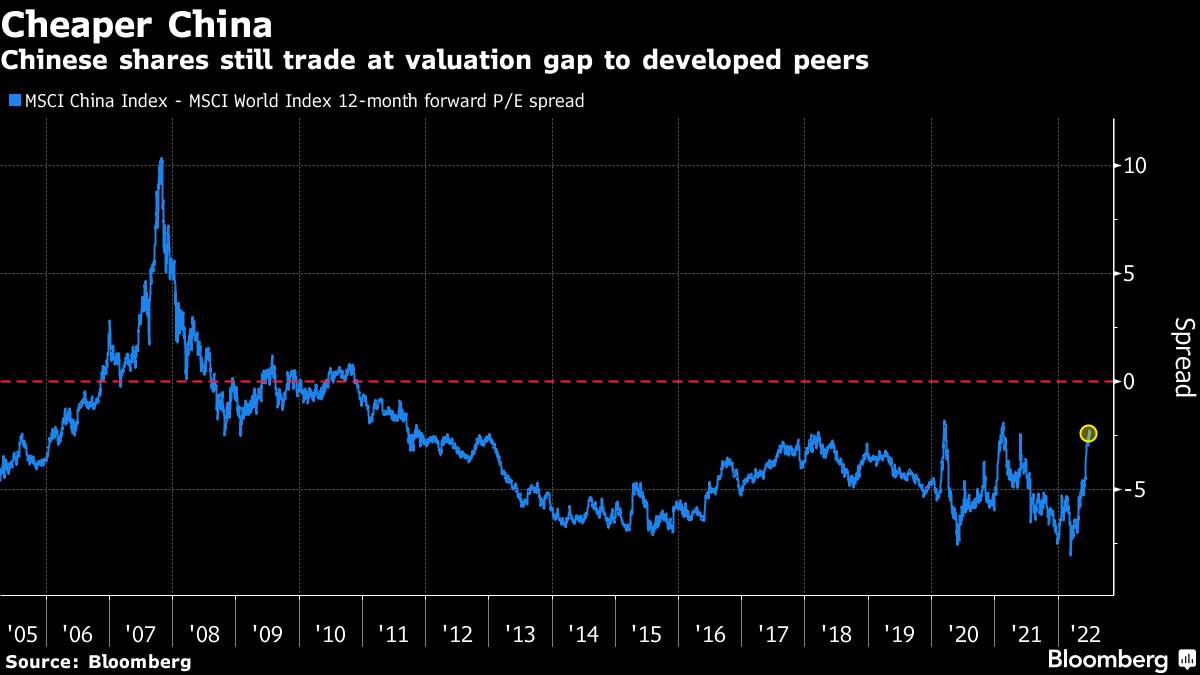

| Good morning. Putin swoops on key gas plant, travel chaos widens, a milestone in crypto rules and a royal subsidy. Here's what people are talking about. President Vladimir Putin signed a decree to transfer rights to the Sakhalin-2 natural gas project to a new Russian company, a move that could force foreign owners including Shell to abandon their investment in the facility. The decree cites threats to Russia's national interests and economic security. The move could prove complicated for Shell, which holds a 27.5% stake in the liquefied natural gas facility in Russia's far east. The energy giant announced it would exit the project after Russia invaded Ukraine and that it wouldn't commit to any new investments in the country. In other war-related developments, Ukrainian President Volodymyr Zelenskiy praised the departure of Russian forces from Snake Island in the Black Sea. Ukraine, meanwhile, is exploring the possibility of debt restructuring with funding options at risk of running out. The chaos that has plagued the European travel industry for weeks is coalescing in France as staff at Paris-Charles de Gaulle airport plan to strike for the second day in a row Friday and a country-wide rail walkout looms next week. France's civil aviation authority ordered the scrapping of 17% of flights through the hub between 7 a.m. and 2 p.m. Friday after talks between unions and management at airport operator Aeroports de Paris failed to reach a wage deal. As demand surges, airports and carriers in Europe have been forced to reduce flight schedules due to staffing shortfalls. Just a day before, London Heathrow asked airlines to cut 30 services, citing concern that peak passenger numbers would exceed levels it could safely handle.  | The European Union late Thursday reached a provisional agreement on its landmark Markets in Cryptoassets directive, bringing years of debate on how to regulate the digital-asset industry to an informal close. The key legislation will regulate the crypto sector with common rules across all 27 member states, marking the first time globally that lawmakers have attempted to supervise the sector on such a scale. The European Parliament, Council and Commission approved new provisions on the supervision of cryptoasset service providers, consumer protection and environmental safeguards for cryptoassets, including cryptocurrencies like Bitcoin and Ether. UK taxpayers will pay an additional £27.3 million ($33 million) over the next two years to plug a funding gap at the royal family and cover a drop in profit at the Crown Estate, which helps pay their expenses. Demands for more government cash follow a 17% increase in spending by the royals last year and comes at a time when the average UK household income fell for the longest period since records began in 1955. Family incomes are 1.3% lower than the year before, and public-sector workers have walked off the job in protest against pay offers below the current rate of inflation. European stocks may face a gloomy day after Asian stocks and US equity futures fell Friday while bonds extended a rally amid a looming economic slowdown that drove another bout of risk aversion. Treasuries added to gains -- leaving the 10-year yield below 3% -- in the wake of softer than expected US consumer spending and inflation. The stand out data release is for euro-area inflation, which could reach a new record above 8%. This is what's caught our eye over the past 24 hours. Global stock investors are over the first half hump and enthusiasm is scarce on the ground, with one glaring exception -- China. An MSCI gauge of the country's stocks finished the half on the front foot, climbing almost 6% in June despite the near 9% slump in the equivalent AC World Index. Easing Covid restrictions have boosted sentiment and a Bloomberg survey of 19 fund managers and analysts predicts that benchmark stock indexes in China and Hong Kong will post gains of at least 4% by year-end to outperform their global peers. The iShares MSCI China ETF lured $333 million on Wednesday, its largest single-day inflow since the fund's inception in 2011. Valuations still look relatively attractive versus global peers with Chinese stocks trading at a more than 2 point price-earnings discount although the gap was over 8 points in March. Still, the upbeat forecast for Chinese equities stands in stark contrast with the more negative outlook for US stocks, with Morgan Stanley and Goldman Sachs among those predicting that Wall Street will see further declines.  Cormac Mullen is a Deputy Managing Editor in the Markets team for Bloomberg News in Tokyo. New from Bloomberg UK. Sign up here for The Readout with Allegra Stratton, your end-of-day guide to the stories that matter. |

No comments:

Post a Comment