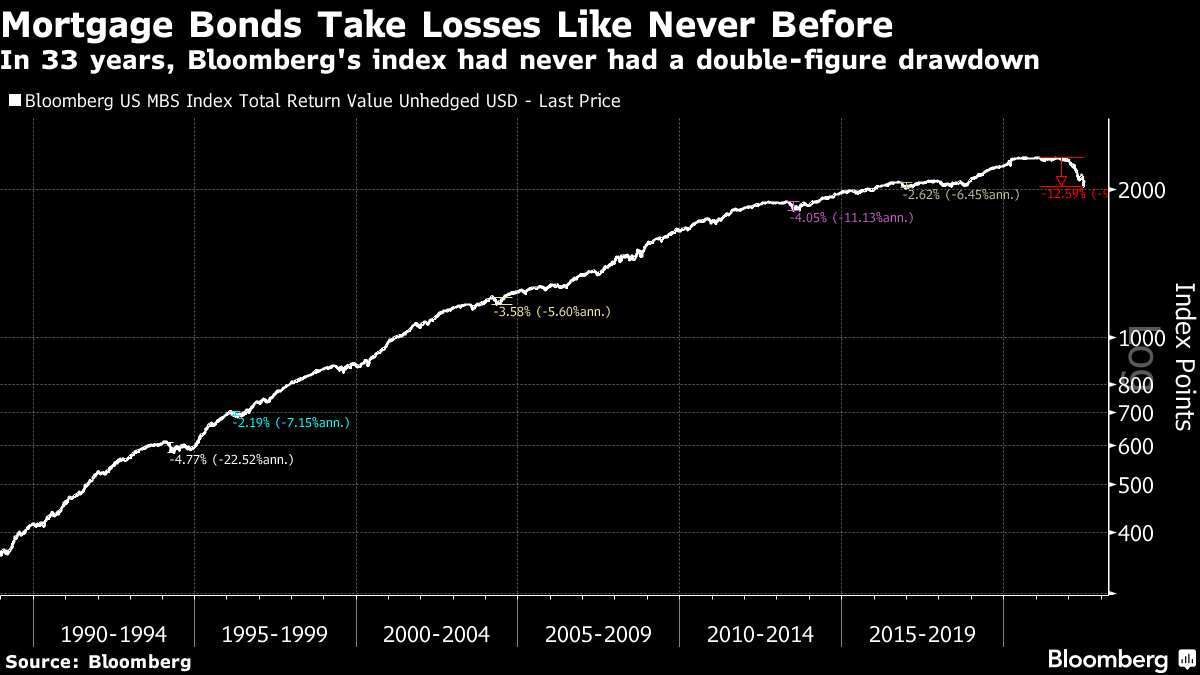

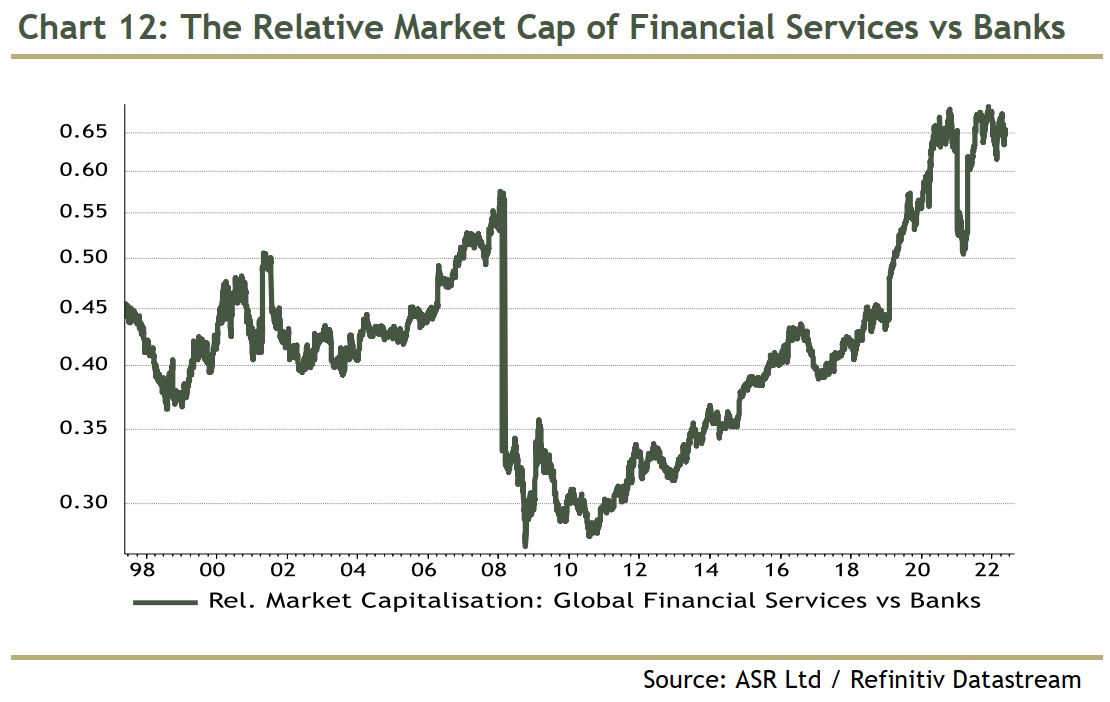

| There are risks in writing a daily column. It can grow a little too tempting to turn it into a running commentary. Tuesday was a "risk-off" day, with stocks falling and bond yields (both real and nominal) rising a bit. There is no particular reason to think that this is a turning point, and the trends since the Fed made clear that it was going to get serious with inflation remain intact — the prices of both stocks and bonds are on a declining trend. The main flies in the ointment from the data were more excuses than reasons to take risk off the table. The Richmond Fed's survey of manufacturing isn't generally one of the most closely monitored releases, but as this one was the worst since the Great Recession (barring only one month during the Covid shutdown), it garnered more attention than usual: Consumer sentiment data from the Conference Board also fed into a risk-off day. As this survey, like the University of Michigan's has been going a long time, it has developed a lot of respect, and the numbers again substantiate anyone who fears that recession fears will be self-fulfilling. Future expectations are their lowest since 2013, and lower than they ever were during the worst of the lockdowns: Again, this matters, but arguably not that much. We knew that people weren't feeling terribly optimistic at present. Any Democrat looking at current poll numbers could tell you that. The next wave of unemployment and inflation data, not due until after the July 4 holiday, will be far more important. If there was one data item that speaks to the issues of the moment, it was the publication of the S&P Case-Shiller house price indexes. These appear with a big lag, but help to confirm that house prices have come a long way. The latest year-on-year increase is the greatest since the inception of the 20-city index in 2000. For plenty of reasons that are now well canvassed, that's disquieting: An overheated housing market is one of the more important reasons why the Federal Reserve is raising rates. The key question now is whether the sector can be brought into some kind of even keel without causing an accident along the way. And which parts of the financial system might be the most vulnerable. The Fed's rate hikes have already had a dramatic effect on the mortgage market. Bloomberg's index of US mortgage-backed bonds, including only those backed by agencies such as Fannie Mae with an implicit government guarantee, have given back all their gains of the last five years: The percentage loss, before the recent bounce, was only about 12%. They've held up far better than stocks. But this is a market in which investors really don't expect to have to put up with drawdowns. In historical context, what's happened to mortgage-backed bonds this year is a radical departure. Bloomberg's index dates back to 1988, when the asset class was still in its infancy. This is the first time it has ever withstood a decline that stretches into double figures:  This looms as a serious shock to anyone who was relying on mortgage-backed bonds to hold their value. That doesn't apply to banks particularly, which in the US were forced to sort out their act in the wake of the disasters of 2008. But as has often happened in the past, tighter regulation in one sector drove financial innovation into new places. Just as money