| Hello. Today we look at a sudden run of good news from the world's second largest economy, signs US supply chains may be easing and an analysis of which countries are being hurt the most from soaring food costs. Finally some better news on China's economy. Purchasing managers surveys for May improved from their April slump, though they remained below the key 50 level dividing expansion and contraction, data showed Tuesday. And Shanghai continued its careful reopening as the city's Covid outbreak appears to have been contained. So it's becoming clearer that April marked a bottom for the world's second-largest economy. The big question now is whether we'll see a 2020-style V-shaped recovery, or something more muted. While a summer spending spree can't be ruled out given authorities' efforts to expedite infrastructure programs, lending data suggest a reluctance on the part of private borrowers that may constrain a full-throated recovery. As Bloomberg's reporters point out, authorities are facing an uphill battle convincing companies and households to boost borrowing as long as Covid outbreaks and lockdowns continue to crush confidence. Another contrast with 2020 is the ongoing weakness in the property sector, as noted by research firm Gavekal in this Tweet: For the global economy, stabilization in China is a welcome development. But we're nowhere near the point where Chinese demand can provide a tailwind to the world's growth outlook. — Malcolm Scott There's also some good news on the supply-chain front amid signs some of the strains in the U.S. are finally easing. - The line of 25 cargo ships headed to Southern California's two big ports is less than a quarter of the record backup in January, and spot container rates have dropped almost 20% this year

- Flexport average transpacific shipping journey of 102 days is the quickest since November

- Delays moving containers out of rail depots in Detroit and Memphis are shorter than they were in September, according to Hapag-Lloyd AG

But for every sign that a cooling economy will give supply chains room to rebalance, there's a reason for skepticism: - On the East Coast, ship bottlenecks are building again.

- The dwell time for containers is still climbing at rail yards near Chicago and Kansas City.

- At 9.6 days in April, the wait to move freight on rail from the adjoining ports of Los Angeles and Long Beach was the longest since July

Read more here  | - White House meeting | President Joe Biden and Federal Reserve Chairman Jerome Powell have a rare White House meeting on Tuesday amid surging inflation.

- Fed signals | Federal Reserve Governor Christopher Waller said he wants to keep raising interest rates in half-percentage point steps until inflation is easing back toward the US central bank's goal.

- Credibility questions | Bank of Canada chief Tiff Macklem is engaged in a battle against inflation while also facing skepticism from politicians about his commitment to the fight. The bank is set to keep hiking this week.

- Euro prices | Euro-zone inflation accelerated to an all-time high, intensifying the debate at the European Central Bank about how rapidly to raise interest rates from record lows.

- Linchpin Egypt | Growing energy exports but a dependence on imported foods are prompting international concern over Egypt, a strategic ally seen as too big to fail.

- Seat sorrow | The cost of watching Premier League football is rising for most fans, stretching the budgets of tens of thousands of supporters already dealing with the UK's cost-of-living crisis.

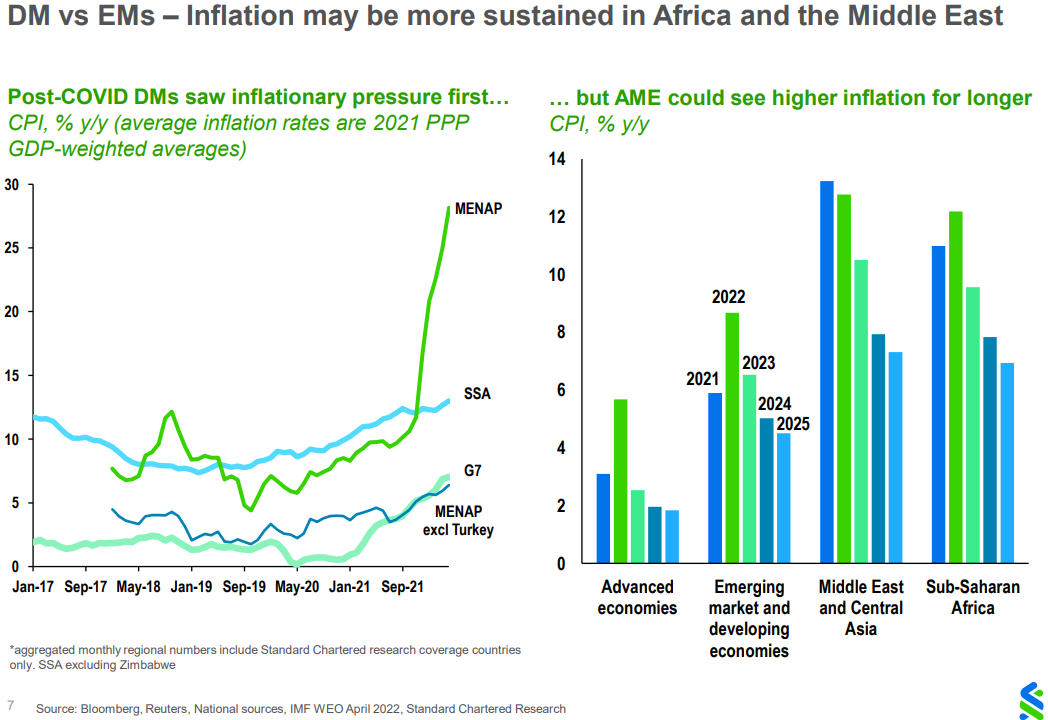

The global food crisis underway comes into greater focus in a report from Standard Chartered's Africa economist. It's a bleak picture for a swath of countries across Africa and the Middle East, which are particularly troubled on food security. Post-Covid, developed markets bore the early brunt of inflationary pressure, but it'll be higher and longer for AME countries, where food has a heavier weight in consumer baskets and most of those countries are heavily food import-dependent, Standard Chartered's Sarah Baynton-Glen writes. Saudi Arabia, for one, has a food-trade deficit exceeding $15 billion.  Source: Standard Chartered Source: Standard Chartered Easy solutions are scarce: Domestic production struggles, especially with countries across Sub-Saharan Africa highly dependent on fertilizer imports, for which global prices are surging. Currency depreciation is an added woe for places like Ghana, Egypt, and Pakistan. For policymakers, this has already meant uncomfortably fast monetary policy tightening. Global governments also have drawn on a menu of fiscal measures to limit price growth, with the most popular being consumption tax cuts, price freezes and subsidies, and adjustments to income taxes or other revenue measures, according to the report. Read more reactions on Twitter |

No comments:

Post a Comment