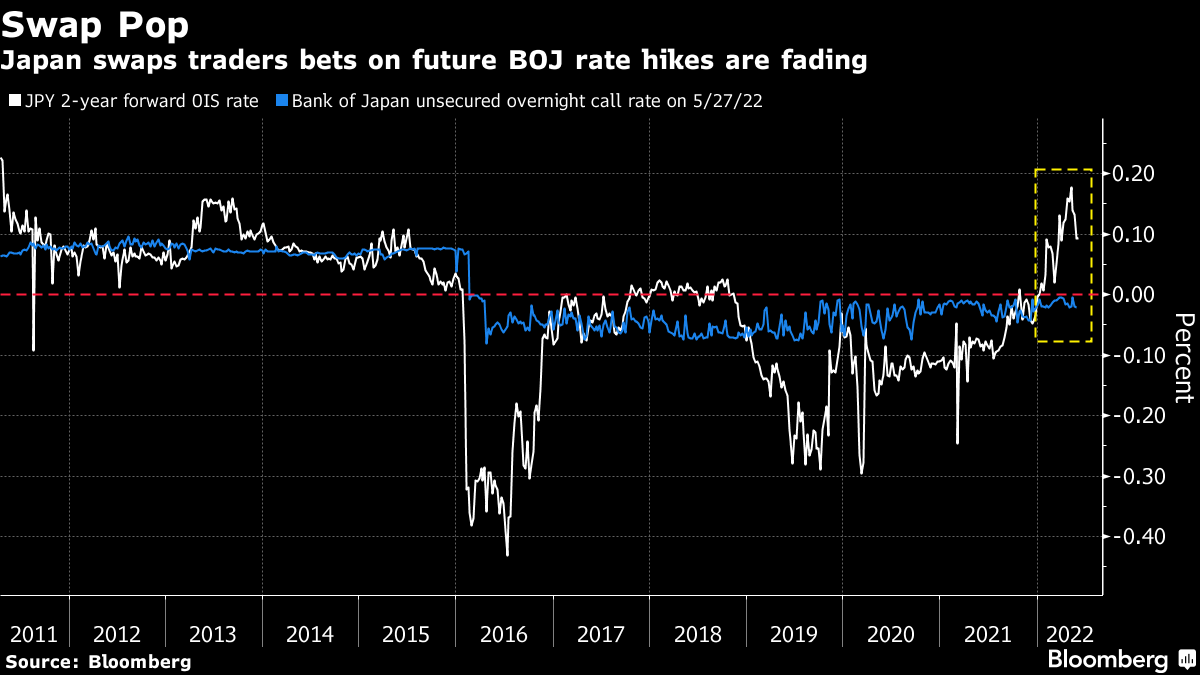

| China doubles down on mass Covid testing. Russia cuts gas to more European buyers. Scientists warn on hydrogen. Here's what you need to know today. China is doubling down on mass testing in a move that's dashing hopes for a shift away from its costly Covid Zero strategy. Tens of thousands of lab testing booths are being set up in the country's biggest cities, with the goal of having residents just a 15-minute walk away from a swabbing point, and allowing officials to order tests as often as every 48 hours. The country will also establish "permanent" Covid hospitals, according to China's top health official. Get the full story here. The news comes as the country of 1.4 billion people reported fewer than 100 infections for the first time since March. Meanwhile in Hong Kong a lobby group representing airlines is pushing the government to cut hotel quarantine for travelers to three days. Russia cut off the gas to more European buyers, stepping up its use of energy as a weapon, after buyers refused to pay in rubles. Gazprom halted pipeline shipments to the Netherlands and Denmark this week, and cut off a small contract supplying Germany. The moves came as the European Union clinched a deal to partially ban Russian oil imports, potentially costing Vladimir Putin $10 billion in lost export revenue. The ban could leave Russia even more dependent on China and India to snap up the oil Europe doesn't want. It could also add a fresh jolt to surging consumer prices.  | Stocks in Asia look set to kick off June lower after ending a month marked by intense volatility. Futures fell in Japan, Australia and Hong Kong after the S&P 500 retreated, ending May virtually flat. Chinese stocks listed in the US posted their first monthly gain since October after eased lockdown measures raised hopes that economic activity will pick up. And Treasuries extended a decline, pushing 10-year yields up about 10 basis points as traders raised bets on Federal Reserve interest-rate hikes. Chinese banks are overflowing with cash that no one wants to borrow. Authorities face an uphill battle convincing companies and households to boost borrowing as long as Covid outbreaks and lockdowns continue to crush confidence. Businesses have had to halt production and cut jobs, revenue has slumped and profits have plunged. The upshot is that the financial system is awash with cash, and any monetary easing from the central bank — such as interest rate cuts and liquidity injections — will likely prove less effective in spurring growth in the economy. A world desperate for a climate-friendly fuel is pinning its hopes on hydrogen, seeing it as a way to power factories, buildings, ships and planes without pumping carbon dioxide into the sky. Sounds like the perfect fuel, no? But now scientists are warning that hydrogen leaked into the atmosphere can contribute to climate change much like carbon — and could even make global warming worse over the coming decades. Read our hydrogen Big Take here.  The latest iteration of DeLorean: The Alpha5 electric car. Peak hawkishness looks to have even spread to the one country where it barely took off — Japan. Money market bets on Bank of Japan rate hikes in the future have pulled back as speculation eases that a shift in policy lies ahead. A gauge of where overnight borrowing costs in the interbank market will be in two years time has narrowed once more toward current rates, having hit the highest since 2011 in recent weeks. Two-year forward overnight index swaps have fallen back to below 0.1% — halving the gap with the current rate to about 10 basis points — as officials insist they will stick to super-easy policy.  The BOJ is currently committed to rock-bottom rates to support the economy and is undertaking unlimited bond purchases to keep benchmark yields within its target band of 0.25% either side of zero. Muted inflation figures from Tokyo has offered support for the central bank's view that Japan is not on the verge of an upward inflation spiral. And a drop in factory output in April in data released Tuesday added to early signs that an expected economic rebound this quarter may prove lukewarm as China's lockdowns exacerbate supply-side bottlenecks. Cormac Mullen is a Deputy Managing Editor in the Markets team for Bloomberg News in Tokyo. |

No comments:

Post a Comment