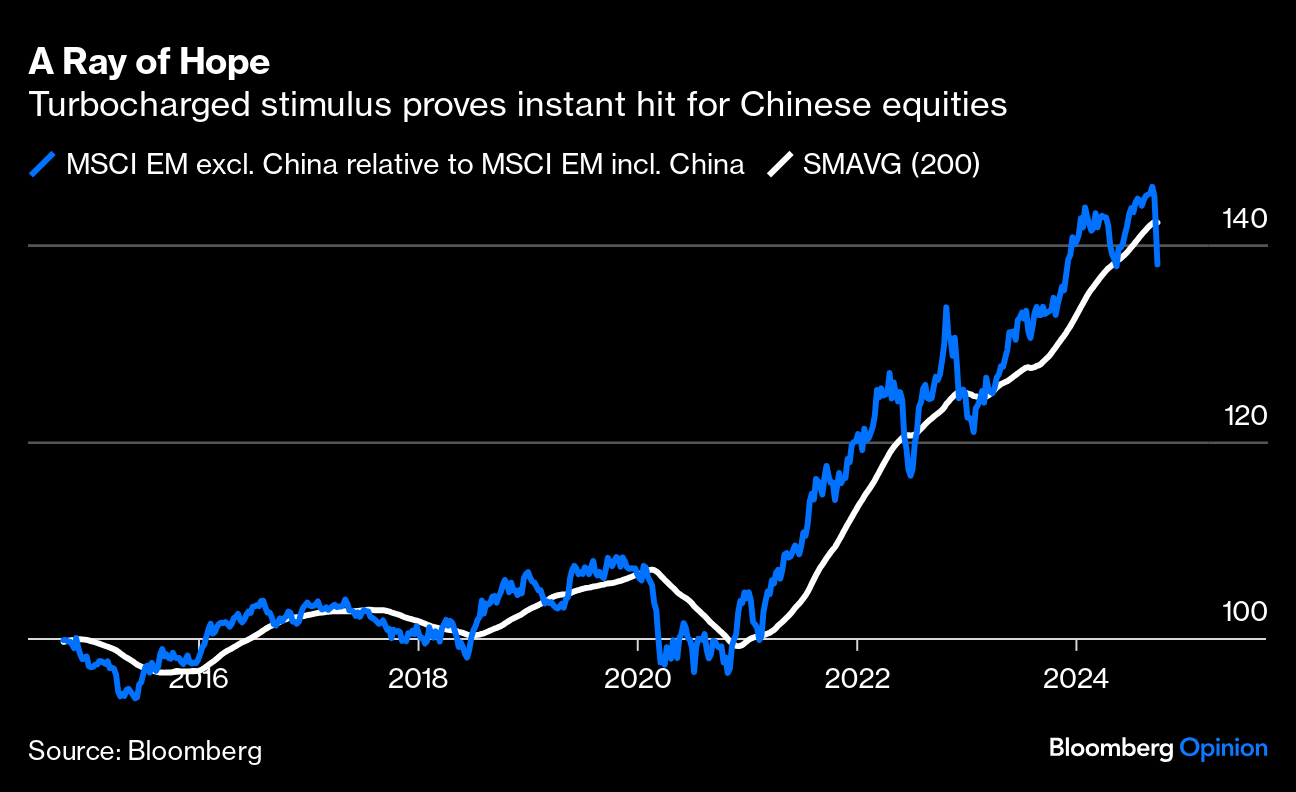

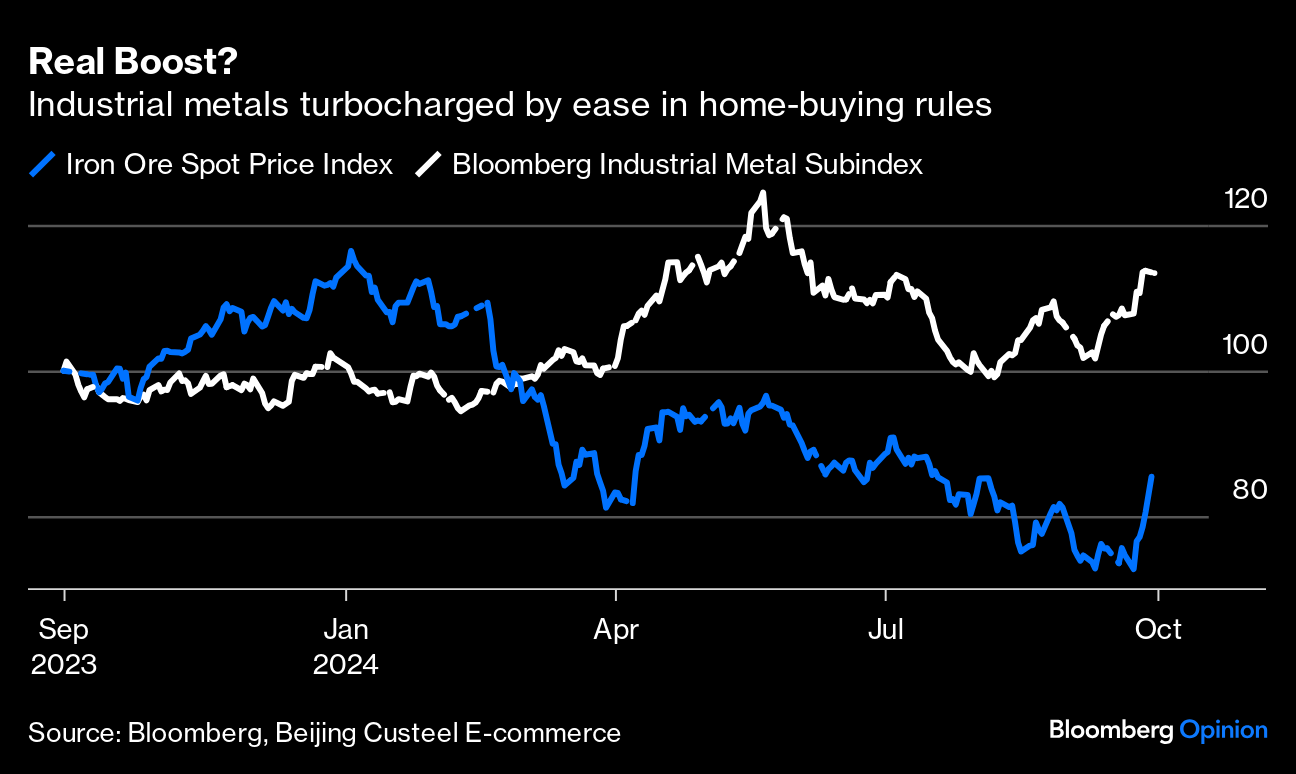

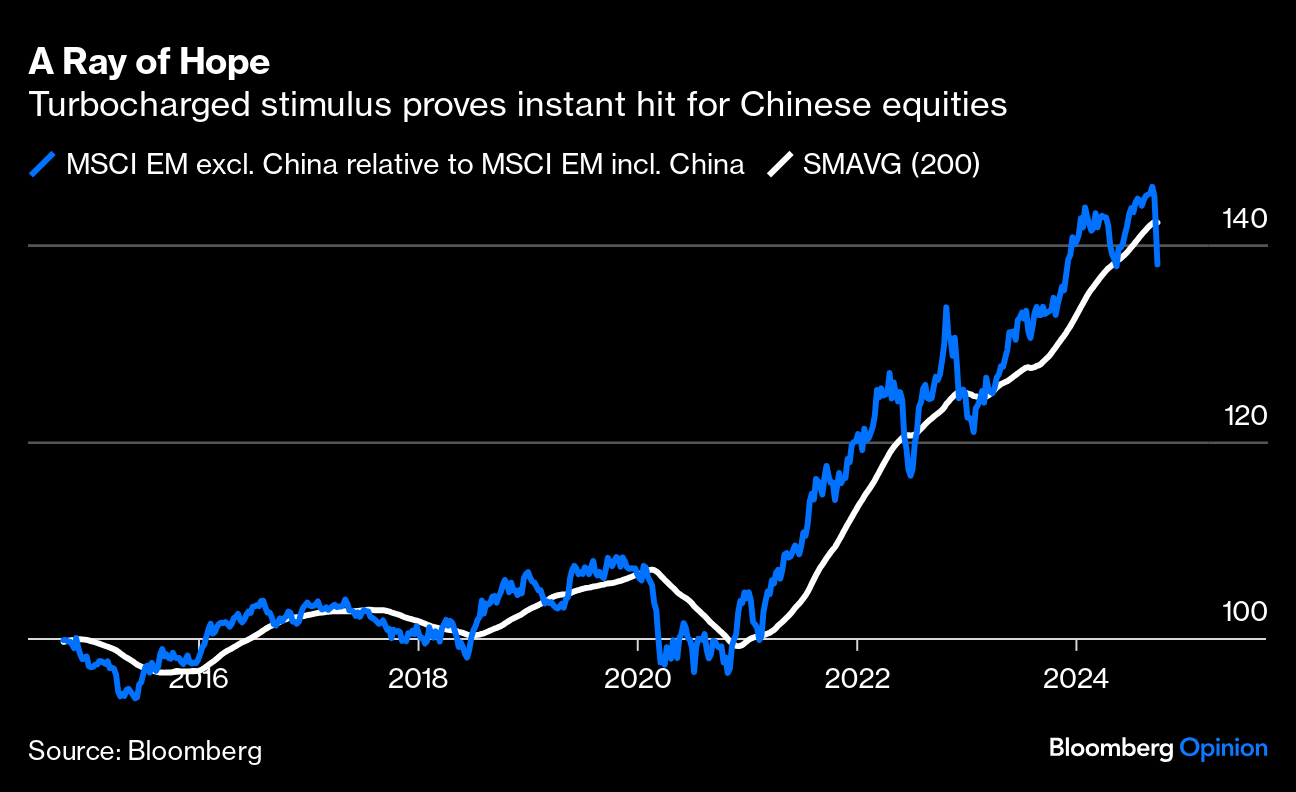

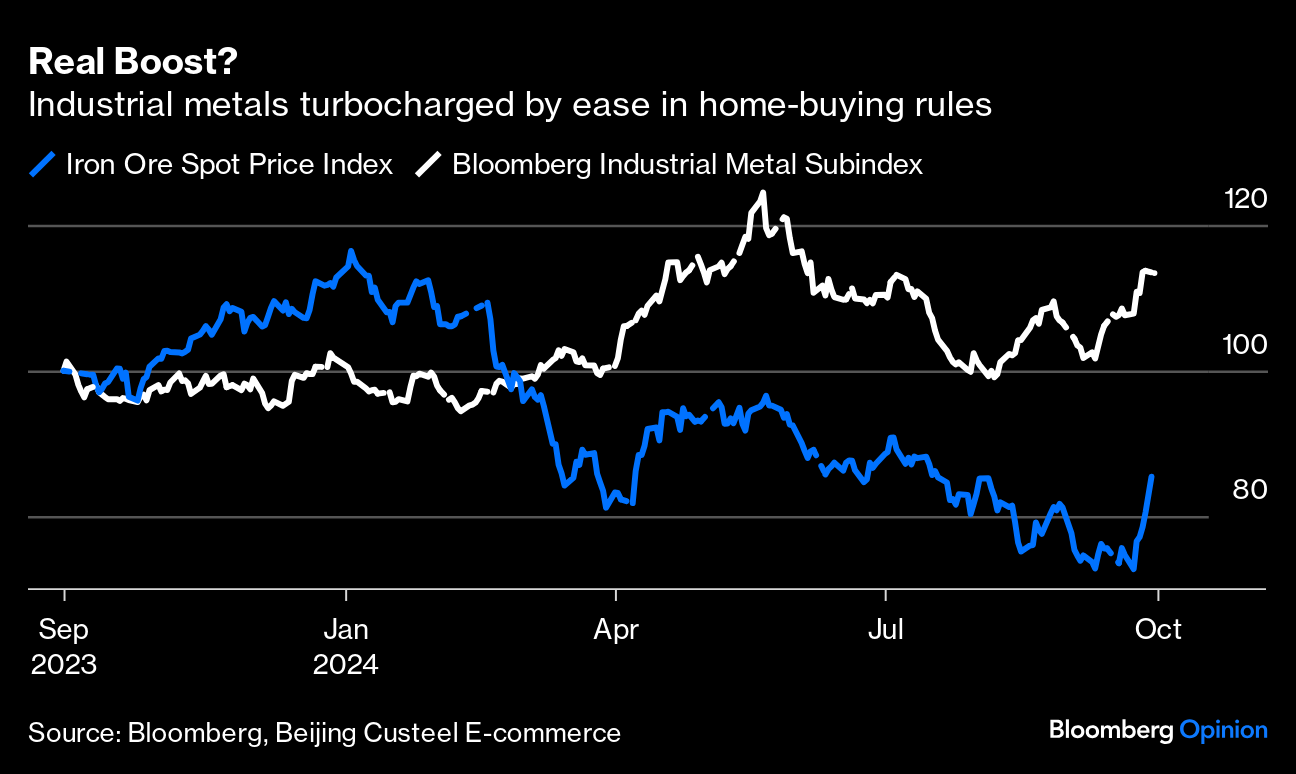

| China's stimulus packages announced last week came right on cue for the Golden Week celebrations. Domestic investors can take the week off happy in the knowledge that their stock portfolios have just gained 25% in six days. It's been breathtaking, and has taken up Chinese stocks wherever they are quoted: But while the impact on China's asset prices is instantaneous, these reforms are far from the silver bullet to deal with endemic economic woes. The lag in transmission means the measures — which include interest-rate cuts, liquidity and support for the stock market, a 20-basis-point reduction in the seven-day reverse repo rate, a 50-basis-point decrease in the reserve requirement ratio, and an average drop of 50 basis points on rates on existing mortgages — will take some time to bear fruit in the real economy. The international impact is harder to gauge