market mutual funds developed to allow investors to avoid paying for deposit insurance, as they would have to do on funds held in banks, so non-bank financial institutions have been able to seize yet more business that would once have been done by traditional lenders. This chart by London's Absolute Strategy Research Ltd. demonstrates the strength of global non-bank financials compared to their orthodox peers. After a collapse in 2008, a new range of non-banks has emerged whose market cap has grown much faster than the incumbents:  The new nimbler players have quickly established a big share of the mortgage market. This chart, drawn by Absolute Strategy from bankrate.com data, shows the 10 biggest originators in the US last year. Most non-Americans will only have heard of two; and very few Americans will have heard of all of them: Logic and experience therefore guide us to look into the mortgage market for points of vulnerability. As Absolute Strategy puts it, these companies have "untested business models, and are large enough to create potentially systemic risks for policy makers." The biggest originator, Rocket Cos Inc., based in Detroit, is a good exemplar. My Bloomberg Intelligence colleague David Havens produced the following chart, which sums up the dynamics in play neatly enough. As Treasury rates rise, so the spreads on Rocket's bonds widen, while its share price falls: Charted differently, this is the mid yield on the Rocket mortgage due to mature in January 2028, since 2018. This has more than doubled in six months, and can only have a profound effect on the company's business model: Mortgage production is projected to come down sharply (a consummation devoutly to be wished by the Fed). According to Bloomberg Intelligence, consensus forecasts called for $292 billion in origination volume this year as 2022 started. That's now down to $164 billion. Here are the quarter-by-quarter origination numbers, with projections for the rest of this year in gray: The "bread-and-butter" of refinancing mortgages has understandably been "hammered," according to Havens. None of this means that Rocket or its brethren are doomed. People are still buying houses. Even if it's not a great investment at present, Havens points out that the company has plenty of strengths: "the business model is scalable, the value of the mortgage-servicing rights should act as a hedge and Rocket has used the time of plenty to increase balance-sheet durability." This isn't a time for all-out alarm. But it does demonstrate the scale and uncertainty of the task ahead. The Fed needs to remove the heat from housing demand, and from the rest of the consumer economy, without prompting an accident for one of the companies that lives off mortgage finance. It's not going to be easy. Mr. Havens is a man after my own heart. His piece on Rocket, which you can find on the terminal, is headlined "With Higher Rates, Outlook for Rocket Drops Like a Lead Zeppelin." To ram home the point, subsequent sections are headlined as follows: I think he likes Led Zeppelin. All those tracks are worth listening to. And for a great Led Zep cover that I've trailed before and which proved very popular, here is the City of London's own Jess Greenberg playing Whole Lotta Love. More From Other Writers at Bloomberg Opinion: Want more from Bloomberg Opinion? Terminal readers head to {OPIN <GO>}. |

No comments:

Post a Comment