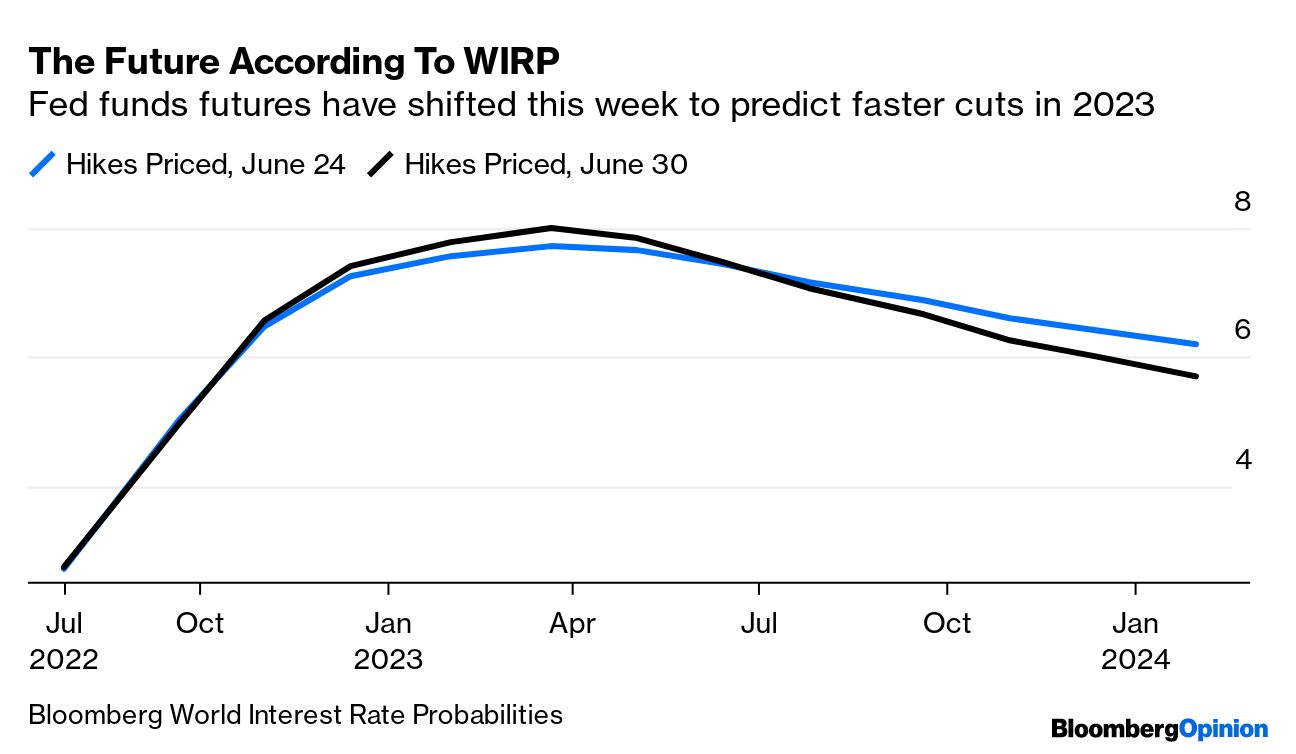

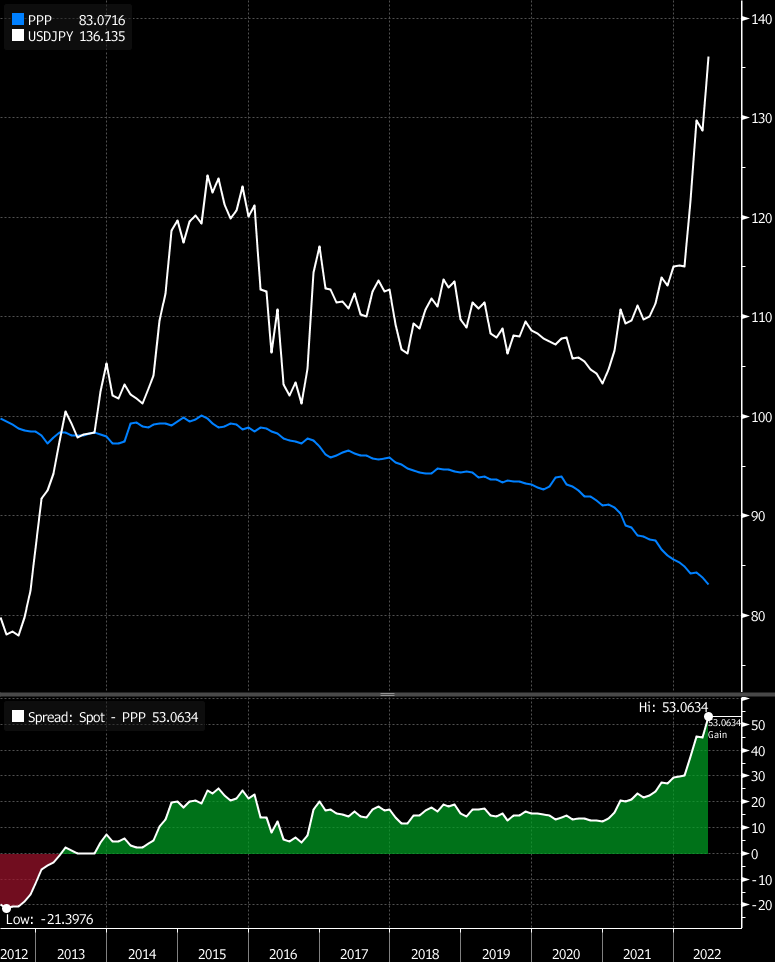

| Inflation almost seems passe. The worry of the moment is now economic growth. That's not unreasonable, as the latest update shows US gross domestic product declined at an annualized rate of 1.6% in the first quarter. With the huge exceptions of the Covid-scarred first two quarters of 2020, this was the weakest US growth since the spring of 2009: That has had the effect of seemingly eliminating concerns about inflation, even though the battle against it has barely begun. Breakevens, derived from yields on inflation-linked bonds, have dropped all around the world. The 5-year, 5-year forward breakeven, which aims to capture average inflation for the five years starting five years hence and is the measure most closely followed by the Federal Reserve, has now dropped below its level from much of 2018, before the pandemic. Fast approaching the Fed's target of 2%, the bond market is saying that inflation is no longer anything to worry about:  The problem is that inflation forecasts have shifted because growth forecasts are also shifting. With a recession now named as a base case for many next year, the belief is gaining greater hold that the Fed will hike rates by a further 2 percentage points, but then swiftly start cutting again. The easing cycle, if you believe the fed funds futures market, will be well advanced by the end of next year. The chart shows the number of 25-basis-point hikes implicitly priced in for each Fed meeting until early 2024. Over the last week, the belief in a swift start to easing has gained a hold — and that, sadly, is because pessimism about the economy has also taken hold:  Even if the markets are confident that inflation is as good as beaten already, however, central bankers are being careful not to seem complacent. The European Central Bank's annual summit at Sintra in Portugal featured a panel (which you can see in full here, moderated by Bloomberg colleague Francine Lacqua) involving Agustin Carstens, Jerome Powell, Christine Lagarde and Andrew Bailey, heads of the Bank of International Settlements, the Fed, the European Central Bank and the Bank of England. None was prepared to divert from the message that inflation was the overriding priority. Powell asserted that the Fed was "committed to, and will succeed, in getting inflation down to 2%," and that to do otherwise would cause more pain — a sentiment fully endorsed by the other central bankers. A less diplomatic way to make that point: It might be necessary to force a recession to get rid of inflation, but the recession that would result from letting price pressures take deeper root would be even worse. That's the message