at a time when US investors are preoccupied by falling rates. The remarkable rally in Shanghai and Shenzhen is reminiscent of a similar run in late 2008 after China intervened to deal with the Global Financial Crisis, but it hasn't buoyed other emerging markets in the same way. Instead, it's had a drastic effect on the many EM managers who had found since Covid that the way to beat the benchmark was to be underweight China. That trade has suddenly and violently turned against them, raising concerns about flows out of other emergents:  The commodity market suggests that a real impact is underway. Renewed confidence in a Chinese economic turnaround is a boon, especially for industrial metals. The real estate market, long a significant growth engine, has in the past been correlated with demand for more industrial metals, and so the package aimed at relieving the deep property crisis sparked a rally in metals prices. Iron ore — which had been one of the year's worst-performing major commodities as the economy slowed — is surging on hopes of a reversal in the real estate slump:  However, there are legitimate questions over whether the rally is more than froth, especially given the prolonged collapse of the real estate sector since the pandemic as Beijing prioritized help for manufacturing. Authorities have now mandatorily reduced mortgage rates and cut the down payment required for second homes to 20% from 25% in hopes of spurring demand. Are these measures enough to engineer a turnaround in construction and sustain the metals rally? Probably not. However, Gavekal Research's Andrew Batson and Wei He suggest that it's significant the sector is getting the attention it deserves: The Politburo called for stepping up existing property support programs and "adjusting housing purchase restrictions," which could be a signal that the remaining restrictions on sales in top-tier cities will be dismantled. For the government to cross one of its own previous red lines in this way would be a big boost to market expectations.

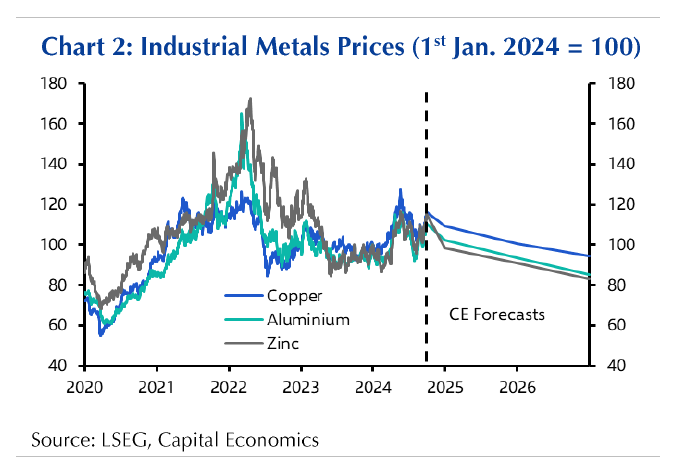

Capital Economics' Kieran Tompkins argues that so far, the scale of the recent stimulus is on par with what was announced last year in the wake of lifting Covid restrictions, which boosted "growth fleetingly for a few months." The measures are no "silver bullet for the structural headwinds to the sector and so we think the stimulus-inspired turnaround in industrial metal prices is likely to prove short-lived." He explains that previous rounds of fiscal stimulus relied on infrastructure spending as a key channel of support, but this package tilts toward consumers. Any help for metals demand is more indirect, as from China's own "cash for clunkers" program to encourage consumers to trade in old cars for electric vehicles: Transfers to households and the extensions of trade-in schemes might indirectly support China's industrial metals demand through greater demand for consumer durables. However, the extension of the auto trade-in scheme will serve to prevent a drop-off in demand rather than spur a fresh increase.

