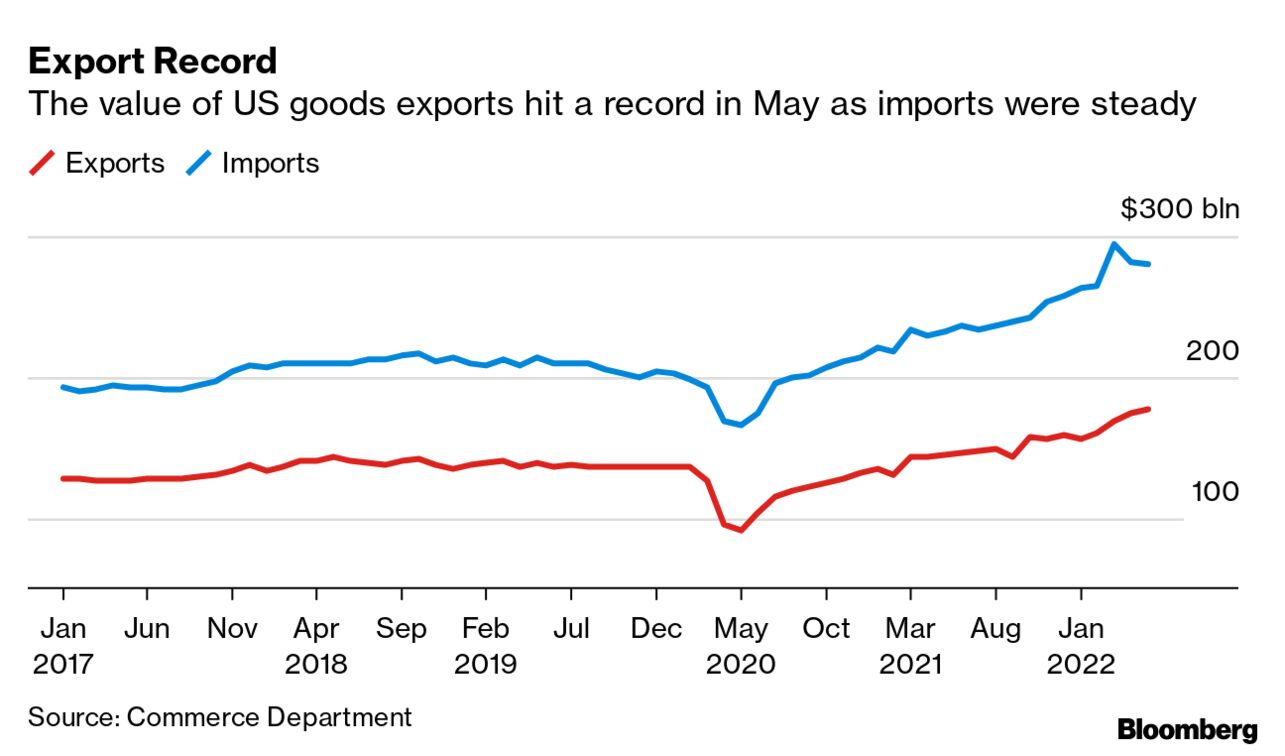

| As economies struggle to untangle unprecedented congestion in global supply chains, one of the world's busiest ports is backing an ambitious modernization plan to provide solutions. A decade ago Singapore launched a project to build the biggest automated container port by 2040 — one that will double the existing space and cut back on manpower using drones and driverless vehicles. Operations started at two new berths last year, and construction work is continuing on the next phase. The plan, set in place long before the onset of supply-chain upheaval, now appears prescient. Shipping experts say the city-state handled the most trans-shipped cargo in the world in 2020 and is adding new capacity at a time when the growth of ports is slowing. "Singapore is the world's biggest trans-shipment hub, a position it will hold for years to come," said Choi Na Young Hwan, head of the international logistics analysis team at think tank the Korea Maritime Institute. Ports are the most visible choke points in the $22 trillion arena for merchant trade, making it more urgent to find solutions as the pandemic rewires global supply chains. Gateways for seaborne trade in the US and Europe are currently struggling to handle cargo flows smoothly and quickly, creating bottlenecks that's blamed on everything from labor shortages to uneven patterns of demand. Exporters in Asia face delays getting goods transported to customers in the US and Europe, and the situation has only worsened this year with Covid lockdowns in China and the war in Ukraine. While Singapore's geographical location in the Strait of Malacca means it doesn't have some of the burdens faced by end-destination ports, and the government has influence over trade unions that many other nations can't copy, its expansion plans offer a possible way forward. —Ann Koh in Singapore  la Exporting More | US exports rose to a record of $176.6 billion in May and imports were little changed at $280.9 billion, leaving the narrowest merchandise-trade deficit of the year and adding a tailwind to economic growth in the second quarter. Other Commerce Department data showed Retail inventories rose 1.1% in May to $705.3 billion from a month earlier as companies stock up on merchandise amid still-uncertain supply chains. Stockpiles at wholesalers climbed 2%. (Click here for more.) - Long recovery | German industrial companies expect the supply-chain issues that have disrupted Europe's biggest economy to hamper output for at least 10 more months.

- Auto slide | Vehicle sales in the US are expected to fall 17.3% this year to the lowest level in a decade as semiconductor shortages and other supply-chain problems hamper production. Meanwhile, Toyota produced 5.3% fewer vehicles in May than a year earlier.

- Labor woes | For the latest example of just how tight the US job market is, look to consumer-goods giant Procter & Gamble. In its bid to lure workers to one of the country's most important tampon plants, the company has been raising wages for months.

- Home remedy | The world's largest lithium producer is urging the US government to cut red tape to accelerate a build-out of a domestic supply chain for materials needed for batteries, electric vehicles and cleaner technologies while cutting dependence on China.

- Oddlots podcast | While the world watches to see if we've reached peak inflation or not, prices for all sorts of things from Rolexes to trucking rates are already rolling over.

| - No recession | The CEO of Maersk, a bellwether for global trade, said the container line's freight volumes don't yet show signs that world economy is headed for a downturn.

- Forwarder thinking | Ocean and air rates have moderated from their peaks but remain well above pre-pandemic levels. Elevated rates should contribute to strong margins and earnings for forwarders through 2022, according to Bloomberg Intelligence's Lee Klaskow.

- Use the AHOY function to track global commodities trade flows.

- Click HERE for automated stories about supply chains.

- See BNEF for BloombergNEF's analysis of clean energy, advanced transport, digital industry, innovative materials, and commodities.

- Click VRUS on the terminal for news and data on the coronavirus and here for maps and charts.

Don't keep it to yourself. Colleagues and friends can sign up here. We also publish the New Economy Daily, a briefing on the latest in global economics. For even more: Follow @economics on Twitter and subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. How are we doing? We want to hear what you think about this newsletter. Let our trade tsar know. |

No comments:

Post a Comment