the market took. At this point, obdurate inflation, forcing rates up to 4% and beyond, definitely isn't priced in. At the macroeconomic level, the most painful surprise over the second half of this year would be for inflation to stay sticky. That would quash the belief in a swift easing campaign in 2023. There's been much talk of "inverse currency wars" as different central banks strive to gain a strong currency to help them deal with inflation (rather than a weak one to boost export competitiveness). It doesn't seem to be happening. The dollar is strengthening, and nobody seems prepared to crimp its style. Powell made clear that he wasn't bothered by a strong dollar, which does after all tend to be deflationary. Frederik Ducrozet, head of macroeconomic research for Banque Pictet & Cie SA, commented that Powell seemed to acknowledge the US was lucky to have a relatively closed economy. "He was looking at Lagarde as if to say he had secret sympathy for the restraints they are working under." That didn't, however, prompt Lagarde to make any comment about the euro. Couple that lack of concern with continuing intention to keep hiking rates and that added up to another rally for the dollar when compared to other major currencies in the widely followed dollar index. It's almost regained the two-decade highs set in the aftermath of the ECB meeting and the May inflation print (ringed in the chart): A key component to this is the yen. Powell's remarks could be taken to show that he wouldn't be happy for the Japanese authorities to intervene to strengthen their currency, and it would certainly be difficult for any major central bank to do such a thing without coordinating with others. Besides, the Bank of Japan seems determined to continue to be a monetary policy outlier. Put these together and the yen at one point dropped to 137 to the dollar, a fresh low since 1998. In terms of valuation, this begins to look extreme. The following chart comes from Bloomberg's world currency ranking system (WCRS <GO> on the terminal). It shows purchasing power parity as calculated by the Organization of Economic Cooperation and Development, compared to the spot price. Japan's prices have famously risen less than everyone else's, which means that all else equal the yen should steadily appreciate over time to maintain purchasing power parity. That isn't what's happened. In the chart, the blue line shows what would have happened if the yen had moved with purchasing parity; the gap between that PPP number and the spot price is now at a record. The yen has never been so undervalued:  Meanwhile, at Sintra, Bailey of the BOE said that his bank didn't target the exchange rate, and he wasn't surprised it was weakening. If