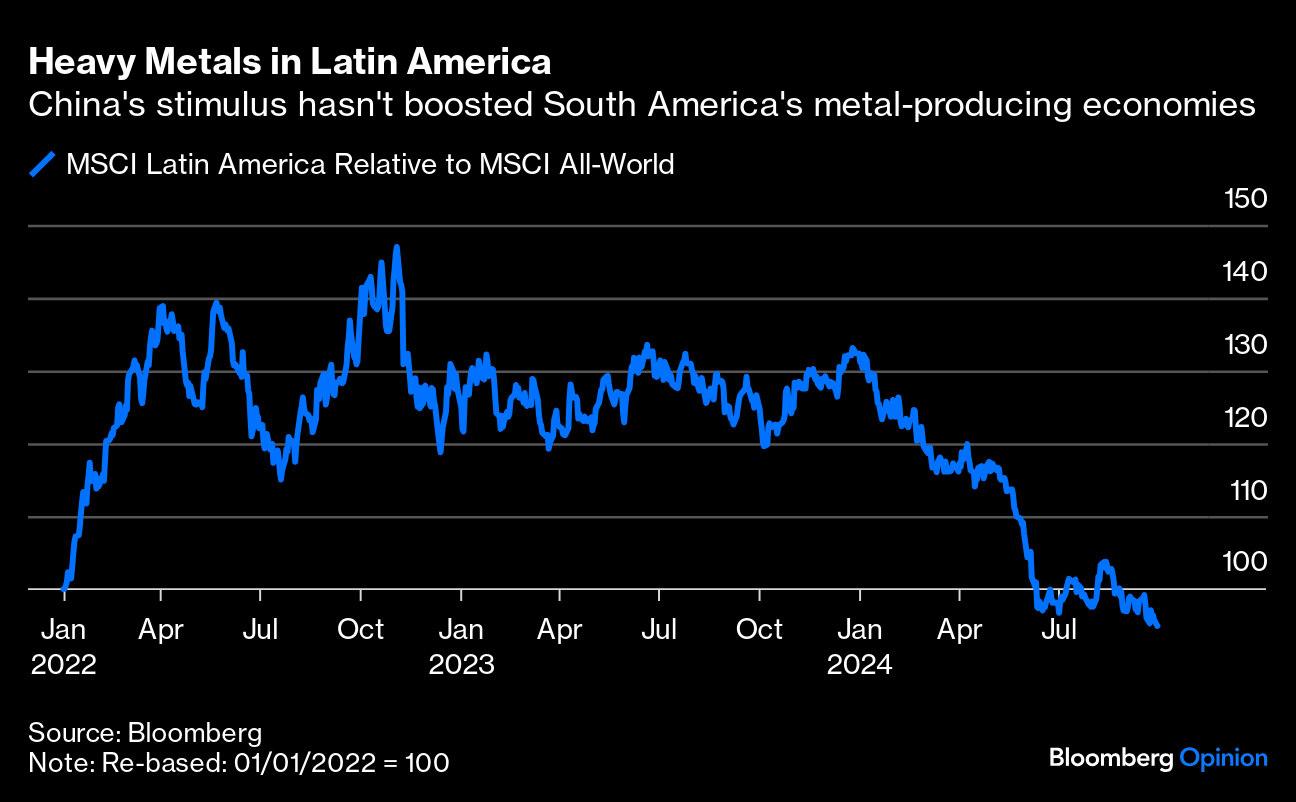

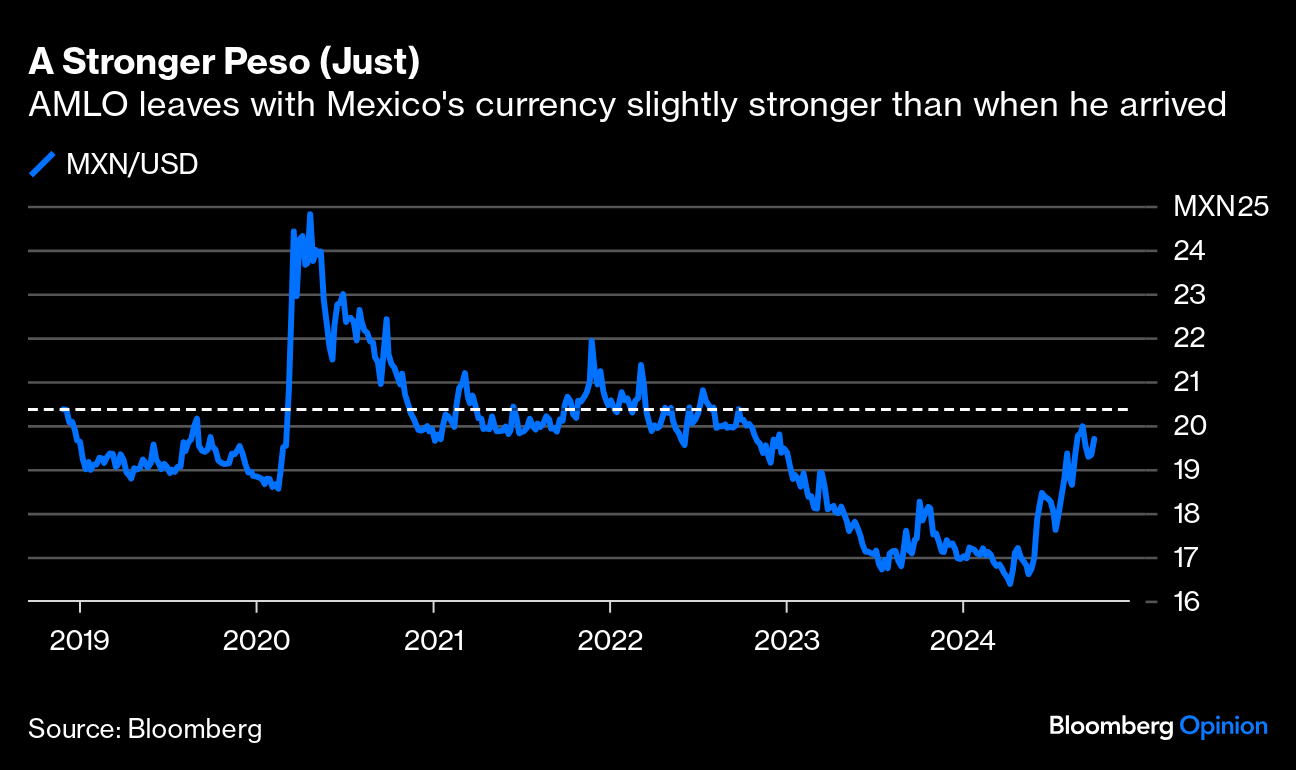

This Capital Economics chart shows that the stimulus effect — barring subsequent interventions — would be muffled in the long run: Perhaps in consequence, the sharp rise in metals prices hasn't translated into the international effects witnessed after previous episodes. Latin American stocks generally benefit whenever China stimulates, as it's seen as a boon for their large metals-exporting businesses. This round, however, hasn't helped them in the slightest, and they continue to lag the rest of the world: The removal of a financial "tail risk"in China, plus the likely surge in liquidity, is plenty enough to buoy global asset prices. But Beijing's renewed sense of urgency over real estate isn't enough to address overcapacity, which is endemic not only in the industrial metals sector. Officials know the task ahead is no walk in the park. They'll at least be comforted that they're starting to earn investors' confidence. The expectation on them is that further policy support isn't off-limits if needed. For now, though, China's holidaymakers can relax knowing that they have something to smile about. —Richard Abbey Has he done it again? Almost six years ago, on the eve of his investiture as Mexico's president, I suggested that Andres Manuel Lopez Obrador had "set stocks up for a tremendous rally." He'd done this by scaring international investors and driving the main stock index to a nine-year low in dollar terms. Now that he's about to relinquish office to his preferred successor, Claudia Sheinbaum, he indeed saw a tremendous stock market rally that lasted four years. That was because he was always rather more of a conservative (with a small "c") than many realized, and determined not to preside over a crisis. Mexico didn't embark on a borrowing spree, while tough monetary policy kept inflation from getting out of hand. But in the last six months, AMLO has created what might be another buying opportunity by scaring investors once more. This is how Mexican stocks have fared since his inauguration day, in dollar terms, compared to the S&P 500 and the MSCI Emerging Markets index: After bracing for Mexico to become an uninvestable wasteland, and then watching the country sell off during the early months of the pandemic, anyone who bought Mexican stocks in the summer of 2020 had a great four-year run, during which the index gained 170% (compared to 132% for the S&P 500). Disaster emphatically avoided. But the Bolsa has dropped more than 25% from its high since April. There was a similar pattern in the currency. AMLO succeeded in becoming the first president since the peso started to float in the early 1970s who left office with the currency stronger against the dollar than when he arrived. But again, a reverse has turned this into a close call, when at one point he was managing a superpeso: Some of this is bad luck. The peso was driven in great part by carry traders, parking in the currency with funds borrowed at rock-bottom interest rates in Japanese yen. When Japan's rates rose and the yen rallied in the summer, heavy selling of the peso resulted. But much of Mexico's damage is self-inflicted. The peso's decline unraveled in three phases. First, it grew obvious that Sheinbaum was going to win, accompanied by a prized "super-majority" in Congress. This gives her Morena party far greater freedom of action. For investors, that's an unwelcome development. Next, the yen carry trade unwound. And then in September, AMLO used Morena's overwhelming dominance in Congress, which took office a month before his departure, to force through constitutional reforms including a contentious switch to the direct election of judges. Mexico's constitution suffers from too many checks and not enough balances, and the nation is vitiated by a weak rule of law. When underpaid judges take charge of big bankruptcy cases in which foreign creditors stand to suffer, international investors lose confidence. There's need for reform. But elected judges, at a time when one party has a very comfortable majority, opens the way for a politicized judiciary that enables the executive. That could easily be abused and is a step in the wrong direction. Moody's warned last week that it could inhibit investments and directly affect Mexico's credit rating.  Sheinbaum will get less benefit of the doubt. Photographer: Stephania Corpi/Bloomberg Two weeks ago, Ernesto Zedillo, president from 1994 to 2000, launched an astonishing denunciation in a speech to the International Bar Association's annual conference, saying the constitutional reforms were an "ongoing atrocity" that would "destroy the Judicial Branch and, with it, bury Mexican democracy and what remains of its fragile rule of law." Zedillo is a politician, and his words should be interpreted with caution. But he has credibility as the president who, after 72 years of uninterrupted one-party rule, oversaw a fair election and allowed the opposition to succeed him. Having kept out of politics since leaving office, his intervention was emphatic: Thanks to Mexicans of several generations, at the end of the 20th century, we were finally able to say with pride that we already belonged to a nation with true democracy. Now, the new anti-patriots want to transform our democracy into another tyranny.