he was engaged in an inverse currency war to strengthen the pound, he certainly didn't sound like it: "We do not attribute good or bad" to the exchange rate's moves, he said. It wasn't exactly "We will fight them on the beaches." As a result, sterling is plumbing the depths once more. According to the OECD, purchasing power parity would be $1.443; and yet the pound is testing $1.21 again. Sterling has seen massive swings compared to fair value over the last three decades, thanks to such excitement as the "Black Wednesday" exit from the European Exchange Rate Mechanism in 1992, and the 2016 Brexit referendum. At times, sterling has been massively overvalued. Now, it's almost as cheap as at the worst moments of the Brexit negotiations: Several major currencies, including the dollar, appear to have valuations far out of whack with their actual purchasing power, which implies a nasty danger ahead. But it doesn't look as though there is any competitive attempt to use monetary policy to strengthen currencies. That should be a source of some relief, for now. Still, the further the markets take currencies from fair value, the more the difficulties stored up for the future. The first half of 2022 is about to end with another installment of the unfolding inflation drama. The personal consumption expenditure deflator, the Fed's preferred measure of inflation, is about to be released. The PCE figures take longer to compile, and so we are only now catching up with May, but the numbers still matter. However, as so many times over the last year as inflation has taken hold, there are bound to be different ways to read the numbers to suit your favorite narrative. If you look at month-on-month figures, eyeing the latest pricing trends, then the expectation is for a third successive rise in monthly inflation. That's discouraging: But we all know that year-on-year figures are what matters most. They're what people think about when drawing up budgets, and they're the way inflation is usually framed. And thanks to base effects from last year, the expectation is that the core PCE rate is going to decline for the third month in a row. That could bolster still further the newly dominant narrative that inflation will soon be licked: Everything is set up for yet another alarum driven by inflation data, then. Enjoy. This is a stressful time, particularly if you spend your time watching news headlines. This is my single favorite panic button piece: the slow movement from Mozart's concerto for flute and harp. If stressed, try listening to it and closing your eyes.

More From Other Writers at Bloomberg Opinion: Want more from Bloomberg Opinion? Terminal readers head to {OPIN <GO>}. |

No comments:

Post a Comment