The next complication for Sheinbaum will be the US election. As American companies shorten supply chains and accede to political pressure to withdraw from China, Mexico is positioned to benefit. But that won't happen if the next president puts extra tariffs on goods from Mexico. Most concerning here, and damaging for confidence in the whole economy, was the decision of Tesla CEO Elon Musk to postpone work on a projected new "gigafactory" in Monterrey. "I think we need to see what happens with the election," he said. "Trump has said he will impose tariffs on vehicles produced in Mexico. So it does not make sense to invest heavily in Mexico if that is going to happen." Sheinbaum, like her predecessor, is pragmatic and doesn't want to preside over a crisis. Particularly if Donald Trump loses north of the border, there's a chance of an AMLO-style relief rally. But investors will be less inclined now to give her administration the benefit of the doubt. A happy 100th birthday to Jimmy Carter! It's amazing, and rather wonderful, that he is around to celebrate the landmark. The longest-lived president in history has, thankfully, survived to witness his reputation recover. The current horrors in the Middle East have made his enduring achievement at Camp David all the more impressive, while even on the economy, the former Republican senator Phil Gramm graciously writes in the Wall Street Journal that Carter deserves much of the credit for deregulation that went to Ronald Reagan.  Ahead of his time: Carter shows off solar panels on the White House in 1979. Source: Jimmy Carter Presidential Library Moreover, it's remarkable to discover that Carter was born the day after Truman Capote, who was brought up 200 miles away in Alabama. There's a fantastic centenary tribute to Capote by Ted Gioia here. It's worth reading in full, but I'll share one Capote tidbit that made my jaw drop: He knew John F. Kennedy, but also knew Lee Harvey Oswald. (Only two people in the world could make that claim.) He knew Robert Kennedy, and also knew Sirhan Sirhan.

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. More From Bloomberg Opinion: - Liam Denning: Gold's Record Run Can't Continue Forever, Right?

- Parmy Olson: OpenAI Is Shattering Big Tech's Promises of a Better World

- Clive Crook: Trump Offers Voters a Trifecta of Economic Madness

Want more Bloomberg Opinion? OPIN <GO>. Or you can subscribe to our daily newsletter. |